(Disclosure: Some of the links below may be affiliate links) A widespread misconception about the Trinity Study is that people believe that they will withdraw 4% of the current portfolio. If the portfolio is worth 1’000’000 USD this year, they can withdraw 4% of it, 40’000 USD. But in reality, the withdrawal is based on the initial portfolio at the time of retirement. If you start with 800’000 USD, you can withdraw 32’000 USD of it. And then, you adjust the withdrawal every year for inflation. During the first year, this is the same thing, but these two methods are widely different in the following years. But what would happen if you were to withdraw based on your current portfolio and not the initial portfolio? Let’s find out! Withdraw from current portfolio I will assume you are

Topics:

Mr. The Poor Swiss considers the following as important: Financial Independence

This could be interesting, too:

Baptiste Wicht writes A few ways to simplify our life

Baptiste Wicht writes Retire Early: The Simple Guide – I wrote a book

Mr. The Poor Swiss writes 9 Reasons to Aim for Financial Independence

Mr. The Poor Swiss writes How to Open an Interactive Brokers Account in 2021?

(Disclosure: Some of the links below may be affiliate links)

A widespread misconception about the Trinity Study is that people believe that they will withdraw 4% of the current portfolio. If the portfolio is worth 1’000’000 USD this year, they can withdraw 4% of it, 40’000 USD.

But in reality, the withdrawal is based on the initial portfolio at the time of retirement. If you start with 800’000 USD, you can withdraw 32’000 USD of it. And then, you adjust the withdrawal every year for inflation. During the first year, this is the same thing, but these two methods are widely different in the following years.

But what would happen if you were to withdraw based on your current portfolio and not the initial portfolio? Let’s find out!

Withdraw from current portfolio

I will assume you are familiar with the Trinity Study and how to retire based on your portfolio. Otherwise, you should read the previous article and come back here.

The basic idea of the Trinity Study is that if you withdraw X% (X being your withdrawal rate) of your initial portfolio, every year, you should be able to sustain your lifestyle for a long time (30 years in the original study). The withdrawal is set once and then only adjusted for inflation. It means that you need to know in advance how much you are going to spend in retirement.

Many people believe they can withdraw X% of the current portfolio, not of the initial portfolio. So, if the portfolio is 1’000’000 the first year, they can withdraw 40’000. And if the portfolio is worth 1’100’000 the second year, they can withdraw 44’000.

Even though this is not what the Trinity Study or the 4 percent rule is about, I think it is important to see what would happen if we do simulations when we withdraw based on the current portfolio instead.

Simulations

I will run simulations based on the Trinity Study with different withdrawal rates. The only thing I am going to do differently is that the withdrawal amounts will be based on the current portfolio, not the initial portfolio.

For this, I am using data from the U.S. Stock market from 1871 to 2020. I am going to use different portfolios with stocks and treasury bonds. In all my simulations, I will assume a TER of 0.1% per year.

I am using my own tool to do these simulations. If you are interested in the tool and the data, you can look at my Updated Trinity Study article.

The output of the simulation is the success rate. Success is defined as not running out of money before the end of the simulation. A simulation ending with 1 CHF is a success. And the success rate is the percentage of successful simulations in the set of simulations.

Retirement of 30 years

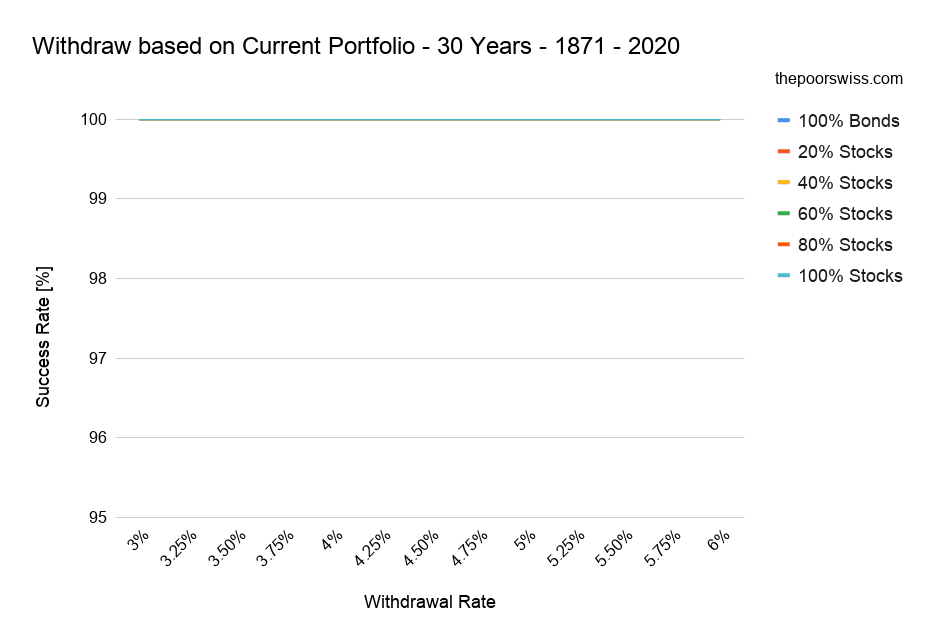

Let’s directly start our simulations with a retirement of 30 years. This is a reasonable time frame for some retirement already. So, here are the results if you base your withdrawals on your current portfolio instead of the initial one:

As you can see, all the portfolios have a 100% chance of success! Even with a 6% withdrawal rate! This is significantly better than with the standard rule of the Trinity Study!

Does that mean that we just found an awesome way to sustain our lifestyle while withdrawing more money with a higher chance of success? No!

If you think about it, as long as you are withdrawing a percentage of your current portfolio, it can never reach zero. For instance, with a 4% withdrawal rate, even 100 USD can sustain for almost ever. You can withdraw 4 USD in the first year, then 3.84 USD, then 3.68 USD, and so on. At some point, you may reach zero since you will not be able to split a cent.

The main problem with this simulation is that it supposes that we can live from any amount of money, including 1 cent. If you could live on 1 cent a year, you would not need to rely on the Trinity Study to retire.

So, we need to introduce a minimum of money that we need to live. This will be the bare minimum to survive. It can be lower than your current planned expenses on retirement, but it still needs to be reasonable (because you will need to stick to it).

Retirement of 30 years with a minimum

Let’s rerun our simulation by introducing a minimum into the system. However, we still have to choose a minimum. What makes sense is to use a percentage of the original portfolio as the minimum for the simulation. So, if you use 4% and have a 1’000’000 CHF portfolio, your minimum will be 40’000 CHF to spend in any given year.

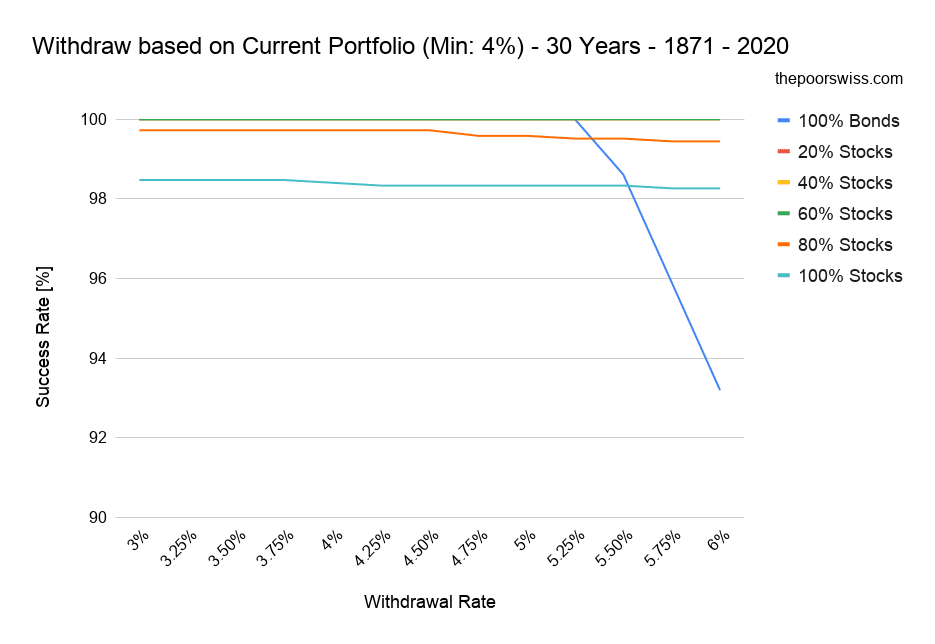

So, let’s see the results with withdrawals from the current portfolio and a minimum of 4%:

This time there is a little variation. But the performance is still excellent, significantly better than using a 4% withdrawal rule. So, can you withdraw 6% of your portfolio every year with a minimum of 4% of your initial portfolio?

Well, not really. There is still one important piece missing: inflation!

Bringing back inflation

Having a minimum is necessary for this method, but then we need to account for inflation. After 30 years, it is unlikely that the minimum is still relevant. We only adjust the minimum for inflation, not the withdrawals, based on the withdrawal rate and current value.

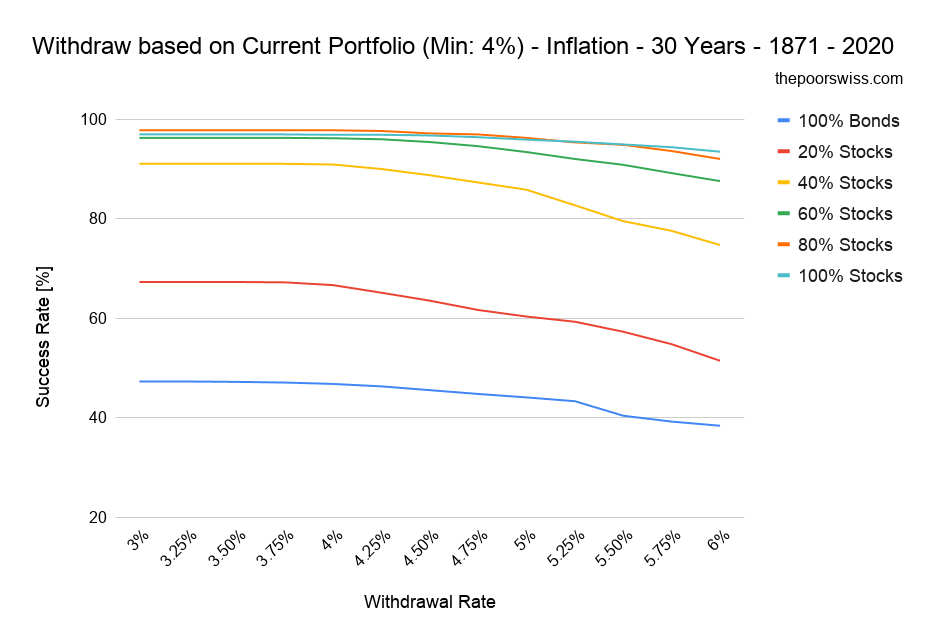

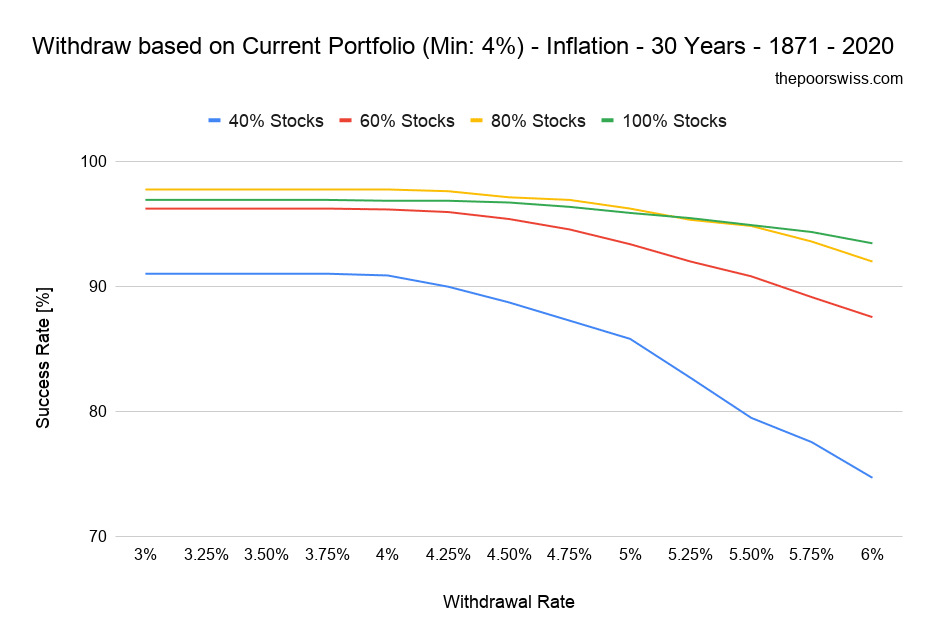

So, let’s see the results when we adjust the minimum for inflation, month after month, using Consumer Price Index (CPI) data from the United States:

We can see that the results are already significantly more interesting. And we can also see that portfolios with less than 40% of stocks are not performing well. So, let’s start by removing these portfolios:

We can already see better the different portfolios now. We can observe a few things on this graph.

First, there is a flat line between 3% and 4%. This is logical since the minimum we are withdrawing is 4% per year. So, we cannot be better than 4%. We will see later what happens when accounting for a minimum of 3%.

The second interesting fact is that, past 4%, the loss of success rate is not extremely significant. Of course, the success rate is still going down, but this makes sense since we withdraw more money from the portfolio every year, especially in the early years. But this also shows that we can withdraw significantly more than the minimum and not risk too much. For instance, we can withdraw 6% of our 100% stocks portfolio every year and reach a 93.4% chance of success with a minimum of 4% withdrawal. This is still worse than a pure 4% withdrawal rate, by a few percent. But it is not significantly worse.

This shows that we generally can withdraw more than people think without depleting the portfolio. This can show the value of a flexible withdrawal rate range. For instance, a 100% stocks portfolio with a 5% dynamic withdrawal rate and a minimum 4% withdrawal will still give a 95.9% chance of success.

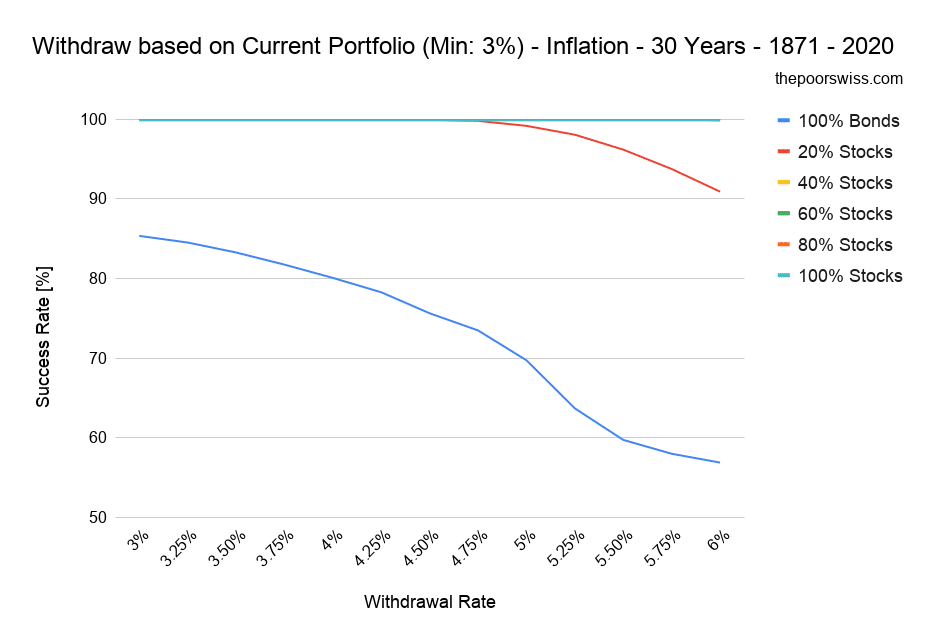

Let’s see what happens if we make the minimum 3% of the initial portfolio, adjusted each month for inflation:

Except for portfolios with 100% bonds, all portfolios are performing really well in this situation. This is logical since we have reduced the minimum withdrawal to a tiny 3%. A 3% withdrawal rate is very conservative and has a very high chance of success. This really shows that the most important parameter is now the minimum, not the withdrawal rate.

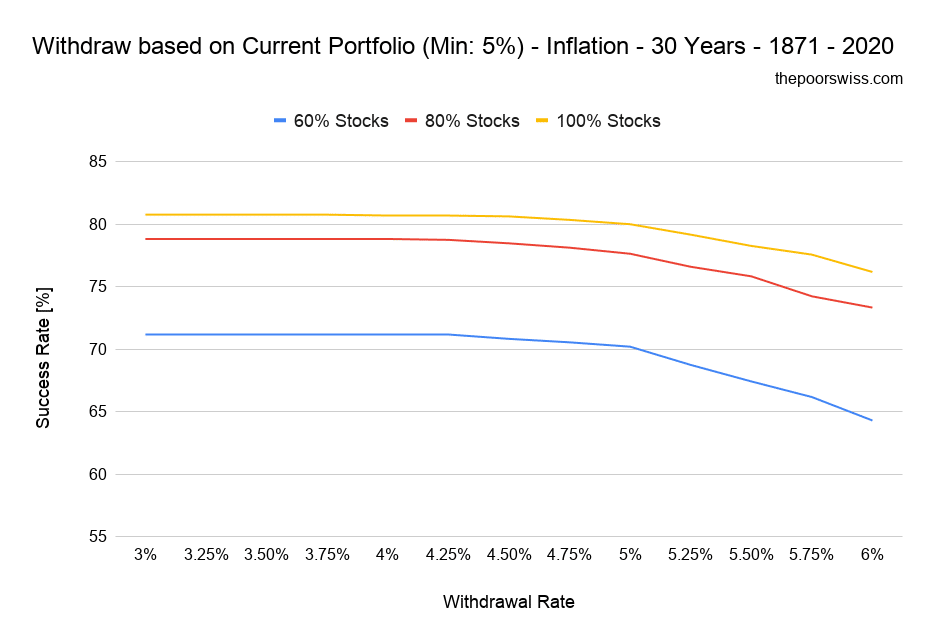

To make sure, let’s see the results with a minimum of 5% of the initial portfolio:

We can see that a minimum of 5% withdrawal is too aggressive. Even with a portfolio fully invested in stocks, we would have barely more than 80% chances of success.

Retirement of 40 years

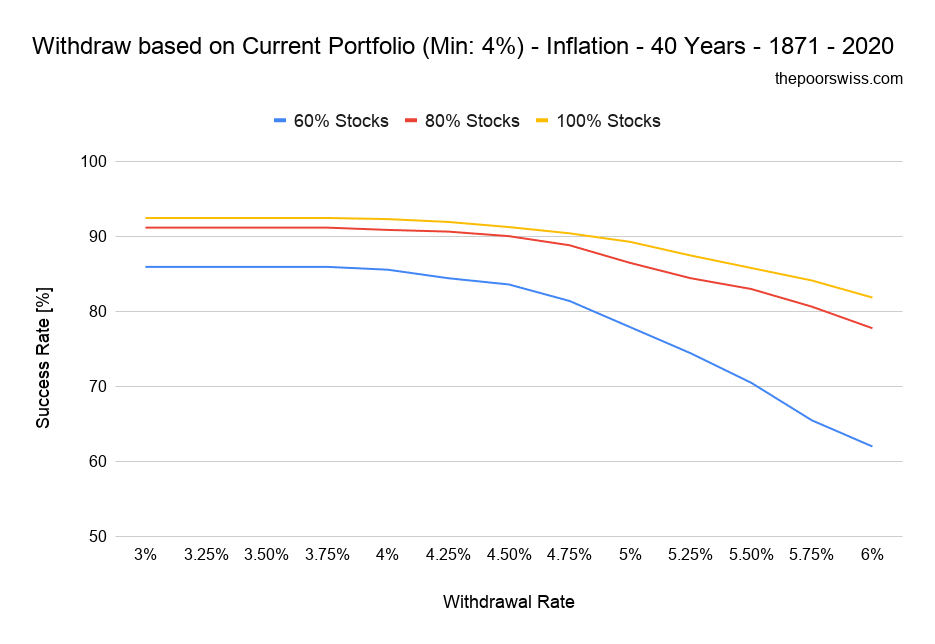

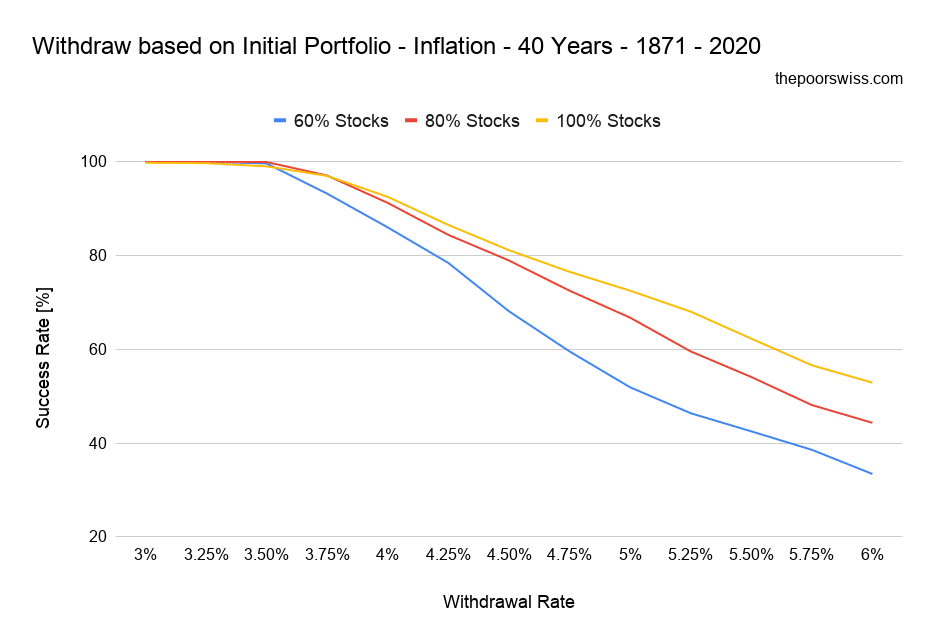

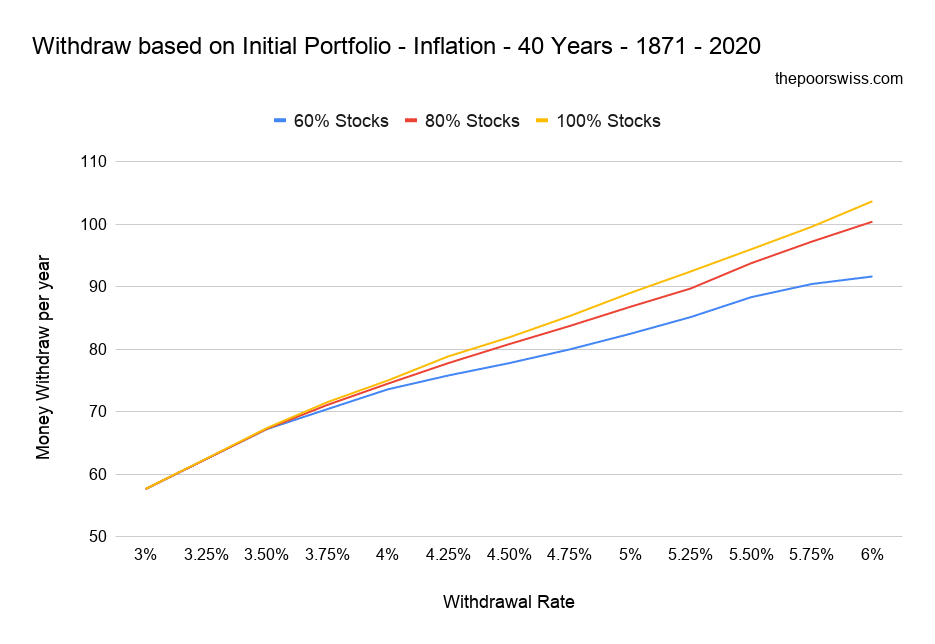

Let’s continue our simulations with retirement of 40 years. With the same parameters, here are the results for 40 years:

We can see that the method holds quite well even for 40 years. For reference, let’s compare it to the standard rule of withdrawal of the Trinity Study with the same parameters:

We can observe several things when we compare both graphs. First, for low withdrawal rates, the standard rule of withdrawal is significantly better. It is entirely normal since we are using a minimum of 4%. A withdrawal rate of 3% of the current portfolio does not make sense when the minimum is 4% of the initial portfolio.

The second point is that the success rates with higher withdrawal rates are better with this new method than the standard Trinity Study method. Why is that?

The reason is that in the early years of the simulation, we can take out a large percentage (the withdrawal rate) of the current portfolio. But as soon as this reaches a small point, we revert to 4% of the initial portfolio. So basically, we revert to the 4% rule! At high withdrawal rates, we will withdraw less than with the standard retirement method once we reach the minimum.

Are we withdrawing more?

Now, are we actually withdrawing more than with the standard withdrawal rule? We have seen that at higher withdrawal rates, at some point, we will withdraw only 4%, but what would be interesting is to see if we are actually withdrawing more money with this method.

So, I have recorded how much is being withdrawn on average for each year of the simulations. I have only counted successful simulations in this average. The simulation started with 1000 USD.

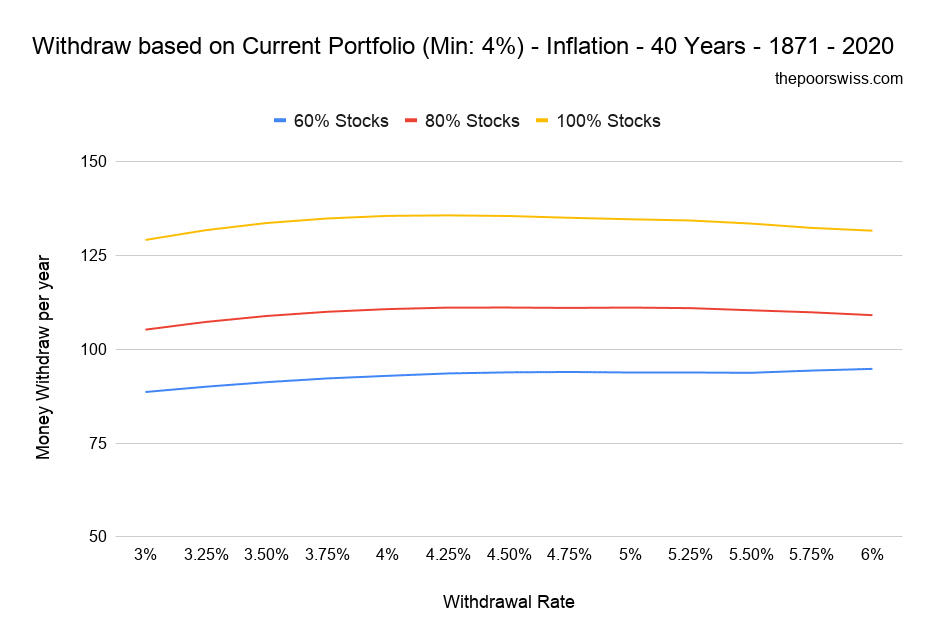

So, here are the results for the average money withdrawn per year with the new method of withdrawal and a 4% minimum withdrawal (based on the initial portfolio) and 40 years:

And here is the same information but for the standard method of withdrawal:

We can observe several things based on these two graphs. First, we are indeed withdrawing more money from the portfolio. In some cases, are getting 50% more on average. This is the goal of this retirement method. But the withdrawal rate itself does not make much difference. What matters the most is the minimum. For the standard method of withdrawal, the money we withdraw per year entirely depends on the withdrawal rate.

So, we can say that we can withdraw more money without impacting the success rate too much. However, this will entirely depend on the minimum that we use. And it means we will get some very different years. We are likely to have years when we can spend double what we will be able to spend in the following year. This could be an issue for people that are not flexible with their spending.

Worst duration

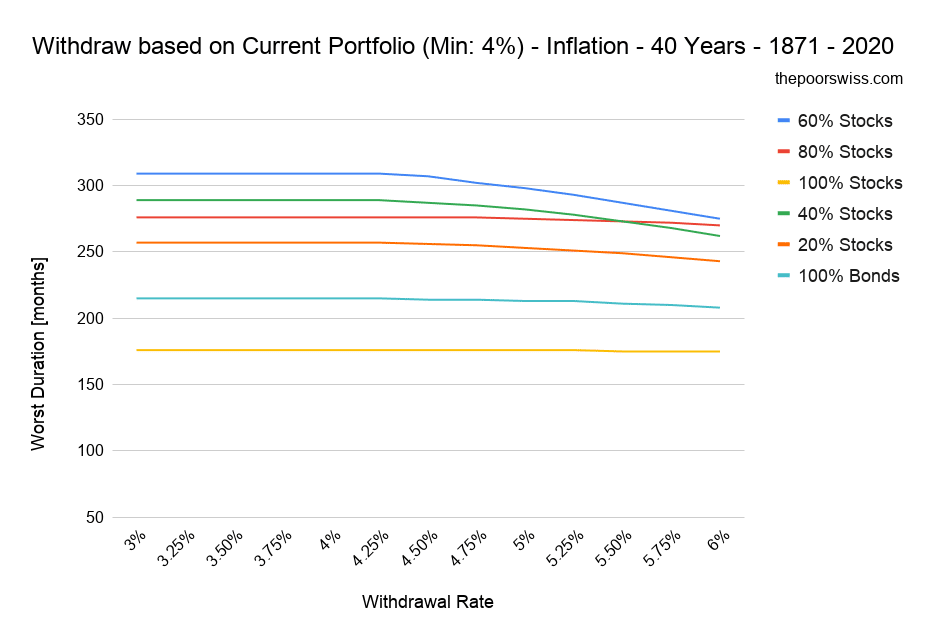

Finally, we also need to look at something else. Many people only take the success rates of each set of parameters into account. But we should also look at the worst duration of each set of parameters. Sometimes, it is better to retire with a lower success rate but significantly higher worst duration. The worst duration is how early a simulation can fail.

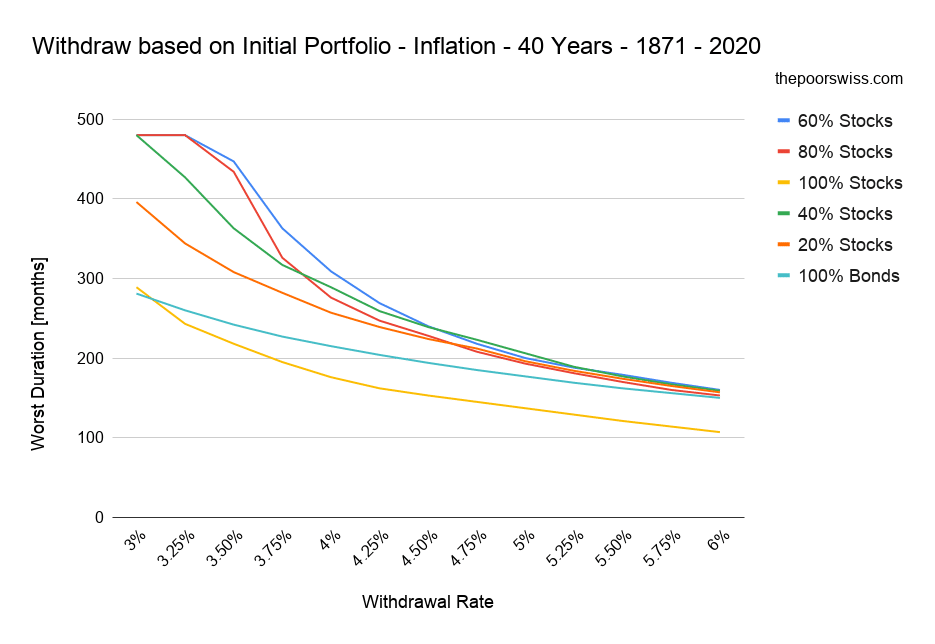

So, let’s check the worst duration with this new method for 40 years of retirement:

And let’s compare against the standard method of withdrawal:

We can see that these two graphs are very different. The main difference is that the current portfolio withdrawal strategy depends almost entirely on the minimum you choose, while the standard method of retirement depends entirely on the withdrawal rate.

So, by using this method, you are moving the problem from choosing a withdrawal rate to choosing a minimum and sticking to it.

The dangers of flexibility

This method can work, but only if you can stick to the minimum you have chosen.

Many people believe they can be very flexible in terms of spending. They could cut their vacations, eat less outside or stop going to the movies. And in some cases, this is true. But in most cases, people grossly overestimate their capacity to be flexible.

The main reason is that if you are used to spending more for several years, it will become difficult to reduce that level of expenses in the future. The more good years you have, the more difficult it will be to spend less.

And flexibility is not always quick. If you have moved into a bigger house, you cannot move out once a bad month is coming and you have not enough money to pay the mortgage interests. It is an extreme example, of course, but not an impossible one.

People can probably handle a difference between 4.5% and 4% in withdrawal rate as flexibility goes. But most people would not be able to change their habits enough from 5% to 4%, even less from 6% to 4%. So, if you are planning a high flexibility level for your retirement, I would recommend being careful!

Conclusion

Since many people believe that they should withdraw based on their current portfolio instead of based on the initial portfolio like the initial Trinity Study results, I have simulated what would happen if we did withdraw based on the current portfolio.

I believe it is possible to retire by using this method. However, you need to set a minimum amount of money that you need to withdraw. This will be defined by the bare minimum of money you need to survive. When the years are good, you can withdraw more, up to your withdrawal rate. But when the years are based, you will only withdraw a small amount to survive.

The advantage of this method would be to be flexible. You can withdraw more money and enjoy a higher lifestyle when times are good and go back to a smaller lifestyle when the times are rough. And this would not lower your chances of success too much.

The big problem of this method is to choose a minimum. It is even more complicated than choosing a withdrawal rate and you still have to choose a withdrawal rate as well. And on top of that, you have to stick to the minimum. If you enjoy several years in a row where you can withdraw more money, you are unlikely to be able to go back to the previous level. And in that case, you will be in trouble. Because this method is only as good as the minimum you have chosen.

If you were to choose a conservative minimum and a slightly higher withdrawal rate, for instance, 3.5% and 4%, I think this method would make sense. But it would not make sense to go with something like 4% and 5%, especially in the long term.

If you have suggestions for simulations like this, let me know! And if you want to read more simulations like this, I suggest you read my simulations about low yield bonds.

What did you think of these results? How do you plan to retire?