Together with major Swiss banks, the Swiss stock exchange BX Swiss is taking the financial market infrastructure for tokenized securities to the next level. In a test, trades on BX Swiss were settled for the first time directly in Swiss francs via a decentralized public-blockchain. The test was conducted as part of a proof of concept under the auspices of the Capital Markets Technology Association (CMTA). In the process, structured products were issued by the Swiss...

Read More »BX Swiss: Test Trades in Swiss Francs via a Decentralized Public-Blockchain.

Together with major Swiss banks, the Swiss stock exchange BX Swiss is taking the financial market infrastructure for tokenized securities to the next level. In a test, trades on BX Swiss were settled for the first time directly in Swiss francs via a decentralized public-blockchain. The test was conducted as part of a proof of concept under the auspices of the Capital Markets Technology Association (CMTA). In the process, structured products were issued by the Swiss...

Read More »New Swiss rail timetable expands offer to tourist regions

The GoldenPass Express direct line now allows passengers to travel from Montreux on Lake Geneva to Interlaken in the Bernese Oberland without changing trains. © Keystone / Peter Klaunzer Swiss Federal Railways has launched a new timetable, which offers more regional services and direct links between eastern and western Switzerland, and additional connections to popular tourist regions. From Sunday, trains run every two hours directly between Romanshorn, in canton...

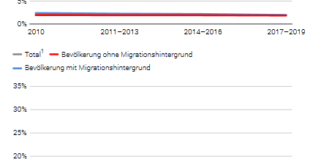

Read More »Since 2012, the population with a migration background has increased by 4 percentage points in Switzerland

The share of the permanent resident population aged 15 or more with a migration background increased from 35% to 39% between 2012 and 2021, according to data from the Swiss Labour Force Survey (SLFS). With a few exceptions, the population with a migration background fares less well in many areas of life than the population without a migration background. Regardless of nationality, the number of immigrants and emigrants rose in 2021. These are some of the findings of...

Read More »The “Barbarous Relic” Helped Enable a World More Civilized than Today’s

One of history’s greatest ironies is that gold detractors refer to the metal as the barbarous relic. In fact, the abandonment of gold has put civilization as we know it at risk of extinction. The gold coin standard that had served Western economies so brilliantly throughout most of the nineteenth century hit a brick wall in 1914 and was never able to recover, or so the story goes. As the Great War began, Europe turned from prosperity to destruction, or more...

Read More »Mises’s Critiques of Social Darwinism and of the Concept of Class Struggle

In his 1922 book, Gemeinwirtschaft, Ludwig von Mises unmasks the intellectual distortion that is social Darwinism. Based on determining the dynamics of socialization through the principle of the division of labor, Mises shows that society is cooperative; that peace, not war, is the father of human progress. Socialization Mises believes socialization proceeds through expansion and deepening. Through societal expansion, people are increasingly drawn into the system of...

Read More »Inflation Firestorm Fuels Sound Money Movement

Sound money, in the form of physical gold and silver, look to be ending the year on a bullish footing. Meanwhile, things are looking positive on the sound money public policy front as well, thanks to some big wins at the state level in 2022 combined with renewed enthusiasm among our legislative allies as we head into the 2023 legislative season. Looking back on 2022, one reality has emerged: Sound money is clearly a winning issue at the state level. At a time of...

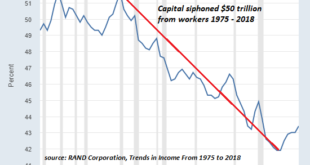

Read More »The Blowback from Stripmining Labor for 45 Years Is Just Beginning

The clueless technocrats are about to discover that unfairness and exploitation can’t be measured like revenues and profits, but that doesn’t mean they’re not real. Economists and financial pundits tend to make a catastrophically flawed assumption. They tend to believe the technocratic myth that all human behavior boils down to financial incentives, data and metrics, as if all people make decisions based on interest rates, tax breaks and greed, the desire to maximize...

Read More »Overseas dollar providers are *not* providing dollars…to Americans.

Context is huge. That goes for the $80 trillion in forex swaps as well as the several trillion which just "disappeared" from the Federal Reserve's Z1 data during Q3. Where ROW should be providing US$s to Americans, instead consistent with what we've seen of markets (you know, volatility), more evidence for heavy dollar shortages thus heavier curve inversions. Eurodollar University's Money & Macro Analysis...

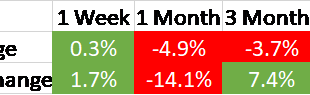

Read More »Weekly Market Pulse: Envy

Legendary investor and Berkshire Hathaway vice-chair Charles Munger recently stated: “The world is not driven by greed. It’s driven by envy.” I think this perfectly encapsulates our current investing era. In a day and age where social media has replaced not only traditional news media but human interaction, where influencers and gamers are top career aspirations for the nation’s youth, where artists (content creators) are paid by the number of followers, likes, and...

Read More » SNB & CHF

SNB & CHF