Japan’s central bank is keeping down the cost of national debt – but is their a hidden price? Keystone / Katsumi Kasahara The cost of paying off spiralling national debt in the United States and Switzerland is rising as interest rates increase. This makes the financing of pandemic expenditure more expensive. That’s not a problem in Japan where the central bank is holding interest rates in check. Would the Japanese recipe also be something for Switzerland? The US Congress recently passed a .9 trillion (CHF1.77 billion) stimulus package. As a result, American national debt will rise to World War Two levels. The Swiss parliament has also been in a generous mood. For example, it recently raised financing of a hardship fund, designed to cushion the economic impact of

Topics:

Swissinfo considers the following as important: 3.) Swissinfo Business and Economy, 3) Swiss Markets and News, Business, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

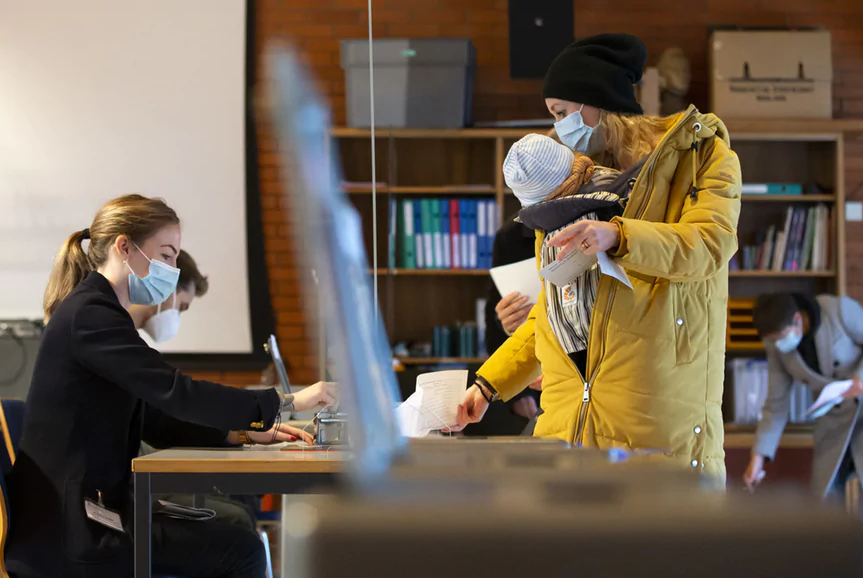

Japan’s central bank is keeping down the cost of national debt – but is their a hidden price? Keystone / Katsumi Kasahara

The cost of paying off spiralling national debt in the United States and Switzerland is rising as interest rates increase. This makes the financing of pandemic expenditure more expensive. That’s not a problem in Japan where the central bank is holding interest rates in check. Would the Japanese recipe also be something for Switzerland?

The US Congress recently passed a $1.9 trillion (CHF1.77 billion) stimulus package. As a result, American national debt will rise to World War Two levels.

The Swiss parliament has also been in a generous mood. For example, it recently raised financing of a hardship fund, designed to cushion the economic impact of Covid-19, from CHF5 billion to over CHF10 billion. Switzerland has in total set aside more than CHF60 billion to tackle the crisis.

Increased spending has been shadowed by rising interest rates in both countries.

Higher interest rates are linked to the expectation of rising inflation. It’s a bit like lending your computer to a friend for a few years. You will get it back when the loan period expires, but the computer will be worth less.

It’s similar with money: investors lend to the state today with an expectation of getting their money back at a later date. However, once the money has been returned, investors cannot afford as much because the price of goods and services has been rising in the meantime. That is why investors are demanding higher interest payments to compensate for expected inflation.

This is a burden for the state. When interest rates rise, treasuries must spend a greater proportion of their revenues on servicing debts. So, there is less money left for education, the army or social services.

‘Yield curve control’

To prevent this from happening, the Japanese central bank promised back in 2016 to keep national debt interest rates at zero. This type of monetary policy is known as “yield curve control”.

Controlling the yield curve is risky for central banks. This interest rate pledge could result in the central bank financing the entire national deficit.

Why would others lend their money to the state for zero interest when inflation is forecast to rise?

This type of public financing can also encourage politicians to spend even more money. In the worst-case scenario, governments spending too much at the wrong time can result in uncontrollable inflation and monetary devaluation. The well-intentioned yield curve management would then become counter-productive.

Sharply rising prices slow down economic activity. Instead of introducing a new line of products, managers spend their time constantly adjusting the price of their goods and services. This is what happened in the US after 1946 when the US Federal Reserve opted for yield curve control.

Despite these risks, the Australian central bank is currently also controlling interest rates on national debt. “Yield curve control works pretty well in Australia,” says Anjeza Kadilli, who monitors Australian monetary policy for Pictet Asset Management. The central bank in Sydney was able to stabilise interest on the three-year national debt at 0.1% without major problems. This is one of the reasons that unemployment is now significantly lower than forecast. And it did not lead to a surge in prices.

The Swiss National Bank (SNB) could theoretically employ yield curve control to ensure that the cost of financing pandemic expenditure remains low. “We are closely monitoring measures taken by other central banks and are evaluating their suitability for Switzerland,” says the SNB. But ahead of its next monetary policy meeting, the Swiss central bank does not explicitly say whether yield curve control is under consideration.

What do you think about yield curve control? Should the SNB keep government funding costs low? You can discuss this with the author on Twitter – in German, English and French. You can find his profile hereExternal link.

Author Fabio CanetgExternal link completed his doctorate on monetary policy at the University of Bern and the Toulouse School of Economics. Today he is a lecturer at the University of Neuchâtel. As a freelance journalist, he writes for SWI swissinfo.ch and RepublikExternal link. He moderates the monetary policy podcast “GeldcastExternal link”.

End of insertion

Tags: Business,Featured,newsletter