Charles Hugh Smith, Jesse Hirsh and Mark E. Jeftovic return with another AoE Salon. Show notes and references: https://axisofeasy.com/podcast/salon-23-lords-of-the-algos

Read More »FX Daily, September 25: Sentiment Remains Fragile Ahead of the Weekend

Swiss Franc The Euro has fallen by 0.13% to 1.0801 EUR/CHF and USD/CHF, September 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The dramatic week is finishing on a quieter note. The modest gains in US equities yesterday helped the Asia Pacific performance today. Most markets but China and Hong Kong pared the weekly losses, and easing regulations in Australia spurred a rally in financials that saw its stock...

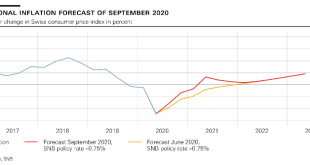

Read More »Monetary policy assessment of 24 September 2020

Swiss National Bank maintains expansionary monetary policy The coronavirus pandemic continues to exert a strong influence on economic developments. The SNB is therefore maintaining its expansionary monetary policy. In so doing, it aims to cushion the negative impact of the pandemic on economic activity and inflation. The SNB is keepingthe SNB policy rate and interest on sight deposits at the SNB at −0.75%.In view of the fact that the Swiss franc is still highly...

Read More »2500 students quarantined at Lausanne’s hotel school

EHL – source Wikipedia Around three quarters of the students at the hotel school of Lausanne (EHL) have been placed in quarantine after a number of students tested positive for SARS-CoV-2, reported RTS. The 2,500 students affected will be isolated until 28 September 2020 to stop the spread of the virus. The Swiss canton of Vaud, where recorded infections recently reached 213 per 100,000 over 14 days, is currently Switzerland’s Covid-19 hotspot. Eleven students spread...

Read More »Switzerland and UK balance sovereignty with EU market access

Britain’s controversial Internal Market Bill has prompted Switzerland’s former chief negotiator with the EU, Michael Ambühl, to examine the thorny issue of sovereignty in EU talks. The issue of balancing access to the EU market in exchange for a degree of EU regulatory intrusion on home turf has come to the fore during the ongoing Brexit negotiations. The British government is trying to enact new legislation, the Internal Market Bill, that could limit the ability of...

Read More »And Silver Crashes Some More! 24 Sept

A few days ago, we wrote about a big silver crash. The price dropped around 7.5%. And the basis dropped from around 2% to 0.6%. At the end, we said: “The key question is: what is the follow-through? If the price stays down and the basis goes back up, that will be a bearish signal. If the basis stays down, that means the silver market is markedly tighter at $24.50 than it was at $26.75.” Which this brings us to yesterday’s silver dive. Here’s the graph of the day’s...

Read More »Carter vs. Reagan: The Last Semi-Intelligent Presidential Race

Carter vs. Reagan Presidential campaigns in the United States tend to be discouraging affairs, even if one is not a libertarian who has zero expectations that anything good can come from American elections. The old saw that insanity consists of doing the same thing repeatedly and somehow expecting different results applies to presidential campaigns as well as to anything else. For whatever reason, Americans (and especially the American media) seem to believe that the...

Read More »How the Swiss film industry is coping with the pandemic

Filmmaking doesn’t naturally lend itself to social distancing, meaning the coronavirus is disrupting films worldwide. This is how Swiss directors and the industry have been coping with the situation. After coming to a halt during the first few critical months of the outbreak, the making of the film “Une histoire provisoire” (A temporary story) was recently able to start up again, but under certain conditions. The crew first gathered in Luxembourg to complete the interior...

Read More »FX Daily, September 24: Darkest Before Dawn

Swiss Franc The Euro has risen by 0.07% to 1.0779 EUR/CHF and USD/CHF, September 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The two recent market developments, push lower in stocks, and higher in the dollar is continuing. Tuesday’s gains in the S&P 500 and NASDAQ were unwound on Wednesday and this is helping drag global markets lower. The MSCI Asia Pacific Index fell for the fourth consecutive...

Read More »Keith Weiner on Wall Street and Main Street

David Gornoski hosts A Neighbor's Choice LIVE 4-6pm EST. Comment below or call in at 727 587 1040.

Read More » SNB & CHF

SNB & CHF