The New In Gold We Trust Report is Here! As announced in our latest gold market update last week, this year’s In Gold We Trust report by our good friends Ronald Stoeferle and Mark Valek has just been released. This is the biggest and most comprehensive gold research report in the world, and as always contains a wealth of interesting new material, as well as the traditional large collection of charts and data that makes it such a valuable reference work for gold investors. To provide a brief overview of the contents, here is the press release that accompanied the publication – the report is available for download via a link further below. Nothing provides a feeling of material security comparable to the reassuring

Topics:

Pater Tenebrarum considers the following as important: 6) Gold and Austrian Economics, 6a) Gold & Bitcoin, Chart Update, Featured, Mark Valek, newslettersent, Precious Metals, Ronald Stoeferle

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

The New In Gold We Trust Report is Here!As announced in our latest gold market update last week, this year’s In Gold We Trust report by our good friends Ronald Stoeferle and Mark Valek has just been released. This is the biggest and most comprehensive gold research report in the world, and as always contains a wealth of interesting new material, as well as the traditional large collection of charts and data that makes it such a valuable reference work for gold investors. To provide a brief overview of the contents, here is the press release that accompanied the publication – the report is available for download via a link further below. |

Gold and the Turning of the Monetary Tides

- The 12th edition of the annual In Gold we Trust report discusses three fundamental turning points affecting the global monetary system. The authors of the report Ronald- Peter Stoeferle and Mark Valek refer to these as “Monetary Turns of the Tide”:

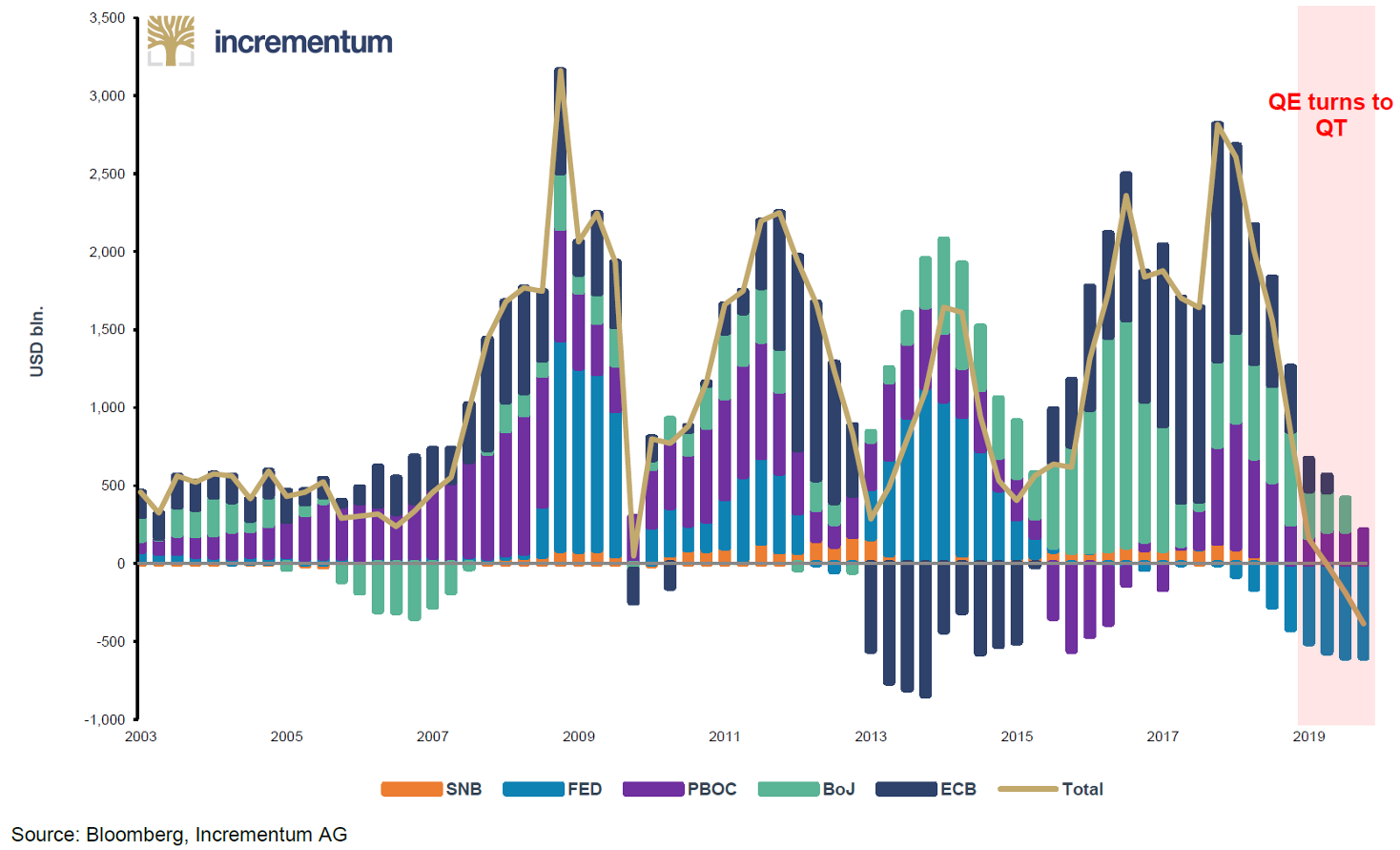

- The Federal Reserve has sounded the bell on a beginning turn of the tide in monetary policy: the start of a global rate hike cycle and particularly the reversal from “QE” to “QT” puts an end to a decade of flooding the markets with liquidity. The fact that the liquidity tide is going out marks the first time in ten years that financial markets are facing a real test.

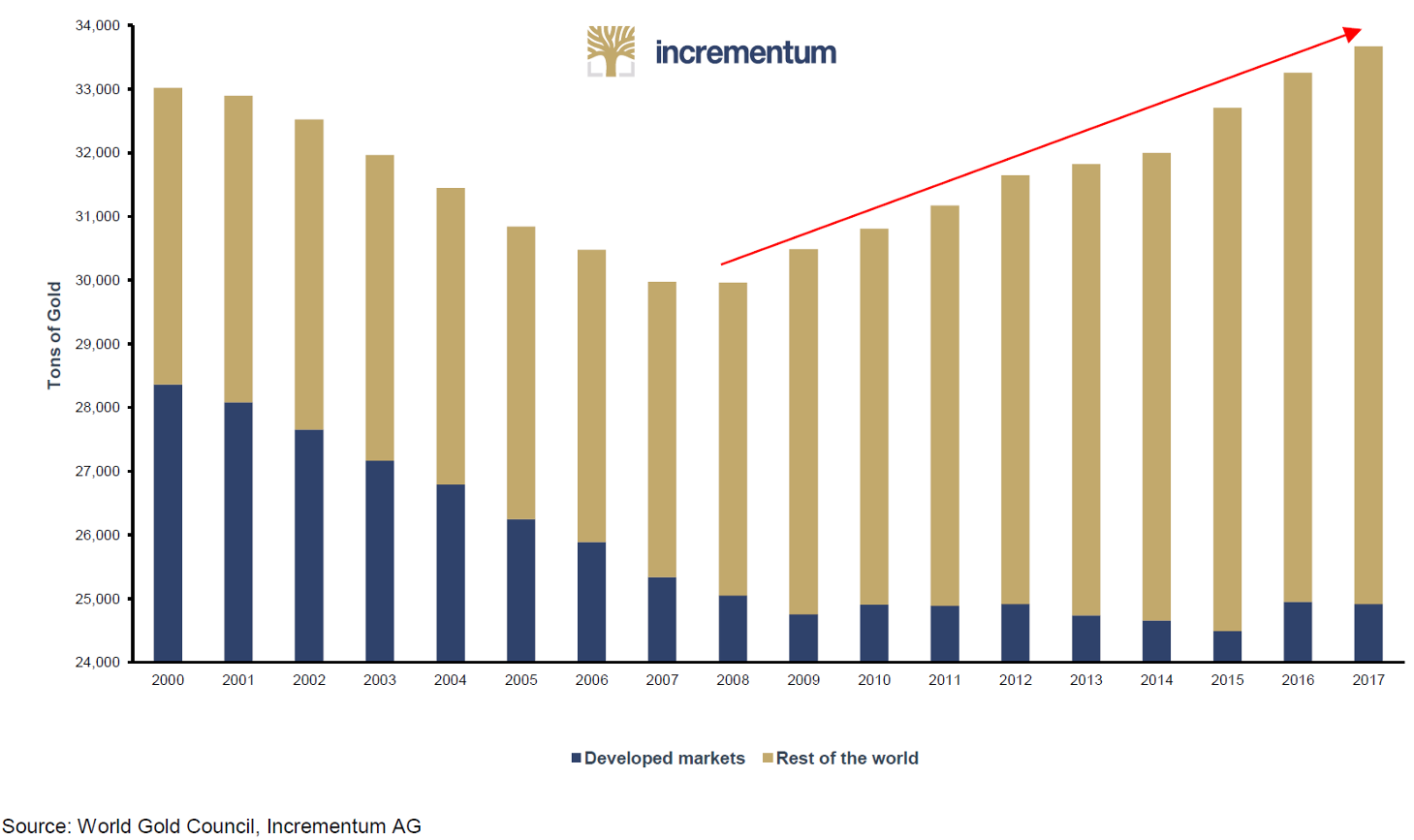

- A turn of the tide in the global monetary system, away from the US dollar-centric monetary order toward a multi-polar order increases the relevance of gold. Gold is beginning to play a more prominent role in the currency policy deliberations of central banks, above all as a result of growing geopolitical polarization, increasing over-indebtedness and the continuing process of “de-dollarization”.

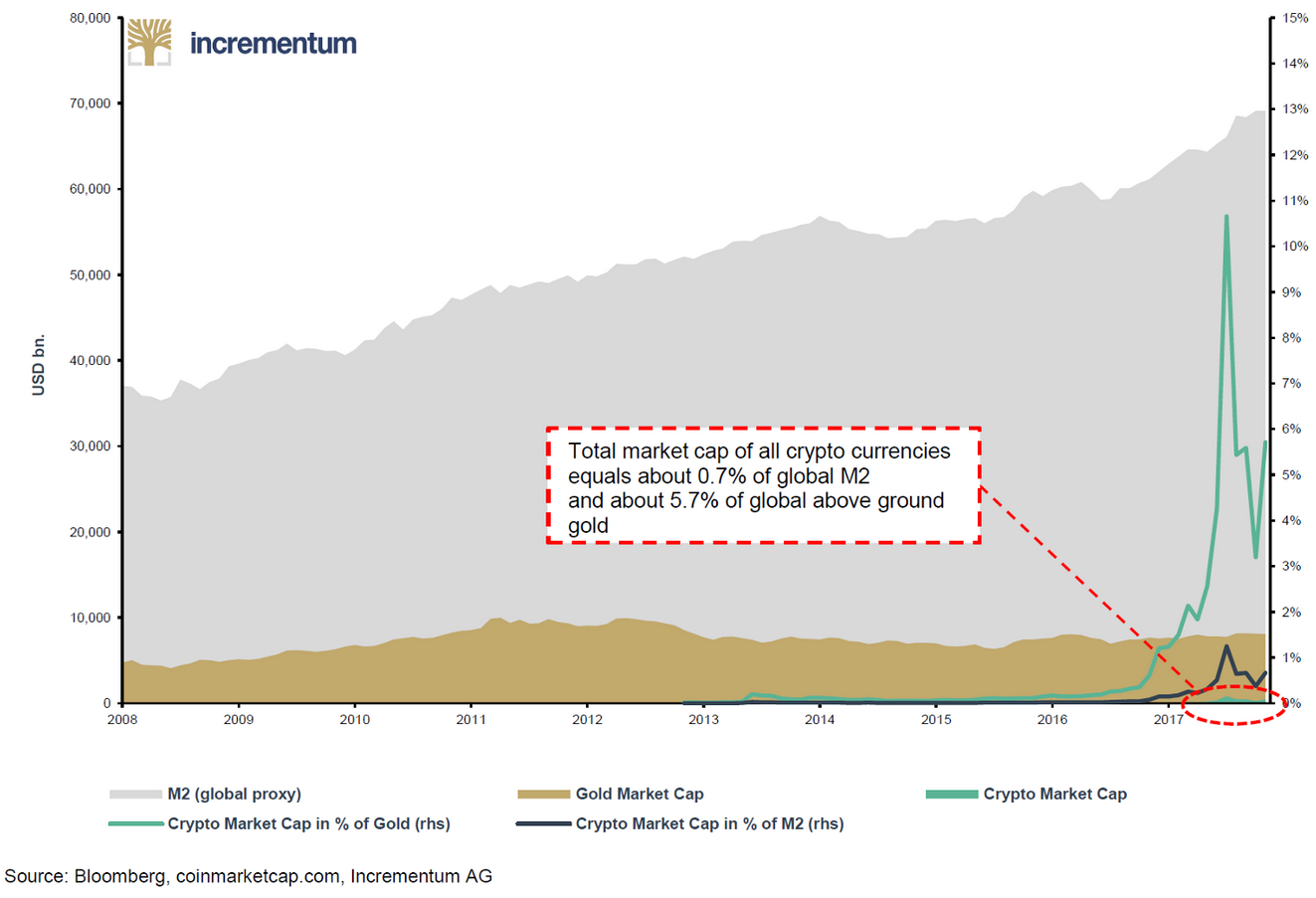

- A technological turn of the tide has occurred due to the proliferation of blockchain technology and the cryptocurrencies associated with it. These new technologies are offering a multitude of innovations as virtual means of payment and stores of value. In the meantime even gold-backed crypto-tokens have been successfully launched.

- Another topic examined in this year’s In Gold we Trust report are inflationary tendencies. In the ongoing tug-of-war between inflationary and deflationary forces, inflationary forces appear to have gained the upper hand in the course of the past year. Since September 2017 our proprietary Incrementum Inflation Signal also indicates that price inflation is gathering pace.

- After a period of intense creative destruction, precious metals mining stocks are once again attractive. In light of the currently extremely high level of the gold-silver ratio, excellent investment opportunities should become available in the stocks of primary silver producers, in particular once the trend in the ratio changes again.

- Technical analysis by and large indicates that a positive set-up for gold is in in place. Sentiment on gold is pessimistic and there was a healthy adjustment in speculative positioning in the futures markets. The seasonally strongest period for the gold price begins in June.

This year’s edition of the In Gold we Trust report was presented at an international press conference in Vienna, Austria on May 29, 2018. Ronald-Peter Stoeferle and Mark Valek, investment managers of the asset management company Incrementum AG in Liechtenstein, are the authors of the report. Last year’s edition of the In Gold we Trust report was downloaded more than 1.7 million times and the report is widely considered the “gold standard” in gold-related research. Further information on the report and its authors can be accessed at www.ingoldwetrust.report.

On more than 200 pages, the authors analyze a wide variety of drivers affecting the gold price. This year’s edition of the report also contains two exclusive interviews: one with US-based analyst Luke Gromen (FFTT), in which he discusses the future of the US dollar. The other interview was conducted with Dr. Richard Zundritsch, the nephew of renowned Nobel Prize laureate Friedrich A. Hayek. He comments on Hayek’s proposal calling for competition between (privately issued) currencies. Due to the introduction of gold-backed cryptocurrencies, the idea has gained renewed topicality.

In the course of 2017 the price of gold rallied primarily in US dollar terms (+13.7%). It gained ground in almost every other currency as well (AUD, CAD, JPY, etc.). Only in euro terms did the gold price suffer a small decline of -1%. Since the beginning of 2018, the performance of gold in USD terms was to date slightly negative (-1.2%), while euro-based investors enjoyed a small gain of +0.6%. The recent low volatility of the gold price is quite remarkable. It has decreased to the lowest level in more than 10 years.

Three turns of the tide are the focus of this year’s edition of the In Gold we Trust report:

| 1) A turn of the tide in monetary policy

The changeover from quantitative easing (QE) to quantitative tightening (QT) has received surprisingly little attention in public debate. By creating a gargantuan flood of liquidity over the past decade, global central banks have pushed asset prices to dizzying heights. The world’s five largest central banks have created the almost unfathomable equivalent of USD 14.357 trillion in this time period and invested it in securities. However, this year central banks will turn from net buyers of into net sellers of securities. The consequences of this turn of the tide in monetary policy – the implementation of which has already begun in the US, with the euro area set to follow suit soon – could be quite dramatic, as the monetary stimulant applied in an attempt to prevent a relapse into crisis conditions in the post-Lehman era had numerous side effects. For one thing, the medicine enticed the patient to indulge in a da capo of the global debt accumulation orgy. Mario Draghi’s “whatever it takes” policy was supposed to buy time for Southern European countries to implement structural reforms and reduce their indebtedness – that was the theory, anyway. In practice extremely low interest rates were an irresistible incentive to pile up even greater mountains of debt. For another thing, investors have come to know and love what is a supposedly low-risk financial market environment. Now the first dark clouds are appearing on the interest rate horizon. Apart from the Fed, the ECB is slowly but surely implementing a turn of tide in monetary policy as well, albeit with a considerable lag. The tide of global liquidity is beginning to go out. |

From quantitative easing to quantitative tightening 2003-2019 |

| 2) A turn of the tide in the global monetary orderThis fundamental change is nothing less than the process of “de-dollarization”, i.e., the slow renunciation of the US dollar as the dominant global reserve and trading currency and the associated changeover from a uni-polar to a multi-polar world and monetary order continues.

The process is accompanied by geopolitical polarization and a rhetoric that puts greater emphasis on divisiveness rather than on common ground. This trend has reached a new pinnacle with the election of Donald Trump. European politicians in particular are trying to take advantage of this geopolitical opportunity to escape – at least to some extent – from the clutches of the US. The creeping loss of the hegemonic status of the US dollar as the senior global reserve currency could have far-reaching consequences for the US. Declining global demand for the US dollar and treasury bonds could boost domestic US price inflation and drive interest rates up further. The increasing need for substitutes for the ever less popular US dollar leads – not least due to a lack of real alternatives – to a revival of gold’s role as a currency reserve. Particularly the central banks of Russia, China, India and Turkey have been regular buyers of gold for quite some time. |

Central bank gold reserves |

| 3) Technological turn of the tide

Epochal technological change is taking place at a breathtaking pace. More and more financial transactions are conducted with smart phones or over the internet. With the invention of cryptocurrencies the digitalization of money has received a further boost. With respect to cryptocurrencies, the authors are convinced of three major points: 1) not everything designated “crypto” has value; 2) nevertheless, cryptocurrencies are here to stay. They will fundamentally change business and quite possibly the working of the current monetary system, perhaps decisively; 3) gold and cryptocurrencies are friends, not foes. In fact, a collaborative approach would play to the strengths of both. The first gold-based cryptocurrencies are underway as we speak. |

Market capitalization: cryptocurrencies vs. gold vs. M2 |

Other key messages of this year’s edition of the In Gold we Trust report are:

- The risk-reward profile of the precious metals mining sector strikes us as excellent. We expect the gold-silver ratio to decline in the medium term. In this scenario stocks of primary silver miners should offer particularly enticing investment opportunities. In our own investment process we remain focused on developers and emerging producers.

- In the great tug-of-war between inflationary and deflationary forces, inflationary forces have gained the upper hand in the course of the past year. Since September of 2017 our proprietary Incrementum Inflation Signal also indicates that price inflation is gathering pace.

- Technical analysis by and large indicates a positive set-up for gold is in in place. Sentiment on gold is pessimistic and there was a healthy adjustment in speculative positioning in the futures markets. The seasonally strongest period for the gold price begins in June; this seasonal pattern in the gold price tends to be particularly pronounced in mid-term election years.

The authors expect significant upheaval in coming years that will have noticeable effects on the gold price. “In view of the three major turns of the tide discussed in this year’s edition of our In Gold we Trust report, we are quite confident regarding the prospects for gold. Once the consequences of the recent turn of tide in monetary policy become obvious and the threat of recession looms on the horizon, demand for gold as a traditional safe haven is bound to return”, notes Ronald Stoeferle in summarizing the insights of this year’s In Gold we Trust report.

Download link:

Charts and data by Incrementum, Bloomberg, World Gold Council, coinmarketcap.com

Tags: Chart Update,Featured,Mark Valek,newslettersent,Precious Metals,Ronald Stoeferle