(Disclosure: Some of the links below may be affiliate links) September 2021 was very eventful for my family and me. Usually, there is not much new in my updates, but this update is packed with two big news! Keep reading if you want to know! Financially, this was a good month, without anything out of the ordinary. We had a good income and also low expenses, despite some unexpected expenses. So, we managed to save a sizeable portion of our income. In this article, we will see everything that happened to us and our finances in September 2021. September 2021 – They were three! Let’s start with the biggest news (the only one that truly matters!). We are very happy to welcome our son, Baby Poor Swiss, into our family! He was born healthy in the middle of September, and he decided to make us

Topics:

Mr. The Poor Swiss considers the following as important: Updates

This could be interesting, too:

Baptiste Wicht writes July 2022 -Another hot month

Baptiste Wicht writes June 2022 – Taxes and heat

Baptiste Wicht writes May 2022 – Another month goes by

Baptiste Wicht writes April 2022 – A good month

(Disclosure: Some of the links below may be affiliate links)

September 2021 was very eventful for my family and me. Usually, there is not much new in my updates, but this update is packed with two big news! Keep reading if you want to know!

Financially, this was a good month, without anything out of the ordinary. We had a good income and also low expenses, despite some unexpected expenses. So, we managed to save a sizeable portion of our income.

In this article, we will see everything that happened to us and our finances in September 2021.

September 2021 – They were three!

Let’s start with the biggest news (the only one that truly matters!). We are very happy to welcome our son, Baby Poor Swiss, into our family! He was born healthy in the middle of September, and he decided to make us wait a while since he was born more than a week post-term. But all is well now.

We are delighted and slowly adapting to life in a family of three. The first few days were rough, but once we got into somewhat of a rhythm, we managed to sleep a little better and cope better. That’s not to say that we have it totally under control (nobody does), but we manage.

The first days at home were okay for sleeping, but then his sleep schedule went nuts. We are currently happy when we sleep two hours in a row. Sleep deprivation is the biggest issue for us. Our son does not yet have much of a regular rhythm for sleeping and napping. At this time, we can get between 5 and 15 interruptions during the night.

Fortunately, my son is born just in time for his father to get the new ten days paternity leave. I was able to take more than two weeks off in a row. And I still had some extra days to have 3-days weekends for the entire October and maybe beyond if need be.

Going back to work was very rough for me. I am very glad to be working from home because adding the commute on top of my working hours would have been a nightmare. Working while sleeping so little is very challenging, given that I have to do deep work for many hours a day.

We are looking forward to sleeping properly. It may sound selfish, but this will help us enjoy the time with our son during the day. Another thing I am looking forward to is being able to have a meal with my wife without interruptions (it has not happened in the last 3 weeks). And we are obviously looking forward to being able to play with our son.

This event is going to change our lives in the coming months as well. But I do not doubt that this will be for the better. The blog may be getting a little less attention from me, but it is not going anywhere.

Except for this, there is nothing personal worth mentioning about this month. So, we can jump over to the second piece of news.

I wrote a book

And here is the second big piece of news! I wrote a book with Thomas Walke, another blogger living in Switzerland! We have decided to write a book about early retirement, aimed more internationally than the usual books specific to the US. We believe there is still room for books with an international perspective.

So, let me introduce you to Retire Early: The Simple Guide. This book is now available for pre-order on Amazon and will be shipped on October 22nd. It will first be available on ebook only, but the hardcover version will come early November. And we will have a paperback version available in December probably.

Retire Early: The Simple Guide will guide you through all the steps necessary to plan your own financial independence. We have decided to keep it to the basics and not make it specific to any country. For instance, you will learn how to choose your Safe Withdrawal Rate, but not how to save taxes in Switzerland.

To give you an idea, here is the table of contents of this book:

- Is it possible to retire early?

- How much money do I need?

- How can you overcome the 4% rule limits?

- How long will it take me to retire?

- How can I reach my goal faster?

- What do I need to do to make it happen?

- How do I set up my FI plan?

The idea of our book is to guide the reader towards financial independence. The book will give him all the steps he needs to do to reach that goal. And then, it will be up to the reader to get more knowledge on the points on which is he weaker. We believe this is the best path to financial independence.

And if you want to know more, a reading sample is available on Amazon, or you could read the testimonials of our reviewers.

If you order and read our book, we would be very happy if you could let a comment on Amazon. This would help us improve our book and would also increase the visibility of our work.

And you probably have seen from the picture that my name is Baptiste. This is probably not news-worthy, but at least you know!

Expenses

Let’s see the details of our expenses in September 2021:

| Category | Total | Status | Details |

|---|---|---|---|

| Insurances | 899 CHF | Above average | The usual health insurance and one month and a half insurance for our son. |

| Transportation | 72 CHF | Average | No gas, but a lot of parking fees at the hospital |

| Communications | 110 CHF | Above average | More phone bills for all the calls for the baby |

| Personal | 1616 CHF | Above average | Many medicine bills and a health trimestrial bill for the blog |

| Food | 488 CHF | Average | Standard groceries, plus some lunches at the hospital for me and some extra fees for diapers |

| Housing | 795 CHF | Above average | Usual mortgage and heating bills and the trimestrial bill for power |

| Taxes | 3782 | Average | Standard taxes |

In total, we spent 7681 CHF during the month. Given that there were several trimestrial bills and several extra fees for the baby, this is a good result. Without taxes, this sums up to 3900 CHF for the month. This amount is below our goal of 4500 CHF per month, so again, an excellent result. So, this month, we saved about 45% of our income.

We do not expect our expenses to change much during these first months. The most significant change will be health insurance, and we will have to pay for diapers and the occasional medicine, but aside from this, this won’t change for a few months.

Overall, our expenses were relatively standard this month. We had a few trimestrial bills that inflated our expenses, but nothing extraordinary. So, we can be pleased about our finances this month.

2021 Goals

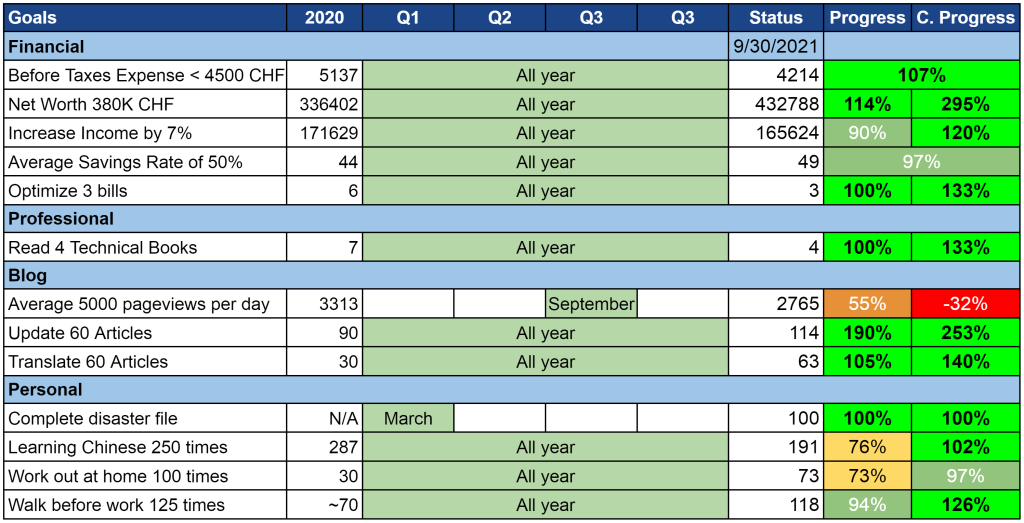

Let’s take a look at our goals by the end of September 2021:

As you can imagine, some goals suffered a little during this month due to having a baby at home.

I gave up on my workout this month. I plan to start again next month because this is the kind of thing that gets more difficult the more days I miss. However, I may not have the time between work, housework, and helping Mrs. Poor Swiss taking care of the baby.

And since I almost did not work this month, I have not done many walks before work either. I am not sure when I will have the time to restart this habit. I also did not do many updates or translations on the blog. But I consider all these goals secondary.

But overall, our goals are doing great regardless. All our financial goals are doing well. So, I am not worried if I do not meet some of the secondary goals.

Net Worth

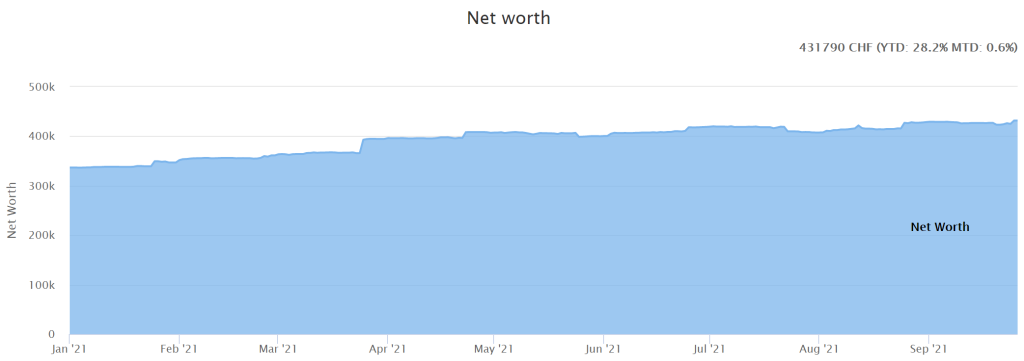

Let’s take a look at our net worth as of September 2021:

Nothing special happened with our net worth. The stock market had some ups and downs (mostly downs). We had nice savings this month, so this helped grow the net worth.

I am quite satisfied with this growth. We are on track to grow our net worth by 100K CHF in one year. This growth is an excellent result. And this is despite having bought a house. So, we are definitely on track to get to half a million next year.

The Blog

SiteGround is a great hosting provider, with very low fees. It has one of the best user ratings of all hosting providers.

Aside from the book, there is not much going on with the blog. I had a few articles ready in advance so that I did not have to write during this month (for obvious reasons).

I have only a few articles ready for next month. So I am not sure I will be able to keep my writing schedule in the coming months. I have selected a few review articles for next month since they can be done without creating many graphs like some of my articles.

Next month should not be much different on the blog. I do not expect any big thing coming, except, of course, for the book’s release.

Next Month – October 2021

We do not have any plans for next month. We will go with the flow and continue to adapt to life with our son. We will see where this takes us. I simply hope we can sleep better. If we can have good nights, this will change significantly our current quality of life. There may be fewer articles on the blog.

Financially, next month should be a good month, without much special. We will probably start receiving child allowances, so our income will be slightly higher, but this will not make a significant difference.

What about you? How was September 2021 for you?