People are arguing over whether artificial intelligence (AI) and robotics will eliminate human employment. People seem to have an all-or-nothing belief that either the use of technology in the workplace will destroy human employment and purpose or it won’t affect it at all. The replacement of human jobs with robotics and AI is known as “technological unemployment.” Although robotics can turn materials into economic goods in a fraction of the time it would take a...

Read More »«Status quo keine Option mehr»: Bekannter Bank-Experte sieht Übernahme der Credit Suisse durch UBS als Szenario Nummer Eins

Die Krise der Credit Suisse wird nach Einschätzung eines renommierten Branchenexperten von JPMorgan mit einer Übernahme der Bank enden. Die Analysten unter der Leitung des langjährigen und bekannten Bankanalysten Kian Abouhossein haben drei Szenarien für die Zukunft der Credit Suisse durchgespielt. Eine Übernahme halten sie für die wahrscheinlichste Option, und als Übernehmer kommt für sie am ehesten der Lokalrivale UBS in Frage. Einer Übernahme durch die UBS...

Read More »Swiss National Bank Support Steadies Market as ECB Faces Difficult Choice

Overview: The pendulum of market psychology is swinging dramatically. Amid the US banking crisis, Credit Suisse's long-running pressures percolated back to top-of-mind, sending ripples through the capital markets, trigging a sharp slide in the euro. The SNB support is helping the markets calm today. The odds of a 50 bp hike by the ECB today have been cut to about 50% compared with a nearly 100% a week ago. The market has about a 66% chance of a 25 bp hike by the Fed...

Read More »Money Supply Growth Went Negative for the Third Month in a Row, and Is Near a Thirty-Five-Year Low

With negative growth now dipping below –5 percent, money-supply contraction is approaching the biggest declines we've seen in the past thirty-five years. Original Article: "Money Supply Growth Went Negative for the Third Month in a Row, and Is Near a Thirty-Five-Year Low" This Audio Mises Wire is generously sponsored by Christopher Condon. [embedded content]...

Read More »Libertarian Law by Democratic Means: Utilitarianism and the Demythologization of Authority

I have previously explained how for Ludwig von Mises, democracy is necessary for the libertarian society because of its usefulness in achieving and maintaining social peace, insofar as social peace is a prerequisite for economic and civil liberty. This time I want to explain an idea that is implicit in Mises’s subjectivist philosophy and that leads him to defend democracy, understood as the consent of the governed, but which may go unnoticed because it is dispersed...

Read More »The “Meritocracy” Was Created by and for the Progressive Ruling Class

All of Al Gore's children went to Harvard. Are we really to believe that this is because the Gore kids had the most "merit"? The only real meritocracy is in the marketplace. Original Article: "The "Meritocracy" Was Created by and for the Progressive Ruling Class" This Audio Mises Wire is generously sponsored by Christopher Condon. [embedded content]...

Read More »Silicon Valley Bank and the Failure of Fractional Reserve Banking

With the apparent failure of Silicon Valley Bank (SVB) potentially causing a crisis in the American and even the global financial system, we will be treated to all manner of explanations, very few of which will accurately state the cause of these troubles: fractional reserve banking. In modern banking there is little separation between warehouse and investment banking. The downside of investment banking is a potential loss of money since no investment can be a sure...

Read More »Investor Anxiety Continues to Run High even If More Comfortable ECB 50 BP Tomorrow and 25 bp Next Week by the Fed

Overview: The capital markets remain unsettled. Asia-Pacific bourses rose, but European markets are sharply lower, with the Stoxx 600 off 1.3%, giving back the lion's share of yesterday's gains and US equity futures are lower. Benchmark 10-year yields are off 3-9 bp in Europe, with widening core-periphery yields. The yield on the 10-year US Treasury is off a dozen basis points to about 3.56%. Two-year yields are also sharply lower, led by the 15-16 bp decline in...

Read More »Looming Bank Failures Point to More Price Inflation as Real Wages Fall Again

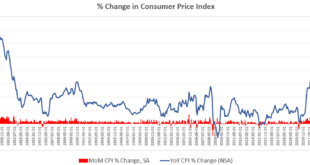

The federal government’s Bureau of Labor Statistics (BLS) released new price inflation data today, and according to the report, price inflation during the month decelerated slightly, coming in at the lowest year-over-year increase in eighteen months. According to the BLS, Consumer Price Index (CPI) inflation rose 6.0 percent year over year in February before seasonal adjustment. That’s down from January’s year-over-year increase of 6.4 percent, and February is the...

Read More »The Theory and Practice of Conspiracy

Adam Smith published The Wealth of Nations in 1776, at the beginning of the Industrial Revolution. The book was the result of twenty years of observation of human action and identification of the mechanisms and processes that lead to economic efficiency and to our well-being. The book was written at a time when guilds had not yet completely disappeared, even though it was already known that the guild system was a brake on innovation and freedom of trade, that guilds...

Read More » SNB & CHF

SNB & CHF