The city of Zug will be the first public authority in the world to accept the cryptocurrency Bitcoin. This pilot project, set to begin on July 1, 2016, will allow people to use the virtual currency to pay for services at the residents’ registration office for sums of up to CHF200. However, Bitcoin has been subjected to major fluctuations and critics fear that the city stands to lose money through the project. (SRF, swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss...

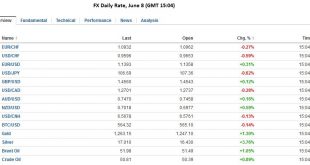

Read More »Greenback is Mostly Firmer, but Yen is Firmer Still

The US dollar is posting modest upticks against most of the European currencies and the Canadian and Australian dollars.However, it has fallen against the yen and taken out the recent low, leaving little between it and the May 3 low near JPY105.50. The New Zealand dollar though is the strongest of the major currencies; gaining 1.5% following the RBNZ’s decision to leave rates on hold, and signal of little urgency to...

Read More »FX Daily, June 8: Currencies Broadly Stable, but Greenback is Vulnerable

On Swiss Franc Once again the Swiss Franc appreciates both against EUR and USD.The euro topped at 1.1095 shortly before the US payroll data and has fallen to 1.0932. The dollar has fallen from 0.9947 to 0.9596. New CHF trade recommendation by Dennis Gartman: We wish to sell the EUR and to buy the Swiss franc this morning upon receipt of this commentary. As we write, the cross is trading 1.0972:1 and we shall risk...

Read More »Cool Video: Bloomberg Television–All about the Periphery

Click to see the video. I am in Boston to attend the Fixed Income Leaders Summit and was invited to join Alix Steel, Joe Weisenthal, and Scarlet Fu on Bloomberg TV. We talked about the peripheral in Europe, especially Portugal, Italy and Spain. Each has a pressing issue. In Portugal, yields have not fallen as much as in other peripheral countries. In Italy, they are belatedly addressing the recapitalization of...

Read More »Presidential Elections and Fed Policy: How Close is Close?

The most important element in next week’s FOMC meeting may come from the dot plot and whether Fed officials back away from the two hikes thought appropriate in March. When looking the schedule of FOMC meetings, and understanding that when the Fed says “gradual” to describe the normalization process, it does not mean hiking at back-to-back meetings, seeing two hikes this year without a summer move is difficult. After...

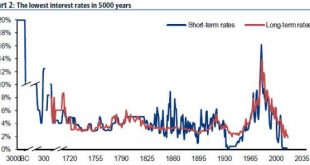

Read More »Visualizing “The 5000 Year Long Run” In 18 Stunning Charts

In the long run, as someone once said, we are all dead, but in the meantime, as BofAML’s Michael Hartnett provides a stunning tour de force of the last 5000 years illustrates long-run trends in the return, volatility, valuation & ownership of financial assets, interest rates & bond yields, economic growth, inflation & debt… The Longest Pictures reveals the astonishing history investors are living through...

Read More »Free Speech Under Attack

Offending People Left and Right Bill Bonner, whose Diaries we republish here, is well-known for being an equal opportunity offender – meaning that political affiliation, gender, age, or any other defining characteristics won’t save worthy targets from getting offended. As far as we are concerned, we generally try not to be unnecessarily rude to people, but occasionally giving offense is not exactly beneath us...

Read More »MACRO ANALYTICS – 06 03 16 – Bull in the China Shop – w/Charles Hugh Smith

ABSTRACT: http://www.gordontlong.com/Macro_Analytics.htm#Smith-06-03-16

Read More »Janet Yellen – Backtracking Again

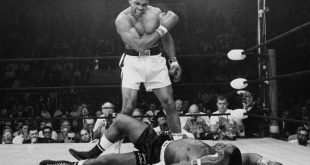

Muhammad Ali Could Take a Punch BALTIMORE – You had to admit. Muhammad Ali could take a punch. Unlike Donald Trump, Dick Cheney, George W. Bush, and Bill Clinton, he was a real war hero. He stood up and faced his enemies on the draft board, rather than dodging them. And when the feds walloped him as a criminal draft resister, Ali didn’t throw in the towel in a whimpering surrender to superior force. Instead, he used...

Read More »Great Graphic: Despite Higher Oil Prices, Middle East Pegs Remain Under Pressure

With today’s gains, the price of Brent has nearly doubled from its lows in January. Of course, the price of oil is still less than half of levels that prevailed two years ago. At the same time, many leveraged investors cast a jaundiced eye toward currency pegs. Many have concluded that the Middle East currency pegs cannot be sustained. Through a combination of the moral suasion and the power of sovereign, Saudi...

Read More » SNB & CHF

SNB & CHF