Summary:

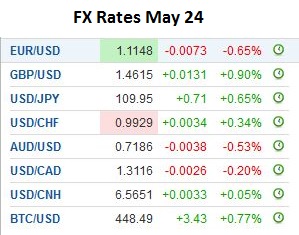

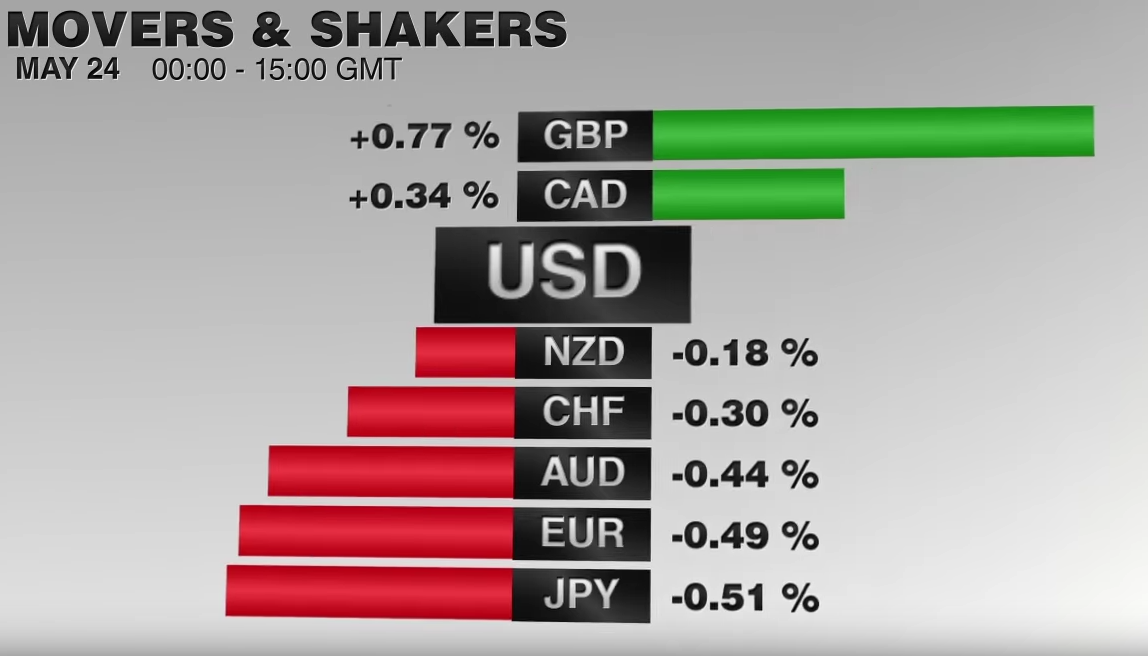

The US dollar lost momentum on May 24 but has regained it on May 25. The euro has been pushed through last week’s lows near .1180. The next immediate target is .1145, which corresponds to the lower Bollinger Band today, though the intraday technical readings suggest some modest upticks are likely first. The .1200-.1220 area may cap upticks. Source Dukascopy The greenback held above JPY109 and bounced to recoup 38.2% of its decline since the pre-weekend high near JPY110.60. A move above this retracement (~JPY109.70) may yield minor gains and still struggle to sustain gains above JPY110. FX Rates May 24, 17:00 GMT, source Investing.com The dollar-bloc currencies have been led lower by the Australian dollar. When the US dollar momentum faltered yesterday, the Australian dollar resurfaced above %excerpt%.7200. Unable to get above %excerpt%.7230 today, RBA Governor Stevens comments helped push it new lows since early March (~%excerpt%.7155). Stevens noted that the Australian dollar, which has been falling since late-April, was moving in the right direction. His observation that inflation was low and below target encourages speculation of an additional rate cut in the coming months. Sterling is recouping nearly everything it lost in the past two sessions and is back knocking on last week’s high above .46.

Topics:

Marc Chandler considers the following as important: Featured, FX Daily, FX Trends, newsletter

This could be interesting, too:

The US dollar lost momentum on May 24 but has regained it on May 25. The euro has been pushed through last week’s lows near .1180. The next immediate target is .1145, which corresponds to the lower Bollinger Band today, though the intraday technical readings suggest some modest upticks are likely first. The .1200-.1220 area may cap upticks. Source Dukascopy The greenback held above JPY109 and bounced to recoup 38.2% of its decline since the pre-weekend high near JPY110.60. A move above this retracement (~JPY109.70) may yield minor gains and still struggle to sustain gains above JPY110. FX Rates May 24, 17:00 GMT, source Investing.com The dollar-bloc currencies have been led lower by the Australian dollar. When the US dollar momentum faltered yesterday, the Australian dollar resurfaced above %excerpt%.7200. Unable to get above %excerpt%.7230 today, RBA Governor Stevens comments helped push it new lows since early March (~%excerpt%.7155). Stevens noted that the Australian dollar, which has been falling since late-April, was moving in the right direction. His observation that inflation was low and below target encourages speculation of an additional rate cut in the coming months. Sterling is recouping nearly everything it lost in the past two sessions and is back knocking on last week’s high above .46.

Topics:

Marc Chandler considers the following as important: Featured, FX Daily, FX Trends, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| The US dollar lost momentum on May 24 but has regained it on May 25. The euro has been pushed through last week’s lows near $1.1180. The next immediate target is $1.1145, which corresponds to the lower Bollinger Band today, though the intraday technical readings suggest some modest upticks are likely first. The $1.1200-$1.1220 area may cap upticks. |

Source Dukascopy |

| The greenback held above JPY109 and bounced to recoup 38.2% of its decline since the pre-weekend high near JPY110.60. A move above this retracement (~JPY109.70) may yield minor gains and still struggle to sustain gains above JPY110. |

The dollar-bloc currencies have been led lower by the Australian dollar. When the US dollar momentum faltered yesterday, the Australian dollar resurfaced above $0.7200. Unable to get above $0.7230 today, RBA Governor Stevens comments helped push it new lows since early March (~$0.7155). Stevens noted that the Australian dollar, which has been falling since late-April, was moving in the right direction. His observation that inflation was low and below target encourages speculation of an additional rate cut in the coming months.

Sterling is recouping nearly everything it lost in the past two sessions and is back knocking on last week’s high above $1.46. It appears to have been helped by a poll out late yesterday that found that not only are the undecideds in the UK referendum breaking toward the remain camp but that some of those that had favored leaving and reversing.

However, we are not fully satisfied with that explanation. After all, sterling has been trending higher against the US dollar like many currencies did in the first part of the year. Sterling rallied 6.7% from the late-February low through the May 3 high. The polls only showed a shift in the last two weeks or so.

Also, the options market is still reflecting anxiety, and given that the referendum poses contingent risk, the options market is where it ought to be expressed. The referendum is within a month now so one-month volatility should be the focus. It is firm today at around 11.2%. This is the upper end of where it has traded since early-March. It finished last week near 10.4%.

The increase in implied volatility suggests options are being bought. The spread between the pricing of puts and calls equidistant out of the money (25 delta) can help determine what options are being bought. The premium for puts over calls is the largest since last May. This suggests that despite sterling’s gains in the spot market, some participants are still seeking protection in the options market by buying one-month sterling puts.

The broader dollar gains have been driven by the shift in expectations of Fed policy. For medium-term investors, it does not make much of a difference whether the Fed hikes in June or July. The August Fed funds futures contract implies a yield of 54 bp. We know that currently Fed funds have been averaging 37 bp. If the Fed were to raise rates 25 bp at either the June or July meetings, fair value for the August contract is 62 bp. The market is pricing in a 68% chance of a hike at one of the next two meetings ( (54-37)/25).

The US reports new homes sales today. Sales in April are expected to bounce back after a 1.5% decline in March. However, this report is not a typically a market mover. Tomorrow’s advance look at April’s merchandise trade balance, durable goods orders the following day and then personal income and consumption data before the weekend will allow economists to fine tune expectations for Q2 growth. Meanwhile, Q1 growth is expected to be revised from 0.5% toward 1.0%.

Yellen’s speech at Harvard on May 27 is also a key. We suspect that Dudley’s comments last week largely reflect that of the Fed’s leadership and do not expect the Chair to pour cold water on the hawkish talk of many regional presidents as she did at the end of March.

The news stream has been light and largely focused on Germany. Its largest bank was downgraded by Moody’s. The market largely shrugged it off. The downgraded banks shares are trading higher. Financials are the second strongest sector in Germany today and outperforming the overall DAX. The ZEW survey showed an improvement in the assessment of existing conditions, but a deterioration in expectations. Is this the best it gets?

Details of Q1 GDP were published. Private consumption and government spending were a bit softer than expected. This was made up for by an increase in capital investment and construction. Exports rose 1% on the quarter, twice what economists expected (follows a 0.6% decline in Q4 15). Imports rose 1.4%. The median expectation was for a 1.0% increase after a 0.5% rise in Q4 15.

The Eurogroup of finance ministers meets today with Greece front and center. The Greek parliament approved various measures over the weekend, including contingency measures if its budget targets are not achieved in 2018. This should be sufficient to free up another tranche of aid that will allow Greece to pay its official creditors and clear arrears. The important issue of debt relief remains at the center of the tension with the IMF. Various schemes are being discussed while Germany is playing up the domestic politics card. The problem though is not with Merkel’s coalition partner the SPD but with the CDU’s sister party the CSU and the farther-right AfD. The AfD has been reinvigorated by Merkel’s immigration policy not her handling of Greece.