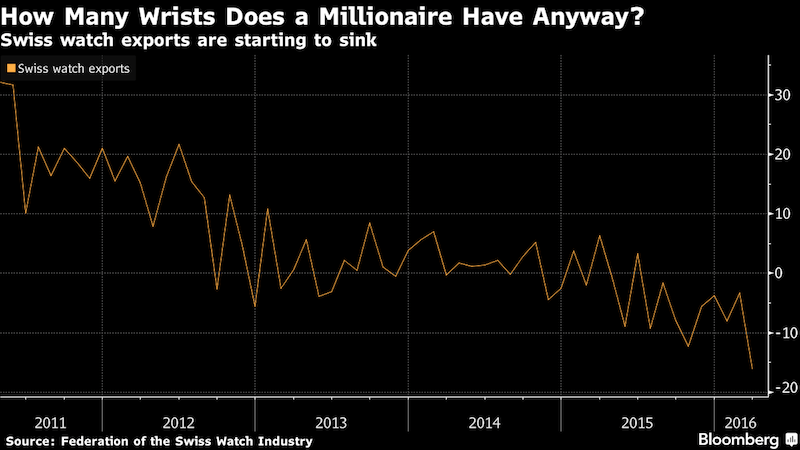

Brought to you by Investec Switzerland. Swiss watch exports posted the biggest quarterly drop since 2009 as the industry faces declining demand across all its main markets. © Ateliermadman | Dreamstime.com Shipments fell 8.9 percent in the first quarter, adjusted for working days, according to data from Switzerland’s customs office. Exports declined 16 percent in March to 1.5 billion francs (.5 billion), the lowest level for that month in five years, the Federation of the Swiss Watch Industry said in a separate statement. The falloff was broad-based, reaching 38 percent in Hong Kong, 33 percent in the U.S. and 14 percent in China. “What’s most surprising is that almost all top markets are in the red,” said Zuzanna Pusz, an analyst at Berenberg in London. “Even if you adjust for the tough comparison base, it’s a really big drop. And what’s most worrying is that there’s no clear outperformance elsewhere, no shift to another region to partially make up for what’s lost in Asia.” Source: Bloomberg A boom in recent years in demand for Rolex, Omega and Cartier timepieces has turned to bust as Swiss watchmakers confront a laundry list of challenges. That’s led to job-cut negotiations at Cartier, Vacheron Constantin and Piaget.

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice, Swiss watch exports

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

Swiss watch exports posted the biggest quarterly drop since 2009 as the industry faces declining demand across all its main markets.

© Ateliermadman | Dreamstime.com

Shipments fell 8.9 percent in the first quarter, adjusted for working days, according to data from Switzerland’s customs office. Exports declined 16 percent in March to 1.5 billion francs ($1.5 billion), the lowest level for that month in five years, the Federation of the Swiss Watch Industry said in a separate statement. The falloff was broad-based, reaching 38 percent in Hong Kong, 33 percent in the U.S. and 14 percent in China.

“What’s most surprising is that almost all top markets are in the red,” said Zuzanna Pusz, an analyst at Berenberg in London. “Even if you adjust for the tough comparison base, it’s a really big drop. And what’s most worrying is that there’s no clear outperformance elsewhere, no shift to another region to partially make up for what’s lost in Asia.”

Source: Bloomberg

A boom in recent years in demand for Rolex, Omega and Cartier timepieces has turned to bust as Swiss watchmakers confront a laundry list of challenges. That’s led to job-cut negotiations at Cartier, Vacheron Constantin and Piaget. It’s also prompted some brands to reshuffle management: Parmigiani Fleurier’s interim chief executive officer resigned last month just five months after he replaced outgoing Jean-Marc Jacot.

Shares Fall

The export figures contrast with Swatch Group AG Chief Executive Officer Nick Hayek’s comment in an interview with Le Temps earlier this month that the industry is healthy. He was quoted in the newspaper saying the Swiss franc is completely overvalued, causing terrible damage in Switzerland. Hayek has said he wants to avoid job cuts in the downturn.

Shares of Swatch, which makes Omega and Longines watches, fell as much as 2.5 percent. Richemont, the owner of Cartier, dropped as much as 1.9 percent, and LVMH, whose brands include TAG Heuer, declined as much as 1.1 percent.

“It’s not a good number,” said John Guy, an analyst at MainFirst Bank in London. “But we also had no great expectations going into the March exports. We do expect April to improve, and if that remains soft, it will mean trends are weaker than we expect.”

By Corinne Gretler (Bloomberg)

For more stories like this on Switzerland follow us on Facebook and Twitter.