The Swiss National Bank (SNB) has shared how it intends to “future-proof” the domestic payment ecosystem, outlining its ambition to leverage technologies and processes including tokenization and distributed ledger technology (DLT) to establish an “efficient, reliable and secure ecosystem” that’s geared towards “the future of cashless payments in Switzerland,” SNB governing board member, Andréa Maechler, said during an event on March 30, 2023. The payment system is undergoing a profound transformation, driven by ongoing digitalization and the increasing use of new technologies, Maechler told the audience in her speech at the semi-annual Money Market event. These are enabling new forms of money and are fundamentally changing the way people make payments. Thomas

Topics:

Fintechnews Switzerland considers the following as important: 6c.) Fintechnews, Blockchain/Bitcoin, Featured, newsletter, payments, Regulation, Switzerland

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The Swiss National Bank (SNB) has shared how it intends to “future-proof” the domestic payment ecosystem, outlining its ambition to leverage technologies and processes including tokenization and distributed ledger technology (DLT) to establish an “efficient, reliable and secure ecosystem” that’s geared towards “the future of cashless payments in Switzerland,” SNB governing board member, Andréa Maechler, said during an event on March 30, 2023.

The payment system is undergoing a profound transformation, driven by ongoing digitalization and the increasing use of new technologies, Maechler told the audience in her speech at the semi-annual Money Market event. These are enabling new forms of money and are fundamentally changing the way people make payments.

Thomas Moser and Andréa Maechler at the 2023 March Money Market event, Swiss National Bank

To prepare Switzerland for this new era, Maechler said the central bank is exploring different technologies that would support the agency’s aspiration of more efficient and faster cashless transactions.

Though it is unknown whether or not DLT and tokenization will play a role in the financial system of the future, she said the SNB is “open to DLT” and the token ecosystem, recognizing these technologies’ potential for efficiency gains and risk reduction.

Integrating central bank money into a regulated token environment

DLT, “one of the biggest innovations in the fintech area”, has witnessed notable traction from the private sector, Maechler said, owing to the technology’s ability to simplify the booking of transactions and eliminate the need for costly and error-prone reconciliation processes between different databases on different systems.

DLT also allows assets such as securities, real assets like real estate and commodities, as well as money to be securitized in the form of digital tokens, which are then represented and managed in a decentralized and fraud-proof network.

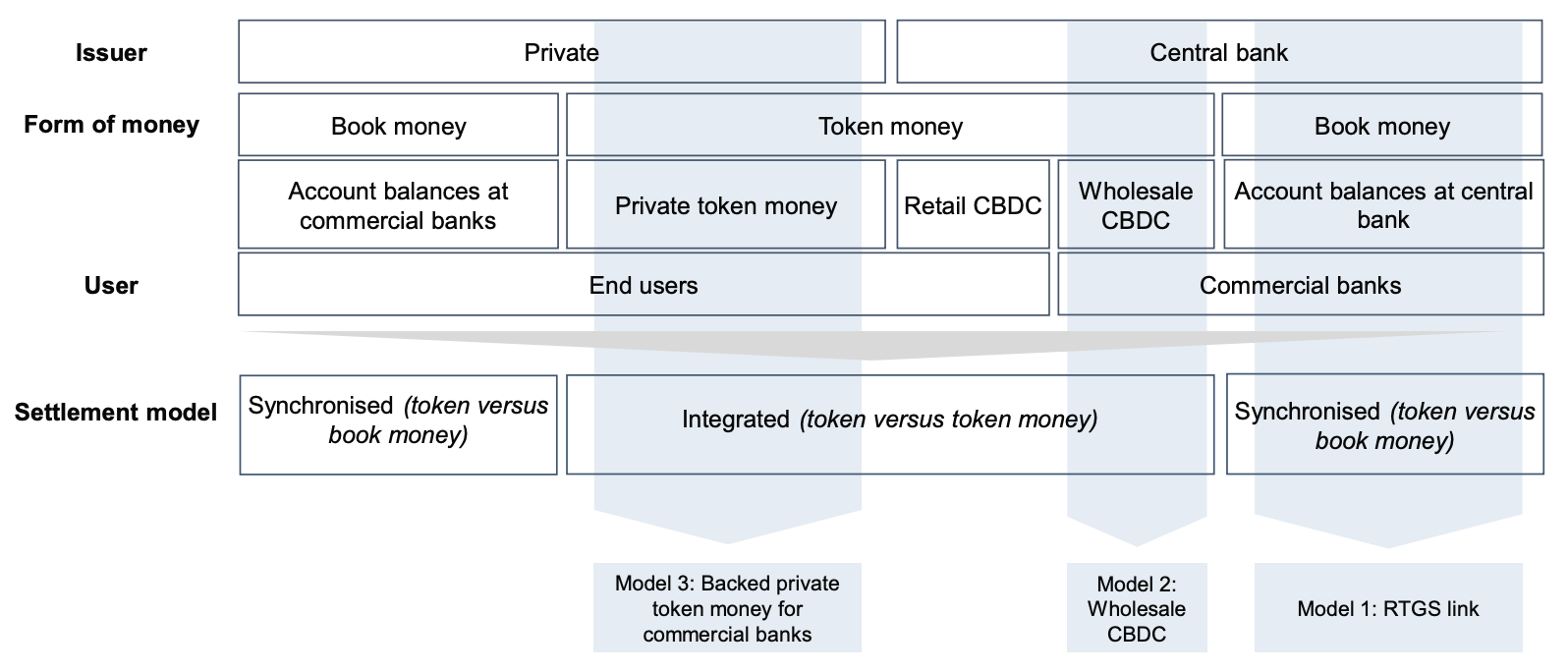

In this context, the SNB said it is conducting a study on how central bank money can be made available in a regulated token environment. This project focuses on examining three models for token settlement, and is being undertaken in collaboration with the regulated financial market infrastructures and other market participants.

SNB is examining three models for secure and efficient token settlement, Source: Andréa M. Maechler/Thomas Moser, Swiss National Bank, March 30, 2023

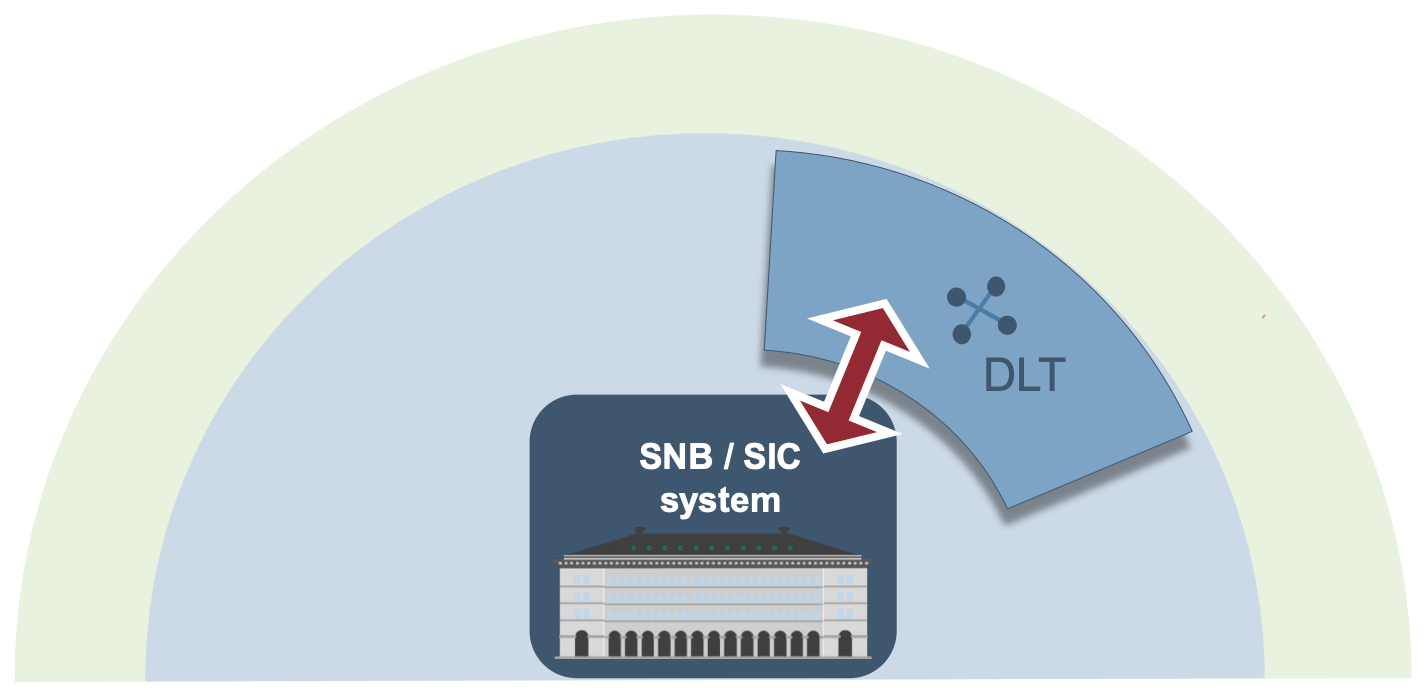

The first model involves synchronized settlement and is centered around expanding the existing functionalities of Switzerland’s real-time gross settlement system (RTGS) to support token settlement, the SNB said. It focuses on creating a link between Switzerland’s central payment system, the Swiss Interbank Clearing (SIC), to the new DLT system.

The so-called RTGS link was tested in partnership with SIX, the operator of Switzerland’s financial infrastructure, and the Bank for International Settlements (BIS), in Phase I of Project Helvetia, and though such synchronization was shown to be technically feasible, the model revealed some drawbacks compared with integrated settlement including limited DLT functionalities, the SNB said.

RTGS link (model 1), Source: Andréa M. Maechler/Thomas Moser, Swiss National Bank, March 30, 2023

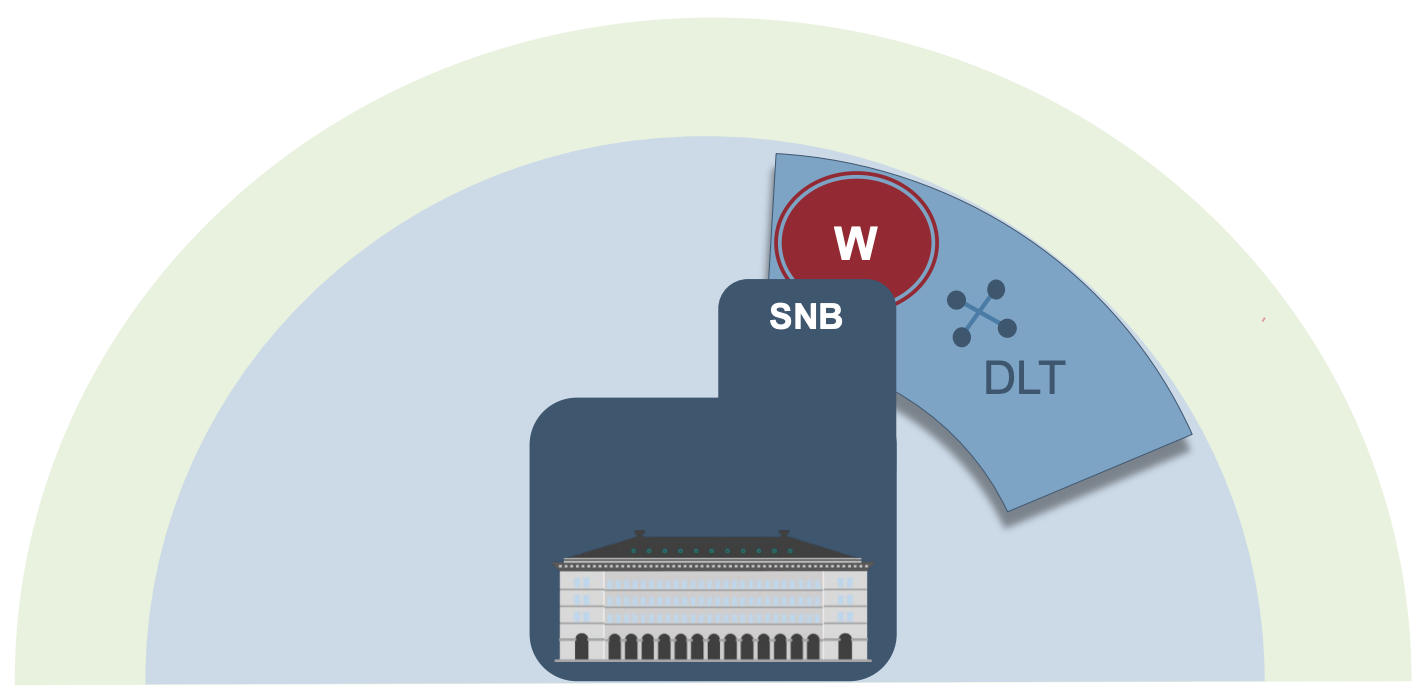

The second model focuses on integrated settlement using a Swiss franc wholesale central bank digital currency (wCBDC). This model was also explored in Phases I and II of Project Helvetia during which a Swiss franc wCBDC was issue on the test environment of SIX Digital Exchange (SDX).

Building on insights gained from this experiment, the SNB said it will further explore the operational basis that would enable it to issue wCBDC for settlement purposes, should the need arise in the future. As part of the project, real wCBDC will be issued on SDX for a limited time and selected transactions will be tested with market participants, the central bank said.

Wholesale CBDC (model 2), Source: Andréa M. Maechler/Thomas Moser, Swiss National Bank, March 30, 2023

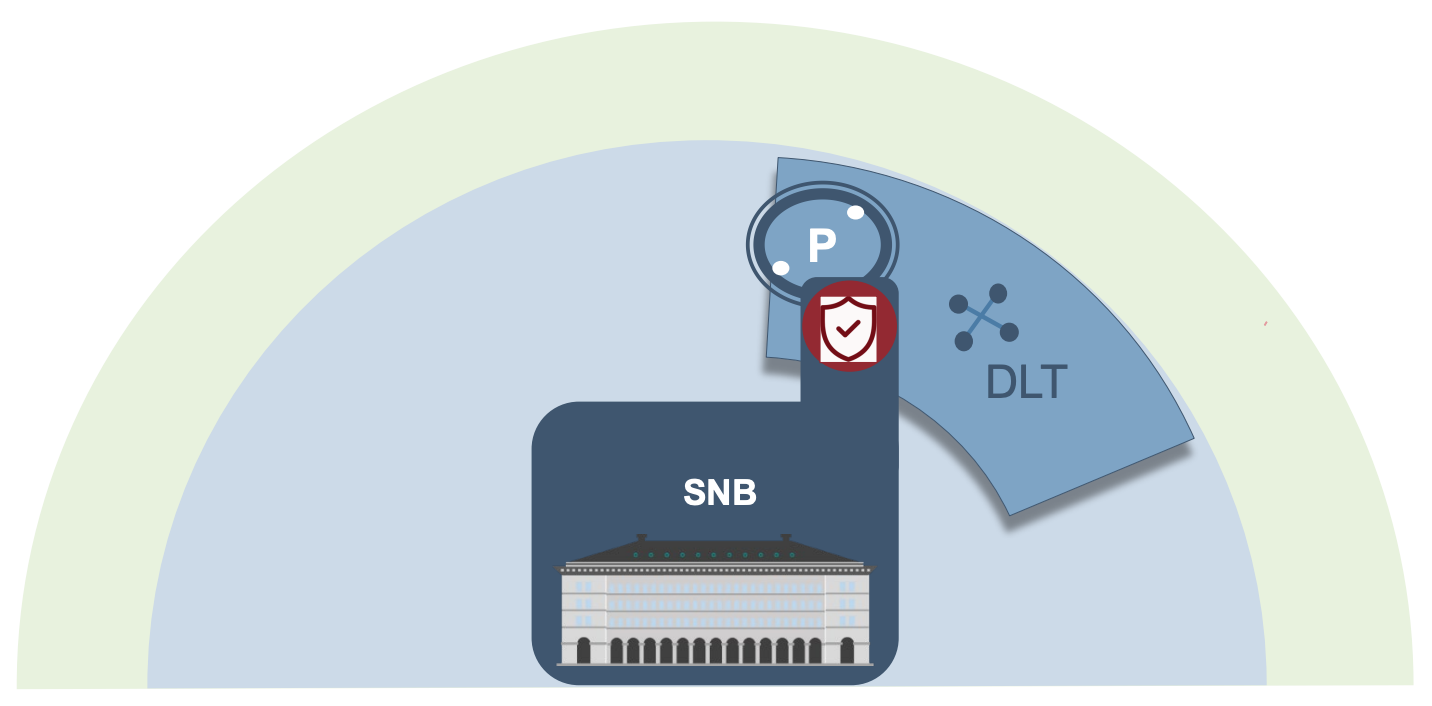

Finally, the third model involves integrated settlement using private Swiss franc token money that is protected under bankruptcy law. As part of the project, the SNB said it aims to examine ways in which private token money that is backed one-to-one by sight deposits at the central bank, can be legally structured in such a way that, in the event of the bankruptcy of the token issuer, it would have a risk profile comparable to that of central bank money.

Backed private token money (model 3), Source: Andréa M. Maechler/Thomas Moser, Swiss National Bank, March 30, 2023

Instant payments as another critical capability

Besides token money and DLT, instant payments are another pillar of the Swiss central bank’s payment strategy. This trend builds on demand from consumers for increased speed, the ongoing digitalization and a changing regulatory landscape that’s driving innovation and new business models, the SNB said.

Instant payments allow retail payments to be completely processed in real-time, around the world and from customer to customer. By settling all payment steps in real-time, instant payments bring important benefits, including shorter settlement chains, lowered risks and reduced costs, it said.

Instant payments can also add value to cross-border payments by linking national schemes to one another. This could potentially improve remittance services and cross-border transactions by lowering costs, increasing innovation and improving processing speed. Initiatives like the BIS-led Project Nexus are exploring this opportunity.

Real-time payments are scheduled for rollout in Switzerland next year. Starting August 2024, all banks operating in Switzerland and processing over 500,000 payments per year will be required to implement the new standard and be able to receive instant payments, the SNB has mandated. In an initial phase, these real-time transfers will be capped at CHF 20,000.

The second phase will require all participants in the SIC network to be able to receive and execute real-time transfers by the end of 2026.

In addition to priority introduction at banks, instant payments will also be implemented as an account-to-account (A2A) payment method in retail, as well as e-commerce.

The post Swiss Central Bank Payment Vision Outlining Focus on DLT, Tokenization and Instant Payments appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Tags: Blockchain/Bitcoin,Featured,newsletter,payments,Regulation,Switzerland