read aloud pause X Retail banks have increased investment in digital marketing by 16% in a bid to attract younger clients. Share Facebook Twitter E-mail Print Copy link In 2023, budgeted sums in this segment will total CHF 47.6 million ($52.8 million), up 16% on last year, according to an estimate by Colombus Consulting in its study on the digitalisation of the customer experience, published on Thursday.UBS, Postfinance and Raiffeisen...

Read More »Food Prices Drive China’s CPI Lower while the Greenback is Mostly Firmer in Narrow Ranges

Overview: The dollar is mostly firmer against the G10 currencies and has been confined to tight ranges through the European morning. Outside of the China's deflation and Japan's monthly portfolio flow data that showed Japanese investors bought the most amount of US Treasuries (~$22 bln) in six months in September, the news stream is light. Most emerging market currencies are trading with a softer bias today. The Philippine peso is the strongest among the emerging...

Read More »Can the American Government Wage a Just War?

Murray Rothbard asked this question and concluded that the current American regime, if the wisdom of Aquinas’ words is taken seriously, cannot wage a just war. Original Article: Can the American Government Wage a Just War? [embedded content] Tags: Featured,newsletter

Read More »Statist Ideology and War: Israel versus Hamas

As I wrote in my previous piece on statism and the Israel-Hamas conflict, states are organized crime rackets. Wars between states thus represent warfare between rival gangs. The proper libertarian position with reference to such gang wars is neutrality, or the opposition to all state parties to war. Neutrality includes opposition to interventionism, including opposition to sending arms and aid to other nations. Foreign aid increases the tax aggression on the...

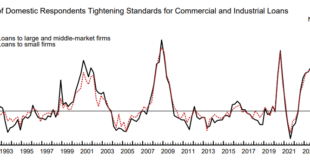

Read More »Macro: Banking: Senior Loan Officer’s Survey and Lending

Banks continue to tighten lending standards across all sectors. This has eased a bit from the July survey. Banks continue to widen spreads across all sectors. The percentage of banks widening spreads has also eased a tad. Banks are not seeing increasing demand for loans. I’m just posting survey results for C&I loans, the graph is very similar for commercial real estate, residential real estate and consumer loans. Commercial and Industrial loan growth has...

Read More »The Oil Price-Stock Market Connection, the 100 Year Financial Cycle, and the Next Crash

Recorded at the Mises Circle in Fort Myers, Florida, 4 November 2023. Special thanks to Murray and Florence M. Sabrin for making this event possible. The Oil Price-Stock Market Connection, 100 Year Financial Cycle, and the Next Crash | Murray Sabrin Video of The Oil Price-Stock Market Connection, 100 Year Financial Cycle, and the Next Crash | Murray Sabrin [embedded content]...

Read More »The Radical Uncertainty of a Polymorphic Fed

Recorded at the Mises Circle in Fort Myers, Florida, 4 November 2023. Includes audience question and answer period. Special thanks to Murray and Florence M. Sabrin for making this event possible. The Radical Uncertainty of a Polymorphic Fed | Jonathan Newman Video of The Radical Uncertainty of a Polymorphic Fed | Jonathan Newman [embedded content]...

Read More »The “Climate Emergency”: Fueled by 21st Century Marxism

Europe currently faces several challenges that potentially harm the quality of life for people in general but especially for young individuals, preventing them from developing their lives autonomously and independently. The housing crisis, reflected in overcrowded accommodation affecting 28 percent of young people aged 15 to 29, is just one example. Freedom of expression in Europe also seems more threatened than ever. Highly controlled content is removed from social...

Read More »Karsten Junius: «Schweizer Aktien bieten das attraktivste Kurspotenzial»

Auf welchem Pfad wird sich die Schweizerische Nationalbank (SNB) bewegen? Den Zinspeak haben wir auch in der Schweiz gesehen, selbst wenn Präsident Thomas Jordan jüngst noch einmal bekräftigt hat, dass die SNB die Zinsen falls nötig erneut erhöhen würde. Ich bin allerdings fest davon überzeugt, dass dies nicht der Fall sein wird. Hier in der Schweiz beobachten wir einen klaren, konjunkturellen Abschwung. Die Inflation bewegt sich im Zielkorridor der Notenbank von 0...

Read More »Swiss government wants to lower licence fee to CHF300

read aloud pause X The government wants to reduce the annual radio and television licence fee from the current CHF335 ($372) to CHF300 by 2029. The turnover threshold for companies to qualify for exemption has been raised from CHF500,000 to CHF1.2 million. Share Facebook Twitter E-mail Print Copy link On Wednesday the government put out for consultation an amendment to the relevant ordinance. In a press release, the government explains...

Read More » SNB & CHF

SNB & CHF