There is nothing new under the sun Modern Monetary Theory, or “MMT”, has been getting a lot of attention lately, often celebrated as a revolutionary breakthrough. However, there is absolutely nothing new about it. The very basis of the theory, the idea that governments can finance their expenditures themselves and therefore deficits don’t matter, actually goes back to the Polish Marxist economist, Michael Kalecki (1899 – 1970). MMT as a centralisation tool MMT says...

Read More »Gold is the 7th sense of financial markets

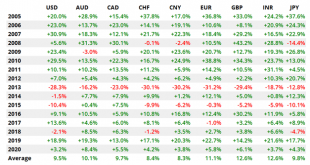

Interview with Ronald Stöferle – Part II Claudio Grass (CG): Looking at the interest rate policy of the last years, it would seem that central banks are backed into a corner. They cannot hike borrowing costs without risking a domino effect, as both government and corporate debt have reached record highs, encouraged by the central banks’ own NIRP and ZIRP policies. In your view, is there a “safe” way out of this vicious circle? Ronald-Peter Stöferle (RPS): Well, for...

Read More »Gold is the 7th sense of financial markets

Interview with Ronald Stöferle – Part I As we embark on this new decade, there are plenty of good reasons to be optimistic about gold’s prospects. The global economy and the financial system are already stretched to a breaking point and demand for precious metals is heating up. This, of course, is plain for all to see, even as mainstream investors and analysts still refuse to face facts and prefer to focus on naïve hopes of an eternal expansion. These facts, however,...

Read More »Das Internet – die dezentrale (R)Evolution

(If you want to read this text in English, please use www.deepl.com – a great translation tool that uses language semantics.) Menschen werden durch unterschiedliche Motive angetrieben. Die einen sehen das höchste Glück in der Ansammlung von materiellen Werten, und andere sind von geistigen Werten angetrieben. Eine Idee kann genauso wie eine Rolex Glücksgefühle und Ansporn auslösen. Mich persönliche treiben Ideen an. Meine Ideen basieren auf Prinzipien und Werten,...

Read More »What lies ahead for gold in 2020

Over the last few months, gold’s performance has been remarkable. Many market observers and mainstream analysts have pointed to various geopolitical developments in their efforts to explain away the bullishness as a reaction to whatever happens to be in the headlines at the time. The Trump impeachment, the US-China trade war, more recently the tensions with Iran, are all among the reasons that have been put forward so far to justify the current gold rush. And yet,...

Read More »Investing in crypto the sound way!

Interview with Christian Zulliger I have long been fascinated by the far-reaching consequences and the great potential of the wave of new technologies and ideas that emerged with the crypto revolution. While most of us first came into contact with these concepts in 2017, this tectonic shift that is only just beginning has been in the making for nearly a decade. Now, we begin to see the basic ideas and tools take shape and give rise to endless exciting possibilities...

Read More »The owl has landed: Lagarde’s new vision for the ECB

Christine Lagarde. Photo Credit: European Parliament On December 12, Christine Lagarde introduced her goals and vision in her first rate-setting meeting as the new President of the ECB. On the actual policy front, there were no surprises. She remained committed to the path set by her predecessor, Mario Draghi, and kept the current monetary stimulus unchanged. The central bank kept its deposit rate at the present record-low -0.5%, and pledged to continue its €20...

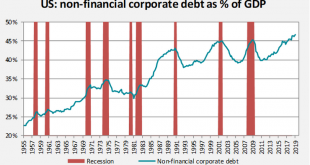

Read More »Corporate Debt Time Bomb

While I have reportedly highlighted the many risks of the current monetary policy direction and the multiple distortions that it has created in the markets, in the economy, and even in society, one of the most pressing dangers of the unnaturally low rates and cheap money is the staggering accumulation of debt. Nowhere is this more obvious than in the ballooning corporate debt, especially in the US. It has been growing so rapidly and for so long, that many investors...

Read More »The destruction of civilization – implications of extreme monetary interventions

When I was asked to write an article about the impact of negative interest rates and negative yielding bonds, I thought this is a chance to look at the topic from a broader perspective. There have been lots of articles speculating about the possible implications and focusing on their impact in the short run, but it’s not very often that an analysis looks a bit further into the future, trying to connect money and its effect on society itself. Qui bono? Let...

Read More »The ECB’s “mea culpa”

Economists, conservative investors and market observers have been issuing stern warnings for years regarding the severe impact of the current monetary policy direction. The problems In a recent statement, ECB Vice President Luis de Guindos warned of potential side effects and risks to the economy resulting directly from the central bank’s policies. He outlined how a decade of extremely aggressive monetary interventions have resulted in an erosion of financial...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org