I don’t know the answer to the question posed in the title. No one does because the future is not predictable. I don’t know what will happen in Ukraine. I don’t know how much what has already happened there – and what might – matters to the US and global economy. I don’t know if the Fed is making a mistake by (likely) hiking interest rates by an entire 1/4 of 1% this week. I can only see things as they are today and think about similar times in the past and know that...

Read More »Weekly Market Pulse: Zooming Out

How often do you check your brokerage account? There is a famous economics paper from 1997, written by some of the giants in behavioral finance (Thaler, Kahnemann, Tversky & Schwartz), that tested what is known as myopic loss aversion. What they found was that investors who check their performance less frequently are more willing to take risk and experience higher returns. Investors who check their results frequently take less risk and perform worse. And that...

Read More »Global Asset Allocation Update

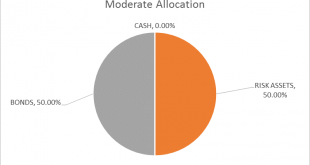

The risk budget is unchanged this month. For the moderate risk investor the allocation to bonds and risk assets is evenly split. There are changes this month within the asset classes. How far are we from the end of this cycle? When will the next recession arrive and more importantly when will stocks and other markets start to anticipate a slowdown? These are critical questions for investors and ones that can’t be...

Read More »Dollar & Stocks Jump; Bonds & Bullion Dump In Lowest Volatility September Ever

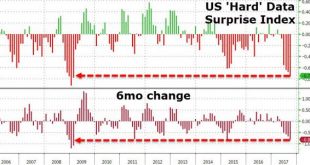

It has now been 318 trading days since the S&P 500 suffered a 5% drawdown – the 4th-longest streak since 1928… So everything is awesome… [embedded content] BUT…US ‘hard’ economic data has not been this weak (and seen the biggest drop) since Feb 2009… US Data Surprise Index, 2006 - 2017 - Click to enlarge Q3 Was a Roller-Coaster… Q3 was the 8th straight quarterly gain in a row for The Dow – the longest streak...

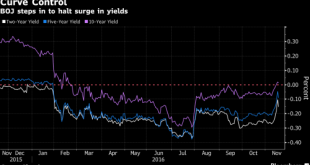

Read More »BOJ “Fires Warning At Bond Market” Sending Global Yields, Dollar Lower; All Eyes On Yellen

Yesterday morning we noted why, in light of the ongoing global bond rout, all eyes would be on the BOJ, and specifically whether Kuroda would engage his "Yield control" operation to stabilize the steepness of the JGB yield curve and implicitly support global bond yields in what DB said would be "full blown helicopter money" where the "BoJ is flying the copter over the US and may be about to become the new US government’s best friend." And sure enough that is precisely what Kuroda did last...

Read More »Stocks Set Another Valuation Record

Believe It Or Not… There Actually Is Some Downside Risk BALTIMORE – Not much action in the stock market last week. A few little steps ahead to over the 18,000 line for the Dow. Then a few little steps back. Currently the index sits at 17,732. DJIA, daily Fed chief Janet Yellen has made it clear she won’t do anything to disturb investors’ sleep. But that doesn’t mean they won’t have nightmares. Our research department...

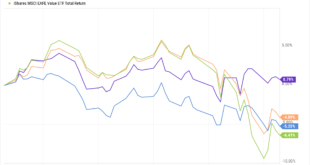

Read More »US Equities: Staying Afloat in Choppy Markets

At first glance, U.S. equities seem to be turning a corner: They’ve rebounded from their February lows, bolstered by signs that China’s economy is stabilizing, dovish signals from the Federal Reserve, and a recovery in oil prices. And the majority of U.S. companies have beat first-quarter earnings and sales expectations. But that’s all in the past. Looking forward, Credit Suisse believes that several challenges will lead to choppy market conditions for the remainder of the year. ...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org