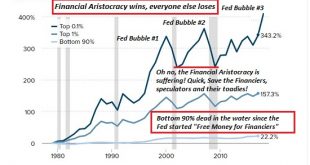

The Fed’s casino isn’t just rigged; it’s criminally unstable. The decay of America’s middle class has been well documented and many commentators have explored the causal factors. The bottom line is that this decay isn’t random; the income of the middle class isn’t going to suddenly increase at 15 times the growth rate of the income of the top 0.1%. (see chart below) The income of the top 0.1% grew 15 times faster than the incomes of the bottom 90% because that’s...

Read More »The “Helicopter Parent” Fed and the Fatal Crash of Risk

All the risks generated by gambling with trillions of borrowed and leveraged dollars didn’t actually vanish; they were transferred by the Fed to the entire system. The Federal Reserve is the nation’s Helicopter Parent, saving everyone from the consequences of their actions. We all know what happens when over-protective Helicopter Parents save their precious offspring from any opportunity to learn from mistakes and failures: they cripple their child’s ability to...

Read More »Is a Cultural Revolution Brewing in America?

The lesson of China’s Cultural Revolution in my view is that once the lid blows off, everything that was linear (predictable) goes non-linear (unpredictable). There is a whiff of unease in the air as beneath the cheery veneer of free money for almost everyone, inequality and polarization are rapidly consuming what’s left of common ground in America. Though there are many systemic differences between China and the U.S., humans in every nation are all still running...

Read More »What’s Changed and What Hasn’t in a Tumultuous Year

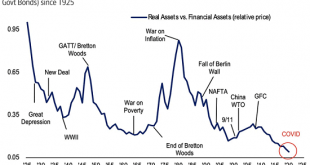

Inequality is America’s Monster Id, and we’re continuing to fuel its future rampage daily. What’s changed and what hasn’t in the past year? What hasn’t changed is easy: 1. Wealth / income inequality is still increasing. (see chart #1 below) 2. Wages / labor’s share of the economy is still plummeting as financial speculation’s share has soared. (see chart #2 below) What’s changed is also obvious: 1. Money velocity has cratered. (see chart #3 below) 2. Federal...

Read More »Our “Wealth”: Cloud Castles in the Sky

Buyers know there will always be a greater fool willing to pay more for an over-valued asset because the Fed has promised us it will always be the greater fool.I realize nobody wants to hear that most of their “wealth” is nothing more than wispy Cloud Castles in the Sky that will dissipate in the faintest zephyr, but there it is: that which was conjured out of thin air will return to thin air. . I’ve assembled a few charts that reflect the illusion of financial...

Read More »The UFO/Fed Connection

Perhaps the aliens’ keen interest in Earth’s central bank magic and its potential for destruction results from a wager. You’ve probably noticed the recent uptick in UFO sightings and video recordings from aircraft of the extraordinary flight paths of these unidentified objects. Perhaps it’s not coincidence that UFO sightings are soaring at the same time as central banks pursue unprecedented monetary policies. Imagine having the power to destroy an entire planet’s...

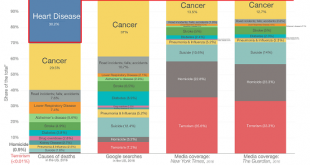

Read More »Health, Wealth and What Kills Most of Us

If health is wealth, and it most certainly is the highest form of wealth, then we would be well-served to take charge of our health-wealth in terms of what behaviors we can sustainably modify. Longtime correspondent J.F. (MD) recently shared a fascinating graphic ranking the leading causes of death in the U.S. (2016 data, pre-pandemic) compared to searches on Google and what the media reports. (see chart below) Note that this data isn’t a survey asking people to...

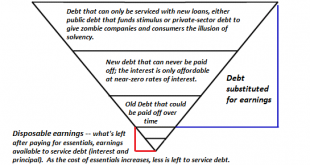

Read More »Stimulus Addiction Disorder: The Debt-Disposable Earnings Pyramid

One glance at this chart explains why the status quo is locked on “run to fail” and will implode in a spectacular collapse of the unsustainable debt super-nova.. For those who suspect the status quo is unsustainable but aren’t quite sure why, I’ve prepared a simple chart that explains the financial precariousness many sense. The chart depicts the two core elements of a debt-based, consumerist economy: disposable earnings, defined as the earnings left after paying...

Read More »The Cannibalization Is Complete: Only Inedible Zombies Remain

Poor powerless Fed, poor starving cannibals, poor zombies turning to dust. That’s the American economy once the curtains are ripped away. Setting aside the fictional flood of zombie movies for a moment, we find the real-world horror is the cannibalization of our economy, a cannibalization that is now complete. Every organic source of prosperity and productivity has been captured and consumed, hidden behind the convenient curtains of central bank intervention,...

Read More »Too Busy Frontrunning Inflation, Nobody Sees the Deflationary Tsunami

Those looking up from their “free fish!” frolicking will see the tsunami too late to save themselves. It’s an amazing sight to see the water recede from the bay, and watch the crowd frolic in the shallows, scooping up the flopping fish. In this case, the crowd doing the “so easy to catch, why not grab as much as we can?” scooping is frontrunning inflation, the universally expected result of the Great Reflation Trade. You know the Great Reflation Trade: the world...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org