For Asia’s export-driven economies, last month’s Brexit vote could rub salt in a nagging wound. China’s slowdown has already hampered export sectors in countries that count the Middle Kingdom as their largest trading partner. While a Brexit-based recession that is limited to the United Kingdom would have a minimal direct impact on the region — average export exposure to the U.K. from non-Japan Asia is about 0.9 percent of GDP — a downturn that spreads to Europe would inflict two to three times more damage. Vietnam would be among the hardest hit, as exports to the European Union account for approximately 7 percent of its GDP. Declining exports to Europe would compound another economic trouble spot—frustratingly stagnant private investment. Fiscal policy in the region has resulted in dramatic increases in government investment spending since 2015, but private investors haven’t followed suit. That’s at least in part because flagging exports have made businesses nervous about expanding capacity and investors nervous about funding it, according to analysts with Credit Suisse’s Global Markets team. “The common theme across the Asian economies is a high correlation between exports and private investment cycles,” say the analysts. If private investment won’t ride to the rescue of ailing Asian economies, what will? Credit Suisse believes that monetary policy easing will be key.

Topics:

Alice Gomstyn considers the following as important: World Affairs: Features

This could be interesting, too:

Alice Gomstyn writes Queen Bee Syndrome, Dethroned

Ashley Kindergan writes Unshakeable Europe

Ashley Kindergan writes US Election: Status Quo vs. Who Knows?

Ashley Kindergan writes A Blueprint for Brazil’s Fiscal Reforms

For Asia’s export-driven economies, last month’s Brexit vote could rub salt in a nagging wound. China’s slowdown has already hampered export sectors in countries that count the Middle Kingdom as their largest trading partner. While a Brexit-based recession that is limited to the United Kingdom would have a minimal direct impact on the region — average export exposure to the U.K. from non-Japan Asia is about 0.9 percent of GDP — a downturn that spreads to Europe would inflict two to three times more damage. Vietnam would be among the hardest hit, as exports to the European Union account for approximately 7 percent of its GDP.

Declining exports to Europe would compound another economic trouble spot—frustratingly stagnant private investment. Fiscal policy in the region has resulted in dramatic increases in government investment spending since 2015, but private investors haven’t followed suit. That’s at least in part because flagging exports have made businesses nervous about expanding capacity and investors nervous about funding it, according to analysts with Credit Suisse’s Global Markets team. “The common theme across the Asian economies is a high correlation between exports and private investment cycles,” say the analysts.

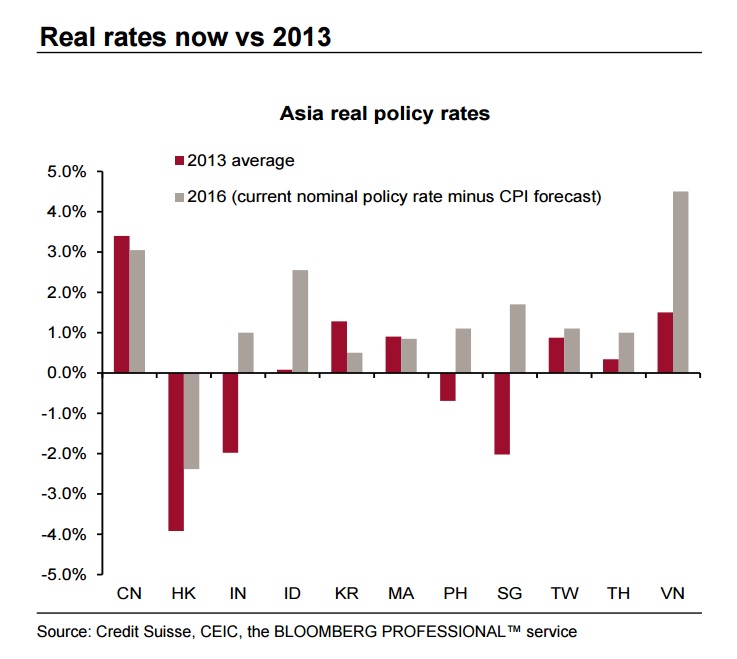

If private investment won’t ride to the rescue of ailing Asian economies, what will? Credit Suisse believes that monetary policy easing will be key. The most likely method of such will be via interest rate cuts, which should prove attractive to central banks for two reasons. For one, the expected delay in interest rate hikes by the Federal Reserve gives Asia’s central banks cover to slash their own rates without fears of weakening their currencies against an even stronger dollar. Furthermore, the banks generally have plenty of room to make such cuts: Their real interest rates are significantly higher today than they were, for instance, during the 2013 “taper tantrum” that shocked emerging markets.

At least one Asian central bank has already enacted post-Brexit rate cuts. Taiwan policymakers announced a cut of 12.5 basis points late last month and Credit Suisse believes another cut will follow this fall. The Bank’s analysts expect Indonesia’s central bank will implement the largest cut at 50 basis points while those in India, Malaysia, South Korea, and Thailand will likely reduce rates by 25 basis points. In India, too, a new benchmark for loan pricing put in place by the Reserve Bank of India earlier this year should ensure the rate cut is passed down to bank customers more readily than in the past.

Rate-cutting policies won’t sweep all of Asia, however. China could be a major exception due to continuing pressure on the yuan and concerns about capital outflows. For Chinese policymakers, monetary policy may take a backseat to fiscal stimulus, which could include accelerating some planned spending from the Communist Party’s most recent five-year plan. But they are not in any rush. Credit Suisse analysts believe that regret over stimulus projects in 2009 and 2010 has left officials more hesitant to approve stimulus this time around, and Chinese government officials will take their time gauging the impact of the Brexit vote before doing so.

If exports are an open question, one spot of good news for several Asian economies is that consumer spending had already emerged as a bright spot for several of them even before the Brexit vote. Those countries with the lowest relative export exposure — India, Indonesia and the Philippines — will likely outperform GDP growth expectations with the help of strong consumer spending. Thailand and Vietnam should also experience robust growth in consumer spending, albeit not enough to compensate for weak investment growth. Credit Suisse projects both countries will see slower GDP growth in 2016 than last year, along with China, Malaysia, and South Korea as well.