The phenomenon of currency devaluation and its consequences is a process that not only occurred in modern times, but has much deeper roots, going back to antiquity. With the collapse of the Roman Republic, Caesar’s grandnephew Gaius Octavianus, renamed Augustus, rose to power and soon implemented a far-reaching monetary reform for the Roman common market. The old republican trimetallic system of different denominations of silver, brass, and bronze became a new...

Read More »Markets and Private Property, Not Government, Protect the Environment

Each century presents its unique set of problems for lovers of freedom, peace, and prosperity. While the great vanguards of liberty in the twentieth century dealt with the looming shadow of centralization and were engaged in a battle against socialists and statists who argued for centralization and adjudication of individual liberty for the sake of universal material opulence, free markets with the fall of the curtain on the twentieth century have definitely shown...

Read More »Biden Admits that Sanctions Don’t Work and they Make Us Poorer

President Biden on Thursday made two big admissions about the US-led economic sanctions on Russia. The first is that the sanctions will lead to food shortages for many countries other than Russia, and that this is simply the price that Americans ought to be forced to pay. The second admission was that sanctions haven’t worked to change Moscow’s policies, and that “sanctions never deter” the targeted regime from carrying out aggression. So, Biden has helpfully now...

Read More »Ludwig von Mises (1881–1973)

One of the most notable economists and social philosophers of the twentieth century, Ludwig von Mises, in the course of a long and highly productive life, developed an integrated, deductive science of economics based on the fundamental axiom that individual human beings act purposively to achieve desired goals. Even though his economic analysis itself was “value-free”—in the sense of being irrelevant to values held by economists, Mises concluded that the only viable...

Read More »Will Biden Sanction Half the World to Isolate Russia?

Sorry, I've looked everywhere but I can't find the page you're looking for. If you follow the link from another website, I may have removed or renamed the page some time ago. You may want to try searching for the page: Search Searching for the terms %3Futm+source%3Drss%26utm+medium%3Drss%26utm+campaign%3Dmcmaken+biden+sanction+the+world+isolate+russia ...

Read More »2022 Libertarian Scholars Conference

Join Joe Salerno, David Gordon, Jeff Deist, Patrick Newman, and many more at the 2022 Libertarian Scholars Conference on Saturday, September 10th! We’ll meet at the Grand Hyatt in Nashville, Tennessee. The first Libertarian Scholars Conference was held in New York City in 1972 under the aegis of the Center for Libertarian Studies. The conference was held annually (except for 1973) throughout the 1970s in New York or Princeton, New Jersey (1977, 1978), with the 8th...

Read More »The West’s Russia Sanctions Could Lead to Many Unpredictable and Unpleasant Outcomes

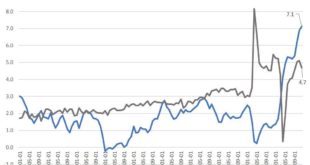

Global supply shocks are historically rare events. All the more extraordinary to have two such shocks in quick succession—the second arriving even before the first has entirely faded away. That is what the world now experiences in the form of the Great Pandemic followed by the Great West-Russia economic war. The most visible symptom of the supply disruption is the sky-high price of energy and a range of other commodities. What Is the Effect of Sanctions? The waging...

Read More »Governments “Sanction” Their Own Citizens Every Day. The Russia Sanctions Are Just a Natural Evolution.

Russian president Vladimir Putin’s invasion of Ukraine in the last week of February 2022 was the culmination of decades of transnational statist expansion. The North Atlantic Treaty Organization (NATO), which managers of the postwar Washington-centered imperium set up to counter Communist imperialism coordinated from Moscow, was rendered obsolete when the Soviet Union collapsed at Christmastide in 1991. But instead of rejoicing in the fall of an adversarial empire...

Read More »Trading with the Enemy: An American Tradition

During the French and Indian War (1754–1763), Americans continued the great tradition of trading with the enemy, and even more readily than before. As in King George’s War, Newport took the lead; other vital centers were New York and Philadelphia. The individualistic Rhode Islanders angrily turned Governor Stephen Hopkins out of office for embroiling Rhode Island in a “foreign” war between England and France. Rhode Island blithely disregarded the embargo against...

Read More »Patents, Legal Monopolies, and the High Prices for Drugs

Currently, 63 percent of American adults are on prescription drugs, according to a 2021 survey. Of this 63 percent of Americans, 26 percent say they have difficulty affording their prescriptions. Despite the prices of prescription drugs falling in recent years, an increasing number of Americans are concerned about high drug costs and demanding action be taken, 88 percent saying they want it to be easier for generic drugs to enter the market. The same percentage...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org