Over the past year, governments and regulatory bodies from around the world have increased their focus on the taxation of the cryptocurrency industry, a trend that comes on the back of increasing investment, adoption and innovation in the space despite collapsing prices and high profile business failures, a new report by consulting firm PwC says. PwC’s 2022 Global Crypto Tax Report, released earlier this month, looks at the state of crypto taxation globally, exploring emerging trends and key developments that have occurred over the past year. According to the report, 2022 has been marked by increasing tax regulation targeting the crypto sector, a trend that was prompted by major steps being taken by governments and international bodies like the Organisation for

Topics:

Fintechnews Switzerland considers the following as important: 6c.) Fintechnews, Blockchain/Bitcoin, Featured, newsletter, Regulation

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

Over the past year, governments and regulatory bodies from around the world have increased their focus on the taxation of the cryptocurrency industry, a trend that comes on the back of increasing investment, adoption and innovation in the space despite collapsing prices and high profile business failures, a new report by consulting firm PwC says.

PwC’s 2022 Global Crypto Tax Report, released earlier this month, looks at the state of crypto taxation globally, exploring emerging trends and key developments that have occurred over the past year.

According to the report, 2022 has been marked by increasing tax regulation targeting the crypto sector, a trend that was prompted by major steps being taken by governments and international bodies like the Organisation for Economic Cooperation and Development (OECD), the European Union (EU) and the US.

In October, the OECD, an intergovernmental organization comprising 38 member countries that focuses on stimulating economic progress and world trade, released its tax reporting framework. Dubbed the Crypto-Asset Report Framework (CARF), the guidance sets forth a global tax transparency framework for the automatic reporting and exchange of taxpayer information between countries relating to financial accounts and crypto-assets.

In the EU, a new law was proposed earlier this month that requires crypto providers to report details of their EU clients’ transactions to national tax authorities within the bloc. The proposed new tax rules, known as the eighth Directive on Administrative Cooperation (DAC8), seeks to halt billions of euros in evasion by taxpayers storing their crypto abroad.

Like the OECD’s CARF, the DAC8 proposal also contains provisions on reporting and exchange of information on crypto-assets for direct tax purposes.

In the US, the bipartisan Infrastructure Investment and Jobs Act (IIJA) was signed into law on November 15, 2021, setting aside over US$1.2 trillion to upgrade the country’s infrastructure over the next decade. Included in the package are new authorities for the US Internal Revenue Service (IRS) and Treasury Department, giving them the power to establish tax reporting rules for cryptocurrency transactions starting in 2023.

Focus on NFTs and DeFi

In addition to increasing tax regulation on crypto trading gains, tax administrators have also started looking at non-fungible tokens (NFTs) and decentralized finance (DeFi) applications

Earlier this year, the US IRS adjusted its annual tax instructions to account for NFTs, replacing the term “virtual currency” with “digital assets,” which encompass NFTs.

In India, the government introduced in the Union Budget 2022 regulations to tax incomes from virtual digital assets, including crypto and NFTs. The amended law includes the definition of crypto assets, NFTs and other similar tokens. It also notifies that any income from the sale or transfer of crypto assets or NFTs shall be taxed at 30%.

Meanwhile, in the DeFi industry, early guidance around taxation remains limited, though some jurisdictions have started looking into the topic.

The UK government, for example, announced in April a package of measures focused on crypto-assets. The measures include an intention to consider and address concerns about the tax treatment of DeFi loans and staking.

In Switzerland, the Swiss Federal Tax Administration and the Association of Swiss Tax Administrations published in December 2021 their updated workpapers and guidelines on the taxation of crypto and blockchain projects, providing greater clarity on how investment tokens, staking/airdrops, and employee participations are to be taxed.

According to Swiss law firm Bär & Karrer, though no specific guidelines relating to NFTs have been published, some of the key Swiss tax principles are applicable to NFTs.

In Switzerland, capital gains on the sale of private assets are in principle tax-free, while capital gains on the sale of business assets, including those that serve a self-employed activity, are subject to income tax.

For private crypto investors, capital gains are exempted from taxation if the assets are held for at least six months and if it doesn’t involve debt instruments, explained experts from Deloitte Switzerland. Trading turnover must not exceed five times the holding at the beginning of the tax period and capital gains should be smaller than 50% of the total income in the respective tax period. Additionally, derivatives must solely be used for hedging.

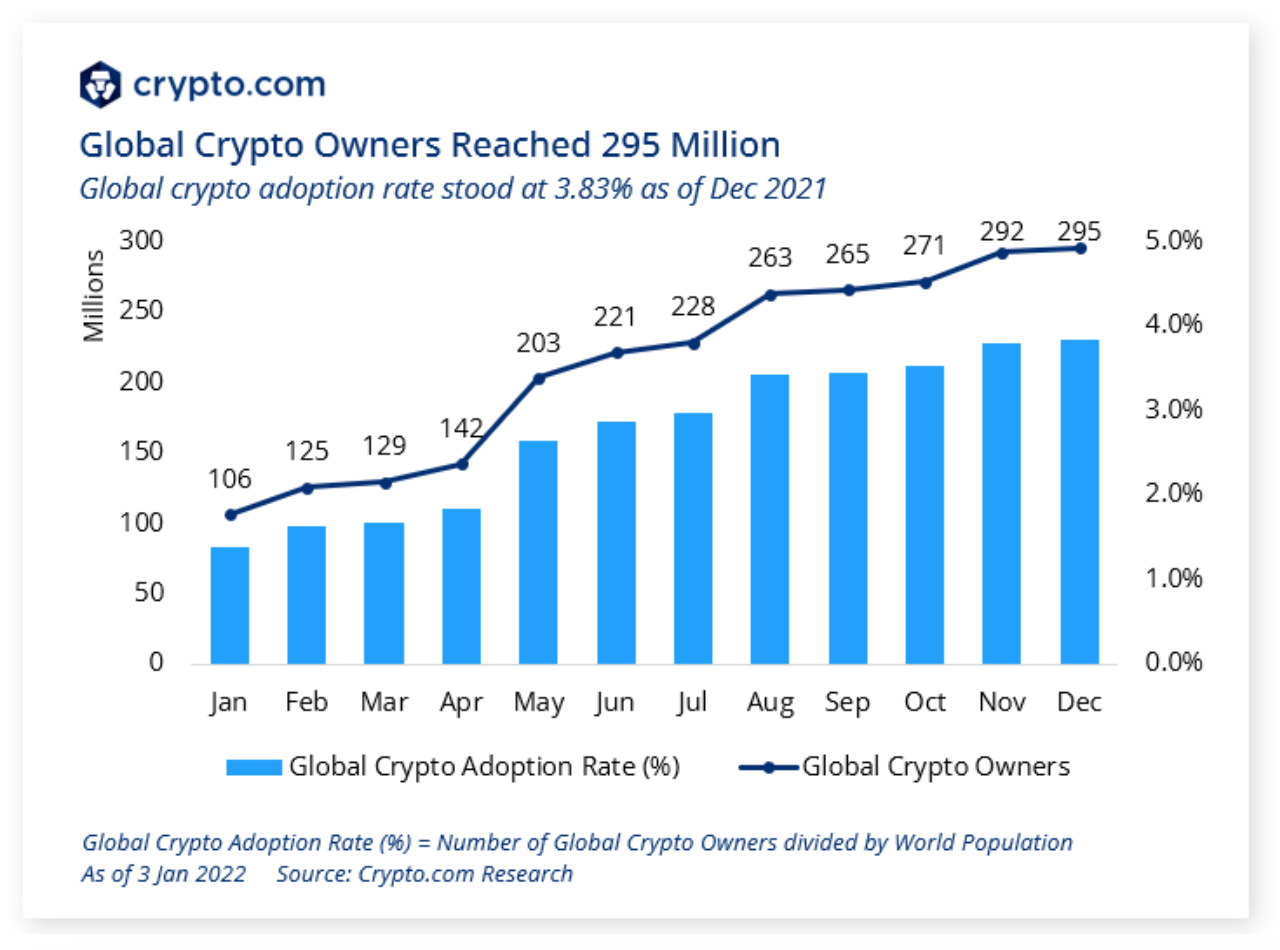

According to a 2022 research by crypto exchange company Crypto.com, the global crypto population increased by 178% in 2021 with users totaling nearly 300 million. Booming adoption of crypto came on the back of heavyweight institutions, including Mastercard and Visa, taking steps to embrace crypto during 2021.

Global crypto adoption, Source: Crypto.com Research 2022

Featured image credit: Freepik

The post Governments, International Bodies Ramp up Crypto Tax Regulations appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Tags: Blockchain/Bitcoin,Featured,newsletter,Regulation