Summary: Swiss policymakers consider their domestic currency (the franc, or CHF) to be significantly overvalued. Measures taken by the Swiss National Bank seem to corroborate this stance, holding its nominal overnight rates well into negative territory. Considering where the Fed and ECB are in their policy cycles and where the SNB is in its cycle, the USD and EUR are likely to appreciate against the CHF. The CHF could nonetheless be a source of safe haven flows depending on events in the EU occurring over the near-term. Basic argument: There is always the risk of safe haven inflows depending on what occurs in the EU politically or otherwise, but the Swiss franc (NYSEARCA:FXF) is still a currency pointing downward. Switzerland’s (NYSEARCA:EWL)(NASDAQ:FSZ) growth and inflation data remain weak compared to the US and even compared to the Eurozone (BATS:EZU) generally, which will likely cause the Swiss National Bank (“SNB”) to lag behind other developed economies with respect to any tightening initiatives (with the exception of Japan (NYSEARCA:EWJ)). Overview The Swiss franc is a difficult currency to figure out. The Swiss economy is subject to a monetary regime holding some of the most accommodative policy in the world and an economic model that still largely depends on exports.

Topics:

LongShort Investments considers the following as important: CHF, Featured, newslettersent

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Summary:

- Swiss policymakers consider their domestic currency (the franc, or CHF) to be significantly overvalued.

- Measures taken by the Swiss National Bank seem to corroborate this stance, holding its nominal overnight rates well into negative territory.

- Considering where the Fed and ECB are in their policy cycles and where the SNB is in its cycle, the USD and EUR are likely to appreciate against the CHF.

- The CHF could nonetheless be a source of safe haven flows depending on events in the EU occurring over the near-term.

Basic argument: There is always the risk of safe haven inflows depending on what occurs in the EU politically or otherwise, but the Swiss franc (NYSEARCA:FXF) is still a currency pointing downward.

Switzerland’s (NYSEARCA:EWL)(NASDAQ:FSZ) growth and inflation data remain weak compared to the US and even compared to the Eurozone (BATS:EZU) generally, which will likely cause the Swiss National Bank (“SNB”) to lag behind other developed economies with respect to any tightening initiatives (with the exception of Japan (NYSEARCA:EWJ)).

Overview

The Swiss franc is a difficult currency to figure out. The Swiss economy is subject to a monetary regime holding some of the most accommodative policy in the world and an economic model that still largely depends on exports. Yet growth and inflation have been mired by stagnancy for years.

Switzerland has some of the wealthiest citizens globally, but transformation to a standard consumption- and investment-based model remains far off, which will likely keep a lid on the currency.

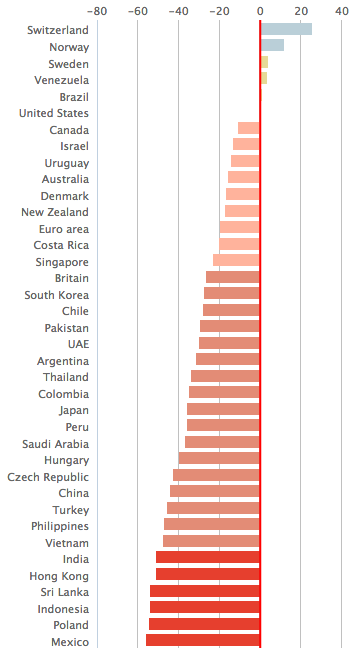

What Does The Big Mac Index Say?The franc remains the most overvalued currency in the world on the basis of the Big Mac Index (“BMI”) run by The Economist. The BMI is a semi-serious measure designed to take into account the purchasing power of various currencies around the globe based on the price of a well-known, commonly demanded item. The raw index shows Switzerland’s purported overvaluation on the basis of purchasing power parity (“PPP”) to be around 25%. |

Big Mac Index Source: Economist.com - Click to enlarge |

| The adjusted index – which corrects for the fact that goods and services will be cheaper in countries with low labor costs – puts Switzerland at only about 4% overvaluation and one of the US dollar’s closest companions on the PPP scale. |

Big Mac Index - Adjusted index |

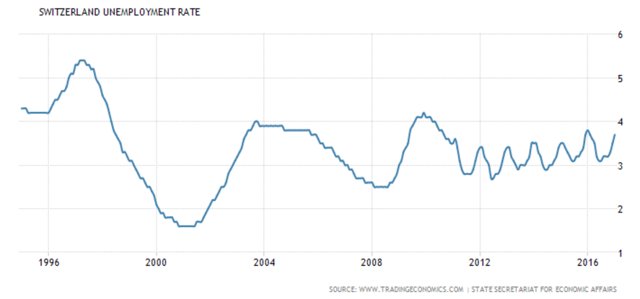

Economic UnderpinningsCheekiness aside, in terms of more relevant signals of a currency’s value, Switzerland presents an interesting scenario wherein its nominal interest rates are the lowest in the world at an overnight rate of (minus)-75 basis points. Its current account is nonetheless one of the highest in the world at 11.0% of GDP, only behind that of Taiwan (14.5%) and Singapore (19.8%). Switzerland is different from the majority of Europe in that it has its own monetary sovereignty. And with that it has the opportunity to tailor its monetary policy to its own unique needs unlike larger European economies such as Germany and France. Until January 2015, The SNB kept the franc pegged to the euro to keep its currency artificially low to help its export sector. A current account surplus (especially one of Switzerland’s size) typically indicates a couple things: (1) that its export total is generally higher than its import total in monetary terms and (2) that its citizens save at a relatively high rate in relation to what they spend. Savings rates correlate with an undervalued currency. If money lacks purchasing power, consumers are less inclined to spend it. This, of course, does not necessarily mean that the franc will be perceived as being undervalued to investors as a whole who may not care about the currency’s value for domestic spending purposes. The SNB’s maintenance of the lowest nominal benchmark rates in the world is designed to help boost employment. This works through the channel of cheapening capital costs to spur business investment, which in turn theoretically necessitates an influx of human capital. Although unemployment rates are heavily flawed and rather arbitrary bureaucratic measures of productivity, there is still nonetheless a general correlation between lower unemployment rates and a healthier labor market. Switzerland’s unemployment rate has mostly cyclically held between 3%-4% since the 2008 recession. |

Switzerland Unemployment Rate 1996-2016(see more posts on Switzerland Unemployment Rate, ) Source: seekingalpha.com - Click to enlarge |

| Its monetary policy has followed the same trend as in developed countries – rates lowered after the dot-com crash, rose from 2004-07, and cut after the financial crisis. The SNB also became more accommodative after it removed the franc’s peg to the euro in an attempt to stimulate the economy further. |

Switzerland Interest Rate 2001-2016 Source: seekingalpha.com - Click to enlarge |

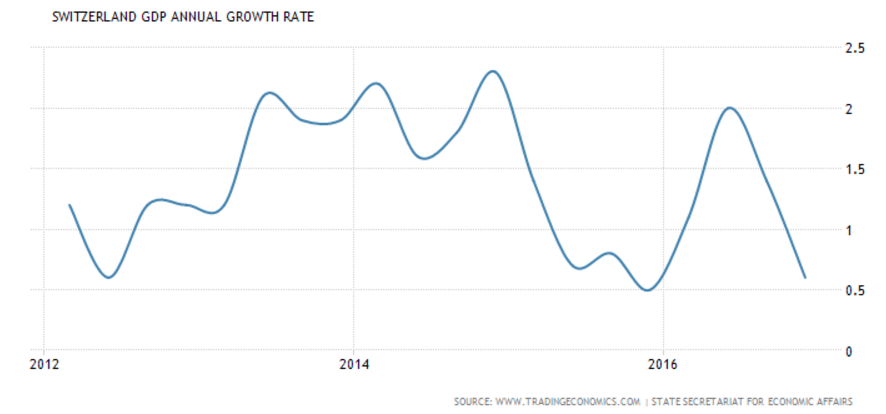

Growth has nonetheless proven elusive.Inflation recently moved up to 0.3% measured year-over-year, which matched 5+-year highs. However, Switzerland has been in a deflationary spiral for around six years despite the lowest interest rates of any country globally. |

Switzerland GDP Annual Growth Rate Source: seekingalpha.com - Click to enlarge |

| The government also constitutionalized a balanced budget amendment in 2001 and was officially implemented in 2003. This forces the government to show a level of restraint in its spending, but can also be a negative influence in limiting the power of the government to stimulate growth from its end, if necessary. This rule is not hard-coded, however, and Switzerland ran very small deficits in 2013 and 2014. |

Switzerland Inflation Rate Source: seekingalpha.com - Click to enlarge |

What to make of this?

All these factors point to the notion of what should be a fairly soft currency. Also, middling growth and inflation despite a very high level of monetary accommodation suggests that something isn’t working as intended.

Over time, it is expected that Switzerland will transform more toward a consumption-oriented economy. With Switzerland’s high international regard in human rights developments, education, labor market efficiency, business sophistication, innovation, technological readiness, among other factors, it ranks #1 in the World Bank’s Global Competitiveness Report 2016-17. It has topped the institution’s Global Competitive Index for eight consecutive years.

Yet, its economic model is still highly export-based like most emerging nations. This is curious in the sense that its GDP per capita is the second-largest in the world, according to the World Bank and the IMF, and behind only Luxembourg (which has a population equivalent to that of Albuquerque, New Mexico).

Switzerland is still small enough with a population of 8-9 million that its economy constitutes less than 1% of all global economic activity and its performance remains largely contingent on developments among bigger economic actors. Despite an elongated period of monetary accommodation, the economy didn’t break out of its deflationary rut until last month, which largely stems from higher inflation expectations coming out of the US (24%-25% of the world economy).

Over time, it would be expected that a combination of fiscal and monetary factors would support a transformation to more of a consumption-oriented economy. When economies transform from a more development-focused export model to a consumption and investment based form (e.g., China), it is typical for policymakers to prefer a stronger domestic currency. With a stronger currency, imports become cheaper, each unit of currency attains greater purchasing power, and consumption is more heavily incentivized assuming inflation achieves a healthy level (around 1.5%-3%).

Removing the franc from its peg to the euro just over two years ago was assumed to be the first step in this process. A liftoff in inflation and growth facilitated by its monetary easing would be the second step and would allow the central bank to begin normalizing its policy.

A tightening cycling, of which the country hasn’t initiated in ten years, would expect to attract greater capital inflows, boost the value of the currency, cheapen imports in relative terms, and encourage consumption. This could work so long as inflation doesn’t remain muted below a level that incentives cash hording.

At the same time, we’re in a period where seemingly no country wants a stronger currency, believing it makes their exports less competitive and saps a source of economic growth. If Switzerland remains behind the US and EU in its tightening process as it currently is, it’s conceivable the franc could depreciate further against these currencies.

Final Thoughts

The SNB seems further from moving its benchmark rate than the ECB and much further behind the US Federal Reserve, which is actively working to increase rates over the coming months. And for what it’s worth, members within the SNB still believe that the franc is “significantly overvalued,” a statement made in November when the EUR/CHF rate was trading at 1.07, the level where it remains currently.

Accordingly, the outlook on the franc still remains mostly down. But this is chiefly due to the fact that other parts of the developed world are likely to tighten over the next 2-3 years rather than any specific reason regarding SNB policy or the Swiss economy itself. The SNB is in a wait-and-see period as Switzerland’s economic data remains muted.

The franc wouldn’t be a high-conviction sell and wouldn’t expect to generate strong returns on an unleveraged basis. Although the franc could be subject to safe haven inflows in the event of perceived instability from the EU (e.g., political events), I believe the general sentiment is correct that the franc is set for some level of decline.

Disclosure:I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am net long the US dollar and have no position in the Swiss Franc.

Tags: Featured,newslettersent