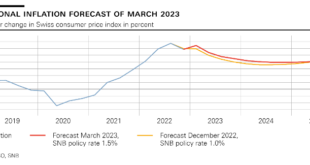

Swiss National Bank tightens monetary policy further and raises SNB policy rate to 1.5% The SNB is tightening its monetary policy further and is raising the SNB policy rate by 0.5 percentage points to 1.5%. In doing so, it is countering the renewed increase in inflationary pressure. It cannot be ruled out that additional rises in the SNB policy rate will be necessary to ensure price stability over the medium term. To provide appropriate monetary conditions, the SNB...

Read More »How Politicians Use Regulations to Deflect Blame

The pro-life activist Randall Terry has a famous quote that anyone who cares about politics should be familiar with: “He who frames the question wins the debate.” Politicians are well aware of this fact, which is why they spend much of their time directing the political conversation into frameworks that benefit them. If they can get us arguing over how best to “reform” the education system, for instance, there will be little discussion about the bigger question of...

Read More »Winter tourism in Kyrgyzstan | #shorts

Video journalist Julie Hunt talks about her latest documentary that she filmed in Kyrgyzstan. It's about a group of Swiss ski instructors helping to create new winter tourism jobs in a country where one in four people are out of work. Watch Julie's documentary here: https://www.youtube.com/watch?v=p8csbKtJGLA --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on...

Read More »Market Hears Dovish Fed Hike and Sells Dollars

Overview: The dollar remains under pressure following the Federal Reserve's rate hike. The market thinks it heard that the Fed was done hiking, even though Fed Chair Powell held out the possibility that "some additional firming may be necessary." The Norwegian krone is the strongest of the G10 currencies today, up more than 1%, spurred by a 25 bp hike and a commitment to do more. The Dollar Index briefly traded below 102.00 for the first time since February 3. A...

Read More »The Fear of Mass Unemployment Due to Artificial Intelligence and Robotics Is Unfounded

Ever since the Luddites rampaged through British textile factories in the early 1800s, people have feared that technology will result in mass unemployment. They were wrong then and are wrong now. Original Article: "The Fear of Mass Unemployment Due to Artificial Intelligence and Robotics Is Unfounded" This Audio Mises Wire is generously sponsored by Christopher Condon. [embedded content]...

Read More »The Fed Backtracks on Future Rate Hikes as Bank Failures Loom Large

The Federal Reserve’s Federal Open Market Committee (FOMC) on Wednesday raised the target policy interest rate (the federal funds rate) to 5.00 percent, an increase of 25 basis points. With this latest increase, the target has increased 4.75 percent since February 2022. However, with an increase of only 25 basis points, the March meeting is the second month in a row during which the Fed has pulled back from its more substantial rate hikes of 2022. After four...

Read More »Whither Goest the Entrepreneur

The Ludwig von Mises Memorial Lecture, sponsored by Yousif Almoayyed. Recorded at the 2023 Austrian Economics Research Conference hosted at the Mises Institute in Auburn, Alabama, March 16–18, 2023. [embedded content] The Austrian Economics Research Conference is the international, interdisciplinary meeting of the Austrian School, bringing together leading scholars doing research in this vibrant and influential intellectual tradition. The conference is...

Read More »The Other Covid Crisis: Prospects for Recovery from Pandemic Policies

The F.A. Hayek Memorial Lecture, sponsored by Greg and Joy Morin. Recorded at the 2023 Austrian Economics Research Conference hosted at the Mises Institute in Auburn, Alabama, March 16–18, 2023. [embedded content] The Austrian Economics Research Conference is the international, interdisciplinary meeting of the Austrian School, bringing together leading scholars doing research in this vibrant and influential intellectual tradition. The conference is hosted by...

Read More »Looming Bank Failures Point to More Price Inflation as Real Wages Fall Again

Even if Powell is sincere in this stated desire to slay inflation with more rate hikes, recent bank failures will put the Fed under enormous pressure to end its rate hikes and to once again embrace easy money to save the banks and Wall Street. Original Article: "Looming Bank Failures Point to More Price Inflation as Real Wages Fall Again" This Audio Mises Wire is generously sponsored by Christopher Condon. [embedded content]...

Read More »Did Colonialism Impoverish Africa and Asia? Perhaps Not

Revisiting the legacies of colonialism to indict Western imperialism has become a fashionable pastime for leading academics. Many argue that colonialism erected permanent roadblocks to thwart the progress of ex-colonies. Western colonialism is so vilified that any attempt to present a balanced overview is deemed improper. Bruce Gilley’s controversial essay, “The Case for Colonialism,” spawned a firestorm of criticisms that led the journal, Third World Quarterly, to...

Read More » SNB & CHF

SNB & CHF