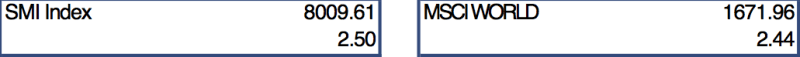

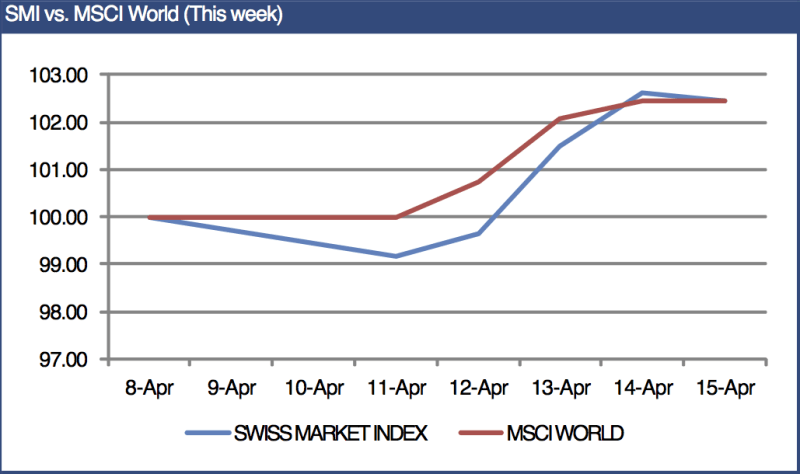

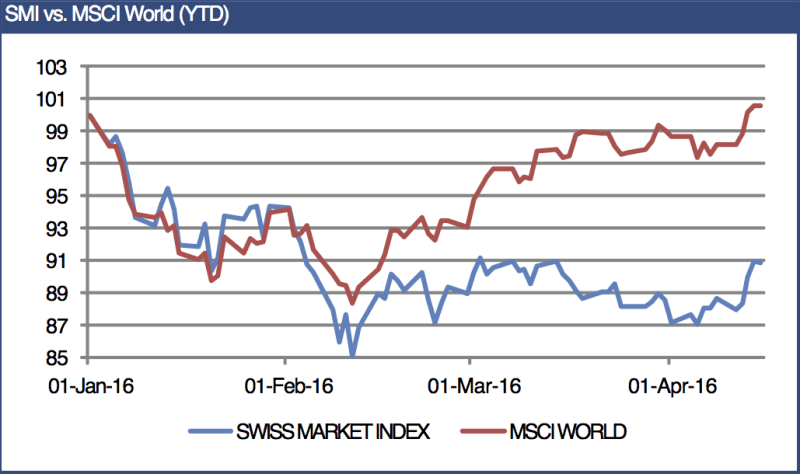

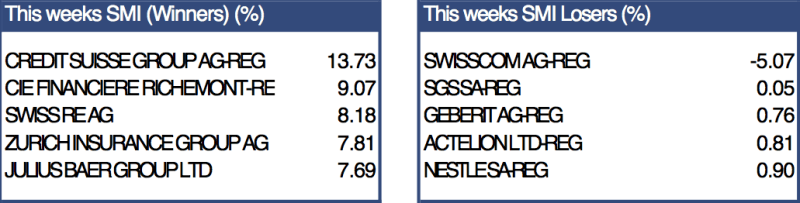

Investec Switzerland. The SMI is set to finish this week more than 2% higher, showing modest outperformance against global equity markets as cyclical companies from banks to luxury goods surged on improving investor sentiment. European shares experienced their longest winning streak since early March this week buoyed by a strong performance from the banking sector and signs that China’s economy is finally stabilizing. © Rad100 | Dreamstime.com Global banking stocks rallied this week on an announcement of support for Italy’s struggling financial sector and better than expected earnings releases from JPMorgan Chase. Italian officials and financial firms said this week that they had agreed to create a multibillion-euro fund to help tackle the country’s estimated 360 billion euros of bad loans which have undermined Italy’s attempt to recover from recession. In the US, JPMorgan was the first U.S. bank to report quarterly results for what is generally seen as the banking industry’s worst start to a new year since the 2008 financial crisis. The banks’ earnings and revenue beat analysts’ lowered estimates and helped lift sentiment towards the banking sector in general.

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice, Investec Switzerland

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

The SMI is set to finish this week more than 2% higher, showing modest outperformance against global equity markets as cyclical companies from banks to luxury goods surged on improving investor sentiment. European shares experienced their longest winning streak since early March this week buoyed by a strong performance from the banking sector and signs that China’s economy is finally stabilizing.

© Rad100 | Dreamstime.com

Global banking stocks rallied this week on an announcement of support for Italy’s struggling financial sector and better than expected earnings releases from JPMorgan Chase. Italian officials and financial firms said this week that they had agreed to create a multibillion-euro fund to help tackle the country’s estimated 360 billion euros of bad loans which have undermined Italy’s attempt to recover from recession. In the US, JPMorgan was the first U.S. bank to report quarterly results for what is generally seen as the banking industry’s worst start to a new year since the 2008 financial crisis. The banks’ earnings and revenue beat analysts’ lowered estimates and helped lift sentiment towards the banking sector in general.

Positive news from China this week also helped boost stocks after the International Monetary Fund (IMF) said in a quarterly update of its World Economic Outlook that it expects China to increase growth forecasts by 0.2% this year. The fund said that signs of “resilient domestic demand” appeared to be offsetting weakness in the manufacturing sector. Trade data released this week also showed that China’s exports jumped the most in a year in March, adding further optimism that the economy is stabilizing. However, gains maybe fleeting after the Chinese government released its slowest quarterly economic growth figures in seven years on Friday. Although the 6.7% growth reported in the first quarter was in line with expectations, it confirms the ongoing slowing trend in the world’s second largest economy.

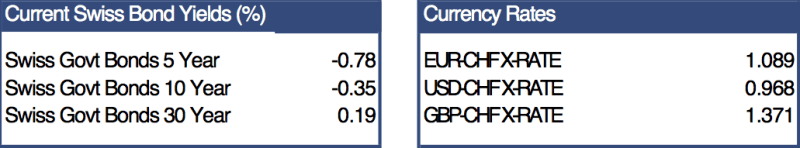

In Switzerland, SNB Governing Board member Andrea Maechler attempted to highlight potential risks with negative interest rates, stating that it is “not clear” how low rates could go. Maechler said however that while further SNB action was possible, any additional measures will be weighed carefully against its potential side effects. In economic data, the Swiss unemployment rate came in at 3.6% versus 3.7% in February which was in line with expectations. However, the jobless rate rose to a seasonally adjusted 3.5% up from 3.4% last month.

In company news, Nestle SA reported first-quarter sales that beat analysts’ estimates after coffee brands Nescafe and Nespresso boosted earnings. Nestle added that it expects “further momentum” in the second half of this year. According to reports from Bloomberg News this week, consumption of bottled water in the US is set to overtake that of soft drinks for the first time in history as health-conscious buyers shun soda. Nestle SA, the world’s biggest water bottler, may be set to benefit with brands such as Poland Spring and Perrier positioned to take advantage of growing demand.