(Disclosure: Some of the links below may be affiliate links) CornerTrader is one of the oldest Swiss brokers. It is an interesting broker that claims to be very affordable, especially compared to other Swiss brokers. So, is CornerTrader (CT) any good for a Swiss investor, especially a passive investor? This is what I am going to find out in this in-depth review. We will see what CornerTrader is, what you can do with it, how much it costs, and much more too! By the end of this review, you will know whether CornerTrader is a good broker for your investing or not! CornerTrader CornerTrader logoCornerTrader is part of Corner Group. Corner Group is a private Swiss banking institution founded in 1879. It is now centered around Corner Bank, the bank of the group. Corner Bank was already

Topics:

Mr. The Poor Swiss considers the following as important: Investing

This could be interesting, too:

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes Estimates By Analysts Have Gone Parabolic

Lance Roberts writes The Impact Of Tariffs Is Not As Bearish As Predicted

(Disclosure: Some of the links below may be affiliate links)

CornerTrader is one of the oldest Swiss brokers. It is an interesting broker that claims to be very affordable, especially compared to other Swiss brokers.

So, is CornerTrader (CT) any good for a Swiss investor, especially a passive investor? This is what I am going to find out in this in-depth review. We will see what CornerTrader is, what you can do with it, how much it costs, and much more too!

By the end of this review, you will know whether CornerTrader is a good broker for your investing or not!

CornerTrader

CornerTrader is part of Corner Group. Corner Group is a private Swiss banking institution founded in 1879. It is now centered around Corner Bank, the bank of the group. Corner Bank was already established in 1952. CornerTrader itself was officially launched in 2012.

Corner Group also has business in several other countries. But in this review, I will only focus on its trading services in Switzerland via the CornerTrader broker.

Corner Bank has a Swiss banking license and is regulated by FINMA. CornerTrader uses Corner Bank as its custodian bank. Corner Bank has an excellent reputation in Switzerland.

At the time of this writing, CornerTrader has more than 10’000 users. This is a relatively small number compared to some larger brokers, but they still have a loyal user base. They offer access to stocks, Exchange Traded Funds (ETFs), options, Contracts For Difference (CFDs), and more investing instruments. CornerTrader has access to 22 stock exchanges in the world. So, if you are a simple passive investor, like me, they have more than enough instruments.

So, now, we can delve deeper into what CornerTrader offers as a broker.

CornerTrader Account Types

CornerTrader has four different accounts types:

- Private. The default trading account.

- Capital. The trading account for large portfolios.

- Pro. The trading account for professional traders.

- VIP. The trading account for very large portfolios.

The Pro and VIP accounts have very high trading volume requirements. So, they are not possible to achieve for us. So, we need to focus on the first two accounts. Capital is significantly cheaper than Private but requires having more than 75’000 CHF in your account. You can start with Private, and then once you reach this limit, you will be promoted to Capital.

In this review, I will go over the details of both the Private and Capital account types since they are both useful. And except for the fees, they have the same features.

CornerTrader Fees

In the long-term, you need to reduce your fees. Investing fees are extremely important. Therefore, we must look at the fees of the broker accounts at CornerTrader.

One great thing about CornerTrader is that they have no custody fees. This means you will not pay anything to have an account. This is great since most Swiss brokers have custody fees.

On the other hand, CornerTrader has an inactivity fee. If you do not trade during one quarter, you will have to pay a 35 CHF inactivity fee. I do not think this is an issue since most investors make at least one trade per quarter. I recommend investing every month during the accumulation phase and withdrawing once a month during retirement.

For trading, the fees are different for each stock exchange on which you are doing an operation.

Fortunately, the pricing system is straightforward, much simpler than other Swiss brokers. Also, Exchange Traded Funds (ETFs) have the same fees as stocks. This makes it even simpler to study the fees of CornerTrader.

So, here are the fees for some important stock exchanges with the Private account:

- Swiss Stock Exchange (SWX): 0.20% with a minimum of 20 CHF

- Euronext Amsterdam: 0.25% with a minimum of 25 EUR

- London Stock Exchange (LSE): 0.25% with a minimum of 20 GBP

- NASDAQ: 4 cents per share with a minimum of 25 USD

- New York Stock Exchange (NYSE): 4 cents per share with a minimum of 25 USD

And here are the fees for the same exchanges with the Capital account:

- Swiss Stock Exchange (SWX): 0.12% with a minimum of 18 CHF

- Euronext Amsterdam: 0.20% with a minimum of 20 EUR

- London Stock Exchange (LSE): 0.12% with a minimum of 18 GBP

- NASDAQ: 3 cents per share with a minimum of 12 USD

- New York Stock Exchange (NYSE): 2 cents per share with a minimum of 12 USD

These fees are not cheap. Given the large minimums, they are really not suited for small transactions. For instance, if you buy 1000 CHF on the Swiss Stock Exchange, you will pay 20 CHF, a 2% fee! Only if you buy for 10’000 CHF will you reach the minimum. So, I would not recommend using CornerTrader if you are going to do many small transactions.

For large transactions, CornerTrader is affordable when comparing with other Swiss brokers. Actually, as far as Swiss brokers go, CornerTrader is a good choice in terms of prices.

If you are going to trade in currencies other than CHF, you will also need to pay the currency conversion fee. At CornerTrader, you will pay 0.5% of each currency conversion. If you buy shares for 5000 USD from CHF, you will pay a 25 USD currency conversion fee. And you will have to pay this fee when you sell your shares as well. You should not neglect this fee since it is relatively high. Over time, this can accumulate to be a lot of fees.

But CornerTrader is actually the Swiss broker with the lowest currency conversion fee! I do not say it is cheap because it is not. But as far as Swiss brokers go, this is the best you are going to get.

Finally, let’s not forget the Swiss Stamp Tax Duty fee. Since CornerTrader is a Swiss broker, you will have to pay this tax on each stock market operation. This fee is 0.075% for Swiss shares and 0.15% for foreign shares. This fee is the same for each Swiss broker.

Overall, CornerTrader is not cheap. Its fees for small transactions are really high. But when we compare only with other Swiss brokers, it is one of the cheapest Swiss brokers. This is especially true for currency conversion fees and trading fees on large transactions.

Opening an account at CornerTrader

Let’s see how we can open a CornerTrader account.

You can fully open an account online. Opening an account will take you less than 10 minutes. However, before you can make trades on the stock market, your account will need to be validated based on the documents you have submitted during the onboarding process. So, it may take days before the account is fully accessible. In the meantime, you will still be able to look at the platforms.

Aside from this point, there is really nothing special about the account opening process. They will ask you all the usual questions:

- Your personal information

- Your personal investing knowledge and experience

- Proof of address and identity

There is no minimum for opening an account at CornerTrader. So, you can start trading with very little money. But as mentioned before, be very careful about the high minimums for trading operations. Doing small operations on CornerTrader may quickly become very expensive.

So, overall, the process of opening an account is very straightforward. But they could make the process faster.

Trading with CornerTrader

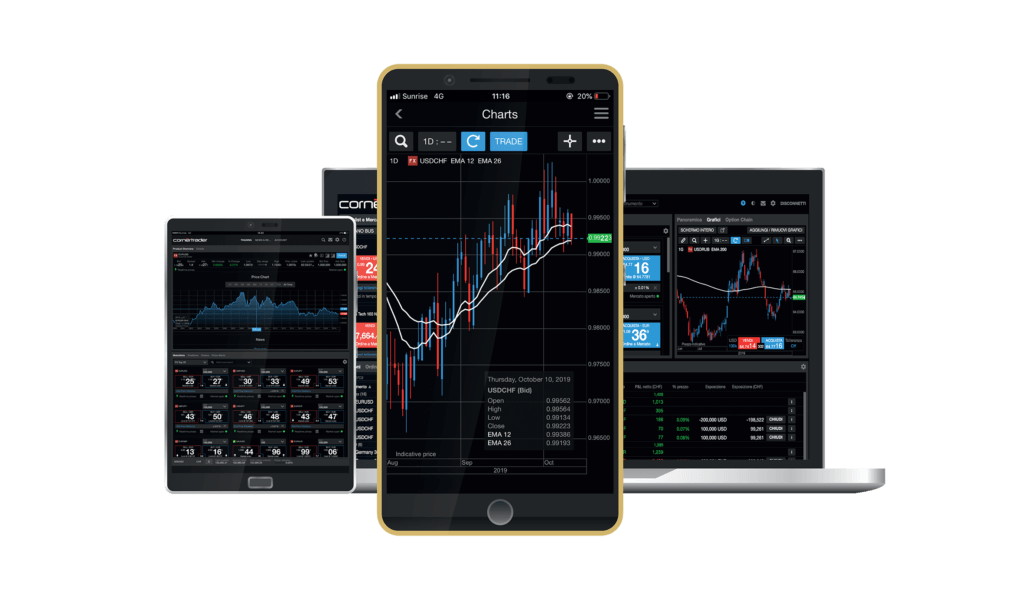

CornerTrader offers three platforms to trade:

- Invest: A simple platform for investors.

- Flexibility: A slightly more advanced platform for investors that are on the move.

- Advance: The platform for advanced traders. For instance, you can use up to 6 monitors to show off to your friends.

So, if you are a simple passive investor, the Invest platform will have all the features you will ever need. The first two platforms can be used on desktops, phones, and tablets. The Advance platform can only be used on a desktop computer.

These options are quite good. It is great to separate platforms based on each level of investing. That way, simple investors are not lost in a sea of features they do not need. 99% of investors will only need the Invest platform.

Is it safe?

If you are going to invest a significant amount of money with a broker, you need to make sure it is safe.

CornerBank is regulated in Switzerland by the FINMA. Its other entities are also regulated in other countries. Since your assets are deposited at Corner Bank, your assets are regulated.

Corner Bank is a well-established bank with a good reputation. I would say that the chances of it going bankrupt are slim. Nevertheless, it is good to know what would happen if a broker went bankrupt. Your cash will be protected for up to 100’000 CHF. Your securities should be deposited in your name in Corner Bank and should be safe.

For technical security, you can choose to activate a second factor of authentication for your account. I strongly recommend doing that. In fact, it should be enabled by default. Many people have reported to me that it is complicated to configure.

I have not heard of any security leaks or breaches from CornerTrader.

So, investing with CornerTrader is as safe as investing with other Swiss brokers.

CornerTrader Reputation

It is essential to look at a broker’s reputation before using it to invest in the stock market.

As a source of review, I generally use TrustPilot. Unfortunately, there are no reviews of CornerTrader on TrustPilot. But I found 25 reviews on Google, with an average score of 2.5 stars. This is a bad result, but given the small number of reviews, it may not be very accurate.

On the negative reviews, most of them can be classified into two categories:

- Poor communication when introducing the inactivity fees in 2019. Apparently, this fee was introduced without enough time for the customers to prepare. And since closing an account is not free, many customers were not satisfied.

- Very long account creation time. Since the account has to be manually validated, it takes a long time. Given the age we live in, people are used to creating and using an account within minutes, not days.,

Since most of the issues are regarding account creation, I am not too worried since this only happens once. However, the reputation of CornerTrader really took a hit when they introduced their inactivity fees with poor communication.

On the other hand, positive reviews are focused on two different categories:

- Good customer service. It is rare to read that, so that is interesting.

- Simple investment. This is a good point for simple passive investors.

Overall, user reviews on CornerTrader are very much mixed. There are many user reviews on both extremes (love and hate).

CornerTrader Pros

Let’s summarize the advantages of CornerTrader:

- No custody fees

- Well established broker

- Good reputation in general

- Relatively good trading fees for large transactions

- The Best currency conversion fee among Swiss brokers

CornerTrader Cons

Let’s summarize the disadvantages of CornerTrader:

- A small number of users

- Inactivity fee if you do not a trade per quarter

- Expensive trading fees for small transactions

- It may take a few days to open an account

- Communication may be improved

CornerTrader vs Interactive Brokers

Interactive Brokers is an outstanding broker, with extremely affordable fees! Trade U.S. security for as little as 0.5 USD!

It is important to note that I am not using CornerTrader. Why is that? As soon as you look at international brokers, you will find out much cheaper and better alternatives. For my investing, I decided to go with Interactive Brokers. So, let’s compare both platforms.

Interactive Brokers is a much larger broker, with many more customers and better established. Both are properly regulated and protected.

The main difference between these two brokers is when we compare the fees.

First, CornerTrader has no custody fees. At Interactive Brokers, you will pay 10 CHF per month if you have less than 100K in your account. After this, you will pay no custody fees. So, CornerTrader will be slightly cheaper in custody fees if you have a small account.

But things are much more different in terms of trading fees. Even on the Swiss Stock Exchange, Interactive Brokers is cheaper (10 CHF against 20 CHF). But the main difference lies in the American Stock Exchange. For instance, if I buy 10’000 USD of Microsoft shares, I will pay about 0.40 USD on IB. On CornerTrader, this would cost me 12 USD with the cheaper Capital account. In this example, IB is 30 times cheaper than CornerTrader!

Finally, currency exchange at IB costs about 2 USD while they cost 0.5% at CT. So, unless you are converting less than 400 USD, IB will be much better at converting money.

On top of that, since IB is a foreign broker, you will not pay the Swiss Stamp tax. This means, with IB, you are saving 0.075% on each Swiss operation and 0.15% on each foreign operation.

Overall, for me, IB has too many advantages to pass on. I save a lot of money every year by using IB. The only advantage of CT over Interactive Brokers is that it is a Swiss broker with your money being in Switzerland.

Conclusion

Overall, CornerTrader is a cheap Swiss Broker. They offer access to many investing instruments on many stock exchanges. In terms of prices, they compare very well with other Swiss brokers.

If you are looking for a good Swiss broker, CornerTrader is a good candidate. Now, you have to be careful about small transactions. They can be very expensive with this broker. Also, they have relatively few users compared to some other brokers. So, some people may want to use a better-established broker.

Now, do I recommend CornerTrader to Swiss investors? Not really. Compared to international brokers, CornerTrader is much more expensive (an order of magnitude). Therefore, I still recommend Interactive Brokers as the best broker for Swiss investors. However, if you only want to consider Swiss brokers, CornerTrader is a good broker.

If you are interested in Swiss brokers, I compared the best Swiss brokers. This should help you choose, but you need to know the differences in costs between Swiss and foreign brokers. The only other good Swiss broker alternative is Swissquote. You can read my review of Swissquote for more information.

What about you? What do you think of CornerTrader?