The key here is the gains generated by owning US-denominated assets as the USD appreciates. Is the Greatest Bull Market Ever finally ending? One straightforward approach to is to follow the money, i.e. global capital flows: assets that attract positive global capital flows will continue rising if demand for the assets exceeds supply, and assets that are being liquidated as capital flees the asset class (i.e. negative capital flows) will decline in price. Global capital flows are difficult to track for a number of reasons. A significant percentage of global mobile capital is held in secretive offshore tax havens and “shadow banking,” and tracking global corporate capital flows is not easy. Capital held in precious

Topics:

Charles Hugh Smith considers the following as important: 5) Global Macro, Featured, newsletter, The United States

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

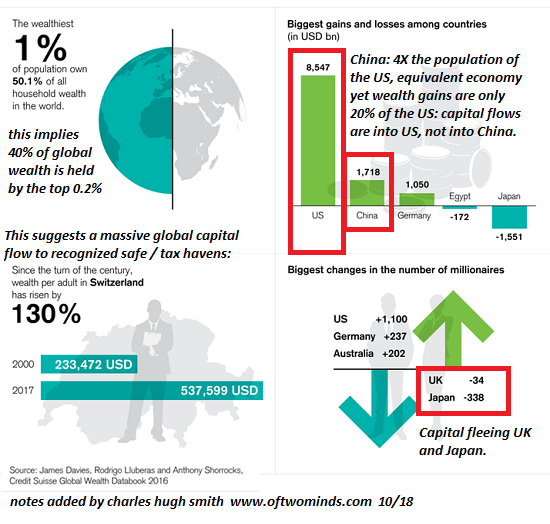

| These charts from Credit Suisse reflect this capital flow into the US and out of other nations. The phenomenal expansion of wealth in China is put into a different perspective here:with 4 times the population of the US and an economy roughly comparable in size, China’s wealth has registered only 20% of the gains accrued by the US.

If global capital was buying empty flats in China, etc., and selling US-based assets, these numbers would be reversed. This suggests mobile capital is leaving China and other nations and moving into US-denominated assets. |

Global wealth CSa |

| Most of the gains in global wealth have accrued to the US and to the top 1%.The wealthier the entity / individual, the greater the rewards and opportunities for moving wealth into tax havens and safe havens such as Switzerland and the US, which is a massive tax haven in its own right. |

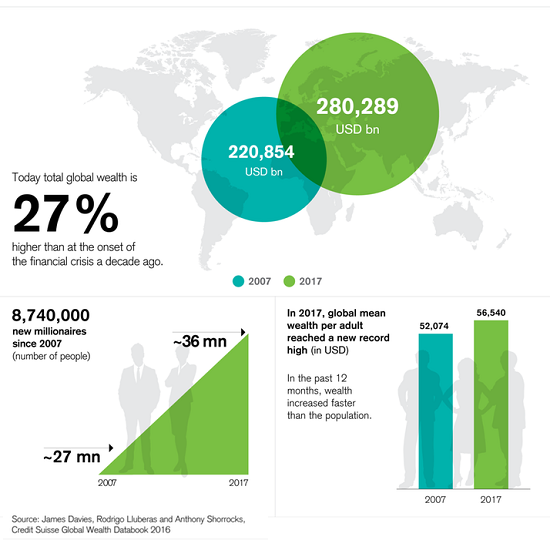

Global Wealth 2007-2017 |

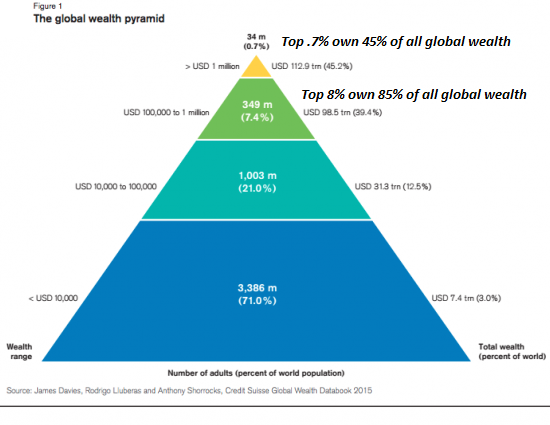

| Here’s another snapshot of the global wealth pyramid: since the Pareto Distribution applies to wealth and income, we can guesstimate that roughly 40% of all global wealth is held by the top .2% or so. The top 8% (350 million people) own 85% of all global wealth. |

The global wealth pyramid |

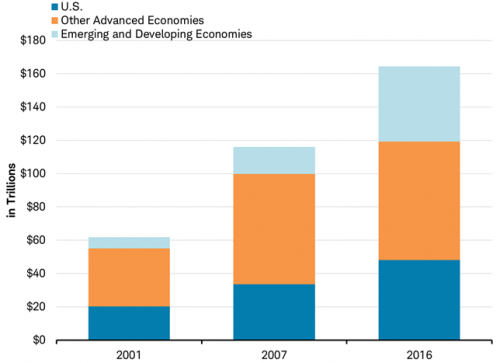

| Where is all this money coming from? Largely from debt which has expanded by over $100 trillion since 2001: |

Global Debt 2001-2016 |

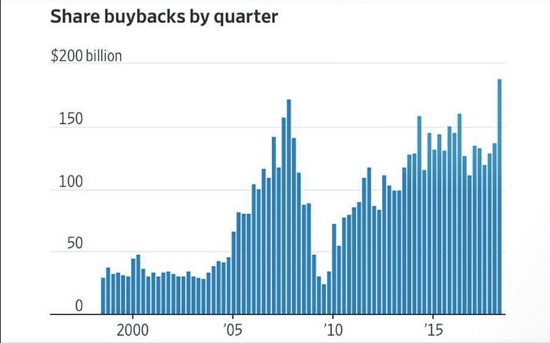

| Corporations have poured earnings into stock buybacks at a torrid pace: |

Share buybacks by quarter 2000-2018 |

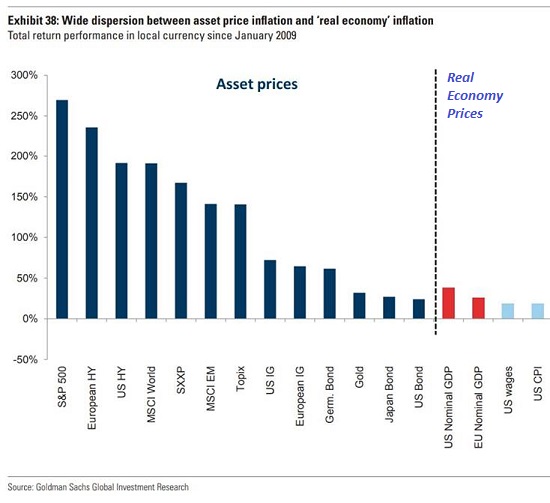

| The net result is a gargantuan inflation in assets while real-economy wages and GDP have stagnated. |

Asset Prices |

| As long as US yields and the USD are ticking higher while the US economy continues expanding opportunities for capital to earn relatively safe yields and capital gains, capital will continue to flow into US assets, despite the nose-bleed valuations of assets such as stocks and left / right coast housing.

The key here is the gains generated by owning US-denominated assets as the USD appreciates. A 3% yield in US Treasuries isn’t all that great, but add in 10% annual FX gains and you’re netting a very healthy 13% annual return in relatively safe and liquid assets. |

Global Currency Returns vs. US Dollar 2018 |

In summary: follow the money. Smart money is mobile, opaque and constantly on the move seeking safety, tax shelters, yield and capital gains. If mobile capital continues flowing into US assets such that demand exceeds supply, the Bull Market will continue sloshing higher. Once supply exceeds demand and capital starts liquidating US assets, the Bull Market will end, perhaps with a whimper (stagnation) or with a bang (crash). Capital flows will dictate the outcome.

Ridiculously affordable fiction sale: 7 of my 8 novels are now a ridiculously affordable $1.29 (Kindle digital edition)–the first two have never been available digitally until now:

Tags: Featured,newsletter