Illustration via irs.com A Wake-Up Call The price of gold moved down about twenty Federal Reserve Notes, and the price of silver dropped %excerpt%.57. The big news is that the gold-silver ratio moved up about 1.5. We hate to say “we told you so,” well, OK. Actually… sometimes there’s a certain je ne said quoi about gloating. *Achem* In all seriousness, the dollar is going up. We measure it in gold, or alternatively in silver. In gold, the dollar rose 0.4mg gold to 24.84. In silver, it was up 60mg to 1.88g silver. We do not think that the dollar can be measured in terms of its derivatives such as euro, pound, etc. for the many of the same reason that the gold can’t be measured in terms of its derivative, the dollar. Why is the dollar going up? It’s the debtors that give value to a debt-based currency (not the quantity). Right now, debtors are feeling the pressure. Meanwhile, most mainstream speculators are looking at price charts and they want all-in on the dollar (most would look at this as avoiding gold exposure). Fundamentals Continue to Deteriorate Let’s take a look at the supply and demand fundamentals. The prices of gold and silver But first, here’s the graph of the metals’ prices. The prices of gold and silver – click to enlarge. Next… Gold-silver ratio This is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio.

Topics:

Keith Weiner considers the following as important: dollar price, Featured, Gold and its price, gold basis, Gold co-basis, gold price, gold ratio, newsletter, Precious Metals, silver basis, Silver co-basis, silver price, silver ratio

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

A Wake-Up Call

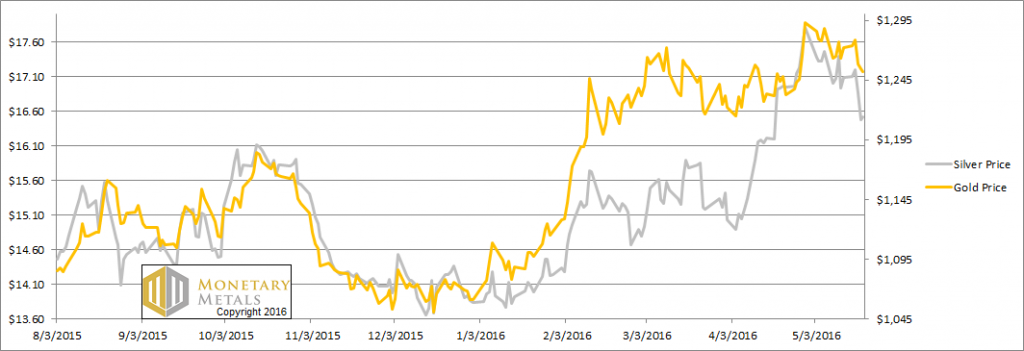

The price of gold moved down about twenty Federal Reserve Notes, and the price of silver dropped $0.57. The big news is that the gold-silver ratio moved up about 1.5. We hate to say “we told you so,” well, OK. Actually… sometimes there’s a certain je ne said quoi about gloating. *Achem*

In all seriousness, the dollar is going up. We measure it in gold, or alternatively in silver. In gold, the dollar rose 0.4mg gold to 24.84. In silver, it was up 60mg to 1.88g silver. We do not think that the dollar can be measured in terms of its derivatives such as euro, pound, etc. for the many of the same reason that the gold can’t be measured in terms of its derivative, the dollar.

Why is the dollar going up? It’s the debtors that give value to a debt-based currency (not the quantity). Right now, debtors are feeling the pressure. Meanwhile, most mainstream speculators are looking at price charts and they want all-in on the dollar (most would look at this as avoiding gold exposure).

Fundamentals Continue to Deteriorate

Let’s take a look at the supply and demand fundamentals.

The prices of gold and silverBut first, here’s the graph of the metals’ prices. |

Next…

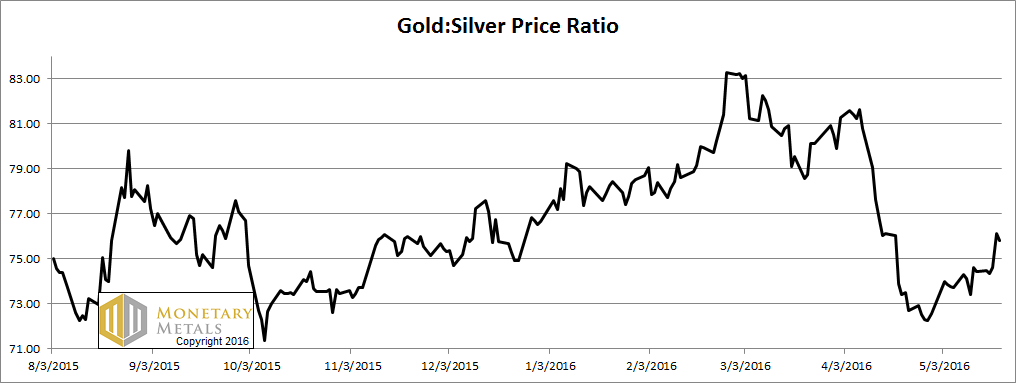

Gold-silver ratioThis is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio was up significantly this week. |

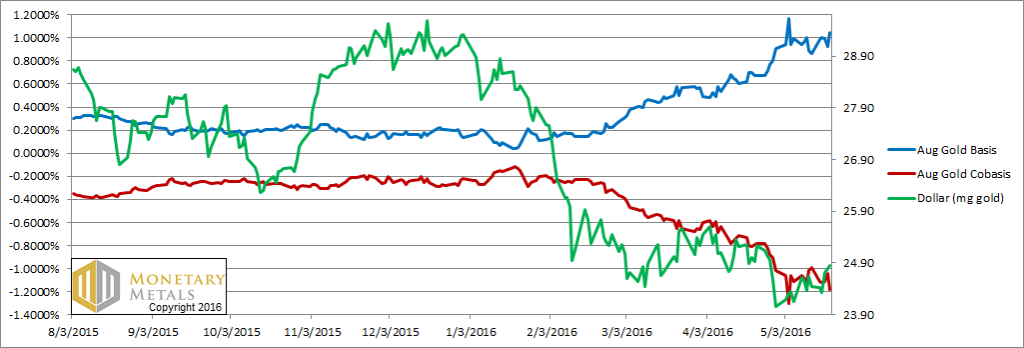

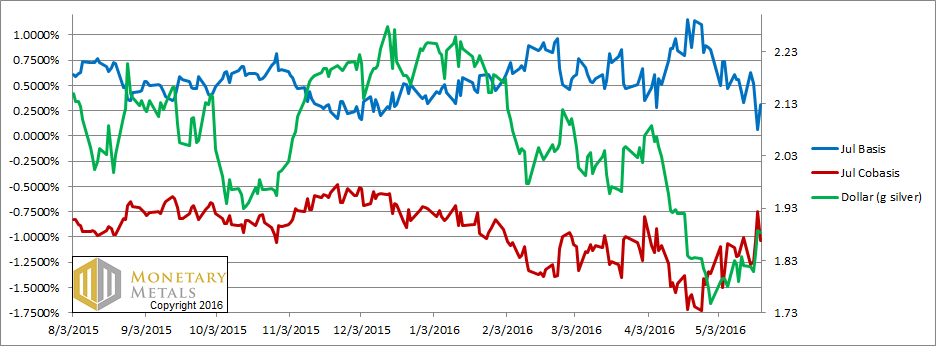

For each metal, we will look at a graph of the basis and co-basis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and co-basis in red.

Here is the gold graph.

Gold basis and co-basis and the dollar priceYou can see it clearly on this chart. As of this month, the price of the dollar (i.e. price of gold is falling) is rising but the scarcity of gold is falling. Our calculated fundamental price of gold is around $1,170. |

Now let’s turn to silver.

Silver basis and co-basis and the dollar priceIn silver, the co-basis is actually down for the week despite a large rise in the dollar (i.e. fall in the price of silver). This is despite the lopsided pressure on the July contract (it happens earlier in silver than it does in gold). In farther-out contracts, the silver co-basis is lower. |

It is worth emphasizing that the silver co-basis dropped on Friday to around the same level as Wednesday, despite the price being 35 cents lower. Our calculated fundamental price of silver now has a 13 handle on it.

Charts by: Monetary Metals

Previous post