According to a new report from the federal government's Bureau of Labor Statistics this week, the US economy added 275,000 jobs for the month of February while the unemployment rate rose to 3.9%. In what has become a predictable ritual, reporters from the legacy media were sure to declare "another strong jobs report." Heather Long of the Washington Post, who is always careful to toe the regime line, announced that "the hiring boom continues" and we are in "an incredible era" for job growth.Long, however, is apparently incapable of reading much deeper into the report than the first paragraph. And she's hardly the only one within the corporate financial media with so little interest in the details. In fact, if we look just slightly more closely at the report, even a

Topics:

Ryan McMaken considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

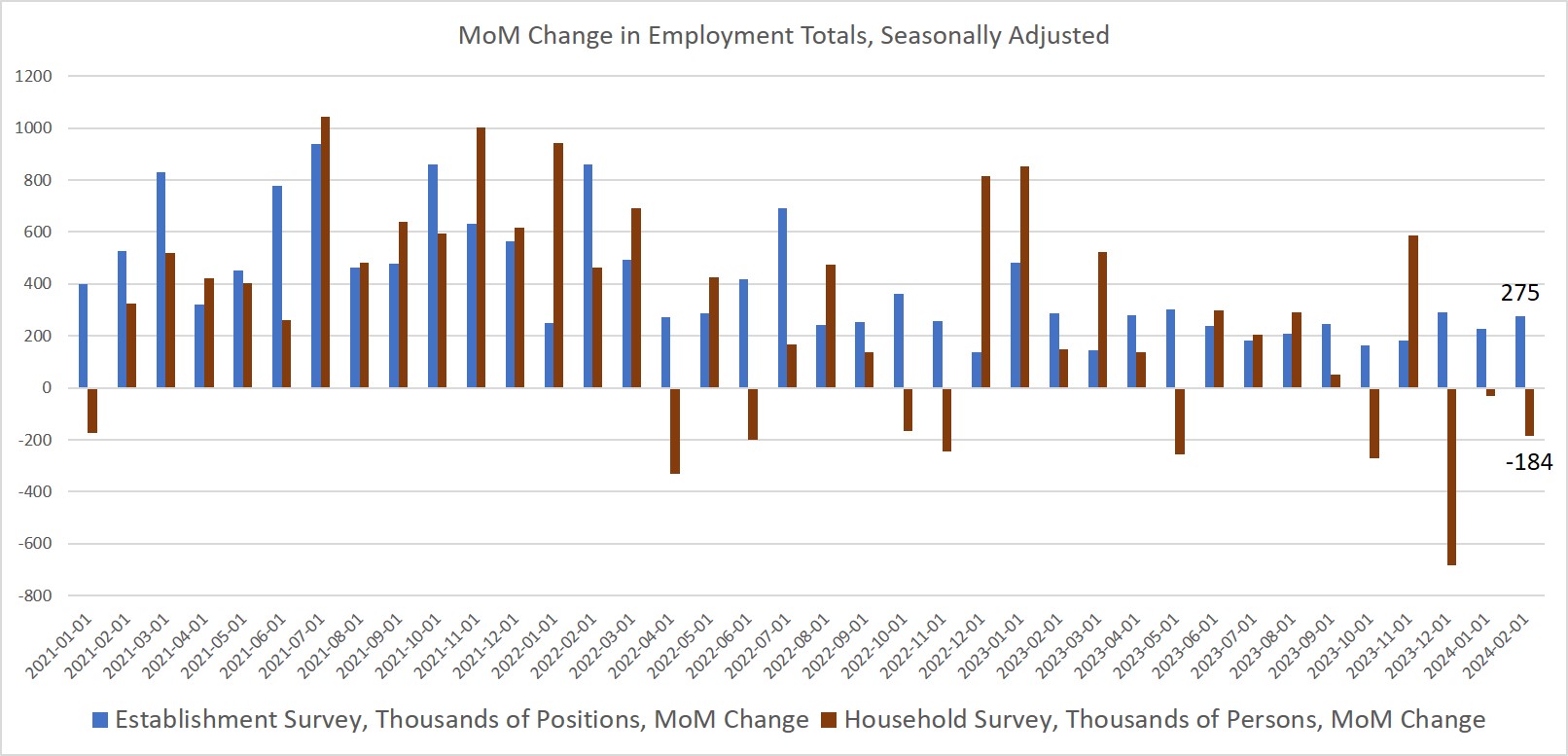

According to a new report from the federal government's Bureau of Labor Statistics this week, the US economy added 275,000 jobs for the month of February while the unemployment rate rose to 3.9%. In what has become a predictable ritual, reporters from the legacy media were sure to declare "another strong jobs report." Heather Long of the Washington Post, who is always careful to toe the regime line, announced that "the hiring boom continues" and we are in "an incredible era" for job growth.

Long, however, is apparently incapable of reading much deeper into the report than the first paragraph. And she's hardly the only one within the corporate financial media with so little interest in the details.

In fact, if we look just slightly more closely at the report, even a minimal amount of curiosity quickly reveals that the jobs situation is anything other than a boom. What we really find is that the total number of employed persons has fallen by nearly 900,000 jobs in three months and that 1.8 million full-time jobs have disappeared over the same period. Meanwhile, government jobs continue to make up a larger and larger share of what new job growth there is.

Indeed, the so-called establishment-survey headline number is one of the few beams of light in an otherwise dour or lackluster report. This headline number, of course, is what people like Long report out to busy readers who don't know any better.

The establishment survey report shows that total jobs—both part-time and full-time—increased, month over month, in February by 275,000. This survey has shown job growth every month for several years now, and it is notoriously unreliable. This can be seen in how the initial estimate number each month is often revised downward. For January, for example, the initial estimate—the one reported in all the headlines—was quietly revised downward by a whopping 78,000 jobs in the later revision.

Yet, the establishment survey is only a survey of large employers and does not distinguish between full-time and part-time jobs. It measures total jobs, not employed persons. We get a very different survey if we look at the household survey, which is used to calculate the unemployment rate.

The household survey shows us that in February, the total number of employed persons fell, month over month, by 184,000 people.

If we compare the two surveys, we find quite a difference. While the establishment survey reliably shows job gains, the household survey of the population shows that employment has fallen during four of the last five months.

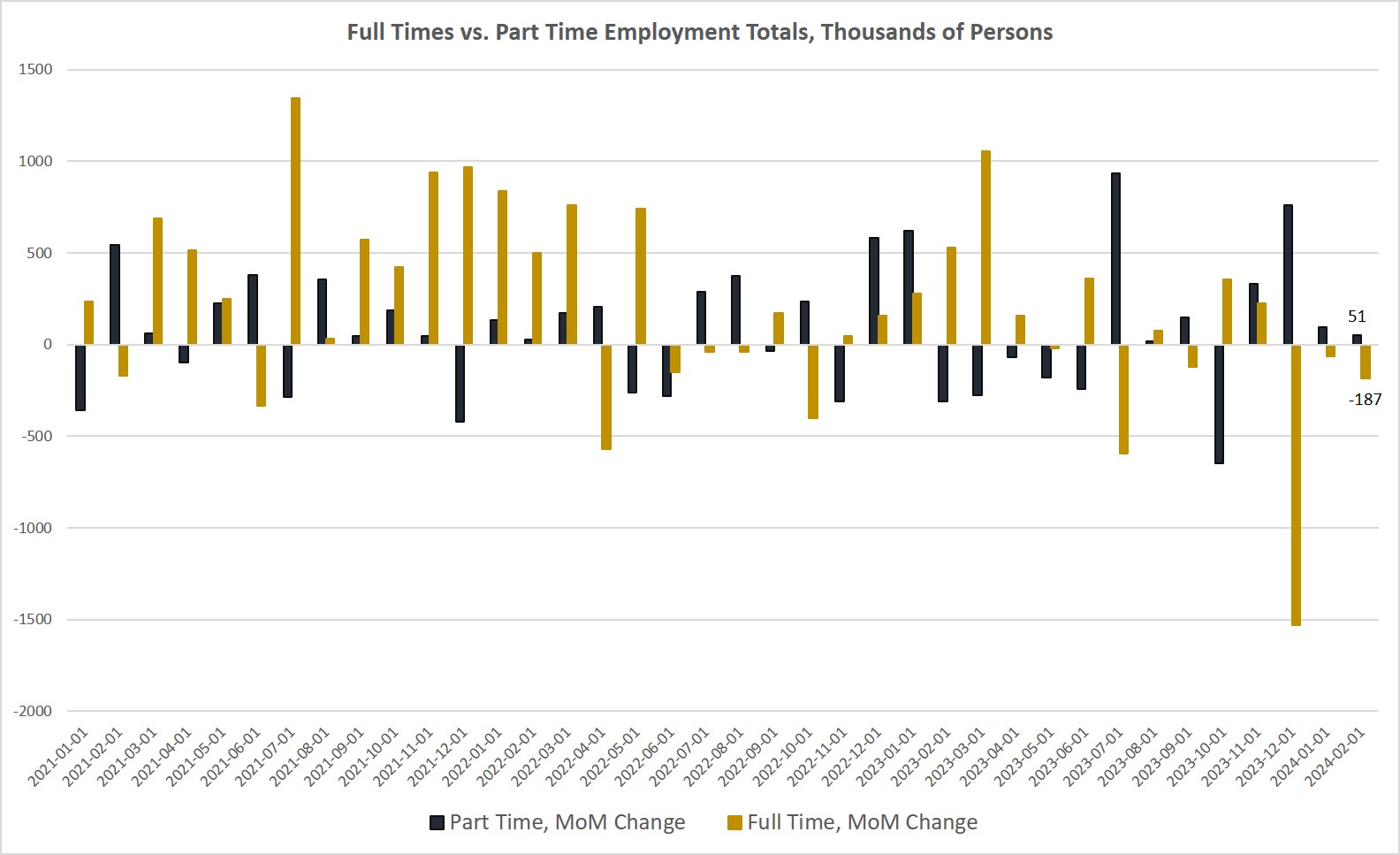

Moreover, the household survey shows that growth in new full-time work has plummeted. Full time work has now fallen for three months in a row, with full-time work falling near twice as much as part-time work as grown. In February, full-time employment fell, month over month, by 187,000 workers. Part-time work, on the other hand, grew by 51,000 over the same period.

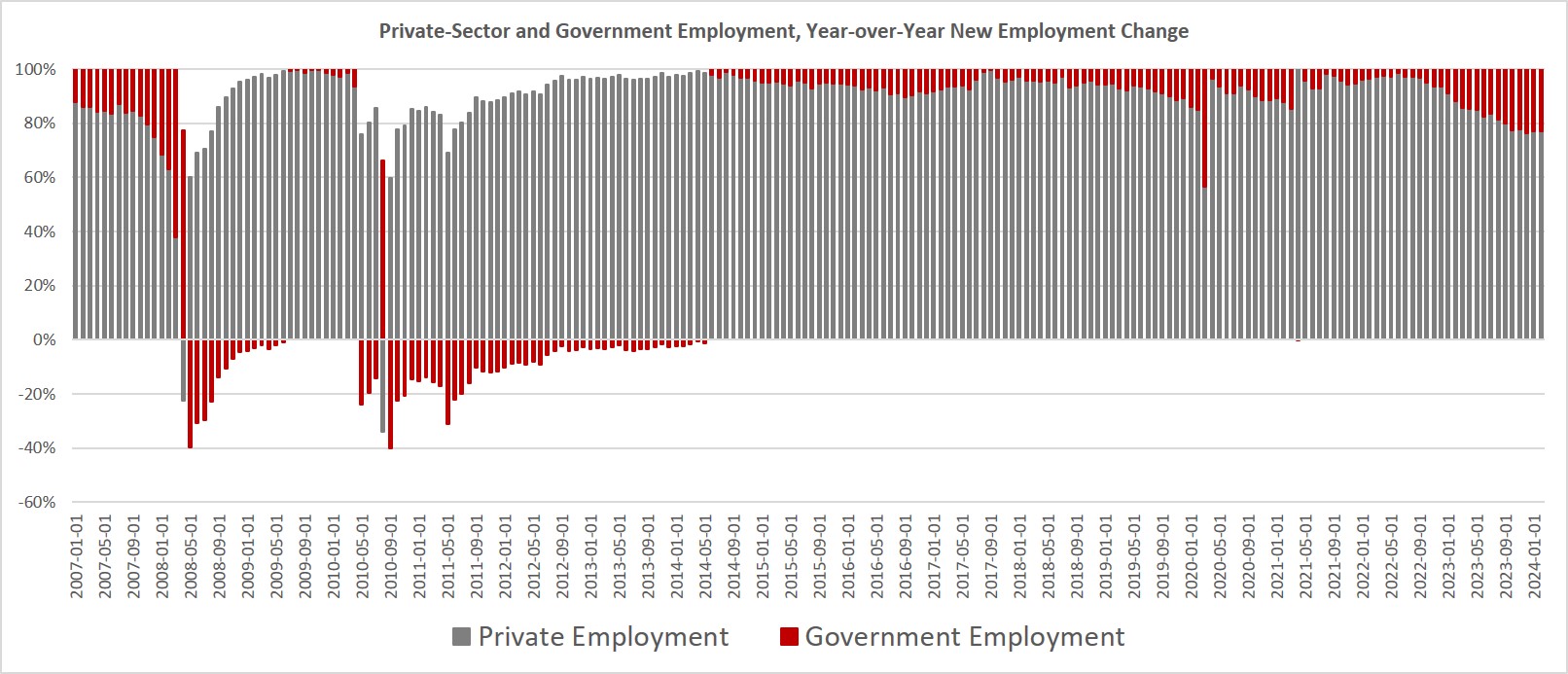

Another concerning aspect of this report is the fact that growth in government jobs makes up about 20 percent of all new jobs. Of the 275,000 new payroll jobs added according to the establishment survey, 52,000 of those were government jobs. Historically, this ratio suggests an approaching recession since, in times of solid economic growth, government jobs rarely make up more than ten or twelve percent of job growth.

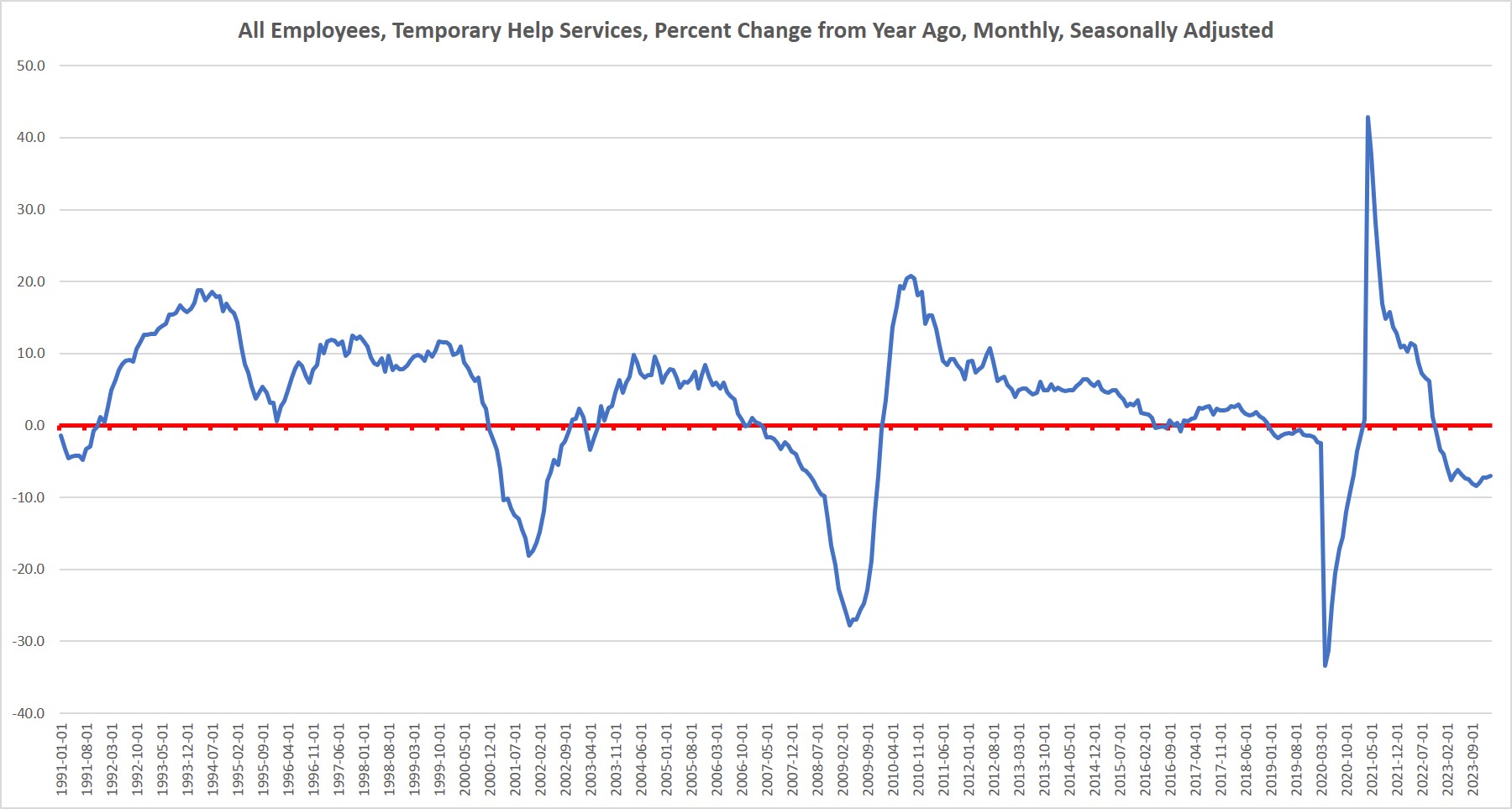

We might also look to temporary employment for a sense of just how sustainable is this alleged jobs boom. In February, jobs in temporary help services (THS) have fallen, month-to-month, for sixteen months in a row. As we can see in the graph, a sustained drop in THS jobs points to recession rather than a jobs boom. Temporary jobs are often the first jobs to be eliminated by firms, and as the BLS puts it, "flexible labor arrangements provided by temp agencies allow firms to scale down their operations readily and without the added expense of separation pay or having to let go of their best workers." In a weakening economy, there is no longer a need to use THS workers as a means of screening potential new workers or adding work hours to supplement the full-time work force. It appears that over the past year, the need for new workers is fading fast and dropping temp workers is a cheap way to cut costs.

None of this is likely to get in the way of the "soft landing" narrative repeatedly pushed by Wall Street, the legacy media, and the Federal Reserve. For a hint at how this narrative works, we look to a story in today's ABC News:

While the job market remains hot, its easing temperature could allow the Federal Reserve to go forward with interest rate cuts expected in the coming months, some analysts told ABC News on Friday. ... In other words, the fresh jobs report aligns with the central bank's path toward a soft landing, in which inflation returns to normal levels while the economy averts a recession, they said. ... "If the economy can continue to add jobs but without triggering a resurgence in wage growth, the Fed will achieve its soft landing," [chief strategist for Principal Asset Management Seema] Shah said.

The narrative is this: job growth is solid and great, but it is now very slightly less great than was the case last month. But, that's good because that's what the Federal Reserve wants. This means the Fed can lower interest rates later this year and steer the current softening economy to a new expansion cycle and the economy will escape anything worse than a very mild recession. The end.

It's a nice story, but it's a fairy tale. For decades, the central bank and it's friends in the media has repeatedly claimed that the Fed will steer the economy to a soft landing each time a recession approaches. Each time, the Fed is dead wrong. There has never been a soft landing. Moreover, employment data is a lagging indicator and is only confirming what other economic data has already been showing for months.

If we take a larger look around, we find plenty of worrisome data in the leading indicators: The Philadelphia Fed's manufacturing index is in recession territory. The same is true of the Richmond Fed's manufacturing survey. The Conference Board's Leading Indicators Index keeps looking worse. The yield curve points to recession. Business bankruptcies surged 58 percent in 2023. Net savings turned negative for only the second time in decades in recent months. The economic growth we do see is being fueled by the biggest deficits since covid.

Now, not even the employment data, apart from a superficial look at the establishment survey, suggests there's much gas in the economic gas tank. This, unfortunately, is the result of years of economic damage done to our economy by more than a decade of ultra-easy money, price inflation, and malinvestment.

Tags: Featured,newsletter