Fed Chairman Jerome Powell held a press conference at the annual Jackson Hole economic conference today, and he all but said that a September cut to the federal funds rate is a done deal: “The time has come for policy to adjust. The direction of travel is clear.”Naturally he threw in the usual propaganda phrases about how the Fed is data driven. He continues: “the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”Remember, with its official statements, the Fed is always careful to try and give the impression that it is not a political organization and responds only to economic data.But, for whatever reason, Powell and the Fed have now decided official CPI inflation is low enough for the central bank get away

Topics:

Ryan McMaken considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

Fed Chairman Jerome Powell held a press conference at the annual Jackson Hole economic conference today, and he all but said that a September cut to the federal funds rate is a done deal: “The time has come for policy to adjust. The direction of travel is clear.”

Naturally he threw in the usual propaganda phrases about how the Fed is data driven. He continues: “the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

Remember, with its official statements, the Fed is always careful to try and give the impression that it is not a political organization and responds only to economic data.

But, for whatever reason, Powell and the Fed have now decided official CPI inflation is low enough for the central bank get away with NEW infusions of easy money, even as stocks, rents, home prices, and food prices are all at record high.

On price inflation, Powell all but declares “mission accomplished”: “With an appropriate dialing back of policy restraint, there is good reason to think that the economy will get back to two percent inflation while maintaining a strong labor market.”

So, in addition declaring victory over rising prices – even though last month’s official CPI growth was still nearly 3 percent— Powell is again pushing the myth of the “soft landing” even though there is absolutely no reason to believe the Fed can engineer such a thing.

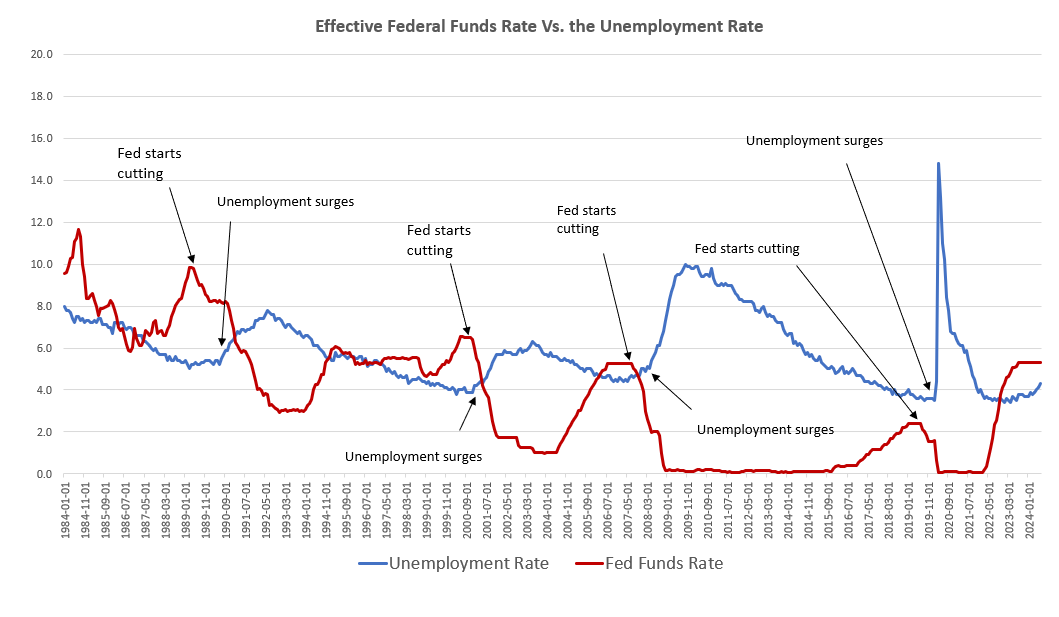

In fact, if anything, the fact that the Fed now plans to start cutting rates is one of the strongest recession signals we can get.

If we look back at the relationship between rate cuts and recessions, we see that in almost every case that recessions begin shortly after the Fed starts a cycle of rate cuts. The fed started cutting the Fed funds rate in 1989. Then we got the recession of the early 90s. In late 2000, the fed started the rate cuts again. We got a recession in 2001. The Fed did it again in late 2007. The recession began in December 2007, followed by a financial crisis several months later. This relationship even holds for the 2020 recession because even without covid there would have been a recession in late 2020. The Fed had begun to ease the target rate in summer 2019.

There was no soft landing in any of these cases, even though it has been routine for the Fed to promise a soft landing at least as early as 2001.

Fed rate cuts don’t cause recessions, of course. The boom-bust cycle is caused by reckless Fed-driven money creation.

But it makes sense that the Fed hits the panic button and starts cutting rates when it does because the Fed is reacting to fears about impending recessions. The same is true this time around. The Fed has no special prediction skills, so it sees what the rest of us see: a weakening economy and a much less rosy employment picture than what was sold to us by the administration over the past year. July’s weak jobs report with rising unemployment, combined with this week’s massive downward revision in 2023-2024 jobs numbers, gives us good reason to figure that the Fed is now trying to prevent a recession by flooding the economy with more easy money.

This is what the Fed has been doing over and over for decades.

Unfortunately, if the Fed steps on the money-creation accelerator now, that’s only going to guarantee that today’s high prices stay high, and all during a period of rising unemployment.

This is especially alarming right now because price growth isn’t nearly as sedate as Powell and the Fed would have you believe.

After all, since 2020, the Case-Shiller home price index is up 48 percent, so good luck affording a house if you’re a first time homebuyer. Food prices are up 26 percent in the official CPI data. And that’s the official data which conveniently ignores how you’ve had to switch from eating steak to eating the cheapest ground meat you can find.

None of this should be surprising given how monetary inflation—that is, growth in the money supply—has risen rapidly in recent years.

Since 2009, the money supply is now up by more than 185 percent. Out of the current money supply of $18.8 trillion, $4.6 trillion—or 24 percent—of that has been created since January 2020.

Since 2009, more than $12 trillion of the current money supply has been created. That is, nearly two-thirds of the total existing money supply have been created just in the past fourteen years.

So why has the Fed concluded now is a great time to abandon what small amount of monetary restraint it has shown in the last 18 months? The answer is politics. Maybe the fed wants to give a shot in the arm to markets right before an election, or maybe the Fed is caving to pressure to force back down interest rates on the massive federal debt.

In any case, we can be sure the Fed’s decision definitely isn’t based on any sort of sound economic theory, and regular people should probably be prepared for either rising prices or rising unemployment. Or maybe even both.

Watch a video summary of this article.

Tags: Featured,newsletter