(Disclosure: Some of the links below may be affiliate links) Today, we are going to see if the 4% Rule works in Switzerland, with Swiss Stocks, or not. I have wanted to do this experiment for a very long time. Now, I got all the data I need for a full simulation!I have been able to obtain data up to 1924 for Swiss Stocks and Swiss Inflation. It was not easy since not many people are interested in the data. But now, it is done! So I could finally do the simulation!I know that many of my readers are waiting for this. And I was also waiting for these results. Contents show The 4% RuleThe Trinity Study introduced us to the 4% Rule. If you withdraw 4% of your initial portfolio every year, you can sustain your expenses for an extended period. You will also have to adjust your withdrawal amount

Topics:

Mr. The Poor Swiss considers the following as important: Investing, Switzerland

This could be interesting, too:

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes Estimates By Analysts Have Gone Parabolic

Fintechnews Switzerland writes Top 12 Fintech Courses and Certifications in Switzerland in 2025

(Disclosure: Some of the links below may be affiliate links)

Today, we are going to see if the 4% Rule works in Switzerland, with Swiss Stocks, or not. I have wanted to do this experiment for a very long time. Now, I got all the data I need for a full simulation!

I have been able to obtain data up to 1924 for Swiss Stocks and Swiss Inflation. It was not easy since not many people are interested in the data. But now, it is done! So I could finally do the simulation!

I know that many of my readers are waiting for this. And I was also waiting for these results.

The 4% Rule

The Trinity Study introduced us to the 4% Rule. If you withdraw 4% of your initial portfolio every year, you can sustain your expenses for an extended period. You will also have to adjust your withdrawal amount based on inflation every year.

Contrary to popular belief, the original study never said that you could sustain your portfolio forever. The authors only simulated up to 30 years of withdrawal. But I have done several simulations with up to 60 years. And if you withdraw less than 4%, you should be able to sustain a very long early retirement.

This rule is at the base of the new Financial Independence and Retire Early (FIRE) movement. We should call it the 4% Rule of Thumb. For very early retirement, 3.5% is a better withdrawal rate. On top of that, it will depend on your portfolio.

The Experiment

The issue with this study and most experiments is that they focus on United States stocks and bonds. It means it is difficult to apply to other countries. Even if you invest only in United States stocks, you will still have the extra factor of the currency exchange.

I am going to use the same system I already used to update the results of the Trinity Study. But this time, I am going to focus on Swiss Stocks first. It will help us understand if we can replicate these results in Switzerland or not!

In my simulation, we are using monthly withdrawals. Each month, the value of the portfolio is updated based on the monthly returns. After that, the monthly withdrawal is updated for inflation. And then, it is removed from the portfolio.

For this simulation, I have not done any rebalancing. For more information, I have compared different rebalancing methodologies for retirement.

I am using the data for Swiss Stocks from 1924 to 2019. It is as much data as I was able to find. I think it is already a good period to see if the 4% Rule works in Switzerland.

The 4% Rule with Swiss Stocks

Let’s get started! First, I am going to consider a portfolio entirely made of Swiss Stocks. I want to see how they compare with United States stocks.

Since this is the first time I am experimenting with the 4% Rule on this data, I am going to start with a short period and then increase it ten years by ten years.

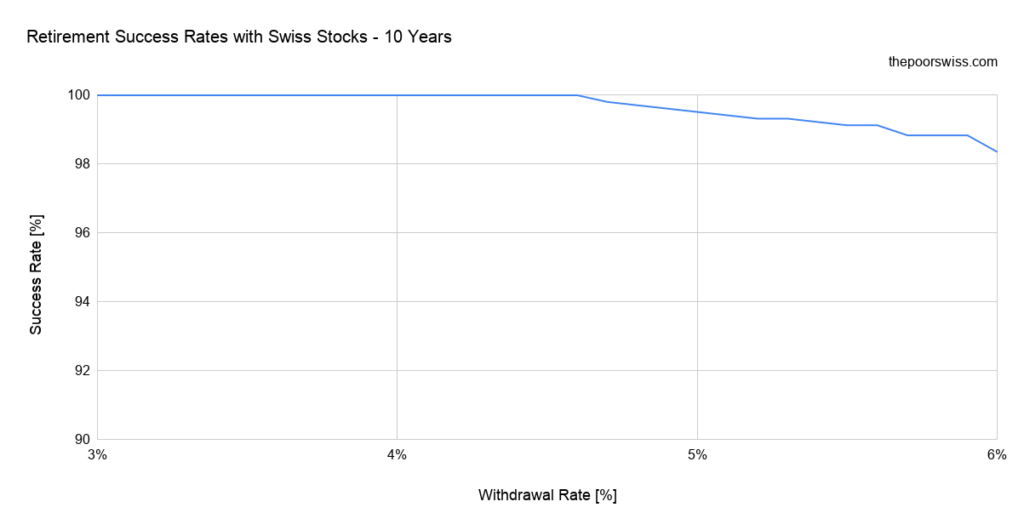

Retirement of 10 Years

Let’s start to see if Swiss Stocks can hold for ten years with different withdrawal rates.

As expected, with a ten years time frame, it is almost impossible to fail. Almost everything portfolio will sustain this.

But it is interesting to note that with a 5% withdrawal rate, it is already possible to fail. It is unexpected. Over ten years, a 5% withdrawal should withdraw a bit more than half of the value. It means there are periods where a Swiss portfolio would not even sustain ten years of retirement. It is not the case with U.S. Stocks.

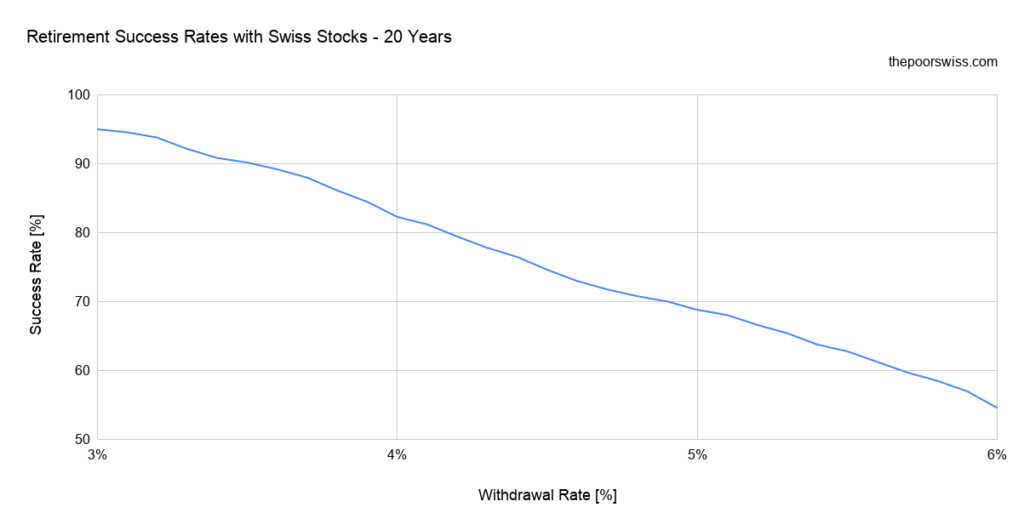

Retirement of 20 Years

Let’s see what happens with 20 years of retirement. It is already a good period to test the 4% rule. Without any returns and reasonable inflation, this would already withdraw the entire portfolio. So we already need some returns to sustain 20 years.

This time, the results are not nearly as good as I expected. A 4% withdrawal rate only gives you 82% chances of success for 20 years! If you want more than a 90% chance of success, you will have to use a 3.5% withdrawal rate.

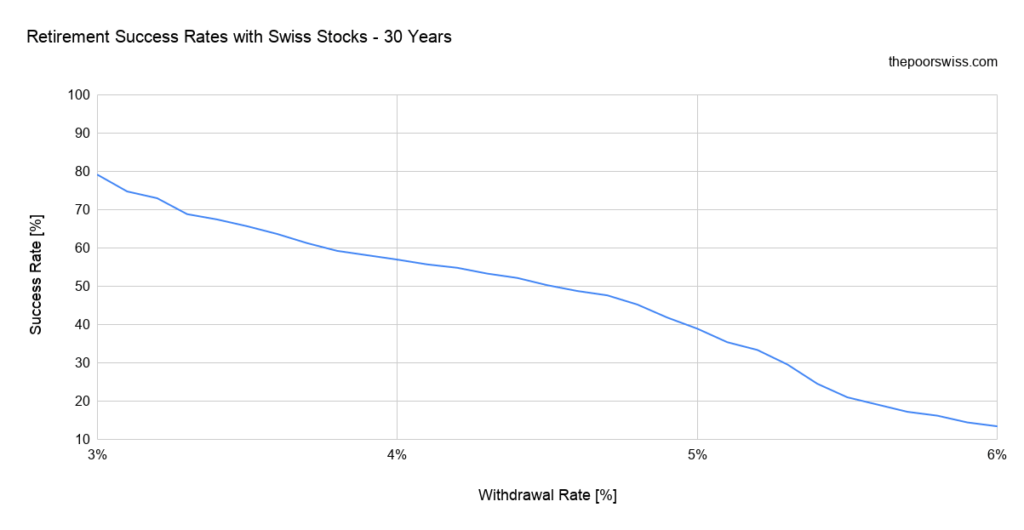

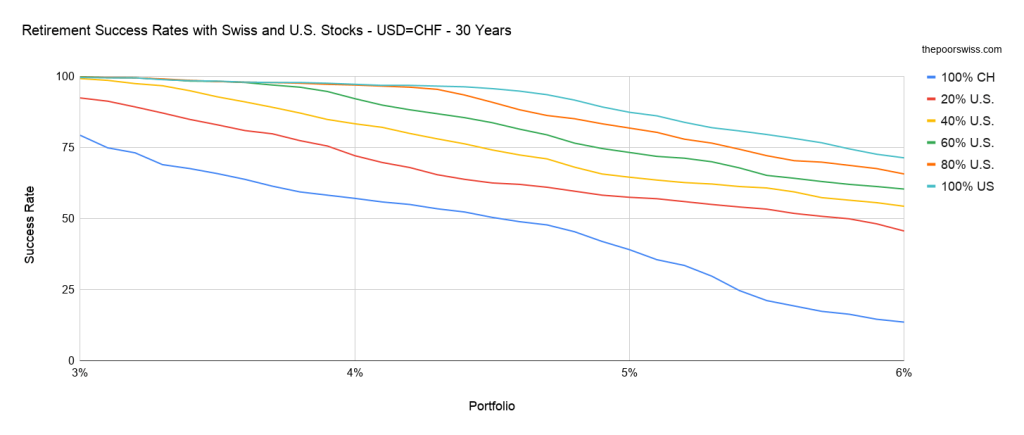

Retirement of 30 Years

So far, this is worse than I expected. But let’s see what happens with 30 years.

Sustaining a 30 years retirement with Swiss stocks is difficult. A 3% withdrawal rate would only give you an 80% chance of success. With the standard 4% rule, you will already be lower than 60%. You have just a little more chance of success than flipping a coin.

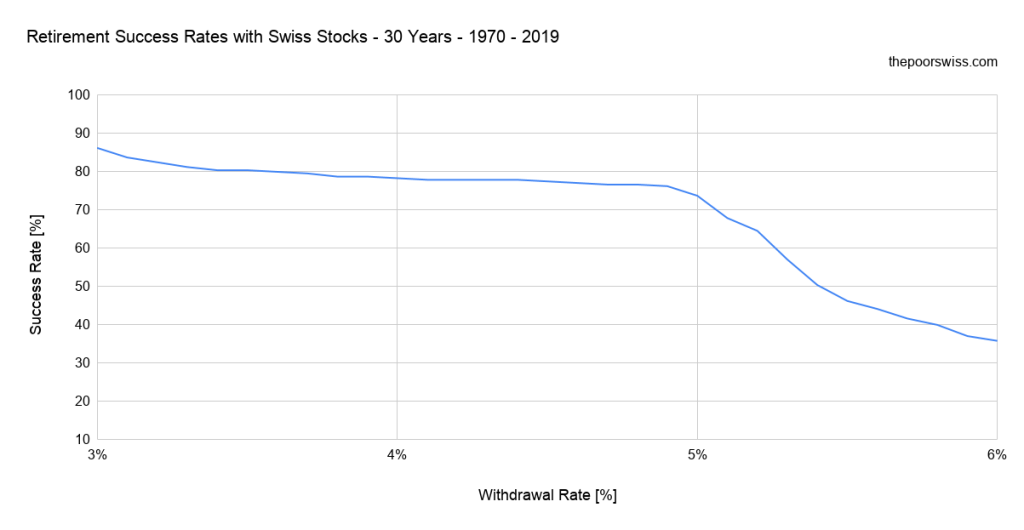

Swiss Stocks in recent years

There is one good thing with Swiss stocks. They have been performing significantly better in recent years.

For instance, here are the results for 30 years of retirement if we only take the last 50 years into account.

This data is already looking much better. And it looks even better in the last 40 years. But this is starting to be too short for any simulation. It is still good to know that Swiss Stocks are not fairing too badly in recent years.

Swiss Stocks and the 5% Rule

We can already draw the first conclusion for Swiss Stocks: They do not generate enough returns on their own to sustain a long retirement. You would have to get a very low withdrawal rate for this to work. And this means you would have to accumulate a substantial amount of money.

The second interesting fact we can get from this data is that the Swiss Stocks did much better in recent years than before. They have been pretty flat until 1950. After that, they have seen good results. In recent years, they have done pretty well. And they are generally not as volatile as U.S. Stocks.

Diversifying our Swiss Stocks Portfolio

Generally, people should not invest only in Swiss Stocks. It makes sense for Americans to invest only in U.S. Stocks. They represent half of the world’s stock market.

But Switzerland represents about 3% of the world’s stock market. So, people in Switzerland should diversify their investment. Ideally, this would be with a World ETF. Since I do not have the data for the world stock, we are going to do it with U.S. Stocks.

Instead of using only Swiss Stocks, we are going to see different allocations of Swiss Stocks and U.S. Stocks.

But this means we have one more thing to take into account: currency exchanges! In that case, we need to scale the value of the U.S. Stocks to CHF based on the exchange rate. I was able able to find historical data for the USD/CHF exchange rate for this simulation.

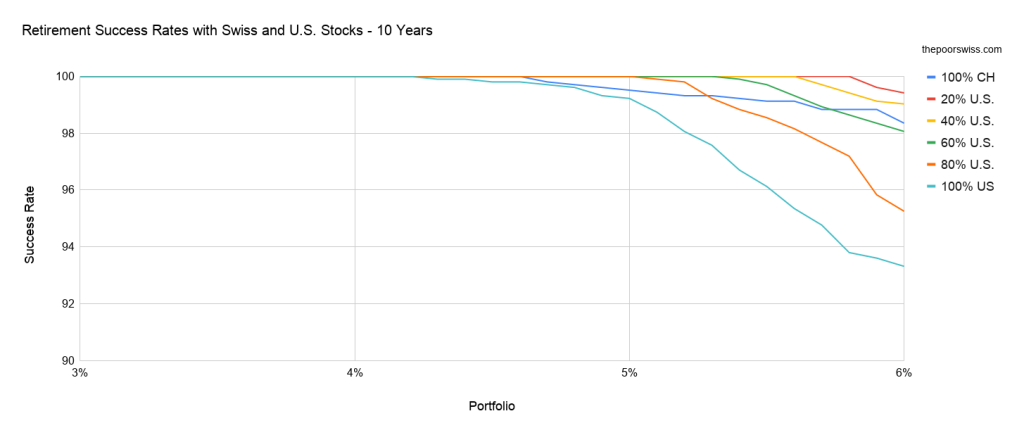

Retirement of 10 Years

Let’s start again with ten years of retirement.

Adding some U.S. Stocks improves our chances of success. But adding too much decreases them. This situation is something I did not expect!

The 100% U.S. Stocks portfolio is the worst performing portfolio. I would have expected it to be the best. It seems that exchange rates are not as good for our portfolio.

But this is a very short period. We need to see what happens with more extended periods.

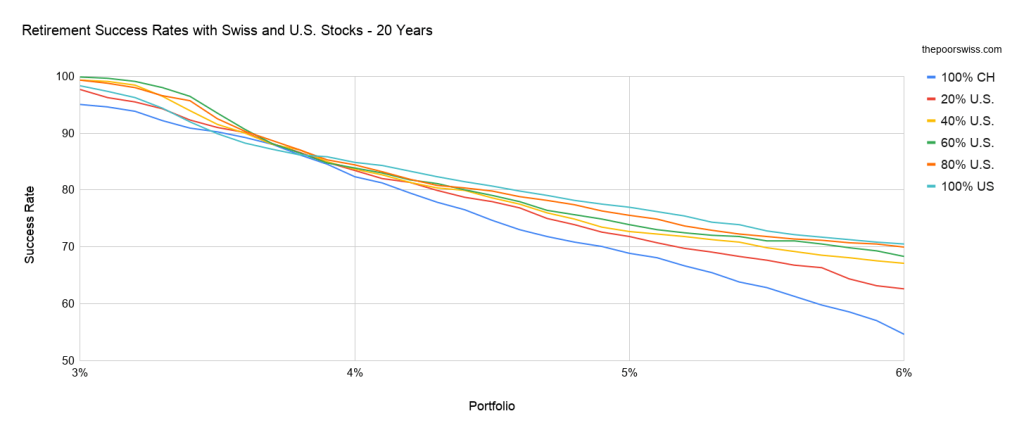

Retirement of 20 Years

So, let’s check what happens with 20 years of retirement.

For a high withdrawal rate, there is a significant improvement by adding some U.S. Stocks. However, for low withdrawal rates, it is not that significant, unfortunately.

Even with 100% U.S. Stocks, the chance of success for 20 years is only 84%. These results are not too bad but not too great either. And this is only 20 years. In practice, we would want to last longer than that. So what is the issue?

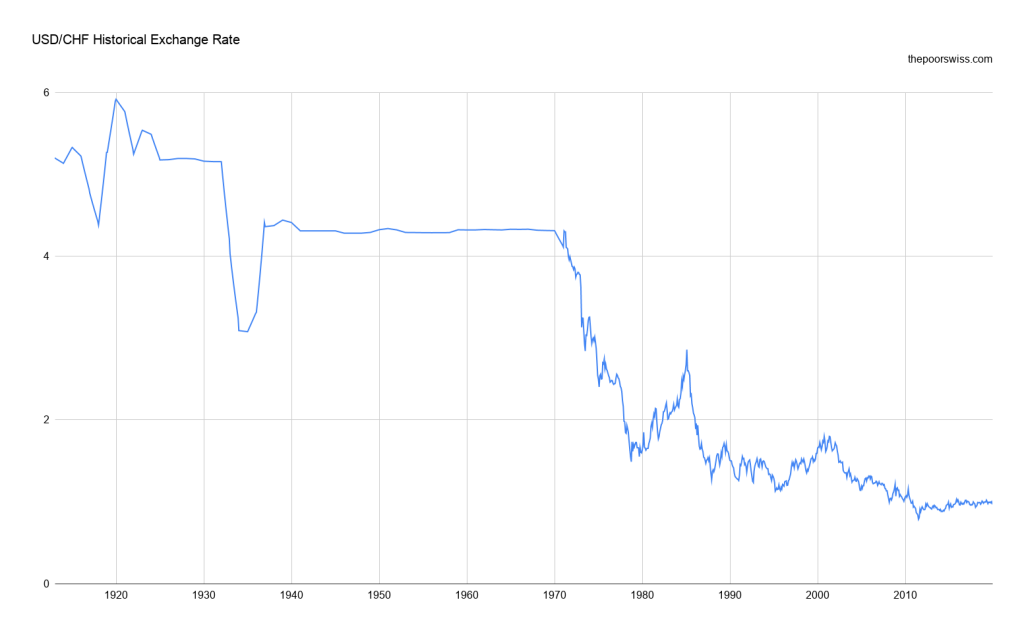

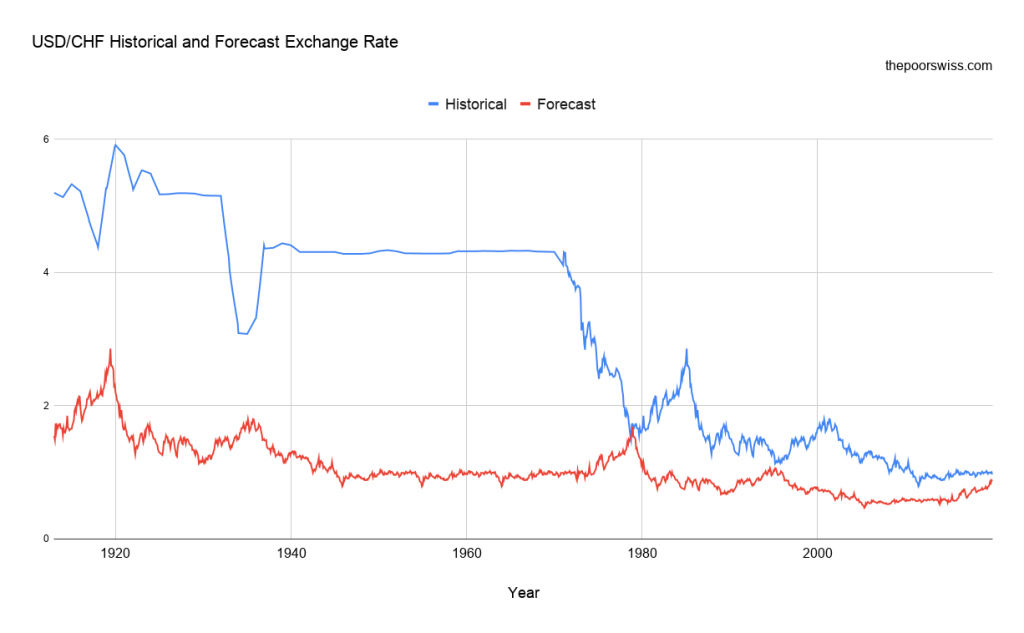

USD / CHF Exchange Rate

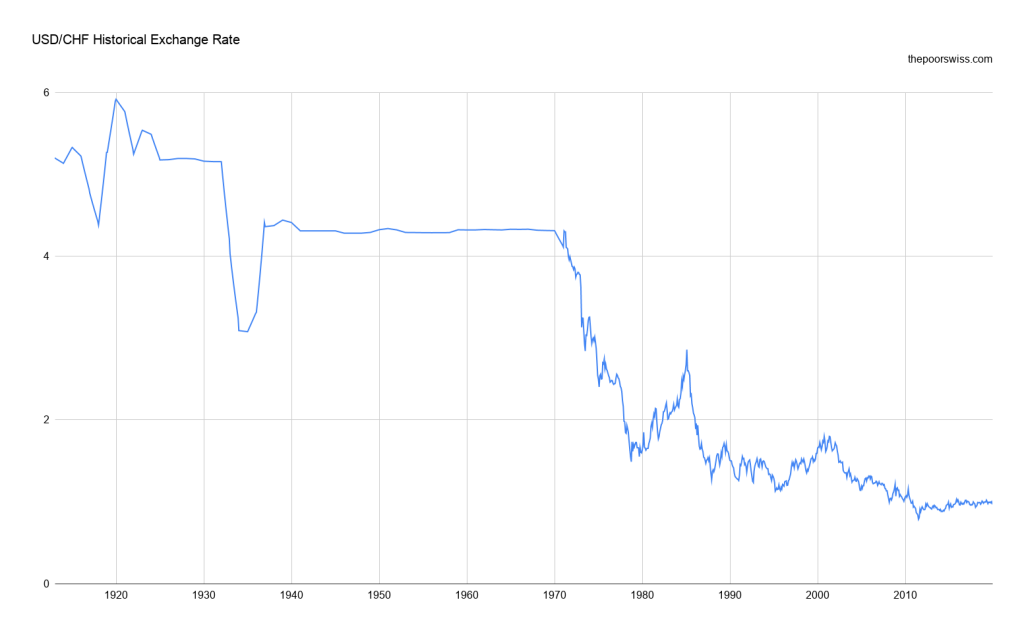

To understand the problem, we have to take a look at the USD / CHF Exchange rate historical data.

I do not know about you, but the first time I saw this graph, I was shocked. The data before 1980 is just weird. But it makes sense. To explain some of the big moves, we need to read about U.S. dollar history.

First of all, since 1900, the United States dollar was convertible to gold. It is called the Gold Standard. It is important to know to understand this graph.

The first significant drop was at the beginning of the first world war in 1914. When the United States enter the war, the value of the dollar starts to recover. And after the war, it goes very high since the economy rose very quickly as well.

Then, we have an almost flat graph until 1933. At this time, Franklin Roosevelt changed the gold standard. The value of a dollar was changed from 1.505 grams of gold to 0.888 grams of gold. This change explained the massive drop in the graph in 1933.

After this, we can see a very flat line. It is mostly due to the Gold Standard and a little to the Bretton Woods system. When the Bretton Woods system was abandoned in 1970, we can see a small decline. But the colossal fall only started after Richard Nixon abandoned the Gold Standard in 1971. This action halved the value of the dollar in less than eight years.

So, why am I talking about these details? Because I think that the data is not representative of the future. We will never see a new gold standard or a new Bretton Woods system. And we will not see huge drops as it was the case before.

So now, we have to do something bad: predict the future! In the last ten years, the dollar has been mostly stable. And in the past 30 years, it has been mostly going down. However, I do not think the value of the dollar will be cut in five ever again. The United States has a strong economy and will remain strong for many years.

I see two ways of estimating a better dollar forecast:

- Ignoring the exchange rate by setting the same value to the dollar and the Swiss franc.

- Cutting the early crazy years and replicating the latter more reasonable years.

We are going to do both now. Keep in mind that the future may hold something entirely different for the dollar and the Swiss franc. I have no way of knowing better! And nobody knows better!

Ignoring the USD/CHF exchange rate

We have seen that if the exchange rate repeats its history, it will not be good for Swiss investors. Let’s start by seeing what happens when we ignore the exchange rate of USD/CHF. It means we set all the exchange rates to one.

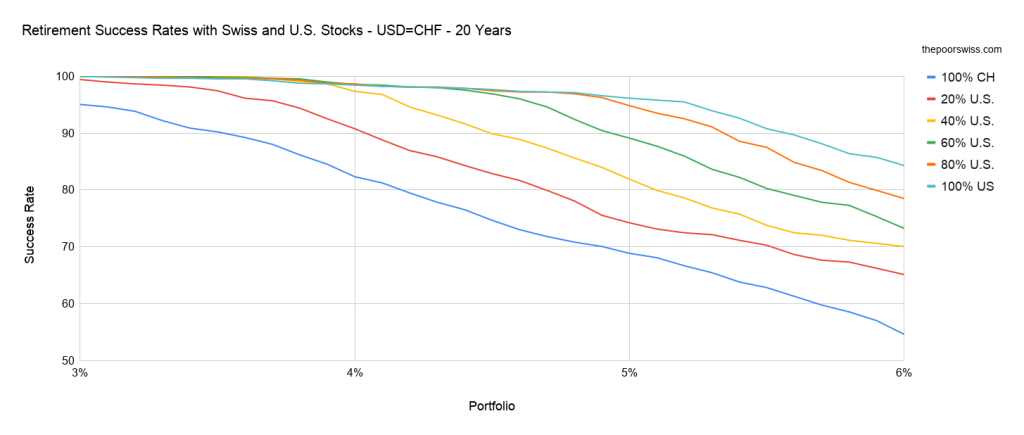

Retirement of 20 Years

Let’s start directly for a retirement of 20 years.

This graph is already much better! If we ignore the exchange rate, adding U.S. Stocks dramatically improves our chances of success. It is logical since they have historically had much better returns. Adding 40% of U.S. Stocks already makes a big difference.

Let’s see what happens when we take a more extended period.

Retirement of 30 Years

Let’s see what happens for 30 years.

We can see that for 30 years, U.S. Stocks are necessary. To get a chance of success higher than 90% with a 4% withdrawal rate, 60% of U.S. Stocks are necessary. Swiss stocks cannot sustain a high withdrawal rate.

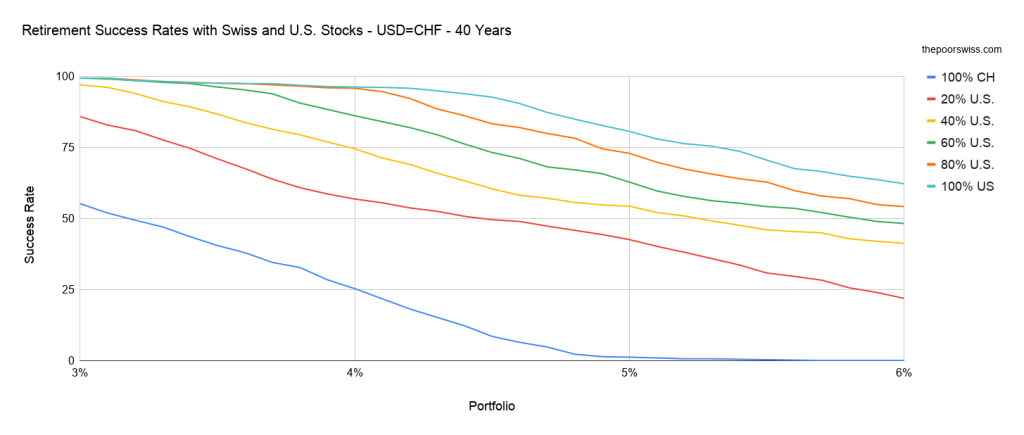

Retirement of 40 Years

What if we want our money to last for 40 years?

For 40 years, even with 60% of U.S. Stocks, it is starting to look dangerous at an 86% chance of success. It would still be fine with a 3.5% withdrawal rate. It is interesting that for a 4% withdrawal rate, both 20% and 0% Swiss Stocks are at almost the same performance. However, for larger withdrawal rates, the 100% U.S. Stocks dominate more clearly.

Forecasting the USD/CHF

Setting the exchange rate to 1 CHF = 1 USD is not too bad for the short-term. But it is not great at all for the long-term. So I propose we do a small forecast based on actual returns.

Here are the forecasted estimations for the USD/CHF exchange rate:

In blue is the actual exchange rate, while in red is the forecast I am making. The beginning of the curve is the actual data from 1978 to 2020, following by the data from 2009 to 2020. Finally, the rest is using the monthly returns from 1978 to 2020 to complete the data.

It is not perfect at all. And it will not turn out to be like this. But I believe that this is a much better representation of what the dollar will become in the future.

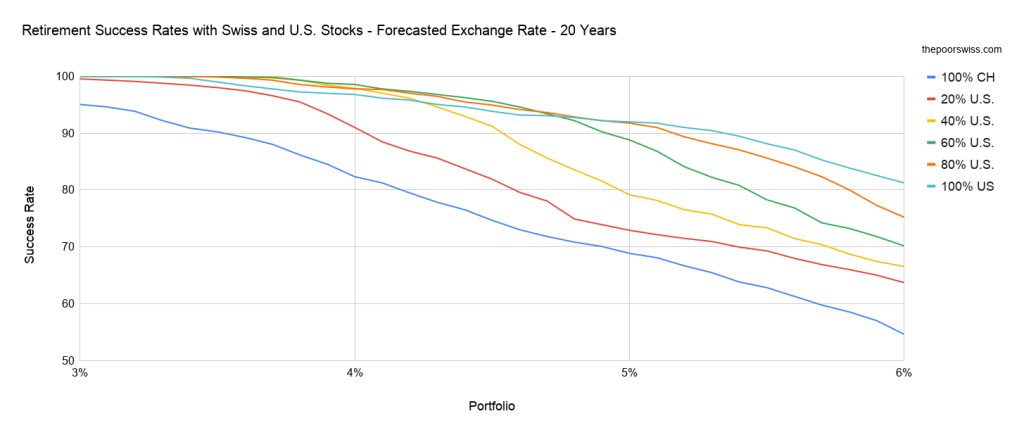

Retirement of 20 Years

Let’s see what would happen with our imaginary forecasted exchange rate.

Now, the results are more interesting! We can see that there is not a clear separation with each increase in the U.S. allocation. As we expect, a too-large allocation to Swiss Stocks does not have much chance of succeeding.

But even 20% of U.S. stocks can give you an increased chance of success, going up to a 90% chance of success with a 4% withdrawal rate. The most interesting is that the best chances are not with the 100% U.S. but with the 60% U.S. stocks. Starting at a 5% withdrawal rate, the 100% U.S. Stocks dominate, but this is too high of a withdrawal rate for most people.

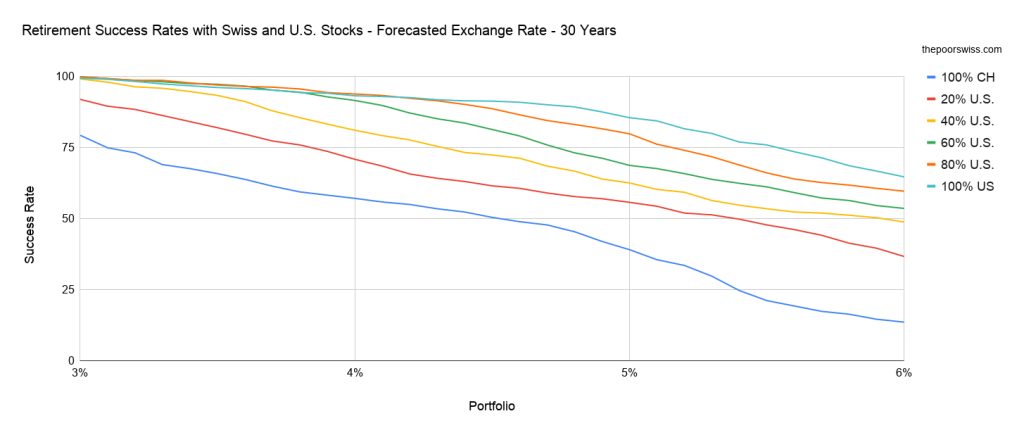

Retirement of 30 years

Let’s see if we can observe the same trend with 30 years of retirement.

We can observe the same behavior here as before. For a long period, you will need at least 60% of U.S. Stocks in your portfolio. It seems that keeping some Swiss Stocks will still help your chances of success with a reasonable withdrawal rate. But this is not by a large margin.

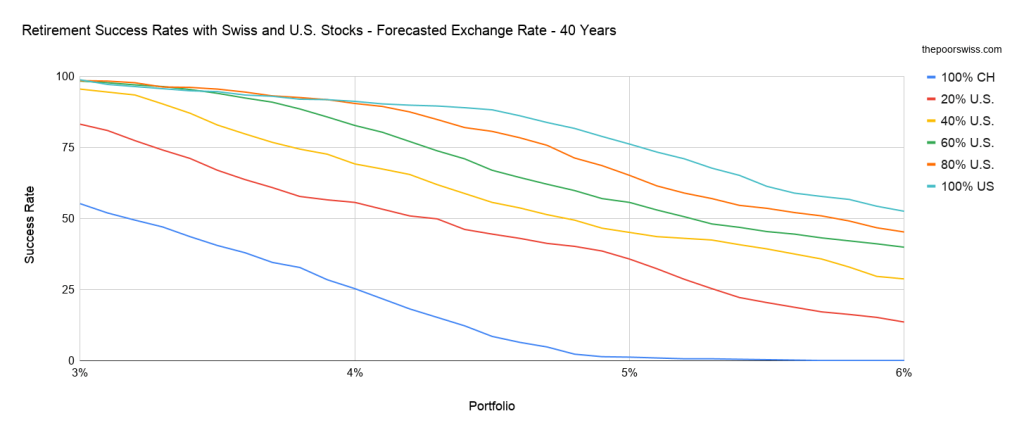

Retirement of 40 years

Finally, let’s see what happens if retirement lasts for 40 years.

This time, the performance with 20% Swiss Stocks and 100% U.S. Stocks is almost the same except for high withdrawal rates. But we can now see a very low performance for even 40% U.S. Stocks. If you have 60% U.S. Stocks, you will need a lower withdrawal rate to sustain.

Exchange rate conclusion

We can see that exchange rates have a strong impact on the returns. Historically, the exchange rates for USD and CHF has been quite crazy. I do not think we have to worry too much about it being too crazy. However, I think we still have to consider it.

I think 20% of Swiss Stocks is a reasonable allocation to have some hedge against bad exchange rates. People using a low withdrawal rate could even consider having 40% in Swiss Stocks to hedge against exchange rate fluctuations.

The Data for Switzerland

If you want more details about the simulation, I detail the technique on my post about my FIRE calculator based on my tool and data. The source code is also available!

Swiss Stocks

For Swiss Stock values, I have gotten historical data from the HSSO. Since this data only last until 1995, I have completed it with SMI data from 1988 to 2020.

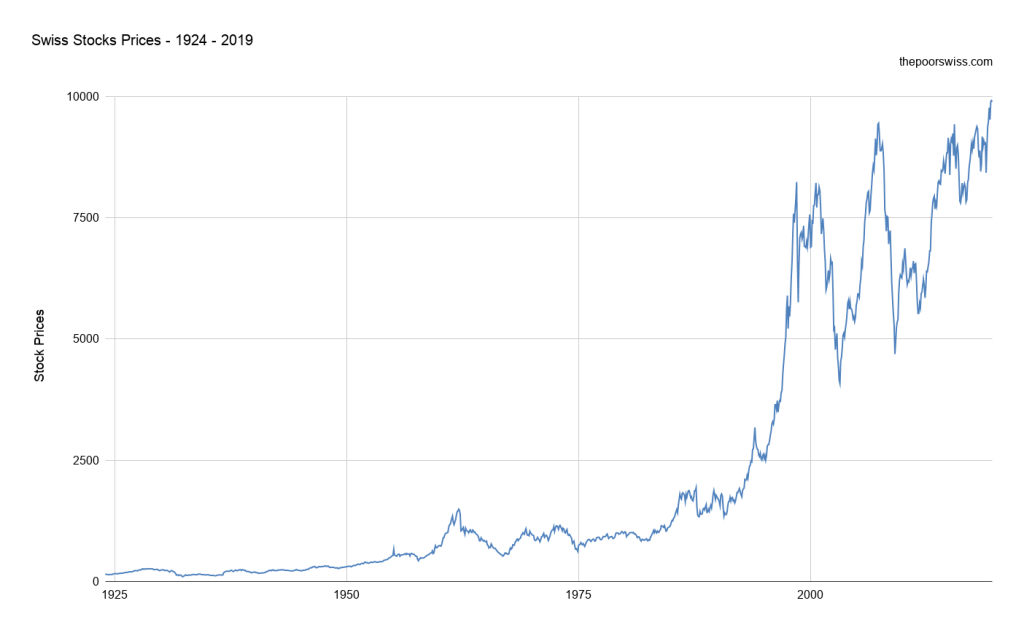

Here is how the Swiss Stocks have looked historically:

As we can see, it has not been a smooth ride for Swiss stocks. Until 1980, they have been stable and returned little. After that, they started returning much more. But they have also been more volatile. They have begun looking quite similar to U.S. stocks but with a smaller magnitude.

Historical Inflation in Switzerland

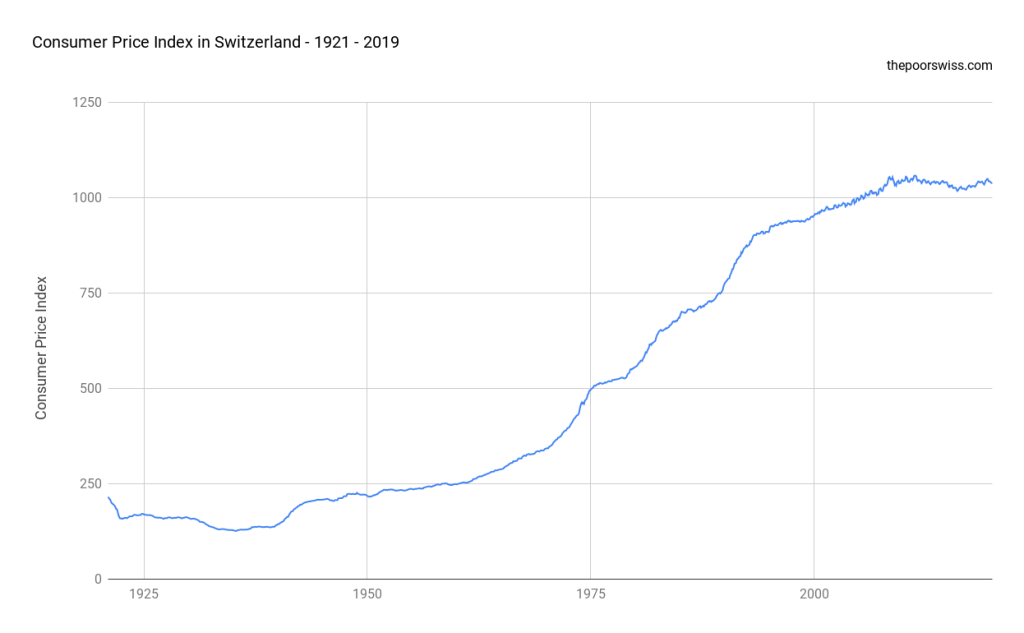

For this simulation, I have gotten historical inflation data from the official statistics office. Since the index has changed several times in history, I have taken 1924 as the reference and computed the prices from each period based on the previous period.

Here is how prices in Switzerland look like in the last 100 years or so.

The last ten years have been mostly flat. Before that, inflation was much stronger. But inflation in Switzerland has always been more reasonable than in some countries.

USD/CHF Exchange Rate

I have found two sources for the historical data of the USD/CHF exchange rate. First, I have found yearly data from 1924 to 2018. I completed this with monthly data from 1971 to 2019.

We have already looked at the graph for U.S. Exchange Rate:

You can read the previous section about the USD/CHF exchange rate if you want to learn what happened to this exchange rate.

Conclusion

From this analysis, we have learned many interesting things about Swiss Stocks and retirement in Switzerland.

First of all, by themselves, Swiss Stocks would not have been enough to sustain a portfolio for a long time. Their returns have been too low historically to sustain withdrawals. However, in the last 50 years of so, they have been doing better. This fact does not prove they will do any better in the long-term. But this still shows that they are going in the right direction for now.

Another thing we can learn is that the USD/CHF exchange rate in the last 100 years has been quite hectic. With changes in the gold standard, the Bretton Woods System, and the abandon of the gold standard came a lot of sharp drops and rises in the exchange rate.

This hectic exchange rate would diminish our chances of success in retiring early in Switzerland. Since the Swiss Stocks are not returning enough, we need some U.S. Stocks (or World stocks) to balance that. But then, we are exposed to currency risk.

I do not think this exchange rate is representative of the future. There is no such thing as the gold standard anymore. And I do not see a new Bretton Woods system coming back. Keep in mind that I am just making guesses.

If we consider a less volatile exchange rate, we can hope to sustain our withdrawal for 40 years. With a 4% withdrawal rate, we would need at least 80% U.S Stocks. And with a 3.5% withdrawal rate, we would need a least 60%.

After doing this simulation, I am going to stick with my current plan. I will keep 20% of Swiss Stocks in my portfolio. And I will keep a withdrawal rate of about 3.75% or lower. I will maybe consider adding 5% extra Swiss Stocks in my portfolio for hedging against the currency risk. But more than that does not seem necessary.

What do you think of these results?