Over the past couple of weeks, we reviewed the U.S. government confiscation of gold by Executive Order in 1933. (see “Gold Confiscation: Will History Repeat Itself?” and “The Facts of Gold Confiscation: The Saga Continues”). One of the points was that the difference between 1933 and today is that gold is not money for banks today. This means banks are not on a gold standard. Some observers have stated that the announcement by Russia’s Central Bank on March 25 to...

Read More »Turkey and Russia Highlight Gold’s Role as a Strategically Important Asset

On 17 April, Turkish news publication Ahval published a report stating that during 2017, Turkey withdrew 26.8 tonnes of gold that it had stored in the vaults of the New York Federal Reserve, and moved this gold under the custodianship of the Bank of England and the Bank for International Settlements (BIS). The source of the Ahval report was a Turkish language article from the popular Hürriyet newspaper in Turkey....

Read More »Buy Gold, Silver Time After Speculators Reduce Longs and Banks Reduce Shorts

Buy Gold, Silver Time After Speculators Reduce Longs and Banks Reduce Shorts – Gold and silver COT suggests bottoming and price rally coming– Speculators cut way back on long positions and added to short bets– Commercials/banks significantly reduced short positions– Commercial net short position saw biggest one-week decline in COMEX history– ‘Big 4’ commercial traders decreased their short positions by 28,800...

Read More »Year-end Rate Hike Once Again Proves To Be Launchpad For Gold Price

Year-end rate hike once again proves to be launchpad for gold price – FOMC follows through on much anticipated rate-hike of 0.25%– Spot gold responds by heading for biggest gain in three weeks, rising by over 1%– Final meeting for Federal Reserve Chair Janet Yellen– Yellen does not expect Trump’s tax-cut package to result in significant, strong growth for US economy– No concern for bitcoin which ‘plays a very small...

Read More »Russia, China and BRICS: A New Gold Trading Network

One of the most notable events in Russia’s precious metals market calendar is the annual “Russian Bullion Market” conference. Formerly known as the Russian Bullion Awards, this conference, now in its 10th year, took place this year on Friday 24 November in Moscow. Among the speakers lined up, the most notable inclusion was probably Sergey Shvetsov, First Deputy Chairman of Russia’s central bank, the Bank of Russia. In...

Read More »Bitcoin – Plan Your Exit Strategy Now – Maybe With Gold

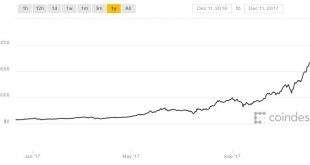

Bitcoin - Plan Your Exit Strategy Now - Maybe With Gold Made money in bitcoin? Well done. Don’t wait until the stampede starts. Here’s what you must do now. by Dominic Frisby in Money Week So there I was on Sunday afternoon, doing what it is one does on a Sunday – very little in my case – and a notification comes up on my phone: “Bitcoin rises over 10% to $11,800”. Bitcoin in USD (1 Year). Source: CoinDesk On a Sunday. When every other market is closed. It’s bad enough that bitcoin is making...

Read More »Russia Buys 34 Tonnes Of Gold In September

– Russia adds 1.1 million ounces to reserves in ongoing diversification from USD – 34 ton addition brings Russia’s Central Bank holdings to 1,779t; 6th highest – Russia’s gold reserves are at highest point in Putin’s 17-year reign – Russia’s central bank will buy gold for its reserves on the Moscow Exchange – Russia recognises gold’s role as independent currency and safe haven Russian Central Bank Gold Reserves, 2006 -...

Read More »Gold Market Charts – A Month in Review

BullionStar has recently started a new series of posts highlighting charts relating to some of the most important gold markets, gold exchanges and gold trends around the world. The posts include charts of the Chinese Gold Market, the flow of gold from West to East via the London and Swiss gold markets, and the holdings of gold-backed Exchange Traded Funds (ETFs). This is the second post in the series. Please see...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org