It’s a peculiarity of the human psyche that it’s remarkably easy to be swept up in bubble mania and remarkably difficult to be swept up in the same way by the bubble’s inevitable collapse. Allow me to summarize the dominant zeitgeist in America at this juncture of history: Grab yourself a big gooey hunk of happiness by turning a few thousand bucks into millions– anyone can do it as long as they visualize abundance and join the crowd minting millions. Beneath the...

Read More »Devisen: Euro gibt etwas nach – Fed-Konjunkturbericht ohne Einfluss

Auch zum Franken hat der Dollar an Wert verloren notierte bei 0,9214 Franken nach 0,9228 Franken am Nachmittag. Der Euro blieb zum Franken unverändert bei 1,0895 Franken. Die Devisenexperten der Raiffeisen Schweiz rechnen damit, dass der Franken in den kommenden Monaten insbesondere zum Euro Stärke zeigen wird und der Kurs in Richtung der Schwelle von 1,07 und bis in einem Jahr allenfalls gar bis auf 1,06 Franken zurückfallen könnte. Die Schweizerische Nationalbank...

Read More »SNB-Vize: Franken ist weiterhin hoch bewertet

Die Schweizerische Nationalbank (SNB) hält den Franken trotz der jüngsten Abschwächung weiter für hoch bewertet. "Für uns ist es klar, auch auf dem jetzigen Niveau ist der Franken nach wie vor hoch bewertet", sagte SNB-Vizepräsident Fritz Zurbrügg am Mittwoch beim Zentralschweizer Wirtschaftsforum. [embedded content] You Might Also Like SNB Sight Deposits: Inflation is there, CHF must Rise...

Read More »The Greenback Continues to Claw Back Recent Losses

Overview: The US dollar continues to pare its recent losses and is firm against most major currencies in what has the feel of a risk-off day. The other funding currencies, yen and Swiss franc, are steady, while the euro is heavy but holding up better than the Scandis and dollar-bloc currencies. Emerging market currencies are also lower, and the JP Morgan EM FX index is off for the third consecutive session. The Chinese yuan’s insignificant gain of less than...

Read More »Unions demand financial reward for efforts during Covid crisis

Trade union representatives argue employees are entitled to higher wages as the Swiss economy has picked up from the Covid crisis. Keystone/Anthony Anex The Trade Union Federation has called for a blanket salary rise for all employees as the Swiss economy recovers from the Covid-19 crisis. Switzerland’s main trade union umbrella group said employees should be entitled to a salary increase of at least 2% or CHF100 ($109) per month. Trade union president Pierre-Yves...

Read More »Remember When Conservatives “Canceled” Anyone against the War on Terror? I Do.

[unable to retrieve full-text content]Life in American changed twenty years ago after the 9/11 attacks. Many Americans became enraged at anyone who did not swear allegiance to President George W. Bush’s antiterrorism crusade. Anyone who denied “they hate us for our freedoms” automatically became an enemy of freedom.

Read More »Weekly Market Pulse (VIDEO)

Alhambra CEO Joe Calhoun talks about last week’s surprising market reaction to the unemployment numbers and why it’s important to study the bond market. [embedded content] [embedded content] You Might Also Like SNB Sight Deposits: Inflation is there, CHF must Rise 2021-09-13 Sight Deposits have risen by +0.2 bn CHF, this means that the SNB is intervening and buying Euros and Dollars....

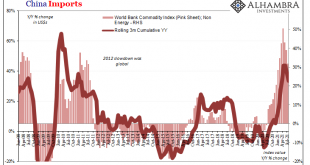

Read More »What’s Real Behind Commodities

Inflation is sustained monetary debasement – money printing, if you prefer – that wrecks consumer prices. It is the other of the evil monetary diseases, the one which is far more visible therefore visceral to the consumers pounded by spiraling costs of bare living. Yet, it is the lesser evil by comparison to deflation which insidiously destroys the labor market from the inside out. You see inflation around you; anyone can only tell deflation by hopefully noticing and...

Read More »A giant water battery in the Swiss Alps

The amount of electricity that can be stored thanks to the new pumped-storage and turbine power station in Nant de Drance, canton Valais, could charge more than 400,000 electric car batteries. Its director explains the role of this "water battery" for electricity supply and grid stabilisation in Switzerland and Europe. “The electric storage capacity of the reservoir surpasses that of 400,000 electric car batteries,” explains Alain Sauthier, engineer and director of the...

Read More »Talking Dodgers with Jeff Snider of Locked on Dodgers

The Dodgers may have lost the weekend series with the Giants. But Jeff Snider of Locked on Dodgers is not worried. LA is still on pace to win over 100 games and look like they are prepared for a solid defense of their World Series title. Follow Locked on Dodgers on Twitter @lockedondodgers Follow Jeff Snider on Twitter @snidog

Read More » SNB & CHF

SNB & CHF