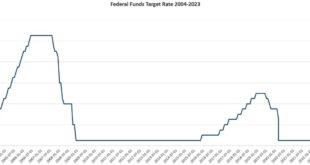

The Federal Reserve’s Federal Open Market Committee (FOMC) on Wednesday raised the target policy interest rate (the federal funds rate) to 5.00 percent, an increase of 25 basis points. With this latest increase, the target has increased 4.75 percent since February 2022. However, with an increase of only 25 basis points, the March meeting is the second month in a row during which the Fed has pulled back from its more substantial rate hikes of 2022. After four...

Read More »Whither Goest the Entrepreneur

The Ludwig von Mises Memorial Lecture, sponsored by Yousif Almoayyed. Recorded at the 2023 Austrian Economics Research Conference hosted at the Mises Institute in Auburn, Alabama, March 16–18, 2023. [embedded content] The Austrian Economics Research Conference is the international, interdisciplinary meeting of the Austrian School, bringing together leading scholars doing research in this vibrant and influential intellectual tradition. The conference is...

Read More »The Other Covid Crisis: Prospects for Recovery from Pandemic Policies

The F.A. Hayek Memorial Lecture, sponsored by Greg and Joy Morin. Recorded at the 2023 Austrian Economics Research Conference hosted at the Mises Institute in Auburn, Alabama, March 16–18, 2023. [embedded content] The Austrian Economics Research Conference is the international, interdisciplinary meeting of the Austrian School, bringing together leading scholars doing research in this vibrant and influential intellectual tradition. The conference is hosted by...

Read More »Looming Bank Failures Point to More Price Inflation as Real Wages Fall Again

Even if Powell is sincere in this stated desire to slay inflation with more rate hikes, recent bank failures will put the Fed under enormous pressure to end its rate hikes and to once again embrace easy money to save the banks and Wall Street. Original Article: "Looming Bank Failures Point to More Price Inflation as Real Wages Fall Again" This Audio Mises Wire is generously sponsored by Christopher Condon. [embedded content]...

Read More »Did Colonialism Impoverish Africa and Asia? Perhaps Not

Revisiting the legacies of colonialism to indict Western imperialism has become a fashionable pastime for leading academics. Many argue that colonialism erected permanent roadblocks to thwart the progress of ex-colonies. Western colonialism is so vilified that any attempt to present a balanced overview is deemed improper. Bruce Gilley’s controversial essay, “The Case for Colonialism,” spawned a firestorm of criticisms that led the journal, Third World Quarterly, to...

Read More »Veranstaltungstip es gibt noch freie Plätze

[embedded content] Tags: Claudio Grass,Featured,newsletter,Uncategorized

Read More »Mises Club Carolinas

Escape the summer heat for a cool weekend in the beautiful mountains of Banner Elk, NC. Tentative plans are to meet for dinner on Friday, July 21 at the Sugar Mountain Ski Resort. Guest speakers will be Franklin Sanders and his son, Justin, who will discuss their decades long effort to protect the precious metal trading industry from government intervention. Saturday, July 22 will begin with breakfast with the owners of Sugar Mountain while they discuss how they...

Read More »Mises Club Carolinas

Join Mises Club Carolinas for their next meetup in Fort Mill, SC, on Saturday, April 22. We'll tour Southpoint Solutions, and industrial lighting company from Club Member Jared Wall. After the tour, we'll have dinner and discussion at Farmhaus Butcher and Beer Garden. The speaker will be a new Club Member, Trey Carson, owner of Happy Mining, a bitcoin mining company in central North Carolina. For more information or to register for this event, please contact Kent...

Read More »The Theory and Practice of Conspiracy

Collusion was a way of life with state-chartered enterprises. Little has changed, as firms with political connections still gain profits from their collusion with the state. Original Article: "The Theory and Practice of Conspiracy" This Audio Mises Wire is generously sponsored by Christopher Condon. [embedded content]...

Read More »The Outbreak of World War I: A Libertarian Realist Rebuttal

As you may have noticed, those dreaded “forces” seem to have rematerialized—in the headlines, in the journals, in the pages of bestsellers: those historical, material, political, or ideological forces that supposedly make conflict between some set of groups, classes, or states “inevitable.” But as the great libertarian historian Ralph Raico never tired of telling, such collectivist narratives are often little more than convenient scapegoats or outright inventions to...

Read More » SNB & CHF

SNB & CHF