Summary:

Confidence Gets a Boost

Payrolls figures are rising. Stocks rose to new records. As we laid out recently, a better jobs picture should lead the Fed to raise rates. This should cause canny investors to dump stocks.

Canny investors at work (an old, but good one…)

Cartoon via Pension Pulse - Click to enlarge

But the stock market paid no attention. It follows logic of its own. Headlines told us that last Friday’s report “boosted confidence” and sent the Dow up 191 points.

Wait – what about the Fed?

Now, with unemployment dropping and the economy appearing to finally recover, isn’t it time to go “back to normal” with interest rate policy? Won’t that mean that today’s stock prices – resting on the brittle reed of super-low rates and buybacks – will collapse?

Maybe. But investors seem to have realized that, as we’ve been saying, the Fed will never normalize interest rates. It operates a fake economy, with fake money, and fake interest rates, and fake statistics, too.

And now, there is no retreat. The bridges have been burned. The ships have been sunk. The return address has been lost. Now, the Fed is so deep into make-believe, the shock of reality would be too much for it. It is like a crazy person you try to protect from the truth:

“Don’t worry about it, Uncle Frank. Ronald Reagan will win again.

Topics:

Bill Bonner considers the following as important:

Central Banks,

Debt and the Fallacies of Paper Money,

Featured,

On Economy,

On Politics,

The Stock Market

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Confidence Gets a Boost

Payrolls figures are rising. Stocks rose to new records. As we laid out recently, a better jobs picture should lead the Fed to raise rates. This should cause canny investors to dump stocks. |

Canny investors at work (an old, but good one…)

Cartoon via Pension Pulse - Click to enlarge |

But the stock market paid no attention. It follows logic of its own. Headlines told us that last Friday’s report “boosted confidence” and sent the Dow up 191 points.

Wait – what about the Fed?

Now, with unemployment dropping and the economy appearing to finally recover, isn’t it time to go “back to normal” with interest rate policy? Won’t that mean that today’s stock prices – resting on the brittle reed of super-low rates and buybacks – will collapse?

Maybe. But investors seem to have realized that, as we’ve been saying, the Fed will never normalize interest rates. It operates a fake economy, with fake money, and fake interest rates, and fake statistics, too.

And now, there is no retreat. The bridges have been burned. The ships have been sunk. The return address has been lost. Now, the Fed is so deep into make-believe, the shock of reality would be too much for it. It is like a crazy person you try to protect from the truth:

“Don’t worry about it, Uncle Frank. Ronald Reagan will win again. He always does.”

“Oh good.”

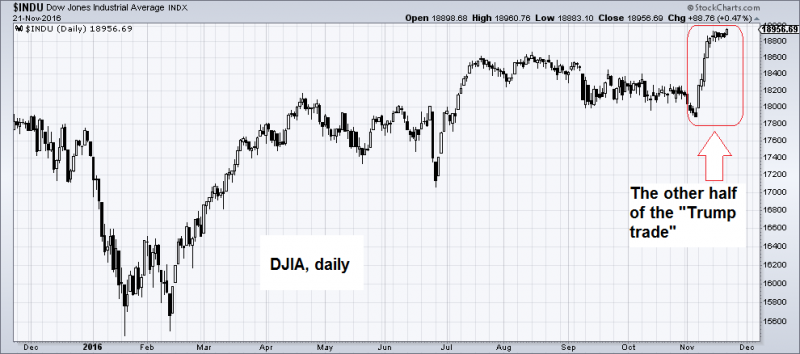

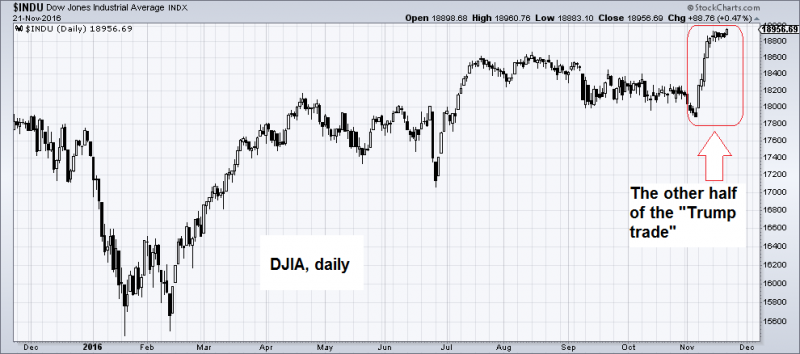

Hold on… fake economy? Fake money? Fake interest rates? |

Dow Jones Industrial Average Index Dow Jones Industrial Average Index - Click to enlarge |

The 30-mph Plan

Visiting this weekend were two of our colleagues – Chris Lowe from Berlin and Vern Gowdie from the Gold Coast of Australia. While many in our group went swimming at the river or sightseeing in the nearby city of Limoges, the three of us kept up a lively debate.

“You talk about ‘fake money,’” said Chris. “But it’s not fake. At the end of the day, money is whatever the government says it is.”

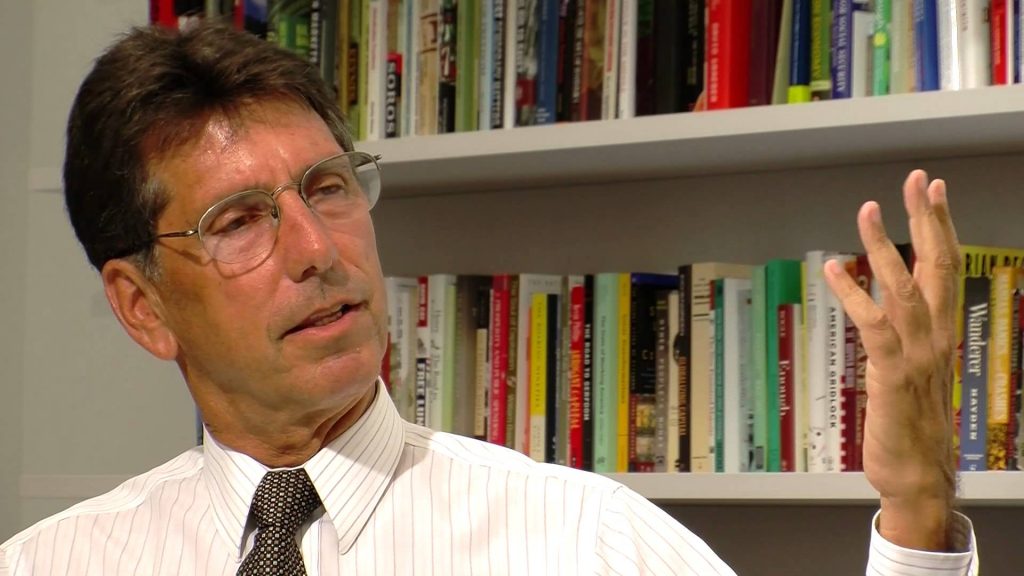

Chris and another colleague, Chris Mayer, have been following the work of former hedge fund manager and economist Warren Mosler. Mosler is known for his work on how the fiat money system functions.

For many months, after hearing about Mosler, we were puzzled. His ideas didn’t quite make sense to us. But we gave him the benefit of the doubt, as we do to reports of subatomic particles, newsletter gurus, and people who claim to have met Hitler in South America.

Then, we found something that clarified the situation. And now we know: Mosler is a quack. You may form your own view. But we will give you the detail that shaped our opinion: He proposed to lower the speed limit nationally to 30 mph. This was supposed to allow autos to run more efficiently and reduce demand for oil. |

Warren Mosler, a proponent of so-called “Modern Monetary Theory” (MMT) – which is essentially a warmed up version of Georg Friedrich Knapp’s Chartalism (Knapp authored “The State Theory of Money”). Knapp’s work was reportedly well-received by members of the board of the German Reichsbank in the decade following the end of WW1.

Photo via neweconomicperspectives.org - Click to enlarge |

Clear, Simple, and Wrong

We don’t know what problem Mosler was trying to solve with his 30-mph plan. But we know that no sensible person would ever suggest such a thing. You might as well tie your shoelaces together and hop to work.

For a moment, we thought that maybe Mosler was just pulling our leg. Nope. Look at the rest of his oeuvre.

“Government should do this…” he says. “Government should do that…” Mosler is full of ideas.

“For every complex problem,” said Baltimore newspaper man H.L. Mencken, “there is an answer that is clear, simple, and wrong.” Mosler seems to find every one of them. There is scarcely any part of the economy or the financial system he doesn’t want to fiddle with.

For example, he believes the feds should buy houses in foreclosure, guarantee all bank deposits, and meet economic recessions – in classic Keynesian fashion – by more government spending.

What? The feds don’t have enough money for all that? That’s not a problem, says Mosler. “Federal checks don’t bounce,” he says. |

H.L. Mencken would undoubtedly have been greatly amused…

Photo via reformedlibertarian.com - Click to enlarge |

The 180-Degree Rule

Mosler points out that the feds are the source of money. They are currency issuers, while the rest of us are mere currency users. That means, says Mosler, they can do what they want… with no natural limits – other than inflation – on their ability to use their money to make a better world.

“Not true,” we replied to Chris.

“Just because the feds want something doesn’t mean they will get it. And just because they say something doesn’t make it true.

“Hunter S. Thompson proposed a ‘180-degree rule’: When the feds say something, usually, the truth is the exact opposite.

“There is good money and there is bad money,” we went on. “The feds can declare anything money, but that doesn’t make it good money.

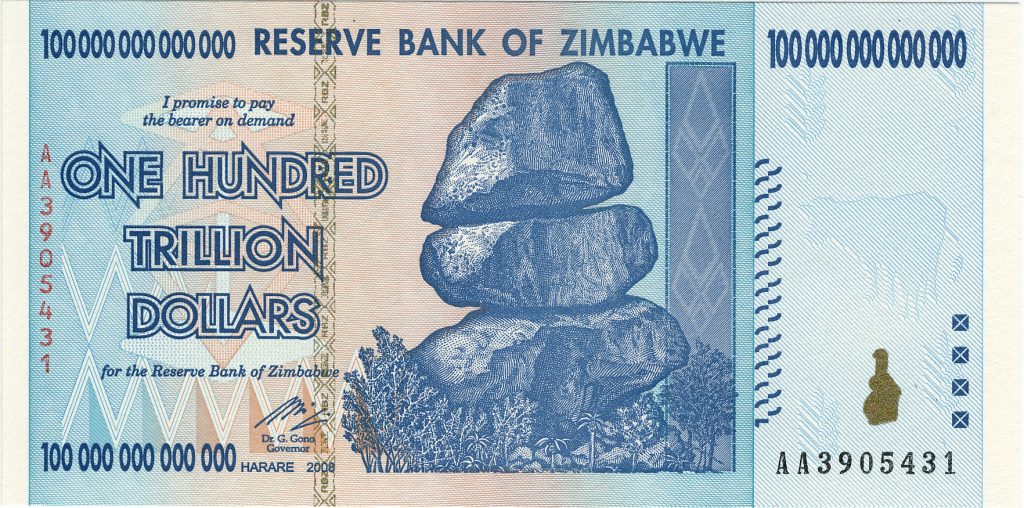

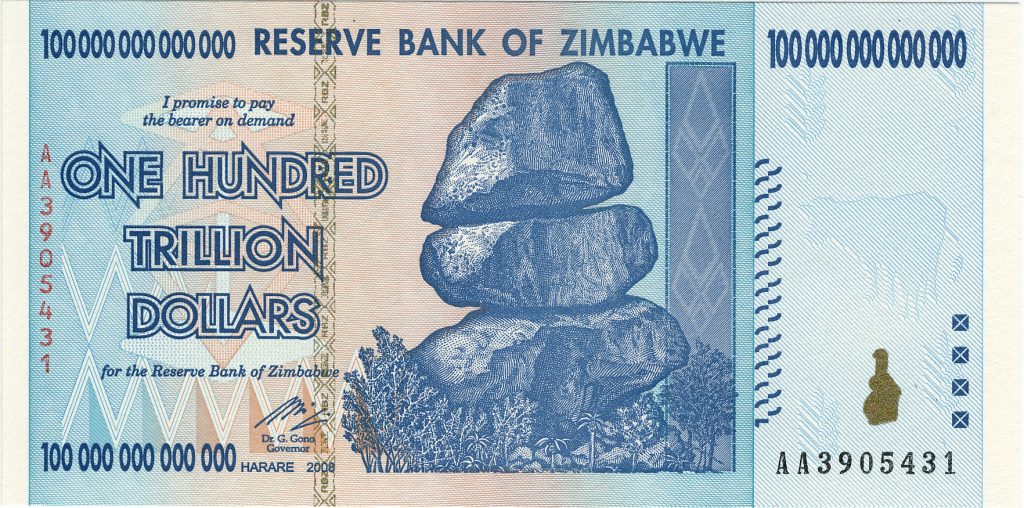

“In Zimbabwe, just 10 years ago, the government printed up 100 trillion dollar notes.

“The government said it was money. But nobody used it as money. Because it wouldn’t buy anything. It was not ‘money’ at all. It was just paper.”

Mosler is an activist, and a world improver – that is, by definition, he is a moron. |

An example of money declared “good” by a government, and “bad” by everybody else. In fact, it ceased to work as a viable medium of exchange and had to be abandoned. Today Zimbabwe uses foreign currencies such as USD and ZAR. - Click to enlarge |

Chart by: StockCharts

Chart and image captions by PT

The above article originally appeared at the Diary of a Rogue Economist, written for Bonner & Partners.