Some journalists like Steve Portnoy of CBS seem unable to grasp that escalations that might lead to nuclear war are a bad thing. The journalist seemed incredulous last week when asking White House spokeswoman Jen Psaki why the United States has not started a full-on war with Moscow. Psaki’s position—with which any reasonable person could agree—was that it is not in the interest of Americans “to be in a war with Russia.” Washington’s reluctance to go to war might seem...

Read More »Heavy Sanctions against Russia Could Usher in a Wider Economic War

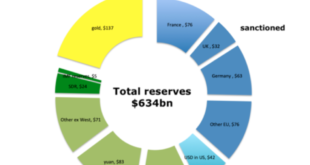

Vladimir Putin’s invasion of Ukraine was met with unprecedented economic sanctions by the United States and its allies in order to cripple Russia’s capacity to wage war. Never before in post–World War II history has an economy of Russia’s size been reprimanded with such force. Moreover, the sanctions could remain in place after the war ends and reach other major economies too, in particular China. In this case, current sanctions could be the harbinger of a...

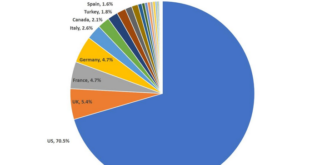

Read More »NATO: Our International Welfare Queens

The states of Europe have more than enough wealth and military potential to deal with a second-rate power like Russia. The American taxpayers, on the other hand, deserve a break from Europe’s grifting. Original Article: “NATO: Our International Welfare Queens” American policy makers have shown a surprising amount of sanity so far in response to Russia’s invasion of Ukraine. While some war enthusiasts among the American punditry have certainly been agitating for...

Read More »It Was the Lockdowns, Not the Pandemic That Created the Havoc

It may be years before we fully realize the ramifications of the lockdown policies governments around the world have imposed on their citizens in response to covid-19, but evidence of the costs is starting to trickle in. A recent study conducted by the Centers for Disease Control and Prevention (CDC) surveyed thousands of high school students on the effects of the pandemic. “Since the beginning of the pandemic,” the study reports, “more than half of students found it...

Read More »Do “Inflationary Expectations” Cause Inflation? Contra Krugman, the Answer Is No

In the New York Times article “How High Inflation Will Come Down,” Paul Krugman suggests that the key for future inflation is inflation expectations. Krugman does not think that currently inflation expectations are comparable to the 1980s. According to him: Forty years ago, as many economists will tell you, inflation was “entrenched” in the economy. That is, businesses, workers and consumers were making decisions based on the belief that high inflation would continue...

Read More »Hazlitt, Hayek and How the Fed Made Itself into the World’s Biggest Savings & Loan

The Henry Hazlitt Memorial Lecture, March 18, 20221 Many thanks to the Mises Institute and to sponsor Yousif Almoayyed for this opportunity to be with you all today as we consider one of the truly remarkable developments in the history of American central banking, money printing, and credit inflation. On a personal note, “the pursuit of clarity” has long been a goal of mine, and it’s a particular pleasure to present a lecture in honor of Henry Hazlitt, whose work is...

Read More »And Now for a Really Bad Response to Political Calamity: Autarky

The invasion of Ukraine, the spike in inflation and the risks of supply shortages have made some politicians dust off some of the worst economic ideas in history: autarky and protectionism. Some believe that if our nation produced everything we needed we would all be better off because we would not depend on others. The idea comes from a deep lack of understanding of economics. There is no such thing as autarky. There is no such thing as covering all the needs of a...

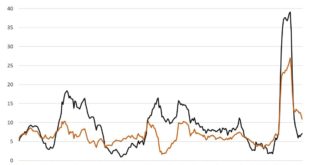

Read More »Money Supply Growth Heads Back Up: February Growth Up to 7 Percent

Money supply growth rose for the third month in a row in February, continuing ongoing growth from October’s twenty-one-month low. Even with February’s rise, though, money supply growth remains far below the unprecedented highs experienced during much of the past two years. During thirteen months between April 2020 and April 2021, money supply growth in the United States often climbed above 35 percent, well above even the “high” levels experienced from 2009 to 2013....

Read More »Putin’s Inflation? Homegrown Modern Monetary Theory Is to Blame

Prices of goods and services in the economy seem to be going through the roof, and both consumers and producers suffer from the falling value of their money. Unfortunately, the public turns to politicians in Washington and economists around the world for answers. While president Joe Biden and his administration call it Putin’s price hike, the US Bureau of Labor Statistics reports that over the last twelve months, the all items index increased 7.9 percent before...

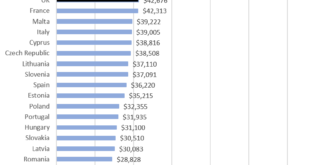

Read More »If Ukraine Joins the EU, It Will Be the Poorest Member by Far

Within days of the beginning of the Russian invasion of Ukraine, the Ukrainian regime applied for membership in the European Union. This is understandable from the perspective of Kyiv. If Ukraine is going to be denied membership in NATO—as increasingly looks to be the case—The Ukraine regime could nonetheless increase its geopolitical connections to the West by joining in the EU. Moreover, given the fact the EU is moving toward creating its own EU military...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org