Summary:

The Swiss National Bank (SNB) reports a profit of CHF 24.5 billion for the year 2016 (2015: loss of CHF 23.3 billion). The profit on foreign currency positions amounted to CHF 19.4 billion. A valuation gain of CHF 3.9 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 1.6 billion. For the financial year just ended, the SNB has set the allocation to the provisions for currency reserves at CHF 4.6 billion. After taking into account the distribution reserve of CHF 1.9 billion, net profit comes to CHF 21.7 billion. This will allow a dividend payment of CHF 15 per share, which corresponds to the legally stipulated maximum amount, as well as a profit distribution to the Confederation and the cantons of CHF 1 billion. The Confederation and the cantons are also entitled to a supplementary distribution of a maximum of CHF 1 billion if the distribution reserve after appropriation of profit exceeds CHF 20 billion. The net profit for 2016 allows a supplementary distribution of CHF 0.7 billion. One-third of the total distribution is allocated to the Confederation and two-thirds to the cantons. After these payments, the distribution reserve will amount to CHF 20 billion. Profit on foreign currency positions The profit on foreign currency positions was CHF 19.4 billion (2015: loss of CHF 19.9 billion). Interest income amounted to CHF 8.

Topics:

George Dorgan considers the following as important: Featured, newslettersent, SNB, SNB Press Releases, Swiss National Bank

This could be interesting, too:

The Swiss National Bank (SNB) reports a profit of CHF 24.5 billion for the year 2016 (2015: loss of CHF 23.3 billion). The profit on foreign currency positions amounted to CHF 19.4 billion. A valuation gain of CHF 3.9 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 1.6 billion. For the financial year just ended, the SNB has set the allocation to the provisions for currency reserves at CHF 4.6 billion. After taking into account the distribution reserve of CHF 1.9 billion, net profit comes to CHF 21.7 billion. This will allow a dividend payment of CHF 15 per share, which corresponds to the legally stipulated maximum amount, as well as a profit distribution to the Confederation and the cantons of CHF 1 billion. The Confederation and the cantons are also entitled to a supplementary distribution of a maximum of CHF 1 billion if the distribution reserve after appropriation of profit exceeds CHF 20 billion. The net profit for 2016 allows a supplementary distribution of CHF 0.7 billion. One-third of the total distribution is allocated to the Confederation and two-thirds to the cantons. After these payments, the distribution reserve will amount to CHF 20 billion. Profit on foreign currency positions The profit on foreign currency positions was CHF 19.4 billion (2015: loss of CHF 19.9 billion). Interest income amounted to CHF 8.

Topics:

George Dorgan considers the following as important: Featured, newslettersent, SNB, SNB Press Releases, Swiss National Bank

This could be interesting, too:

investrends.ch writes SNB schreibt 2024 definitiven Gewinn von über 80 Milliarden Franken

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

The Swiss National Bank (SNB) reports a profit of CHF 24.5 billion for the year 2016 (2015: loss of CHF 23.3 billion).

The profit on foreign currency positions amounted to CHF 19.4 billion. A valuation gain of CHF 3.9 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 1.6 billion. For the financial year just ended, the SNB has set the allocation to the provisions for currency reserves at CHF 4.6 billion. After taking into account the distribution reserve of CHF 1.9 billion, net profit comes to CHF 21.7 billion. This will allow a dividend payment of CHF 15 per share, which corresponds to the legally stipulated maximum amount, as well as a profit distribution to the Confederation and the cantons of CHF 1 billion. The Confederation and the cantons are also entitled to a supplementary distribution of a maximum of CHF 1 billion if the distribution reserve after appropriation of profit exceeds CHF 20 billion. The net profit for 2016 allows a supplementary distribution of CHF 0.7 billion. One-third of the total distribution is allocated to the Confederation and two-thirds to the cantons. After these payments, the distribution reserve will amount to CHF 20 billion.

Profit on foreign currency positionsThe profit on foreign currency positions was CHF 19.4 billion (2015: loss of CHF 19.9 billion). Interest income amounted to CHF 8.3 billion and dividend income to CHF 3.0 billion. Price gains of CHF 1.1 billion were recorded on interest-bearing paper and instruments. Equity securities and instruments benefited from the favourable stock market environment and contributed CHF 8.6 billion to the net result. Overall, exchange rate-related losses amounted to CHF 1.7 billion.

|

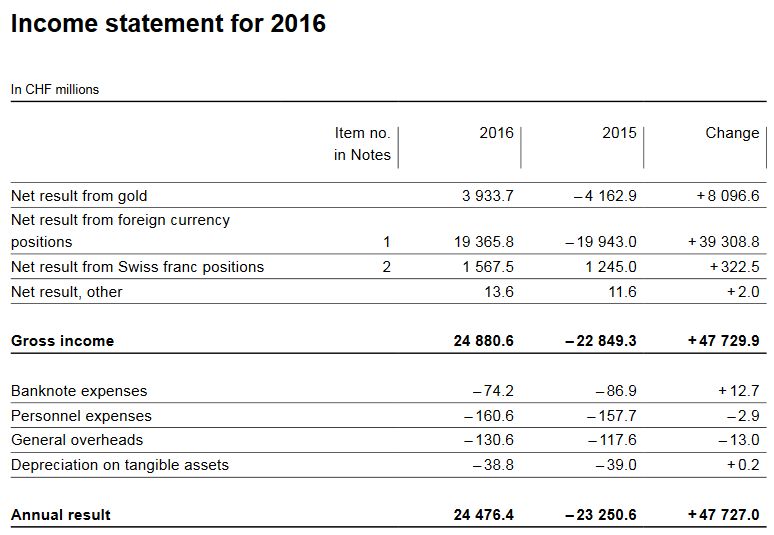

Income statement for 2016

Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||

Valuation gain on gold holdingsAt CHF 37,885 per kilogram, the price of gold was 11% higher than at the end of 2015 (CHF 34,103). This gave rise to a valuation gain of CHF 3.9 billion on the unchanged holdings of 1,040 tonnes of gold (2015: loss of CHF 4.2 billion).

|

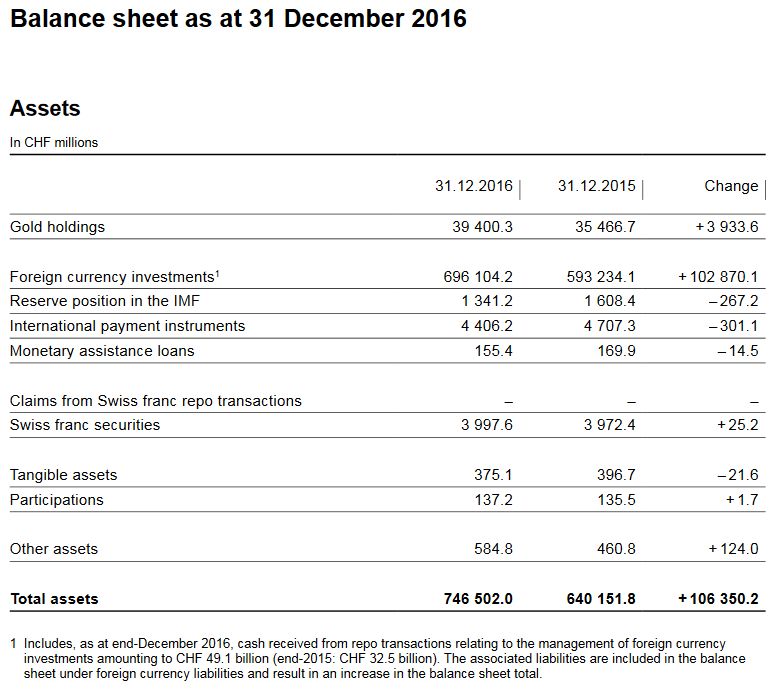

Balance sheet as at 31 December 2016

Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||

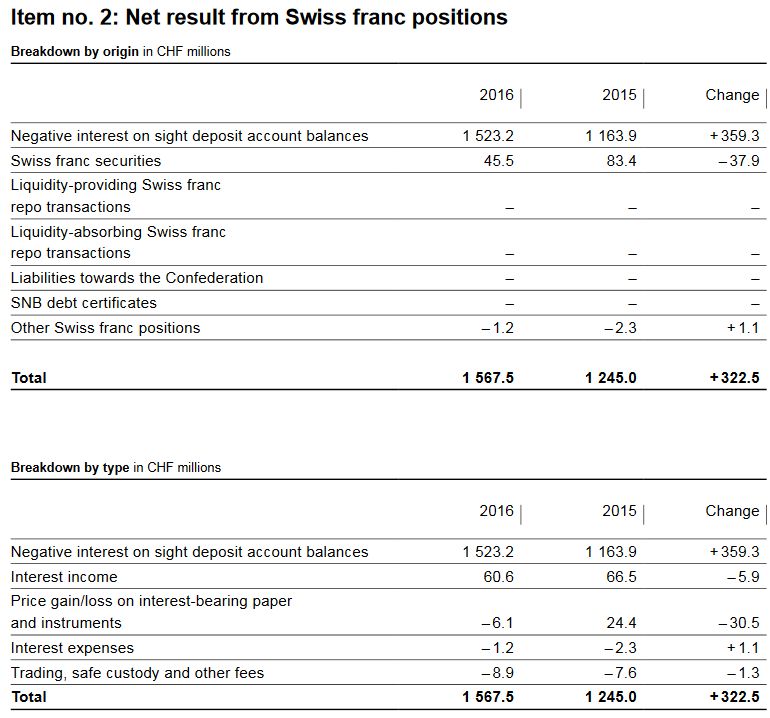

Profit on Swiss franc positionsThe profit on Swiss franc positions, which amounted to CHF 1.6 billion (2015: CHF 1.2 billion), essentially comprised CHF 1.5 billion arising from the negative interest on sight deposit account balances which has been charged for the first full calendar year since its introduction on 22 January 2015. |

Net result from Swiss franc positions

Source: snb.ch - Click to enlarge |