Overview: The pendulum of market expectations has swung dramatically and now looks for 100 bp cut in the Fed funds target this year. That seems extreme. At the same time, the dollar's downside momentum has stalled, suggesting that the dollar may recover some of the ground lost recently as the interest rate leg was knocked out from beneath it. The euro twice in the past two days pushed through $1.09 only to be turned away. Similarly, sterling pushed above $1.23 but...

Read More »The Political Response to our Banking Crisis

This week on Radio Rothbard, Ryan McMaken and Tho Bishop are joined by Peter St. Onge, a fellow at the Heritage Foundation and a regular contributor to the Mises Wire. This episode looks at the political response to the recent turmoil in the banking system and how the Austrian position looks today relative to 2008. St. Onge makes a case for optimism. [embedded content] Recommended Reading "It Turns Out That Hundreds of Banks Are at Risk" by Peter St. Onge:...

Read More »Libertarian Law by Democratic Means: Utilitarianism and the Demythologization of Authority

Mises saw essentialist values as fallacies because they were unverifiable and saw metaphysical ideas as a key component of authoritarianism. His solution was utilitarianism. Original Article: "Libertarian Law by Democratic Means: Utilitarianism and the Demythologization of Authority" This Audio Mises Wire is generously sponsored by Christopher Condon. [embedded content]...

Read More »Statism Is Destroying Real Wages

When we read about the US economy, we often get wage growth as a signal of a strong labor market. It is hardly a strong market when the labor participation rate and the employment to population ratio are both below the February 2020 level and have been stagnant for months. Additionally, the headline figure of 4.6 percent annualized wage growth is misleading, as it shows a nominal and average figure that disguises a much tougher environment. According to the Bureau of...

Read More »Don’t Take Liberties with Liberty

Have you ever thought about the relationship between the words liberty and freedom? Frequently, the words are used interchangeably, but I have always preferred liberty. Perhaps my preference goes back to Thomas Jefferson’s reference to “life, liberty, and the pursuit of happiness” in the Declaration of Independence. Perhaps it traces to Patrick Henry’s “Give me liberty or give me death.” Perhaps it is because “with liberty and justice for all” is “the most important...

Read More »Reparations Are a Statist Cudgel for Bludgeoning Property Owners

San Francisco, as well as the government of California, is calling for millions in "reparations" for black people in that state. Reparations, unfortunately, are fast becoming another anti-property-owner racket. Original Article: "Reparations Are a Statist Cudgel for Bludgeoning Property Owners" This Audio Mises Wire is generously sponsored by Christopher Condon. [embedded content]...

Read More »Silicon Valley Bank and the Failure of Fractional Reserve Banking

The story of the failure of Silicon Valley Bank is the story of nearly every bank failure. Fractional reserve banking invites the risky behavior that brings down the banking system. Original Article: "Silicon Valley Bank and the Failure of Fractional Reserve Banking" This Audio Mises Wire is generously sponsored by Christopher Condon. [embedded content]...

Read More »Nonmeasure for Nonmeasure

How do people in a pluralistic society live peacefully with each other? In his review of Kenneth McIntyre's book, David Gordon points to negative liberty as the best way to preserve values. Original Article: "Nonmeasure for Nonmeasure" This Audio Mises Wire is generously sponsored by Christopher Condon. [embedded content]...

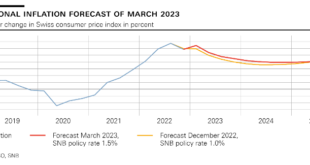

Read More »2023-03-23 – Monetary policy assessment of 23 March 2023

Swiss National Bank tightens monetary policy further and raises SNB policy rate to 1.5% The SNB is tightening its monetary policy further and is raising the SNB policy rate by 0.5 percentage points to 1.5%. In doing so, it is countering the renewed increase in inflationary pressure. It cannot be ruled out that additional rises in the SNB policy rate will be necessary to ensure price stability over the medium term. To provide appropriate monetary conditions, the SNB...

Read More »How Politicians Use Regulations to Deflect Blame

The pro-life activist Randall Terry has a famous quote that anyone who cares about politics should be familiar with: “He who frames the question wins the debate.” Politicians are well aware of this fact, which is why they spend much of their time directing the political conversation into frameworks that benefit them. If they can get us arguing over how best to “reform” the education system, for instance, there will be little discussion about the bigger question of...

Read More » SNB & CHF

SNB & CHF