On 16 June 2022, the Swiss National Bank (SNB) surprised markets with a 50 basis point rise to its policy rate. The move marks the first time Switzerland’s central bank has raised rates since 2007. SNB Governing Board – Fritz Zurbruegg, Thomas Jordan, Andréa Maechle – © Schweizerische NationalbankAimed at taming inflation, the announcement led to a 2% jump in value of the Swiss franc against the Euro to 1.02 CHF to EUR in morning trading with technicals pointing towards further strengthening. If the recent currency appreciation is durable it could shave 2% of the price of imports, which would tame imported inflation. The SNB’s policy rate will move from -0.75% to -0.25% on 17 June 2022. Inflation reached 2.9% in May and is likely to remain at an elevated level for the time being,

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice, Personal finance, Swiss interest rates

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

On 16 June 2022, the Swiss National Bank (SNB) surprised markets with a 50 basis point rise to its policy rate. The move marks the first time Switzerland’s central bank has raised rates since 2007.

Aimed at taming inflation, the announcement led to a 2% jump in value of the Swiss franc against the Euro to 1.02 CHF to EUR in morning trading with technicals pointing towards further strengthening. If the recent currency appreciation is durable it could shave 2% of the price of imports, which would tame imported inflation.

The SNB’s policy rate will move from -0.75% to -0.25% on 17 June 2022.

Inflation reached 2.9% in May and is likely to remain at an elevated level for the time being, said the SNB. There is a risk that high inflation could become entrenched as a result of increased second-round effects, it said.

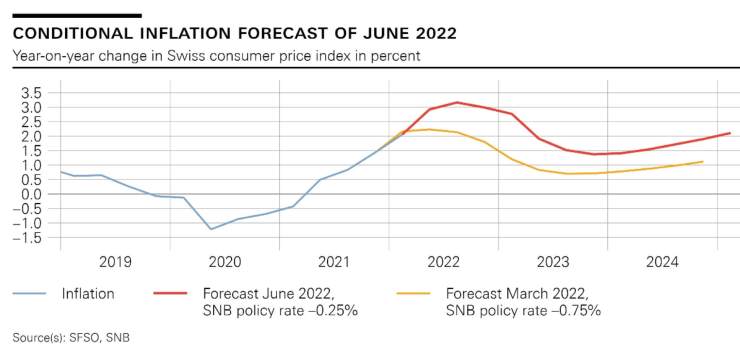

After the rate rise it now predicts inflation of 2.8% in 2022, 1.9% in 2023 and 1.6% in 2024. These percentages are higher than in March when the central bank predicted 2.1% in 2022, 0.9% in 2023 and 0.9% in 2024. Without today’s SNB policy rate increase, the inflation forecast would be significantly higher, said the central bank. The chart below shows Swiss inflation rising above 3% without a rate rise (red line).

The decision, which follows a 75 basis point hike in the US and precedes a 25 basis point rate rise by the ECB scheduled for July 2022 and an expected rate rise announcement by the Bank of England on Thursday afternoon, surprised markets. The franc gained 2% against the Euro within 10 minutes of the announcement.

The SNB, led by President Thomas Jordan, also said more tightening may be needed. In addition, the central bank made no mention, as it typically does, of the franc being highly valued. It cannot be ruled out that further increases in the SNB policy rate will be necessary in the foreseeable future to stabilize inflation, the SNB said. It also added that to ensure appropriate monetary conditions, it is also willing to be active in the foreign exchange market as necessary.

More on this:

SNB announcement (in English)

For more stories like this on Switzerland follow us on Facebook and Twitter.