On 4 March 2018, voters in Vaud will vote on a plan to provide basic universal dental care funded by a tax on salaries. The initiative entitled: Reimbursement of dental care, Pour le remboursement des soins dentaires in French, claims that 10% of the population avoid the dentist because of the cost. They also claim links between poor dental health and cancer, diabetes and premature births. Their plan envisages the creation of a network of polyclinics that would provide basic dental care, but not orthodontics, crowns or dental implants. Those opposed to it, which includes the canton’s association of dentists, claim the state of dental health in the canton is high and that the plan would exact a heavy cost on salary earners and taxpayers without covering many important dental treatments. In

Topics:

Investec considers the following as important: Editor's Choice, Personal finance, Politics, Swiss referenda, Vaud - vote on divisive dental tax and care plan

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

On 4 March 2018, voters in Vaud will vote on a plan to provide basic universal dental care funded by a tax on salaries.

The initiative entitled: Reimbursement of dental care, Pour le remboursement des soins dentaires in French, claims that 10% of the population avoid the dentist because of the cost. They also claim links between poor dental health and cancer, diabetes and premature births. Their plan envisages the creation of a network of polyclinics that would provide basic dental care, but not orthodontics, crowns or dental implants.

Those opposed to it, which includes the canton’s association of dentists, claim the state of dental health in the canton is high and that the plan would exact a heavy cost on salary earners and taxpayers without covering many important dental treatments.

In addition, they object to the way it would be funded, seeing it as a tax that penalizes those who work in favour of those who don’t – the 1% charge would come from base salary in the same way as other social taxes, such as AVS.

Proponents say the plan will only cost workers 0.5% of their salary. This is a fudge say opponents. Employers will be required to chip in another 0.5%, bringing the total to 1%. Given employers must consider the all-in cost of employees, this extra 0.5% will effectively come out of any future pay increases, an invisible cost ultimately borne by the worker.

Based on Federal Statistical Office data, an average Swiss household would need to be spending around CHF 1,200 a year on basic dental care, excluding orthodontics, crowns or dental implants, to be better off under the plan, when the full 1% is included1.

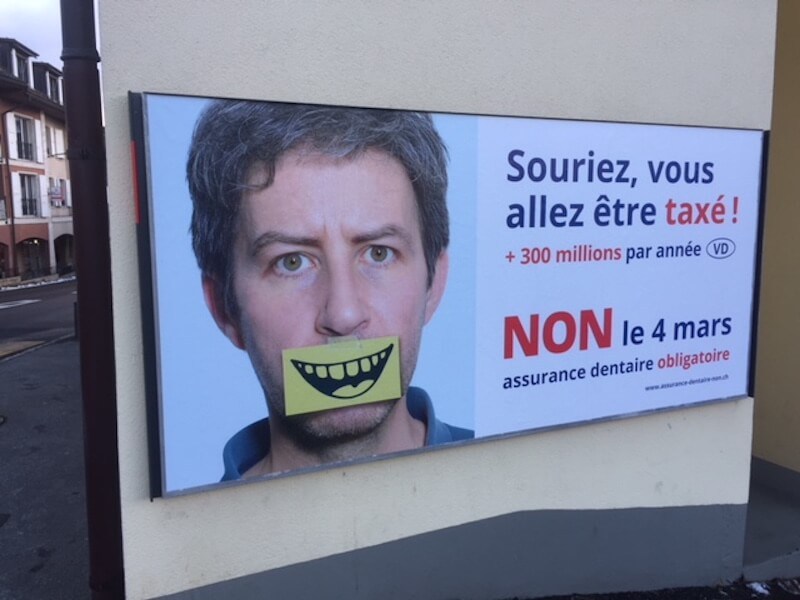

The proposal, similar to a system in place in France, is estimated to cost CHF 300 million per year by opponents – CHF 200 million from salaries and a further CHF 100 million out of the central tax pot.

Not everyone is smiling.

More on this:

1 Assumes a mean annual household income of CHF 119,352 and an average Swiss household comprised of 2.17 people. It also assumes all income is salary and that there no rise in overall income tax – Federal Statistical Office figures (in French) – Take a 5 minute French test now

For more stories like this on Switzerland follow us on Facebook and Twitter.