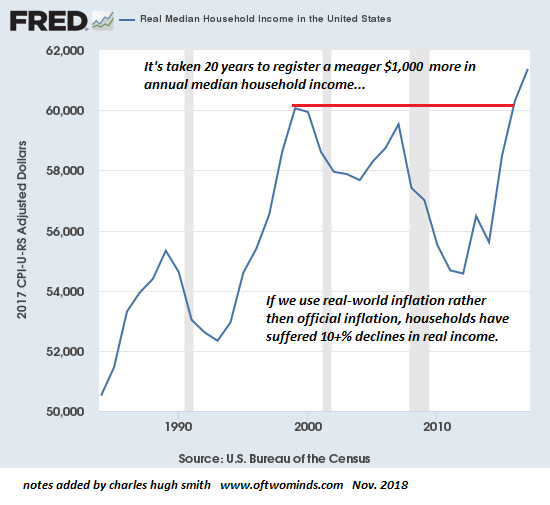

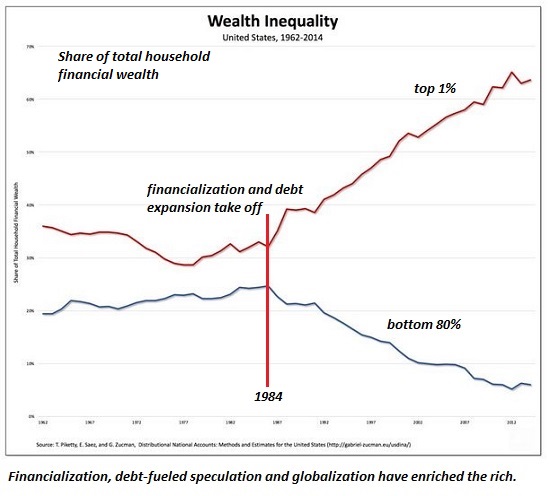

Our entire economy is characterized by cartel rentier skims, central-bank goosed asset bubbles and stagnating earned income for the bottom 90%. Despite the rah-rah about the “ownership society” and the best economy ever, the sobering reality is very few Americans are able to get ahead, i.e. build real financial security via meaningful, secure assets which can be passed on to their children. As I’ve often discussed here, only the top 10% of American households are getting ahead in both income and wealth, and most of the gains of these 12 million households are concentrated in the top 1% (1.2 million households). (see wealth chart below). Why are so few Americans able to get ahead? there are three core reasons: 1.

Topics:

Charles Hugh Smith considers the following as important: 5) Global Macro, Featured, newsletter, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

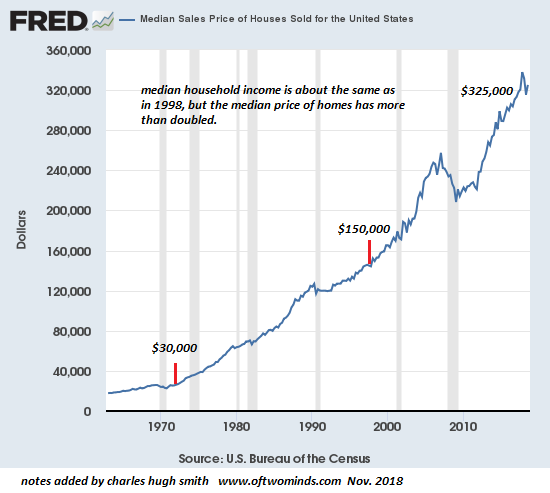

| Meanwhile, the median house price has more than doubled to $325,000 while median household income has stagnated. Please note this price is not adjusted for inflation, like the median income chart. But if we take nominal household income in 1998 (around $40,000 annually) and compare it to nominal household income now in 2018 (around $60,000), that’s a 50% increase–far below the more than doubling of house prices. |

Real Median Household Income in the U.S. 1990-2018 |

| To raise stagnant incomes, the Federal Reserve and other central banks have attempted to generate a wealth effect by boosting the valuations of risk-on assets such as stocks, bonds and commercial real estate. But the Fed et al. overlooked the fact that the vast majority of these assets are owned by the top 10%–and as noted above, the ownership of the top 10% is concentrated in the top 1% and .1%. |

Median Sales Price of Houses Sold for the U.S. |

| As a result, the vast majority of the wealth effect capital gains have flowed to the top 1%:

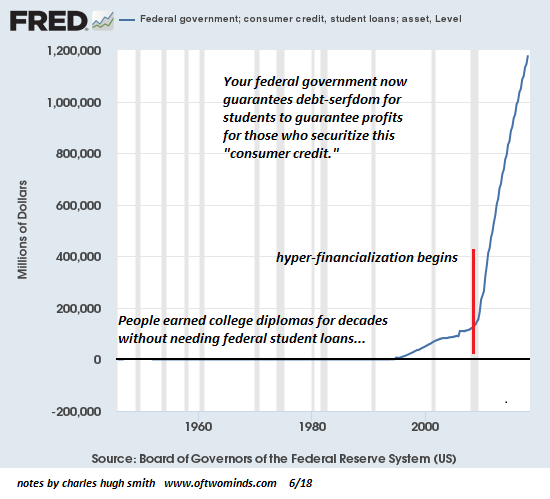

Lastly, the cartel structure of the U.S. economy has raised costs while providing no additional value. One example is higher education, a cartel that issues diplomas with diminishing economic value that now cost a fortune, a reality reflected in this chart of student loan debt, which simply didn’t exist a generation ago: |

U.S. Wealth Inequality 1962-2014 |

| Our entire economy is characterized by cartel rentier skims, central-bank goosed asset bubbles and stagnating earned income for the bottom 90%. Given these realities, the bottom 90% are left with few pathways to get ahead in terms of financial security and building secure family wealth. |

Federal government: Student Loan |

Tags: Featured,newsletter