Investec Switzerland. The Swiss Market Index is set to close lower this week underperforming global equities as US stocks reached new record highs and emerging markets outperformed on a weaker dollar. © Aleksandar Milosevic | Dreamstime.com The week began with some gloomy economic data after reports showed on Monday that Japan’s second quarter GDP growth slowed more than forecast to 0.2%, reflecting a drag on exports from a stronger JPY and a drop in business investment. In Europe, the final release of second-quarter GDP showed that growth halved to 0.3% and that a better-than-forecast expansion in Germany was offset by a surprise stagnation in Italy. Speculation that central banks will remain accommodative in response to the lackluster economic outlook bolstered market sentiment, supporting equity prices. On Wednesday, the Federal Reserve’s latest minutes were released and showed dampened prospects for a US interest-rate hike which was also a positive catalyst for investor confidence. The dollar weakened against all its major peers. Oil also made further gains this week as investors bet that talks between OPEC members and other producers may result in action to stabilise the market in the coming weeks. In Switzerland, the Credit Suisse ZEW indicator, which gauges analysts’ expectations for Switzerland’s economy for the coming six months, fell by 8.

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice, SMI, Swiss market, Swiss Shares

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

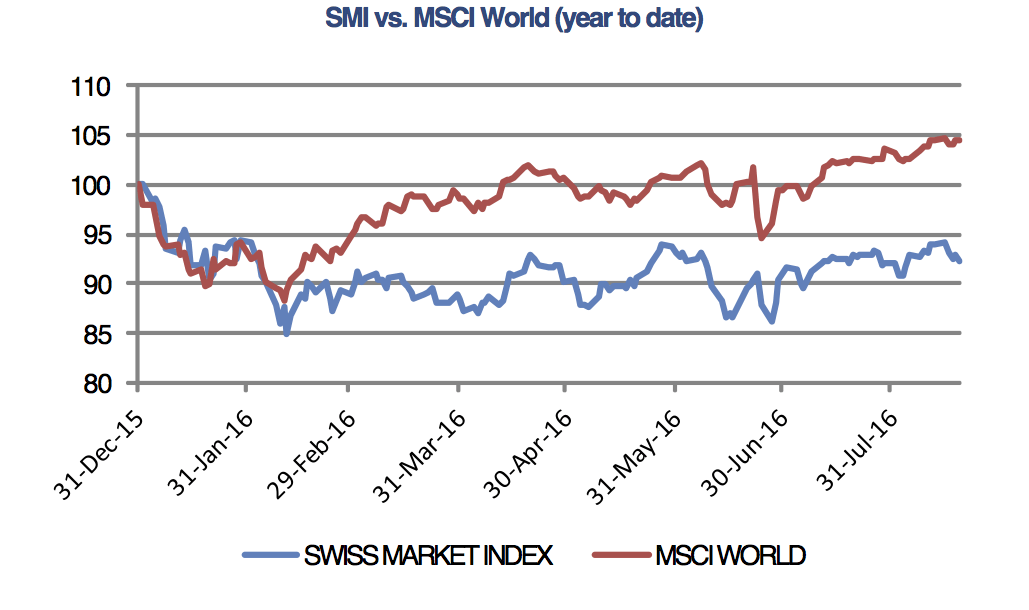

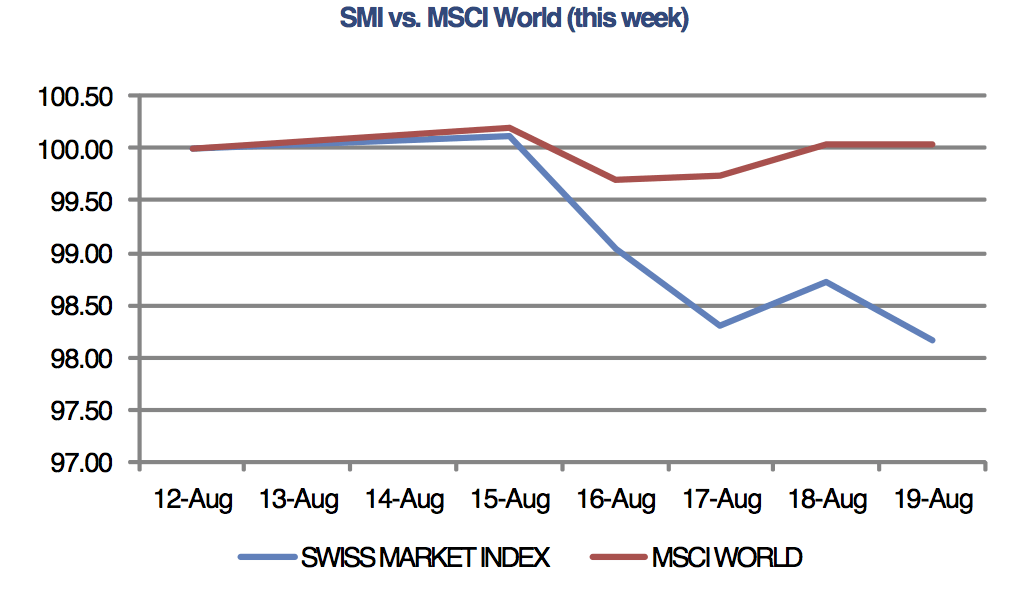

The Swiss Market Index is set to close lower this week underperforming global equities as US stocks reached new record highs and emerging markets outperformed on a weaker dollar.

© Aleksandar Milosevic | Dreamstime.com

The week began with some gloomy economic data after reports showed on Monday that Japan’s second quarter GDP growth slowed more than forecast to 0.2%, reflecting a drag on exports from a stronger JPY and a drop in business investment. In Europe, the final release of second-quarter GDP showed that growth halved to 0.3% and that a better-than-forecast expansion in Germany was offset by a surprise stagnation in Italy. Speculation that central banks will remain accommodative in response to the lackluster economic outlook bolstered market sentiment, supporting equity prices. On Wednesday, the Federal Reserve’s latest minutes were released and showed dampened prospects for a US interest-rate hike which was also a positive catalyst for investor confidence. The dollar weakened against all its major peers.

Oil also made further gains this week as investors bet that talks between OPEC members and other producers may result in action to stabilise the market in the coming weeks.

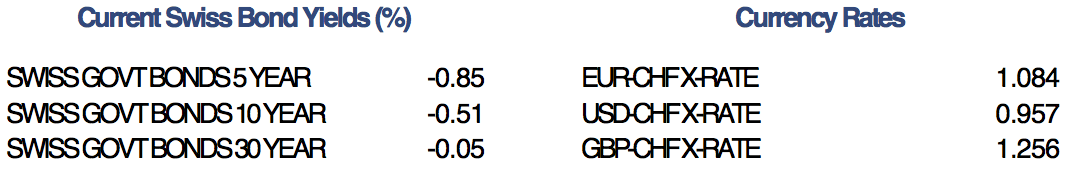

In Switzerland, the Credit Suisse ZEW indicator, which gauges analysts’ expectations for Switzerland’s economy for the coming six months, fell by 8.7 points in August and now stands at a level which suggests that the Swiss economy will move sideways in the coming quarters.

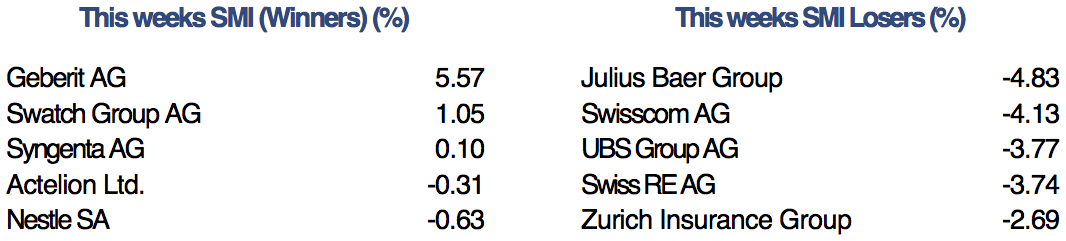

In company news, Geberit was amongst the biggest winners this week as the company’s guidance suggests upside to its current full year estimates. The company’s upbeat outlook comes from strong performance in central Europe, Nordic countries and France. Nestlé also released second quarter results this week, reporting its slowest first-half sales growth since 2009 as the world’s biggest food company struggled to raise prices. However, chief executive officer Paul Bulcke said in the statement that the company expects price inflation to recover in the coming months.