Investec Switzerland. The Swiss Market Index (SMI) is set to post a modest gain this week despite confirmation that the UK has decided to leave the European Union. The SMI opened almost 7% lower following the announcement before recovering. The Swiss franc strengthened the most since the Swiss National Bank (SNB) lifted its cap against the euro in 2015. Around the world, financial markets buckled after Britain’s vote to leave the European Union was announced on Friday morning. The leave camp won by 52% to 48% with England and Wales voting strongly for Brexit while London, Scotland and Northern Ireland backed staying in the EU. The result surprised most campaigners, bookmakers, economists and political analysts whom had largely predicted a close vote to remain in the Union. The pound fell to its lowest level against the dollar since 1985 while safe haven asset’s like US treasuries, the Swiss franc and Japanese yen rallied. The strength of the Swiss franc remains a challenge for the SNB. The Swiss economy is sensitive to the strong domestic currency, which dampens demand for export goods and is increasingly impacting domestic growth prospects. In company news, Swiss financials plunged most of all Swiss Market Index (SMI) sectors following the outcome of the UK vote.

Topics:

Investec considers the following as important: Brexit Swiss markets, Business & Economy, Editor's Choice

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

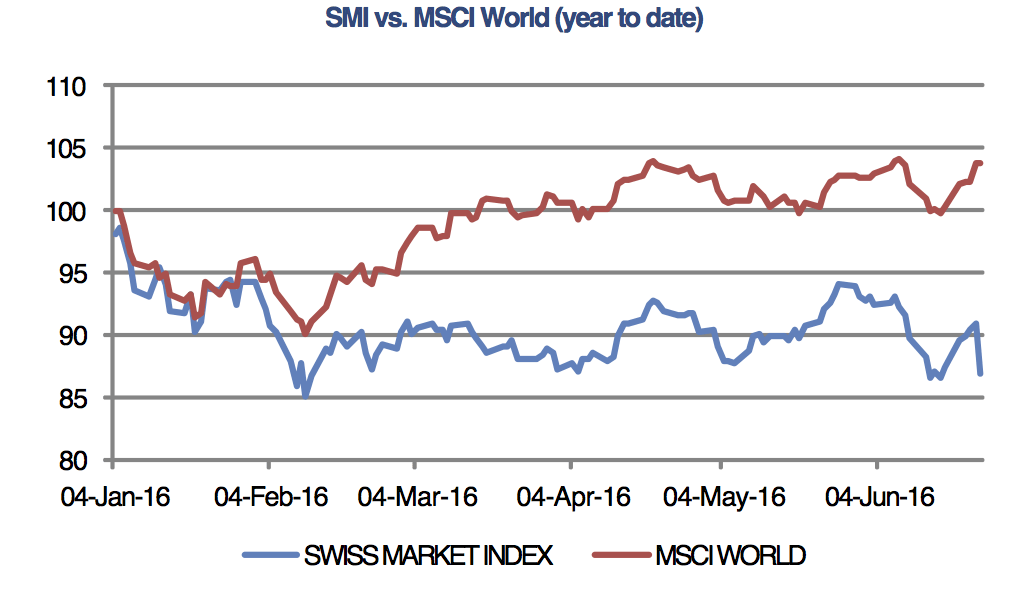

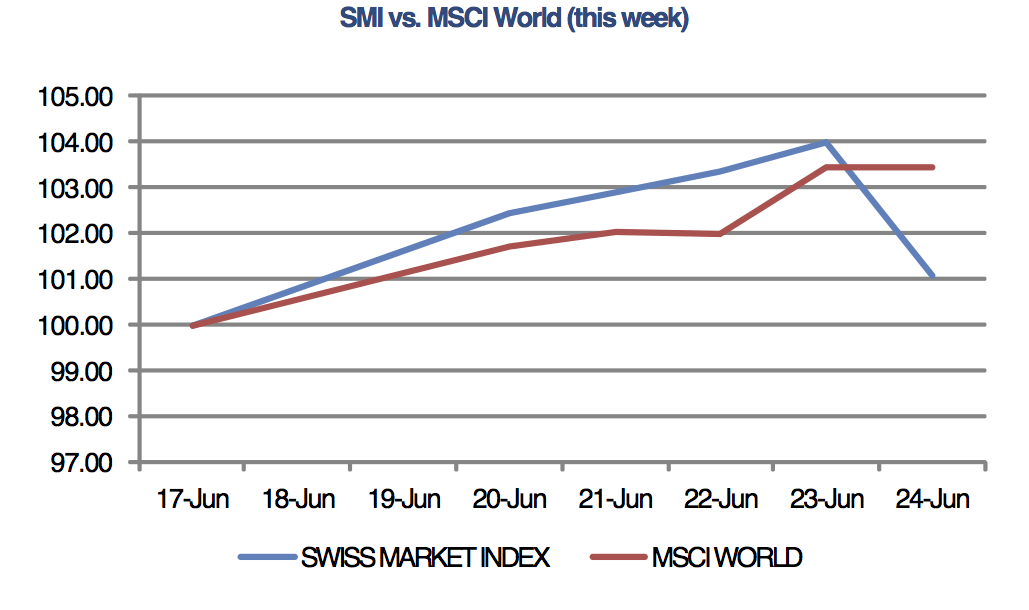

The Swiss Market Index (SMI) is set to post a modest gain this week despite confirmation that the UK has decided to leave the European Union. The SMI opened almost 7% lower following the announcement before recovering. The Swiss franc strengthened the most since the Swiss National Bank (SNB) lifted its cap against the euro in 2015.

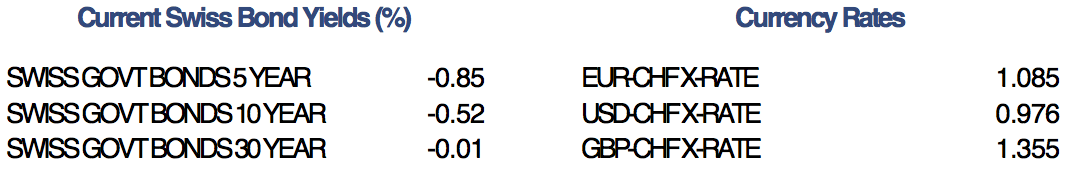

Around the world, financial markets buckled after Britain’s vote to leave the European Union was announced on Friday morning. The leave camp won by 52% to 48% with England and Wales voting strongly for Brexit while London, Scotland and Northern Ireland backed staying in the EU. The result surprised most campaigners, bookmakers, economists and political analysts whom had largely predicted a close vote to remain in the Union. The pound fell to its lowest level against the dollar since 1985 while safe haven asset’s like US treasuries, the Swiss franc and Japanese yen rallied.

The strength of the Swiss franc remains a challenge for the SNB. The Swiss economy is sensitive to the strong domestic currency, which dampens demand for export goods and is increasingly impacting domestic growth prospects.

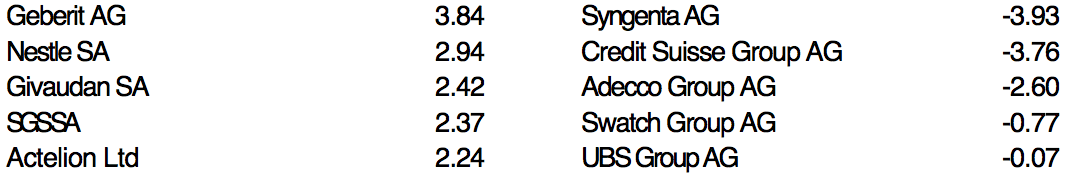

In company news, Swiss financials plunged most of all Swiss Market Index (SMI) sectors following the outcome of the UK vote. Julius Baer said that “Brexit” may lead to wider market turbulence, impacting client trading and transaction activity and temporarily hitting profit margins. UBS took a more relaxed stance, saying that the bank is used to preparing for change in line with the democratic will of the public. In other news, Swatch shares lost ground as exports dropped 9.7% compared to the year-ago. The Federation of the Swiss Watch Industry now reports that exports are lower than in 2012.