The sudden resignation of Japans Prime Minister Shinzo Abe has led to evaluations of his so-called Abenomics. Many have praised Abe’s aggressive monetary policy because the long shopping list of the Bank of Japan (government bonds, corporate bonds, ETFs and real estate investment trusts) has inflated stock and real estate prices (Shirai 2020; Financial Times 2020). Concerns remain on the fiscal side since Abe’s consumption tax hikes from 5 percent to 8 percent in...

Read More »Drivers for the Week Ahead

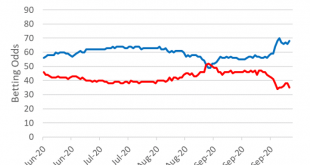

Dollar losses are accelerating; the virtual IMF/World Bank meetings begin Monday A big stimulus package before the election still seems unlikely; there are a fair amount of Fed speakers during this holiday-shortened week The main data event this week is September retail sales Friday; ahead of that, we get inflation readings for September; Fed manufacturing surveys for October will start to roll out The account of the ECB’s September meeting added a layer of...

Read More »Coronavirus: over 1,000 new cases in a day in Switzerland

© Denis Linine | Dreamstime.com On 7 October 2020, the Federal Office of Public Health (FOPH) reported 1,077 new cases of SARS-CoV-2 infection over 24 hours. The latest daily infection figure, which is 2.6 time the daily number a week ago. represents a significant jump in daily infections. Switzerland’s 7-day rolling average daily new infection number has jumped from 312 to 632 in a week. In addition, the rate of positivity – the percentage of tests coming back...

Read More »The Fed’s Quest for Higher Inflation: What Could Go Wrong?

The Federal Reserve is warning investors in no uncertain terms that higher rates of inflation are coming. Yet markets, for the most part, have disregarded that warning. Bond yields, for example, remain well below 2% across the entire duration range. Stock market valuations continue to reflect a sanguine outlook for inflation. And crude oil futures suggest limited upside pressure on prices. It seems the Fed has a credibility problem. In August, Fed Chairman Jerome...

Read More »Dollar Slide Continues as US Fiscal Stimulus Remains Questionable

The dollar remains heavy; stimulus talks may or may not be dead; the White House is still sending mixed signals This is another quiet day in terms of US data; Canada reports September jobs data We got some more eurozone IP readings for August; following Greece yesterday, it’s Italy’s turn today to register another record low for its 10-year bond yield UK data came in significantly weaker than expected; Japan reported weak August real cash earnings and household...

Read More »Our Politicians Would Probably Be Better If We Picked Them by Lot

Rather than choose among a group of narcissists desperate to become popular by redistributing the income of others, why not choose officeholders by lot for a single term? This Audio Mises Wire is generously sponsored by Christopher Condon. Narrated by Millian Quinteros. Original Article: “Our Politicians Would Probably Be Better If We Picked Them by Lot“. You Might Also Like Why Fed Bugs Really, Really...

Read More »Retirement Income Planning Truth with Jim Otar. Part 1.

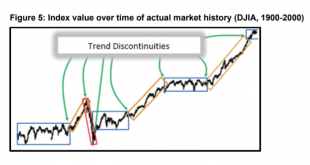

Income is the lifeblood of retirement. In Part 1, wisdom from the early chapters of Jim Otar’s new book about retiree income challenges is explored. A one-person revolutionary. In 2004, I discovered the work of Canadian-based planner and Chartered Market Technician Jim Otar. As a result of his work, I changed my approach to planning. Compared to conventional financial gurus, Jim’s research showcased how stock market cycles changed over time and negatively affected...

Read More »Swiss refiner breaks industry silence on sourcing gold from risky areas

The southeastern region of Madre de Dios in Peru is known for its illegal gold mining practices, but Chave insists PX Precinox does not source any of its precious metal from there. Copyright 2018 The Associated Press. All Rights Reserved. In a rare interview, PX Precinox CEO Philippe Chave defends his company’s record in Peru and says abandoning artisanal miners is not the way to achieve more sustainable and transparent mining practices. For years reports of...

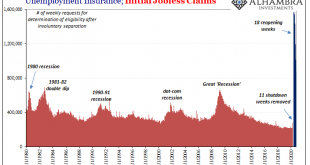

Read More »It Just Isn’t Enough

The Department of Labor attached a technical note to its weekly report on unemployment claims. The state of California has announced that it is suspending the processing of initial claims filed by (former) workers in that state. Government officials have decided to pause their efforts for two weeks so as to try and sort out what “might” be widespread fraud. The state is also using this time to get after a substantial backlog of previous initial claims yet to be...

Read More »The Second Act Will Be Worse Than the First: Lockdowns Are Not the Answer

In the first presidential “debate” (I use that word creatively), Joe Biden hinted that he would order a national lockdown in order to “defeat” the covid-19 virus, and there certainly seems to be a consensus in the media and among political elites that if there is another “outbreak” of covid, then the “shelter in place” order will be the law of the land. Many businesses certainly are making plans for such an order, this time not wanting to be caught unprepared as they...

Read More » SNB & CHF

SNB & CHF