Buying has become much more expensive than renting in Switzerland, according to a report by the bank Credit Suisse. Photo by Curtis Adams on Pexels.comThe market for owner-occupied homes is currently undergoing a reversal of fortunes, triggered by the spike in mortgage interest rates in 2022, said the bank. Although owners enjoyed unprecedented low mortgage rates for a decade, rates have more than doubled over the past year. After 13 years, buying is more expensive than renting again. In aggregate the annual financial cost of owning a residential property is now 47% higher than renting a comparable apartment. This difference, expressed as an ownership premium, is shown by the gap between the dotted blue and dotted yellow lines in the chart below. The chart also shows how most of

Topics:

Investec considers the following as important: Editor's Choice, Personal finance, Property

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

Buying has become much more expensive than renting in Switzerland, according to a report by the bank Credit Suisse.

The market for owner-occupied homes is currently undergoing a reversal of fortunes, triggered by the spike in mortgage interest rates in 2022, said the bank. Although owners enjoyed unprecedented low mortgage rates for a decade, rates have more than doubled over the past year.

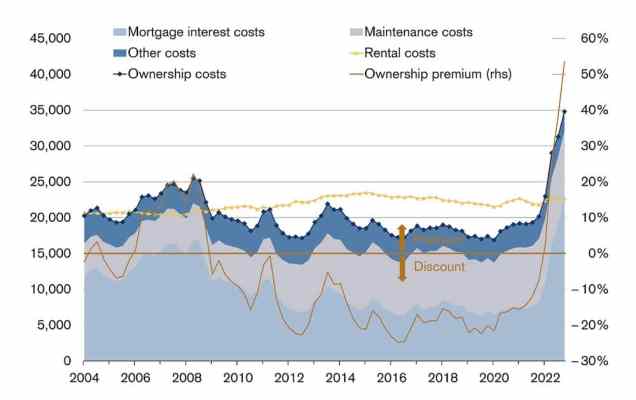

After 13 years, buying is more expensive than renting again. In aggregate the annual financial cost of owning a residential property is now 47% higher than renting a comparable apartment. This difference, expressed as an ownership premium, is shown by the gap between the dotted blue and dotted yellow lines in the chart below. The chart also shows how most of the recent premium is driven by higher mortgage interest costs, represented by the shaded light blue area.

As a result, buyer demand for residential property has taken a hit. However, it has by no means disappeared altogether, said Credit Suisse. After a boom triggered by the Covid-19 pandemic, demand has returned to its lower long-term average.

And while residential property has become significantly more expensive for new buyers, in many cases existing owners who took out long-term fixed rate mortgages continue to benefit from low ownership costs.

Over time the cost gap between renting and owning may close, predicts the bank as a construction slump, driven by rising costs and higher interest, reduces the supply of new rental properties, particularly if this is combined with a robust economy and rising net migration.

More on this:

Credit Suisse article (in French) – Take a 5 minute French test now

For more stories like this on Switzerland follow us on Facebook and Twitter.