The post-COVID inflation surge that was supposed to be “transitory” is looking a lot more permanent. On Friday, the Bureau of Economic Analysis Friday released data on Personal Consumption Expenditures (PCE), the Federal Reserve’s preferred inflation gauge. “The PCE price index for August increased 4.3 percent from one year ago, reflecting increases in both goods and services,” according to the report. “Energy prices increased 24.9 percent and food prices increased...

Read More »Transitory Inflation and Useless Ingredients

Can you remember back to when you were two or three years old? Toddlers often think that there are little people inside the TV (or maybe this was only true when the TV was about as deep as it was wide—and maybe kids today don’t think this when looking at a 60-inch flatscreen…) Anyways, it’s normal to grow out of this naïve view of television. No one believes it past the age of eight, much less into adulthood. Purchasing Power and Intrinsicism This is a simple...

Read More »The Fed’s ‘Dangerous’ Path Toward Debt Monetization

A prominent U.S. Senator just called the head of the nation’s central bank “dangerous.” Unfortunately, the true dangers of U.S. monetary and fiscal policy were lost on everyone involved. On Tuesday, Federal Reserve Chairman Jerome Powell testified before the Senate banking committee, where Senator Elizabeth Warren led the left wing of the Democratic Party’s attack. “Over and over, you have acted to make our banking system less safe. And that makes you a dangerous man...

Read More »Silver Crash Makes Silver Trash?

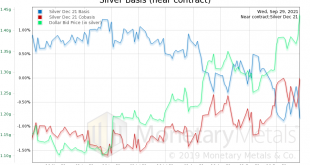

The price of silver dropped a dollar, or over 4% on Wednesday. Some voices in the precious metals press want you to think that there is only one conceivable cause. We should coin a term for this form of logical fallacy: argumentum ad ignorantia. This is an argument of the form: “the cause must be XYZ, as I cannot conceive of anything else.” The Same Old Song and Dance In this case, XYZ is that the alleged cartel, the bullion banks and/or central banks, sold silver...

Read More »Gold and Silver Price Fundamentals Update

This time, we start with the gold-silver ratio. Let’s revisit something we said on 23 August: “…the supply and demand fundamentals of silver are stronger here than they have been since the Covid crisis. … physical silver is scarcer than gold.” This corresponds to the peak where we have drawn an arrow on the gold-silver ratio chart. Soon after we said that, the ratio moved down about 5% (i.e. in favor of silver). And now we see a similar pattern in the ratio of the...

Read More »Gold and Silver Price Fundamentals Update

This time, we start with the gold-silver ratio. Let’s revisit something we said on 23 August: “…the supply and demand fundamentals of silver are stronger here than they have been since the Covid crisis. … physical silver is scarcer than gold.” This corresponds to the peak where we have drawn an arrow on the gold-silver ratio chart. Soon after we said that, the ratio moved down about 5% (i.e. in favor of silver). And now we see a similar pattern in the ratio of the...

Read More »How Do They Get Away With It?

Picture, if you will, a government that deliberately inflicts bad policy on the people. I know this sounds crazy, and could never happen, but please bear with me. Suppose the government criminalizes hiring someone who produces less than an arbitrary threshold. Or it forces the closure of all businesses deemed to be non “essential”. Or it makes all employers obtain government permission for a long and growing list of things, and then denies permission arbitrarily and...

Read More »Gold Leads the Way for Silver

Gold leads the way Last week we wrote about the gold to silver ratio. Our points were that it measures the price of one metal against the other, just as we use the dollars per ounce to measure daily metals prices, and just as we use ounces per Corvette to measure purchasing power preservation. Also, we discussed the range of movement that silver has around gold over the past fifty years. We laid out notes for when to buy silver against gold, and when not to. The...

Read More »Where do gold and silver prices go from here?

[unable to retrieve full-text content]One way to look at the price of gold, is that it dropped from its high around $1,900 in early June. Another way is to zoom out, and look at the big picture. Here is a 10-year chart of gold and silver prices. For over four years, after the peak around $1,900 ten years ago (early September 2011), the price of gold moved down. By December 2015, it was just over $1,000. Then it was a sideways market until three years ago (August 2018), when the price was well...

Read More »The Changing Role of Gold

In our post on August 11 titled End of an ERA: The Bretton Woods System and Gold Standard Exchange, we discussed the significance of then-President Nixon’s action of closing the gold window thereby ending the Bretton Woods Monetary system. Under the Bretton Woods monetary system, central banks could exchange their US dollar reserves for gold. This also ended the gold fixed price of US$35 per ounce. This week we explore the two questions that concluded last week’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org