Watch the video version of this article on X/Twitter. The latest monthly report on taxes and spending from the Treasury Department shows that in July, the federal deficit was 4 billion, or nearly one quarter of a trillion dollars.In spite of the fact that the US government managed to collect 0 billion in taxes in July, they also managed to spend 4 billion.Through the end of July this fiscal year, the feds racked up a deficit of a little over 1.5 trillion dollars. Last year, for the same period, the total deficit was a bit over .6 trillion.By the time the current fiscal year ends, however, we can expect this year’s total to be even larger than last year’s. that is, the Congressional Budget Office in June estimated that the total deficit for 2024’s fiscal

Topics:

Ryan McMaken considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Watch the video version of this article on X/Twitter.

The latest monthly report on taxes and spending from the Treasury Department shows that in July, the federal deficit was $244 billion, or nearly one quarter of a trillion dollars.

In spite of the fact that the US government managed to collect $330 billion in taxes in July, they also managed to spend $574 billion.

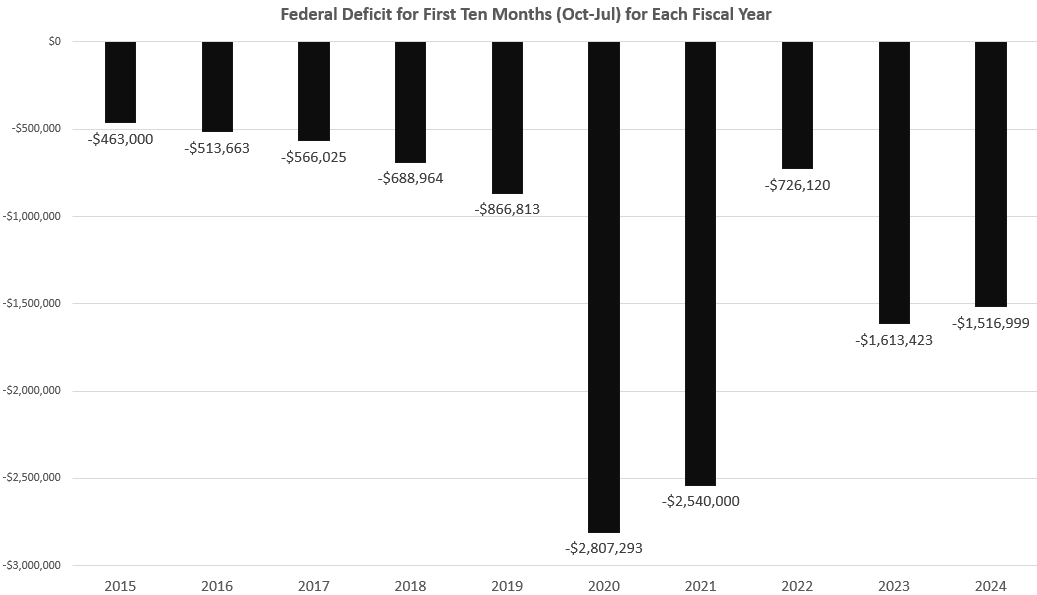

Through the end of July this fiscal year, the feds racked up a deficit of a little over 1.5 trillion dollars. Last year, for the same period, the total deficit was a bit over $1.6 trillion.

By the time the current fiscal year ends, however, we can expect this year’s total to be even larger than last year’s. that is, the Congressional Budget Office in June estimated that the total deficit for 2024’s fiscal year will be 1.9 trillion. Last year’s full-year deficit was $1.7 trillion. That 1.9 trillion estimate assumes no big increases in spending over the next two months, and it also assumes that revenues will continue to be stable.

Those are potentially some big ifs. If the employment data continues to worsen, as it has in recent months, that will lead to falling tax revenues. So, we may looking at a full-year total deficit of over two trillion dollars.

But even if it does come in at a “mere” $1.9 trillion, that will be the worst deficit since 2021 when the Federal government was still spending wildly on a variety of covid-related programs.

With all these deficits year after year, we should not be shocked to find out that the total national debt continues to skyrocket.

As of today, the national debt is now at $35.2 trillion. That’s up $12 trillion from the first quarter of 2020, before the Covid Panic. So, during this fiscal year, the federal debt has grown by about $150 billion per month, or roughly a trillion dollars every six months.

And, by the way, lest you think these numbers aren’t that big in inflation-adjusted terms, we need only look at the fact that total debt as a percentage of GDP is now higher than 120 percent. That’s higher than what it was in 1946 at the end of a major global war.

Of course, at the end of that war, the US began big reductions in overall spending. That’s not happening in the United States today. There are no plans whatsoever to cut spending of any kind. The current runaway spending in welfare and various wars looks to continue indefinitely. And, certainly no presidential candidate is talking about any real cuts.

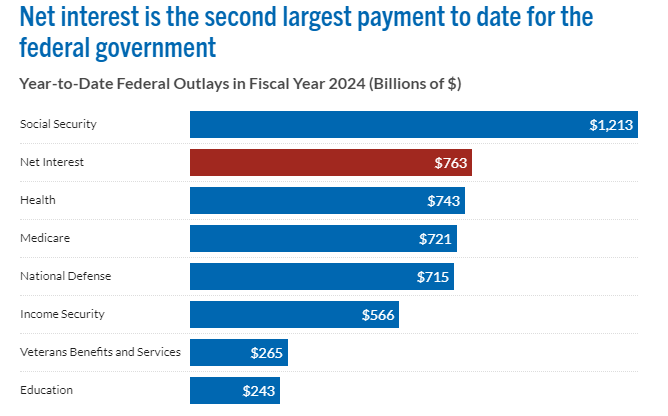

Meanwhile, paying interest on that huge debt is also demanding more and more tax revenue. For example, the US is now on track to spend more than a trillion dollars on interest payments for the 2024 fiscal year. That makes it the largest single category of expenditure outside of social security.

Image Source: The Peter G. Peterson Foundation.

More and more of your tax dollars are going to pay for nothing at all except to pay off old debts for lost wars and failed welfare programs.

It will only get worse. As old Treasurys mature, and as new higher-interest Treasurys come online, interest costs will only go higher. The only trick the feds have up their sleeve is for the central bank to force down interest rates by buying up more federal debt. But where will the central bank get the money to do that? They’ll have to print it. And that will trigger more price inflation.

Unfortunately, there’s no easy way out of this.

Tags: Featured,newsletter