By 2030, affluent clients with assets of EUR 100,000 and up will have access to a highly diversified range of alternative assets comprising private debt, venture capital (VC), real assets, and more. They will benefit from highly personalized financial plans and advice, enabled by automation technology and data analytics. Additionally, advanced digital platforms and features like portfolio aggregation will provide them with a more frictionless experience. These are the three main trends outlined in Wealthtech Radar 2023, a paper produced by German wealthtech software provider Fincite. The paper, which draws on insights from more than 20 experts organizations such as InVenture Capital, the University of Munich, the Frankfurt School Blockchain Center, Sprengnetter

Topics:

Fintechnews Switzerland considers the following as important: 6c.) Fintechnews, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

By 2030, affluent clients with assets of EUR 100,000 and up will have access to a highly diversified range of alternative assets comprising private debt, venture capital (VC), real assets, and more. They will benefit from highly personalized financial plans and advice, enabled by automation technology and data analytics. Additionally, advanced digital platforms and features like portfolio aggregation will provide them with a more frictionless experience.

These are the three main trends outlined in Wealthtech Radar 2023, a paper produced by German wealthtech software provider Fincite. The paper, which draws on insights from more than 20 experts organizations such as InVenture Capital, the University of Munich, the Frankfurt School Blockchain Center, Sprengnetter Gruppe and Morningstar, shares more than 20 trends that are expected to emerge in the wealthtech industry over the next decade. These trends are grouped into three main categories: alternative assets, mass personalization and frictionless experiences.

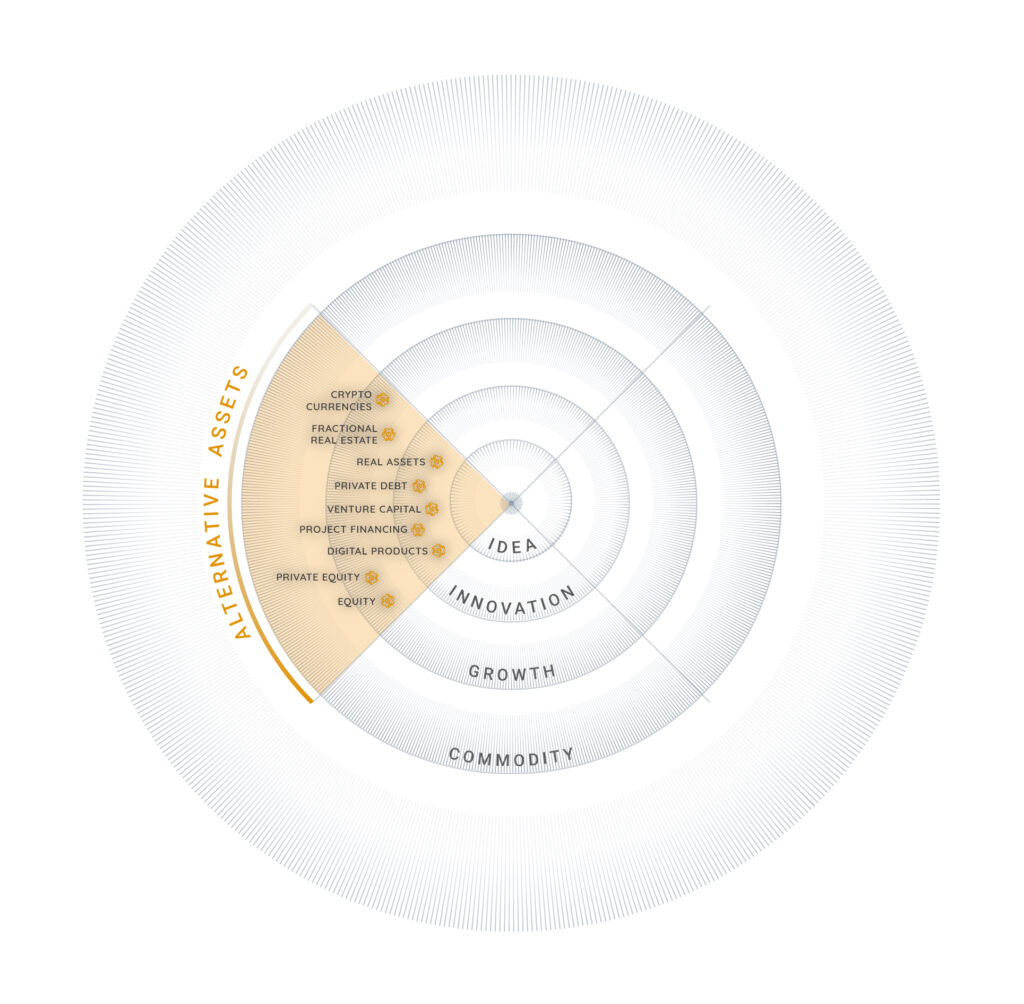

Alternative assets

WealthTech Radar 2023, Fincite

Demand for alternative assets, investment diversification and higher yields are fueling efforts to provide the affluent and private banking segments with access to a broader set of asset classes and investment opportunities.

Digital platforms, as well as trends like asset tokenization and fractionalization, in particular, are helping expedite this by bringing VC, private debt and real assets to the masses.

Companies like Timeless Investments and Arttrade, for example, are making real assets like art, property, raw materials and gold, accessible to those with smaller asset portfolios. This is done by fractionalizing these assets into smaller pieces, thus allowing investors to purchase just a small percentage of these assets.

This concept is also being applied to project financing and private debt. Exporo, for example, allows property projects to be financed with a lower minimum investment, allowing private investors to invest in real estate debt starting at EUR 500. Peer-to-peer (P2P) lending platform Mintos, meanwhile, allows private investors to hold a stake in consumer goods loans, sometimes from as little as EUR 10.

Finally, cryptocurrencies and digital assets such as non-fungible tokens (NFTs) are another popular option for investors looking to diversify their portfolio. Interest in these assets has risen sharply over the past couple of years, and many investors now view crypto as a relevant asset component, the report notes.

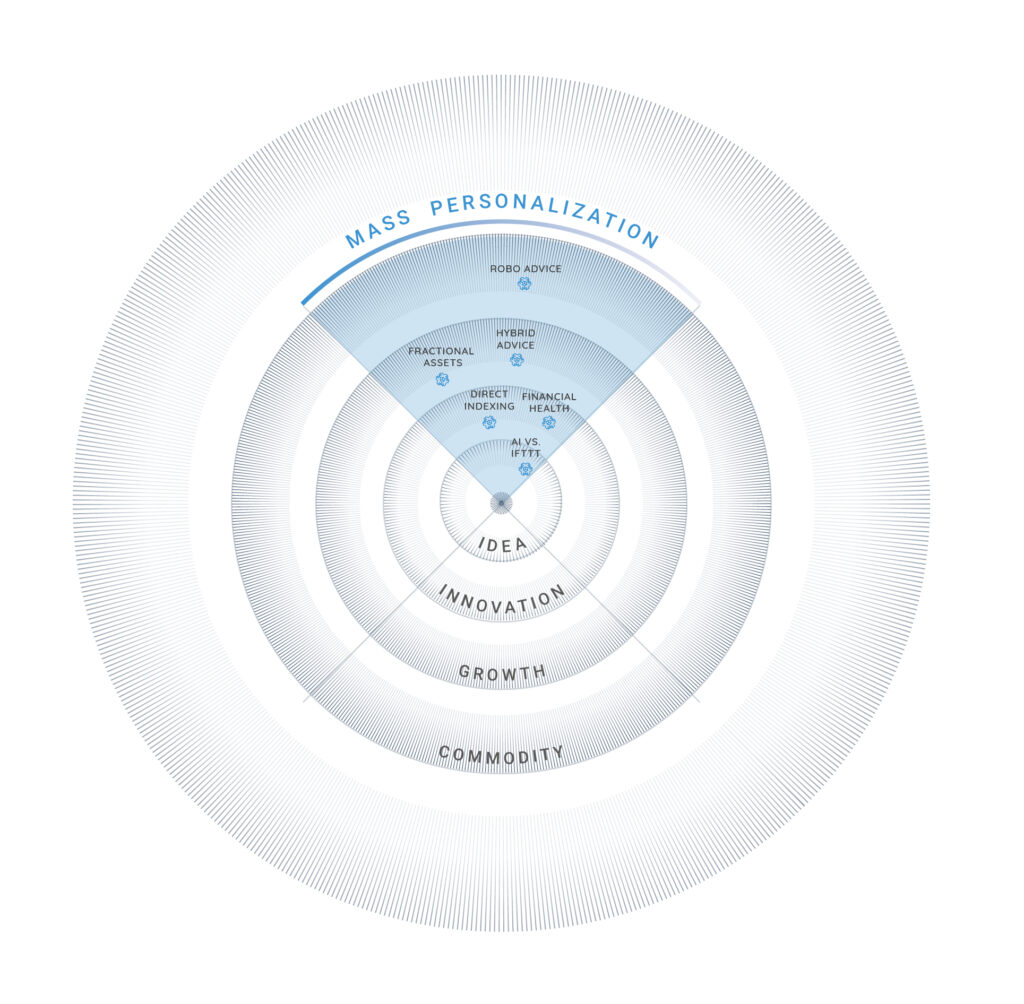

Mass personalization

WealthTech Radar 2023, Fincite

Tailored consulting and asset management have long been considered “top-tier” investment services, available only to clients with assets worth several millions of euros or more. This is changing today as automation is making personalized investment strategies accessible to a wider target group, the report says.

Robo-advisors are a prominent example of this concept. Powered by artificial intelligence (AI), robo-advisors provide automated, algorithm-driven financial planning and investment services with little to no human supervision. Because robo-advisors rely on automation, these platforms are often inexpensive, require low opening balances and are able to provide personalized financial advice.

Ultimately, the next generation of financial advice will be much more reliant on technology, leveraging advanced digital platforms for their internal operations as well as to engage with their customers, the report says.

Hybrid advice, which combines human-assisted personal guidance on investment with a consumer-led automated service on a platform, is already a growing trend, facilitated by platforms such as Addepar or Fincite.CIOS, which are supporting advisors through digital processes and holistic reporting.

Another trend highlighted in the report and which is rapidly gaining pace is direct indexing. Direct indexing involves purchasing the underlying shares of an index, rather than owning an index mutual fund or index exchange-traded fund. By breaking down index funds into their smallest component components, the individual stocks, advisors can build a portfolio with single securities, enabling the cost of fund purchases to be lowered while at the same time offering a high level of personalization.

Environmental, social and governance (ESG) standards are another trend to watch out for, the report says, with many software providers and in-house developers of European providers now working on integrating ESG criteria into the valuation of shares and other investments.

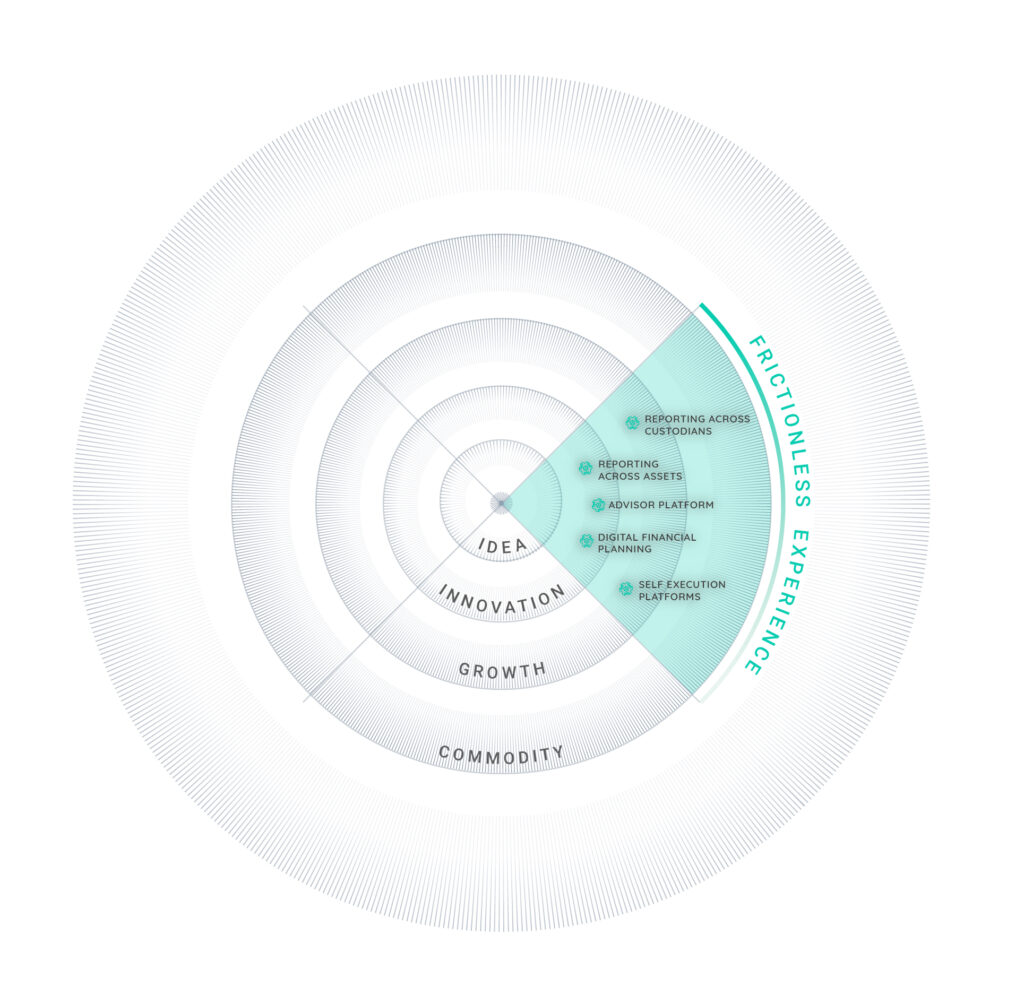

Frictionless experience

WealthTech Radar 2023, Fincite

Finally, the last big trend outlined in the report is the move towards frictionless experiences. This trend will grow in prominence as clients and advisors become less and less tolerant of inefficient processes, poor functionality and unnecessary tasks, the report says.

Several features and capabilities will help wealth managers reach this goal, it says, including portfolio aggregation as well as integrated asset statements. These features will allow investors to get a centralized overview of all of their portfolios, including those held by third-party banks, it says.

Advisors will also rely more heavily on advanced software. These platforms will facilitate the entire value creation process involved in client interaction such as onboarding and profiling, in addition to proposal generation, reporting and ordering, it says.

Featured image credit: Edited from freepik

The post The Top 3 European Wealthtech Trends appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Tags: Featured,newsletter