Arrested Development Despite the best efforts of the bulls to make history happen, they’ve been unable to ‘git-r-done.’ At the time of this writing, the Dow is facing another bout of arrested development; it has yet to notch 20,000 for the very first time. What a feat it will be when this remarkable, but trivial, event comes to pass. After a near eight year run, the Dow will likely eclipse this exquisitely round numeric threshold in the very near future. Shouldn’t such an achievement – and the associated wealth effect – have made us all rich? Apparently not. For on the other side of the ledger a distinct, yet somehow related milestone is imminently approaching. The U.S. National Debt is at .9 trillion. Soon it will surpass a round and rotund trillion. The reality, however, is that the national debt exceeded trillion a long time ago. In fact, it’s really over 600 percent higher. Remember, unfunded liabilities, including Social Security and Medicare, currently total over 4.5 trillion. Added together the national debt and current unfunded liabilities total 4.4 trillion. Verily, this number is so large it’s nigh impossible to comprehend. Thus, for simplicity and for the sake of numerological harmony, today’s reflections are limited in breadth and scope to Dow 20,000 and U.S.

Topics:

MN Gordon considers the following as important: Debt and the Fallacies of Paper Money, Featured, newsletter, On Economy

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

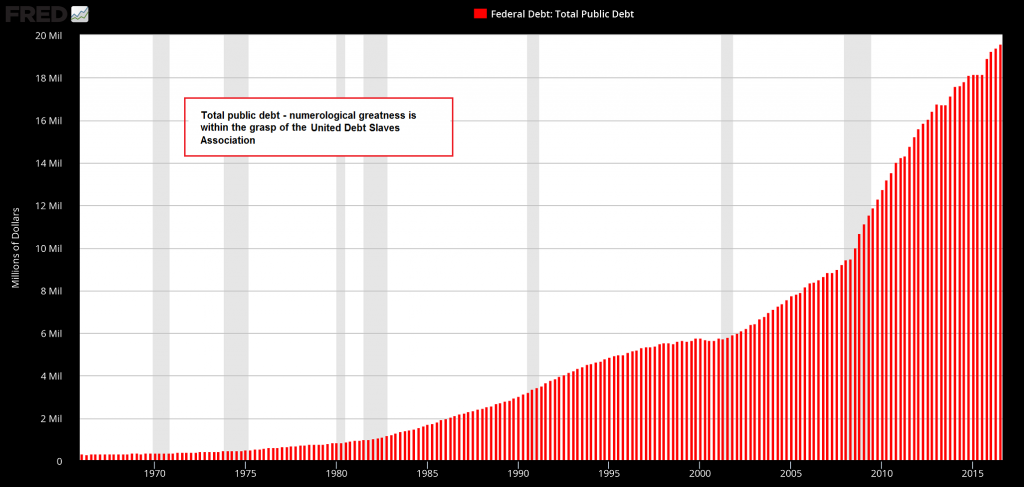

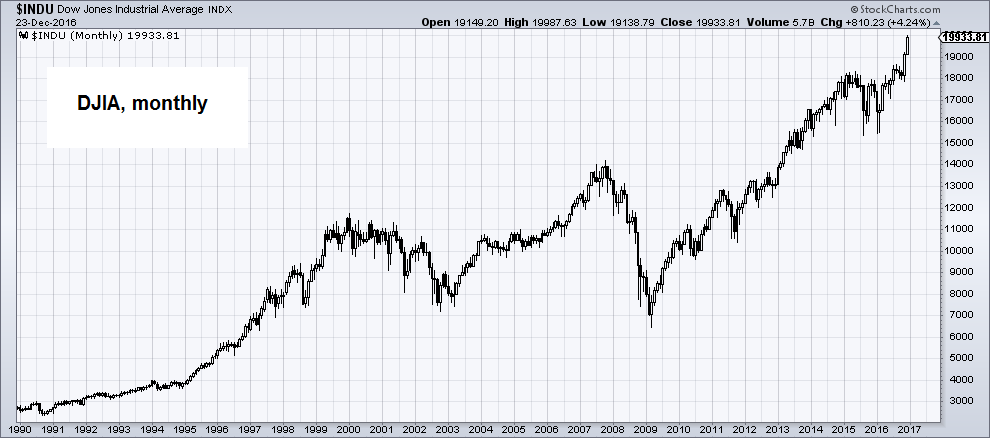

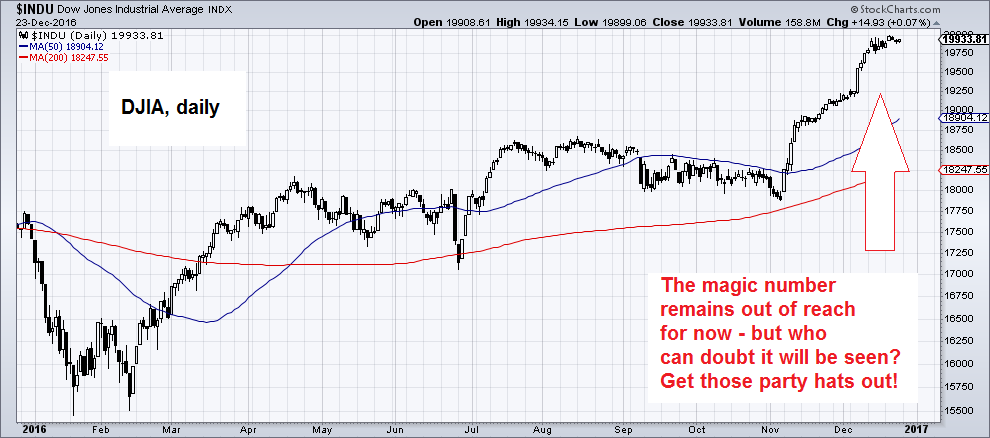

Arrested DevelopmentDespite the best efforts of the bulls to make history happen, they’ve been unable to ‘git-r-done.’ At the time of this writing, the Dow is facing another bout of arrested development; it has yet to notch 20,000 for the very first time. What a feat it will be when this remarkable, but trivial, event comes to pass. After a near eight year run, the Dow will likely eclipse this exquisitely round numeric threshold in the very near future. Shouldn’t such an achievement – and the associated wealth effect – have made us all rich? Apparently not. For on the other side of the ledger a distinct, yet somehow related milestone is imminently approaching. The U.S. National Debt is at $19.9 trillion. Soon it will surpass a round and rotund $20 trillion. The reality, however, is that the national debt exceeded $20 trillion a long time ago. In fact, it’s really over 600 percent higher. Remember, unfunded liabilities, including Social Security and Medicare, currently total over $104.5 trillion. Added together the national debt and current unfunded liabilities total $124.4 trillion. Verily, this number is so large it’s nigh impossible to comprehend. Thus, for simplicity and for the sake of numerological harmony, today’s reflections are limited in breadth and scope to Dow 20,000 and U.S. National Debt $20 trillion. |

Dow Jones Industrial Average Index, Daily The venerable Industrial Average has finally bubbled its way close to 20,000. No-one know as yet from whence the transition from comedy & farce to total horror-show will occur, but the eventual denouement of the post-GFC echo bubble promises to be quite a riveting experience as well – perhaps even more so than last time. - Click to enlarge |

An Exercise in NumerologyQuite frankly, we don’t really know what the Dow and the national debt have to do with each other. We can’t quite put a finger on it. Nonetheless, we have a hunch both milestones are in some way emblematic of a great transformation that has taken place. Is Dow 20,000 and U.S. National Debt $20 trillion merely a coincidence? Or is there a correlation? And if there is a correlation, does it imply causation? No doubt, there are a variety of ways to explore these questions. However, here we opt for the path of least resistance. Hence, what follows is not a detailed desktop evaluation of the numbers; but, rather, one very simply deduced conclusion based on inference, guess work, and conjecture. To begin, we peer back to the past in search of arbitrary data points that look as if they’re interrelated. For example, in the autumn of 1982 the Dow surpassed 1,000. This wasn’t the first time this happened. But 1982 is the last time the Dow rose above 1,000 without then dipping back below. Similarly, 1982 is when the U.S. National Debt topped the $1 trillion mark. From $1 trillion to $20 trillion, the U.S. National Debt generally followed an exponential growth curve. There was a slight pause in the late 1990s. But otherwise it has progressively concaved upward approaching a parabolic trajectory; particularly since 2009. The Dow’s march from 1,000 toward 20,000, on the other hand, has been less direct. There have even been several brief, yet significant, sell-offs along the way. What to make of it? |

Total Public Debt |

Wreck the HallsA statistician may run the numbers for the Dow and the U.S. National Debt and conclude that there’s a weak correlation, and certainly no causation. They may even graph a scatter plot to make their case. A numerologist may look at the divinely round numbers and infer something much different. Maybe even that there’s a connection that can be projected into the future. Who’s right? Who’s wrong? Along the road from Dow 1,000 to Dow 20,000 and from U.S. National Debt $1 trillion to U.S. National Debt $20 trillion one thing is quite clear. There have been episodes of significant divergence. For instance, in March of 2009 the Dow touched down at about 6,700 while the U.S. National Debt was over $10 trillion. Perhaps we’re approaching another such divergence. Namely, using a subjective combination of supposition, numerology, and crude statistics, it seems likely that we are entering a time where the U.S. National Debt continues its exponential trajectory while the Dow dives 8,000 points – or more – to below 12,000. |

Dow Jones Industrial Average Index, Monthly |

| You can take this shrewd little nugget of insight for what it’s worth and set it aside for another day. It’s the Christmas season, after all. Now is the time for joy, good cheer, and merriment. Conversely, it’s not the time for party poopers, wet blankets, and killjoys.

Thus, like the stock market over the last eight years, now is the time to take the unique opportunity that’s been granted to you at this very moment, and overdo it. The stars may not be so amiably aligned come this time next year. So wreck the halls, if you’re so inclined. Have another eggnog or peppermint bark. Give the bell ringing Salvation Army lady a wink and a crisp Benjamin… before Larry Summers outlaws them. Of course, whatever you do, always do it in a ‘safe and sane’ manner. In short, sell bonds. Merry Christmas! |

Charts by: StockCharts, St. Louis Federal Reserve Research

Chart and image captions by PT

MN Gordon is President and Founder of Direct Expressions LLC, an independent publishing company. He is the Editorial Director and Publisher of the Economic Prism – an E-Newsletter that tries to bring clarity to the muddy waters of economic policy and discusses interesting investment opportunities.

Tags: Featured,newsletter,On Economy