Speculators Throw the Towel

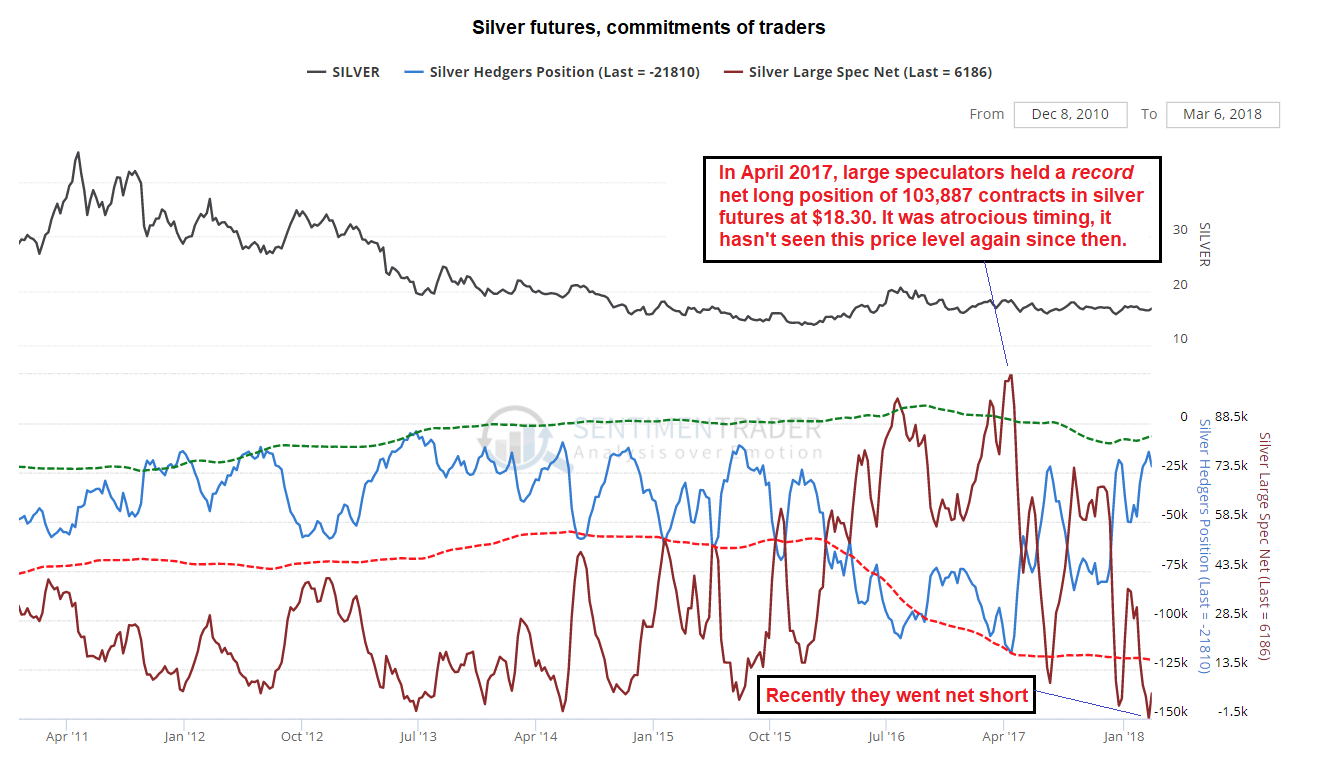

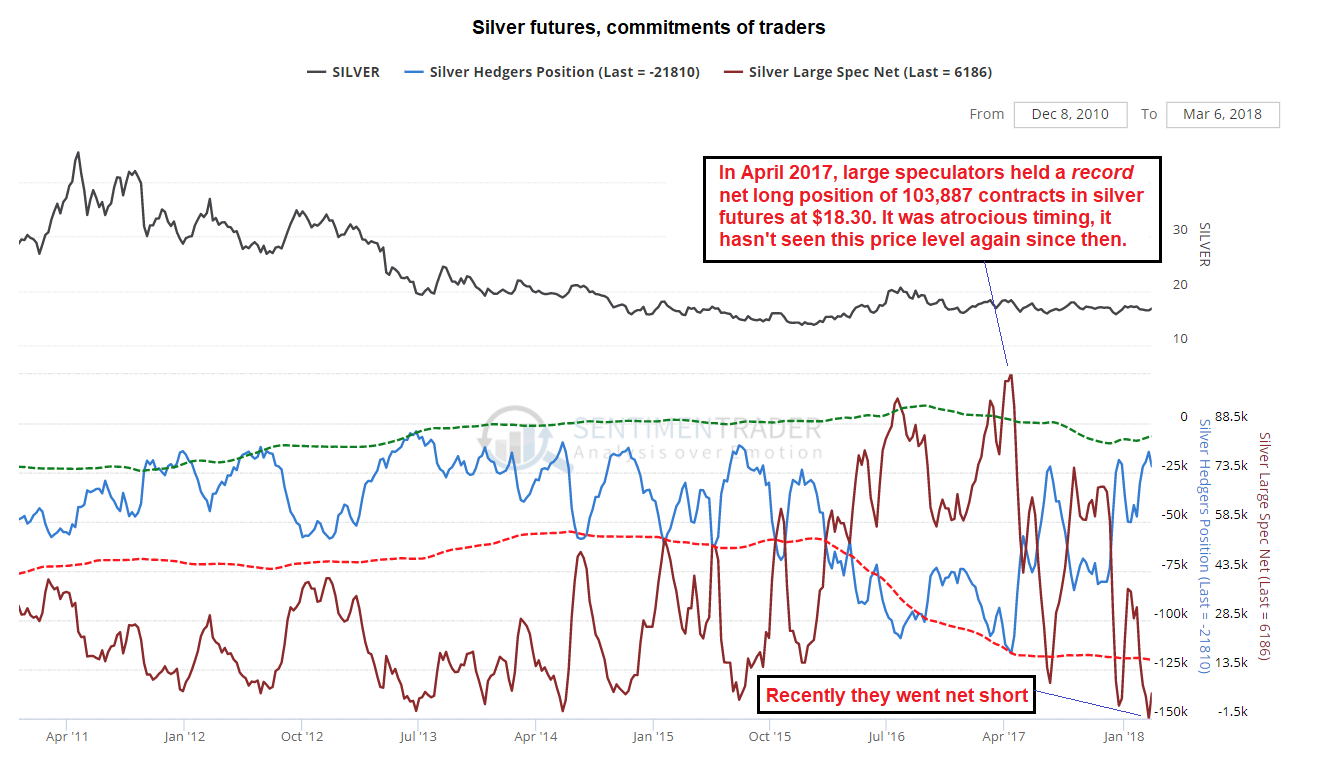

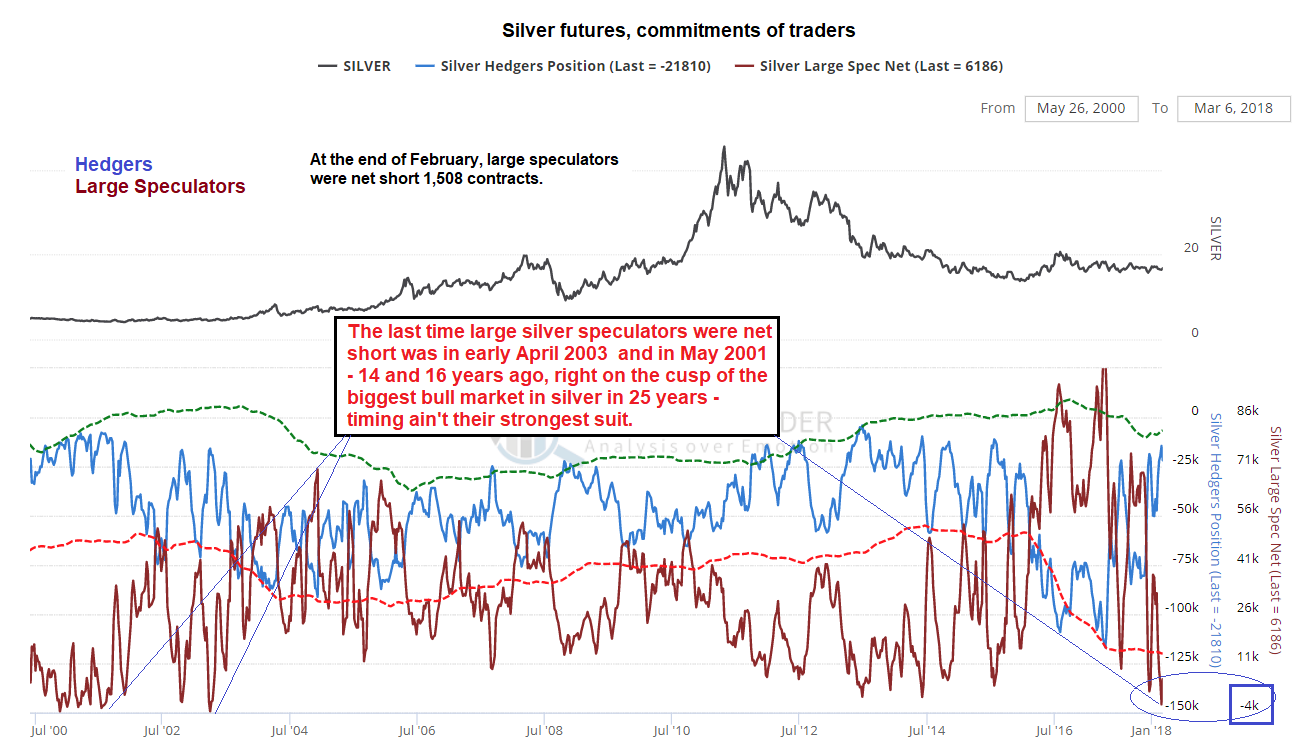

Over the past several years we have seen a few amazing moves in futures positioning in a number of commodities, such as e.g. in crude oil, where the by far largest speculative long positions in history have been amassed. Over the past year it was silver’s turn. In April 2017, large speculators had built up a record net long position of more than 103,000 contracts in silver futures with the metal trading at $18.30. At the end of February of this year, they held their first net short position in 14 years (!) with silver trading at $16.43. This is highly unusual. Here is a short term chart of the net positions of hedgers and large speculators: |

Silver Futures, Apr 2011 - Mar 2018 The net speculative and net hedger positions in silver futures have undergone huge swings lately – while prices moved only very little. - Click to enlarge Consider the much smaller net speculative position at the market top near $50 in April 2011 compared to the peaks seen since early 2016 and especially last year. We suspect that there must have been huge inflows into CTAs given how much larger reportable speculative positions in many commodity futures have become in recent years. Note that the trading strategies employed by such funds rely almost exclusively on technical signals and most of them are trend-followers (a few systems with mean-reversion overlays exist as well). Often there is no longer any human intercession, instead computer algorithms decide what and when to buy and sell. Of course such computerized trading systems are still programmed by humans – they are merely more likely to strictly stick to the rules of whatever trading strategy is implemented (humans are known for frequently second-guessing their own trading rules). As a result of this, herding effects are very likely actually magnified. |

| This is really quite remarkable, particularly when considering the price range that was the backdrop to these huge swings in net positions. Below is a continuous contract chart that shows the price action a bit more clearly (note: because of the nature of this chart, prices are diverging somewhat from the spot prices we mention in the text; but the divergences are small and the general shape of the chart is the same). |

Silver Daily, Oct 2016 - Mar 2018 A continuous contract chart of the active silver futures contract over the past 1 ½ years. - Click to enlarge We have no idea what actually motivates the recent speculative position, particularly in view of the fact that other industrial and precious metals (silver is both) are generally getting a lot more love. |

A Highly Unusual Situation

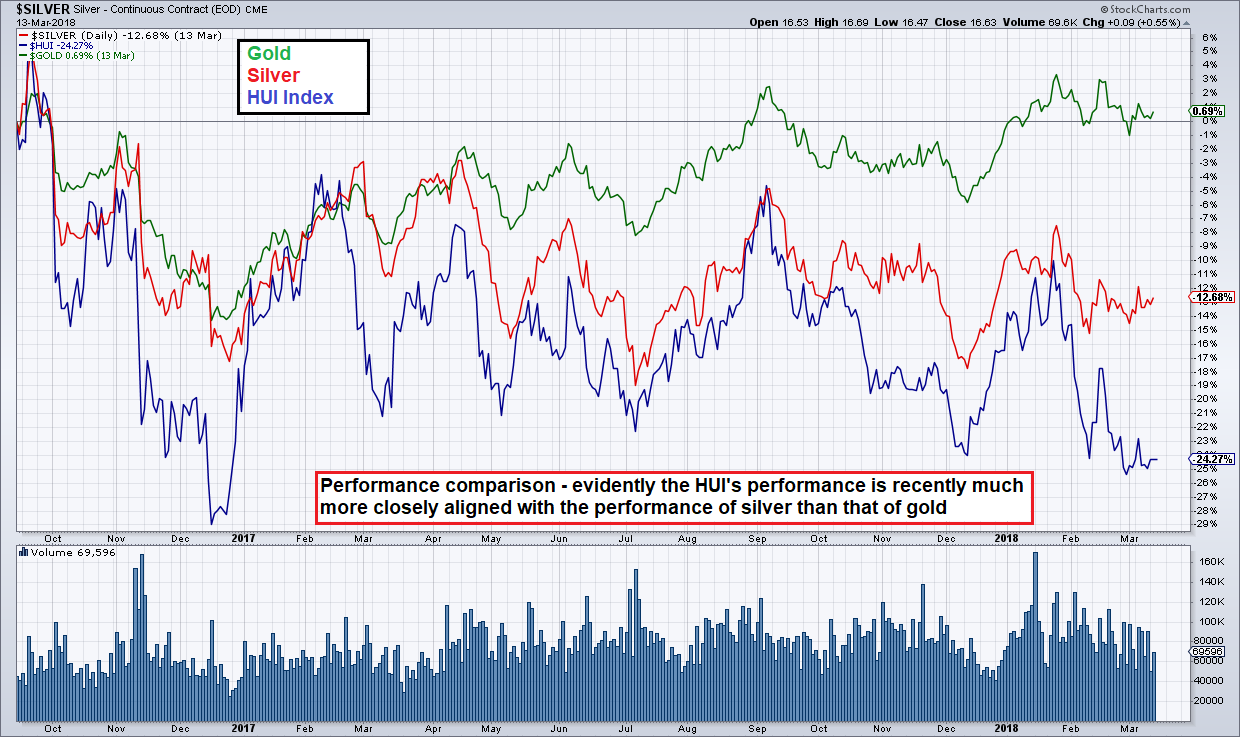

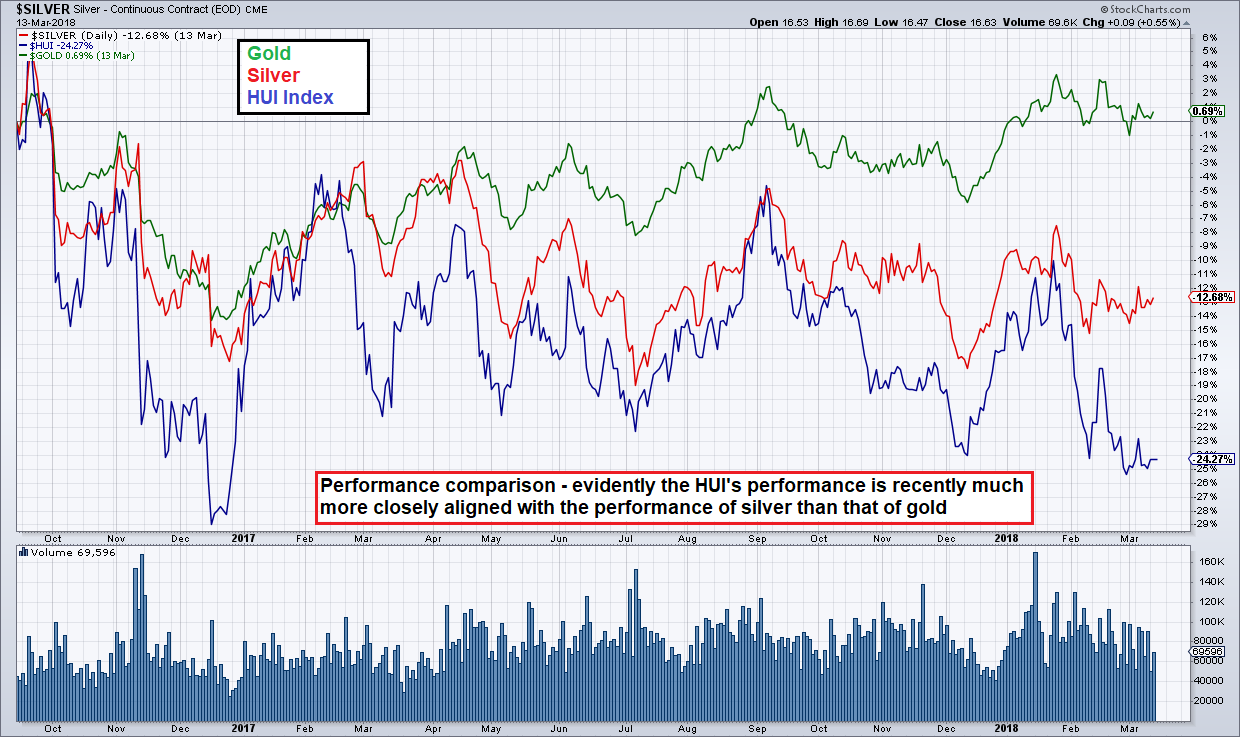

We bring this up for the following reasons: 1. precious metals stocks – regardless of whether they predominantly mine gold or silver – have shown far stronger correlation with silver prices than with gold prices over the past two years (see the chart at the end of this post); 2. whenever the speculative net position has reached an extreme over the past 20 years, the market soon went into the opposite direction, sometimes quite forcefully.

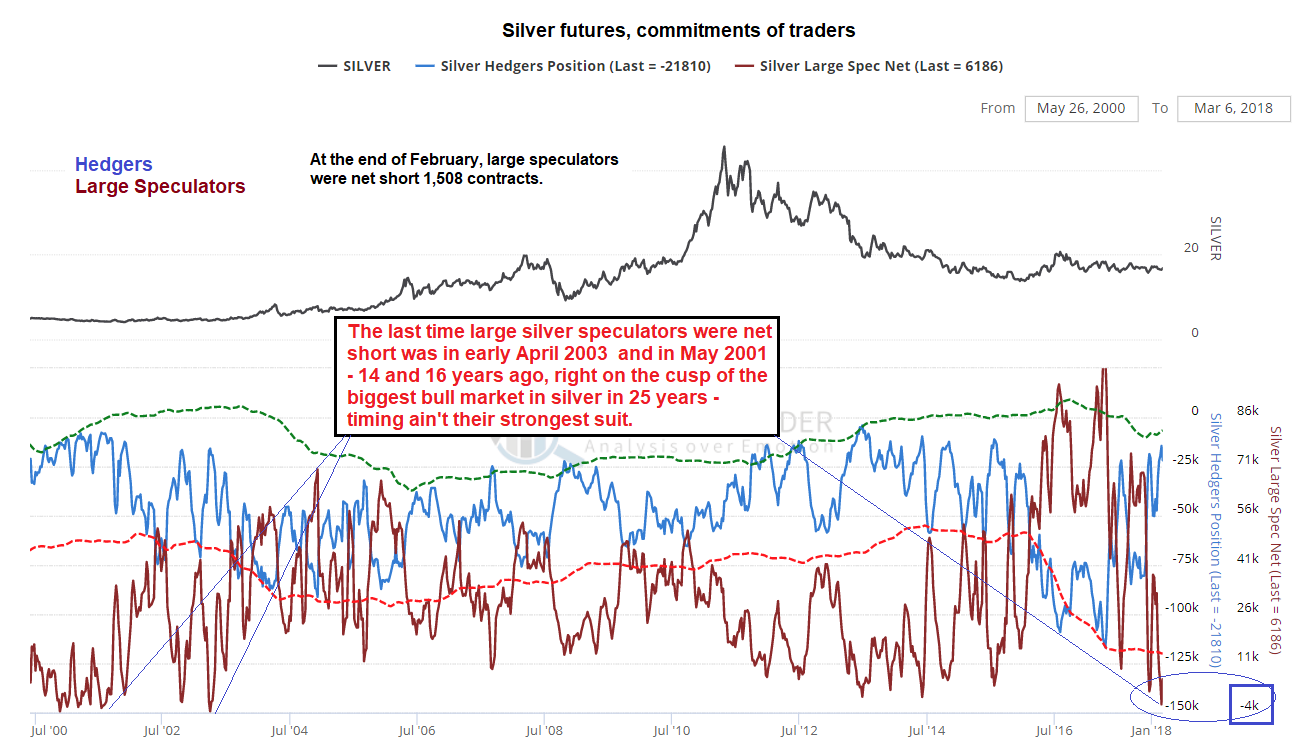

The last time speculators were net short silver was 14 years ago in early April 2003, with silver trading at $4.43 – before that, we can find several small net short positions two years earlier in 2001 – at prices ranging from $4.26 to $4.72. These occasions are rather memorable, because they marked the beginning of the biggest bull market in silver since the blow-off move of 1979 – 1980.

As an aside, the biggest ever speculative net short position in silver futures (of more than 10,000 contracts) was recorded in late July 1997 – with silver trading at $4.43, then the low of the year. Silver prices nearly doubled over the next two months. In other words, timing is apparently the strongest suit of this group of traders, in the sense that they usually just chase the trend. Collectively they have never correctly anticipated a turning point, at least not fully.

To their credit, there is a noteworthy exception to the rule: they did become increasingly skeptical along the way of the blow-off move that topped in 2011, but still held a net long position of 25,000 contracts at the peak (the timing of their sales still left a lot to be desired though, since they missed quite a large portion of the move in this case; we do give some credit to the sellers for at least side-stepping the crash). Here is a long term chart showing the situation since 2000: |

Silver Futures, Jul 2000 - Mar 2018 Silver since mid 2000 – large speculators holding net short positions is an exceedingly rare event. - Click to enlarge When it happens, it usually indicates that sentiment has become much too bearish and that one should begin to anticipate a turning point – that is at least what the historical data indicate. |

Conclusion

This was such an unusual and unexpected development that we felt we had to mention it in these pages (note: as of last week the speculative position has returned to net long 6,186 contracts, which is still very subdued exposure for this group of traders). We want to close with a caveat: precisely because the character of these markets has changed – this is to say, we more and more often see very large changes in trader positioning amid very little price volatility in commodity futures – one should probably not be too hasty to come to conclusions.

Speculative futures market positioning doesn’t trigger price moves by itself – but extremes in positioning can often exacerbate unexpected moves once they get underway. The notion that positioning extremes harbor potential once they reach certain levels rings true in the historical context, but one has to keep in mind that this context may no longer be as relevant as it once was – at least in terms of the specific boundaries that were established in the past.

In short, one shouldn’t mortgage the farm and buy silver on the basis of this signal. We do see it as a heads-up though – at the very least it is telling us that it is time to pay close attention to this market and markets related to it. As mentioned above, in terms of recent correlations the performance of silver seems particularly important for precious metals stocks. Here is a chart illustrating this development – a performance comparison between gold, silver and the HUI Index over the past 18 months: |

Silver Daily, Oct 2016 - Mar 2018 While the HUI has recently begun to even underperform rather noticeably against silver as well, it is generally more closely aligned with silver than with gold. - Click to enlarge As an aside, fundamentally this steadily growing performance gap makes very little sense. Most gold mining companies have new managers who have generally gotten a very good grip on costs and managed to greatly boost margins and cash flows even before the gold price recovery started in late 2015. Debt has been cut quite a bit at the major producers as well. It seems these stocks are simply “out of fashion” at the moment; alternatively the market expects metal prices to fall – but if that is the case, then it is an expectation that has been consistently wrong for quite a long time by now and it is not quite clear why it should become any less wrong going forward. |