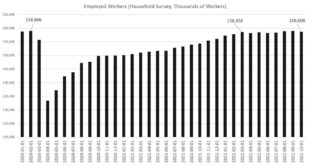

In another sign of weakness for the job market, the total number of employed persons in the United States fell, month over month, in October. That’s the third time in the last seven months this total has fallen, dropping to approximately 158 million. According to new employment data released by the Bureau of Labor Statistics on Friday, the current population survey shows 328,000 fewer people were employed in October than in September, seasonally adjusted. . This...

Read More »Are Robots and AI Really Going to Displace All Workers? Probably Not

Among the components of the World Economic Forum’s Great Reset are a drastically reduced population and the replacement of human labor with robots and artificial intelligence (AI). The question immediately comes to mind: can robots and AI really make all the stuff for the elites after they have gotten rid of the people? Because a plan has been formulated and described does not mean that it is possible to realize. The plan may contradict laws of logic or reality, or...

Read More »Switzerland should do more on tax avoidance, says EU parliamentarian

Switzerland has made progress in reforming tax rates for multinational companies but still has work to do when it comes to turning a blind eye to tax avoidance. In an interview in the French-language paper Le Temps, Paul Tang, who led a delegation of European parliamentarians visiting Bern last week, said that Switzerland had made more progress than the European Union when it came to bringing tax rates for multinational companies in line with other countries....

Read More »Crazy market week because with each rate hike a reason (or two) for coming pivots. Data confirms.

Started in Australia, spread through DC, ending up in London. Rate hikes but more and more reasons piling up to seriously believe they're nearly done. US labor data and corporate earnings add to pivots. Would the end of rate hikes be good for stocks, or would the near-certain recession spoil the punchbowl? Eurodollar University's Weekly Recap, featuring Steven Van Metre Twitter: https://twitter.com/JeffSnider_AIP https://www.eurodollar.university https://www.marketsinsiderpro.com...

Read More »Everything Is Wrong About The Housing Market Jeff Snider & Steven Van Metre | Housing Market Crash

Everything Is Wrong About The Housing Market Jeff Snider & Steven Van Metre, Housing Market Crash. This video was made with Pictory: https://pictory.ai/?ref=636lc copyrighr/business email @ [email protected] DISCLAIMER : I am not a financial advisor. The ideas presented in this video are for entertainment purposes only. You (and only you) are responsible for the financial decisions that you make. This information is what was found publicly on the internet. This information could’ve...

Read More »Can the Dollar Sell Off Much More Before the CPI?

The apparent hawkishness of Fed Chair Powell's comments at the press conference following the FOMC's fourth consecutive rate hike extended the dollar's recovery, which had begun in late October. However, the inability of the greenback to rally after the stronger-than-expected jobs data suggests the bounce has ended. Still, participants may be cautious ahead of the October CPI report due November 10. Although many may think Powell indicated that the Fed was finished...

Read More »The Week Ahead: How Sticky is US Inflation and How Soft is China’s?

There are three potential inflection points. The first is a pause from the Fed; if nothing else, Powell signaled it was too early to think about it. The second is for the Bank of Japan to change monetary policy. Governor Kuroda has signaled that it is not time. Conventional wisdom is there will not be a change until Kuroda's term ends next April. However, we note that the surveys suggest economists and BOJ inflation forecasts for next year have converged. The third...

Read More »Multinational Agrichemical Corporations and the Great Food Transformation

In July 2022, the Canadian government announced its intention to reduce “emissions from the application of fertilizers by 30 percent from 2020 levels by 2030.” In the previous month, the government of the Netherlands publicly stated that it would implement measures designed to lower “nitrogen pollution some areas by up to 70 percent by 2030,” in order to meet the stipulations of the European “Green Deal,” which aims to “make the EU’s climate, energy, transport and...

Read More »Companies are *cutting* full-time jobs like they do EVERY time before recession. Fed pivot coming.

Recessions aren't like flipping a light switch, though most people believe that's how business cycles go. Instead, the transition from expansion to contraction is a process that is easy to spot if you know where to look. The end result has been the same every single time. Having spotted the trio in 2022, confirmed by today's labor data, the Fed's pivot is a matter of time as is when everyone realizes it. Eurodollar University's Money & Macro Analysis Twitter:...

Read More »This Crash Will Leave This Generation & Nations Broke For DecadesJeff Snider

This Crash Will Leave All Generation & Nation Broke Jeff Snider. This is the reason we need eurodollar it is better than central bank. #jeffsnider#eurodollar#economy DISCLAIMER : I am not a financial advisor. The ideas presented in this video are for entertainment purposes only. You (and only you) are responsible for the financial decisions that you make. This information is what was found publicly on the internet. This information could’ve been doctored or misrepresented by the...

Read More » SNB & CHF

SNB & CHF