(Disclosure: Some of the links below may be affiliate links) July 2022 was a pretty standard month for us, at least on the financial side. It was once again a scorching month, too hot for me. But we still managed to see friends and family and have an excellent time. Financially, we are back to a standard month and saved about 50% of our income. So, let’s see in detail what happened to us during the hot month of July 2022. July 2022 July 2022 was a good month. We did not have many events, but we had pleasant times. We met many friends and family members on two separate occasions. The first half of the month was way too hot, but the end of the month finally cooled down, which is excellent. However, I am having a hard time with the heat. And given that we will not be able to slow global

Topics:

Baptiste Wicht considers the following as important: Updates

This could be interesting, too:

Baptiste Wicht writes June 2022 – Taxes and heat

Baptiste Wicht writes May 2022 – Another month goes by

Baptiste Wicht writes April 2022 – A good month

Baptiste Wicht writes January 2022 – A poor start of the year

(Disclosure: Some of the links below may be affiliate links)

July 2022 was a pretty standard month for us, at least on the financial side. It was once again a scorching month, too hot for me.

But we still managed to see friends and family and have an excellent time. Financially, we are back to a standard month and saved about 50% of our income.

So, let’s see in detail what happened to us during the hot month of July 2022.

July 2022

July 2022 was a good month. We did not have many events, but we had pleasant times. We met many friends and family members on two separate occasions. The first half of the month was way too hot, but the end of the month finally cooled down, which is excellent.

However, I am having a hard time with the heat. And given that we will not be able to slow global warming soon enough, this will get worse. I think we should move either higher or much north, but that is not something that will happen quickly.

I am thrilled I can work from home. My office in the basement did not get hotter than 24 degrees on the worst day. The corporate office easily went to 30 degrees.

Even though it was a good month, there is not much to say about it. I had a hectic time at work with many issues and many colleagues on vacation. It was pretty hard, given the lack of sleep, but everything went well.

We had a very nice time on Swiss national day. We stayed in our village and enjoyed the celebrations in our commune.

As far as our finances were concerned, July 2022 was a very standard month. We had low expenses and average earnings. We managed to save more than 50% of our income which is our goal! This savings rate is good after the very expensive month of June.

So, let’s delve into the detail of this month.

Expenses

Let’s see the details of our expenses in July 2022:

| Category | Total | Status | Details |

|---|---|---|---|

| Insurances | 878 | Average | Health insurance |

| Transportation | 99 | Average | Gas and bus |

| Communications | 85 | Average | Internet and phone |

| Blog | 116 | Below average | Multiple services for the blog |

| Personal | 973 | Below average | Many small items and a large gift |

| Food | 484 | Above average | A few lunches or dinners in the city, some market, and usually groceries |

| Housing | 753 | Above average | Mortgage, heating, and water |

| Taxes | 3378 | Average | Communal and cantonal taxes |

In total, we spent 6767 CHF this month. This amounts to 3224 CHF (our best month) without taxes and blog.

Overall, we did a great job managing our expenses this month. To be honest, we did not do much for that. It was a cheap month. We will not be able to keep this level of expense in any month.

Overall, there is not much to say about our expenses. Most of the events we had were either paid for or cheap. So even though we did many things this month, it did not cost much. And my wife nor I did much shopping this month, helping our expenses again.

So, expenses-wise, July 2022 was a great month!

2022 Goals

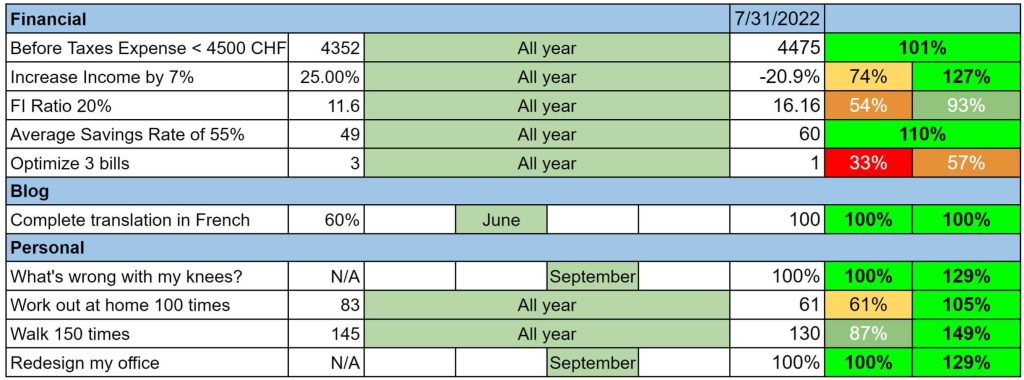

Let’s take a look at our goals by the end of July 2022:

Overall, our goals are doing great. Only two goals are behind schedule.

First, my FI ratio is still lower than it should be (the number in the picture is wrong, check the next section for the actual one). This goal was very ambitious and is highly dependent on the market, which was not in our favor this entire year.

The other goal that is not doing great is our goal to reduce three expenses. I still have not done the second expense. I am not worried about this goal because I already know the other two things I will do. Next month, I should be able to move our complementary insurance over to Assura. We will see if everything will go well or not.

I already have ideas to optimize our expenses later, but they are both locked for several more years. For 2023, I have no idea what we could optimize.

All our financial goals are doing great. The only one we are unlikely to achieve is our FI ratio goal, but this goal was ambitious and dependent on the stock market. The other goals are more important.

I think it is the first month where all but two goals are green, meaning on target to be done by the end of the year. I am pleased about our average spending being below 4500 CHF!

Overall, I am happy about the status of our goals.

FI Ratio

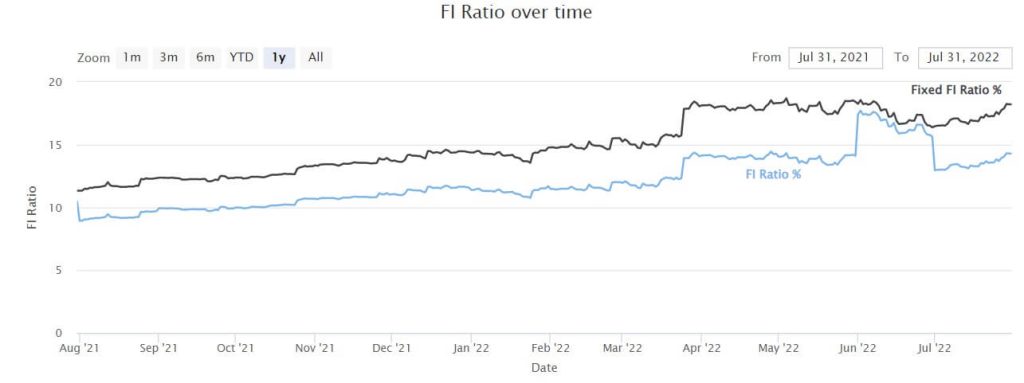

Let’s watch our FI Ratio until the end of July 2022:

As you can see in the image, our FI ratio is pretty wild. We went from about 16% to 14.3% compared to last month.

The huge bump and then going down is due to the average of our expenses where some months are really expensive. This was the case in June, which is now included in our 12-month average.

This makes our average expenses much higher and, as a result, increases our FI net worth. So, our FI ratio went down significantly as well.

If you look at the black line, it represents fixed retirement expenses of 100’000 CHF. This is our current estimate of how much we will spend once we are retired. This line is nearing the top since our FI net worth is also nearing the top.

Indeed, after three months without growth, our FI net worth increased again in July. The stock market recovered some of its losses, and we also managed to save money. On top of that, I received some RSUs, and my ESPP shares vested for a small profit.

So, overall, I am happy about our FI ratio results. Our average expenses are still wild but tend to stabilize over time.

The Blog

There is not much to say about the blog this month. I have been able to do a few updates, which is great. I am not up to date on my tasks, but I have been able to advance in a few projects, which is great.

I have updated many of my underperforming articles and many articles which were out of date. I have also integrated a few more images and tables into my articles.

The traffic on the blog was entirely flat this month. This is not great, but also not terrible.

I have a few important updates to do on the blog. Next month, I hope I will be able to continue working on some improvements and not only on the current articles. And I may tackle revamping the home page in the coming months.

Next month – August 2022

They are announcing another heat wave in August 2022. I am not looking forward to that. I am starting to resent the weather here. On the financial side, it should be a fairly usual month.

What about you? How was July 2022?