At the news conference of the Swiss National Bank, Andréa Maechler discusses the current situation of financial markets and the negative interest environment. She explains the recent Swiss experience with negative interest rates. Negative rates have the desired effect: It makes holding money on Swiss bank accounts less attractive. We see different issues with this explanation: Negative rates make only holding money on accounts less attractive but not cash, real estate or stocks. As her colleague Fritz Zurbrügg explained, nearly all Swiss banks still offer rates slightly above zero for their clients. Finally negative interest rates only reduce the profits of banks. In combination with strong regulator requirements, it reduces bank profits and therefore GDP. Andréa M. Maechler, Member of the Governing Board of the Swiss National Bank News conference of the Swiss National Bank, Berne, 16.06.2016 Complete text PDF (310 KB) I will begin with a review of developments on the financial markets, before commenting on our experience of negative interest in Switzerland. I shall conclude with some remarks about important innovations affecting financial market infrastructure relevant to the SNB. Situation on financial markets Let me start with developments on the financial markets.

Topics:

Andréa Maechler considers the following as important: Featured, newsletter, SNB

This could be interesting, too:

investrends.ch writes Schweizer Inflation fällt etwas stärker als gedacht

investrends.ch writes SNB erzielt nach 9 Monaten einen Gewinn von 12,6 Milliarden Franken

investrends.ch writes SNB hat im zweiten Quartal Devisen für 5,1 Milliarden Franken gekauft

investrends.ch writes SNB belässt den Leitzins bei null Prozent

At the news conference of the Swiss National Bank, Andréa Maechler discusses the current situation of financial markets and the negative interest environment. She explains the recent Swiss experience with negative interest rates. Negative rates have the desired effect: It makes holding money on Swiss bank accounts less attractive.

We see different issues with this explanation:

- Negative rates make only holding money on accounts less attractive but not cash, real estate or stocks.

- As her colleague Fritz Zurbrügg explained, nearly all Swiss banks still offer rates slightly above zero for their clients.

- Finally negative interest rates only reduce the profits of banks. In combination with strong regulator requirements, it reduces bank profits and therefore GDP.

Andréa M. Maechler, Member of the Governing Board of the Swiss National Bank

News conference of the Swiss National Bank, Berne, 16.06.2016

Complete text PDF (310 KB)

Situation on financial marketsLet me start with developments on the financial markets. Risk sentiment deteriorated markedly at the beginning of 2016 due to weak economic data worldwide and a sharp decline in oil prices. Volatility increased temporarily during this period, leading to significant losses on the equity markets (slide 1). In mid-February, investors’ risk appetite returned for a time, thanks to a stabilisation of oil prices and, in particular, improved economic data in the US, China and the euro area. However, by the beginning of June, investor confidence had once again come under pressure due to concerns about a possible exit of the UK from the EU. With the exception of the US and the emerging markets, the major share indices are trading significantly lower than at the beginning of the year.

|

|

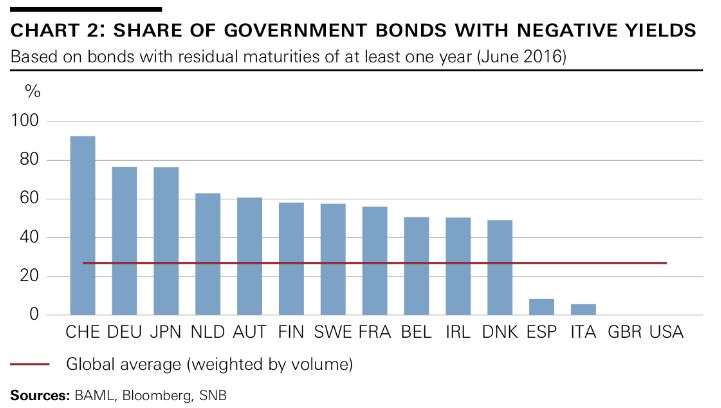

Turbulence on financial marketsThis turbulence caused many market participants to seek refuge in safe investments. Yields declined substantially on the major government bond markets. Very long-dated bonds were in particularly high demand – a fact which resulted in a flattening of the yield curves. Yields on ten-year government bonds in both the US and Germany have fallen by around 60 basis points since the beginning of the year, due in part to the monetary policy decisions of the major central banks. For instance, the Bank of Japan’s decision in January to apply negative interest to central bank deposits took markets by surprise. In March, the ECB decided to further expand its asset purchase programme and took its deposit rate deeper into negative territory. In the same month, the US Federal Reserve signalled that interest rates were likely to rise less quickly than originally anticipated. Yields on the ten-year government bonds of some highly rated countries like Switzerland and Germany touched new lows in June. In Switzerland, for example, the yield on ten-year Confederation bonds fell to –0.5%. Most recently, they have been trading around 40 basis points lower than at the beginning of the year. More than 90% of outstanding Confederation bonds are currently negative yielding (slide 2). However, Switzerland is certainly not the only country witnessing this scenario, which has now become a global phenomenon; some 17 states are currently reporting sub-zero yields on government bonds and, overall, more than a quarter of government bonds outstanding worldwide are trading at negative yields. |

|

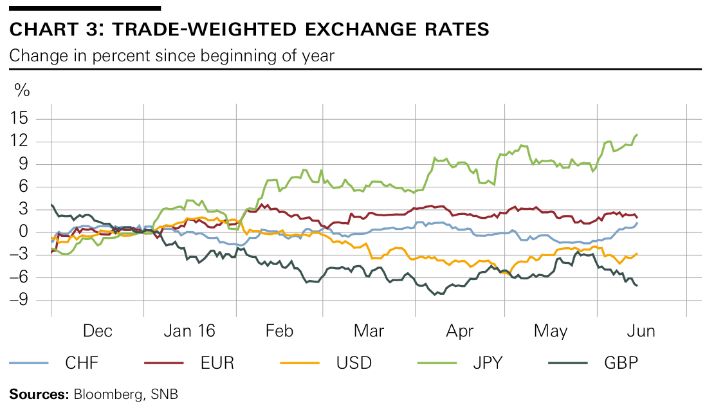

Foreign Exchange MarketOn the foreign exchange markets, the US dollar and pound sterling have depreciated on a trade-weighted basis since the beginning of the year (slide 3). The weakening of the pound is principally due to uncertainty surrounding next week’s EU referendum in the UK. However, the Japanese yen – and, albeit to a lesser extent, the euro – have appreciated despite the monetary policy easing of the respective central banks. The Swiss franc has moved within a narrow range, appreciating only slightly since the beginning of the year. This is likely due in part to the SNB’s monetary policy – that is, to the negative interest rate and our willingness to take an active role in the foreign exchange market, as necessary.

|

|

Experience of negative interest ratesThis brings me to our experience of negative interest. For about one and a half years, we have been charging negative interest of –0.75% on sight deposits held by banks and other financial market participants at the SNB. As Thomas Jordan has already explained, negative interest helps to maintain the interest rate differential between the Swiss franc and other currencies. This differential is necessary in order to make investments in Swiss francs less attractive. If interest rates in Switzerland were the same as those abroad, Swiss franc investments would clearly be favoured in the current environment. Negative interest thus helps ease upward pressure on the Swiss franc.

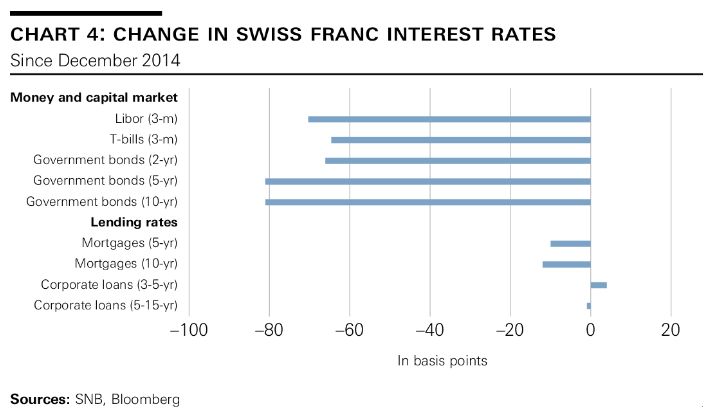

The negative interest rate continues to have the desired effect on the money and capital markets. Money market rates have been tracking close to the SNB’s negative interest rate for a number of months now. Money and capital market interest rates have fallen by over 60 basis points since the introduction of negative interest (slide 4). Interest rates on bank loans have reacted much less strongly to negative interest, however.

The SNB does not charge negative interest on all sight deposits, but grants banks and other financial market participants exemption thresholds, so that the banking system does not have to carry the full burden resulting from the high level of sight deposits. Due to the significant expansion of liquidity, most banks have now completely exhausted these exemption thresholds. If the SNB supplies the system with additional Swiss franc liquidity – notably, by selling Swiss francs in exchange for other currencies on the foreign exchange market – the banks’ interest rate burden increases. This makes holding additional Swiss franc liquidity even less attractive.

|