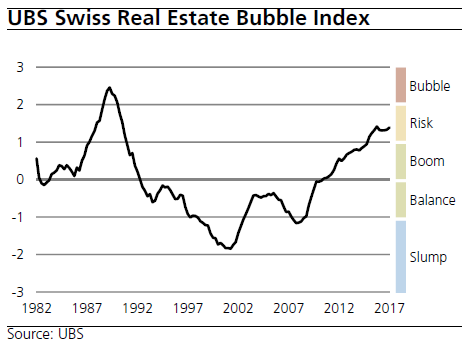

Risks to the Swiss property market remained elevated in the three months through September, according to UBS Group AG’s quarterly index. “While the buy-to-rent price ratio reached an all-time high, moderate mortgage growth and the slightly-improved economy prevented imbalances in the owner-occupied housing market from widening,” it said in a report. Major Findings The UBS Swiss Real Estate Bubble Index remained in the risk zone at 1.39 points in the first quarter of 2017 following a moderate increase. The increase in home prices outpaced the increase in rents and income. Demand for buy-to-let investments also rose, in spite of heightened market risks. UBS Swiss Real Estate Bubble Index The UBS Swiss Real Estate Bubble Index remained in the risk zone at 1.39 points in the first quarter of 2017 following a moderate increase. The increase in home prices outpaced the increase in rents and income. Demand for buy-to-let investments also rose, in spite of heightened market risks. Switzerland UBS Real Estate Bubble Index(see more posts on Switzerland Real Estate Bubble Index, ) Source: static-ubs.

Topics:

UBS Switzerland AG considers the following as important: Featured, newsletter, Swiss Macro, Switzerland Real Estate Bubble Index

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Risks to the Swiss property market remained elevated in the three months through September, according to UBS Group AG’s quarterly index. “While the buy-to-rent price ratio reached an all-time high, moderate mortgage growth and the slightly-improved economy prevented imbalances in the owner-occupied housing market from widening,” it said in a report.

Major Findings

- The UBS Swiss Real Estate Bubble Index remained in the risk zone at 1.39 points in the first quarter of 2017 following a moderate increase.

- The increase in home prices outpaced the increase in rents and income.

- Demand for buy-to-let investments also rose, in spite of heightened market risks.

UBS Swiss Real Estate Bubble IndexThe UBS Swiss Real Estate Bubble Index remained in the risk zone at 1.39 points in the first quarter of 2017 following a moderate increase. The increase in home prices outpaced the increase in rents and income. Demand for buy-to-let investments also rose, in spite of heightened market risks. |

Switzerland UBS Real Estate Bubble Index(see more posts on Switzerland Real Estate Bubble Index, ) Source: static-ubs.com - Click to enlarge |

Sub-indices of the UBS Swiss Real Estate Bubble IndexOwner-occupied house prices relative to annual rents

|

Switzerland Home Prices Relative to Annual Rent Source: static-ubs.com - Click to enlarge |

Owner-occupied house prices relative to household income

|

Switzerland Home Prices Relative to Household Income Source: static-ubs.com - Click to enlarge |

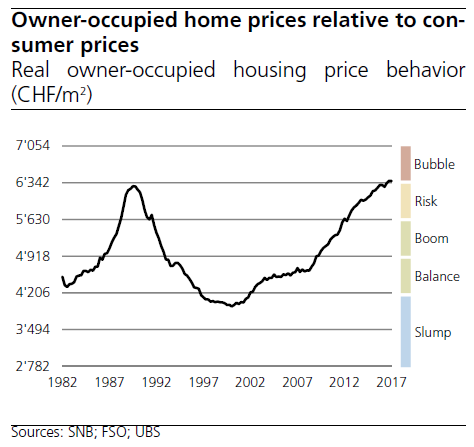

Owner-occupied home prices relative to consumer prices

|

Switzerland Home Prices Relative to Consumer Prices Source: static-ubs.com - Click to enlarge |

Tags: Featured,newsletter,Switzerland Real Estate Bubble Index